Missouri Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan

Description

How to fill out Security Agreement In Personal Property Fixtures Regarding Securing A Commercial Loan?

If you have to full, download, or printing authorized file layouts, use US Legal Forms, the greatest selection of authorized forms, which can be found on the web. Utilize the site`s easy and practical look for to discover the documents you want. Numerous layouts for enterprise and specific purposes are categorized by classes and claims, or search phrases. Use US Legal Forms to discover the Missouri Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan within a few click throughs.

When you are presently a US Legal Forms buyer, log in to your bank account and click on the Download option to get the Missouri Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan. Also you can accessibility forms you in the past delivered electronically within the My Forms tab of your bank account.

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your appropriate metropolis/nation.

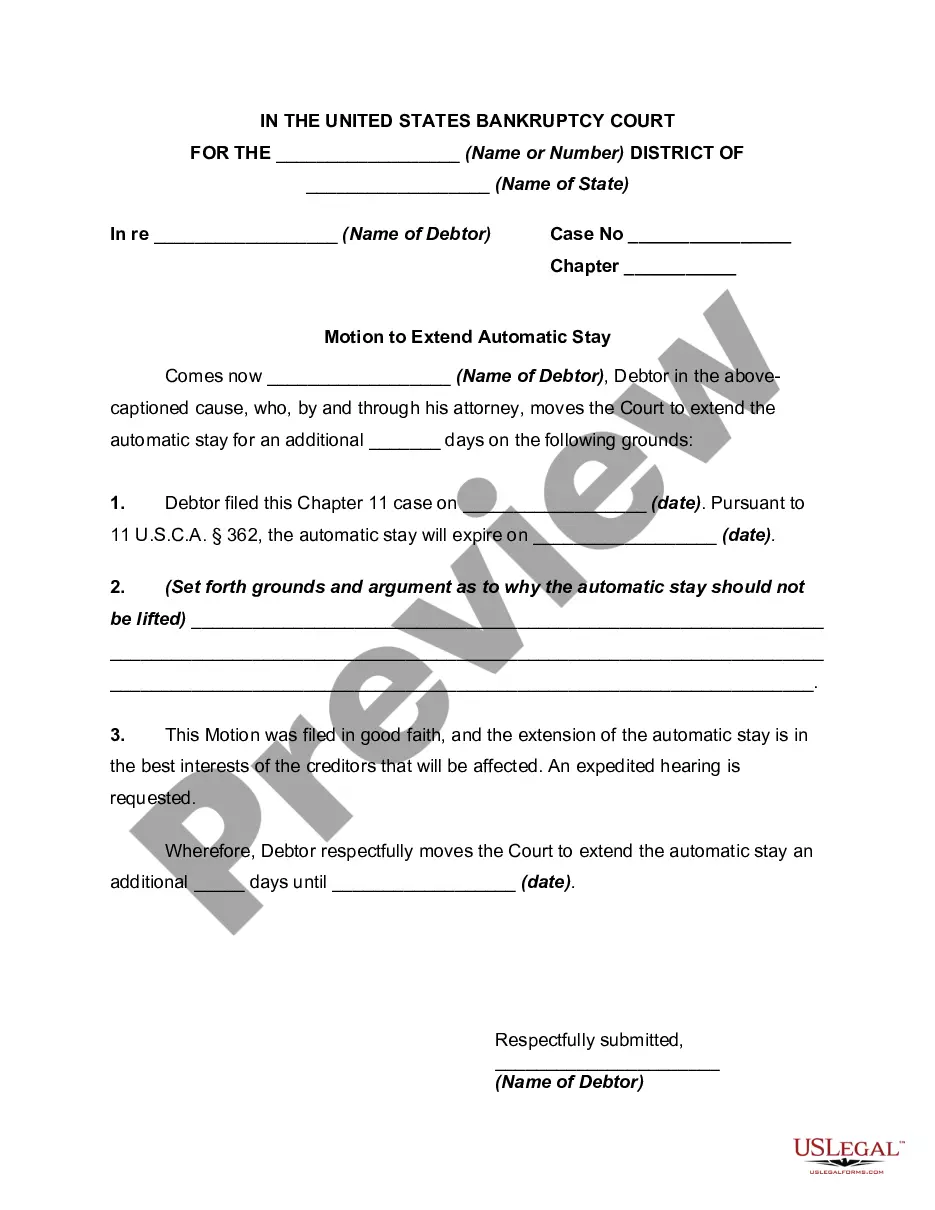

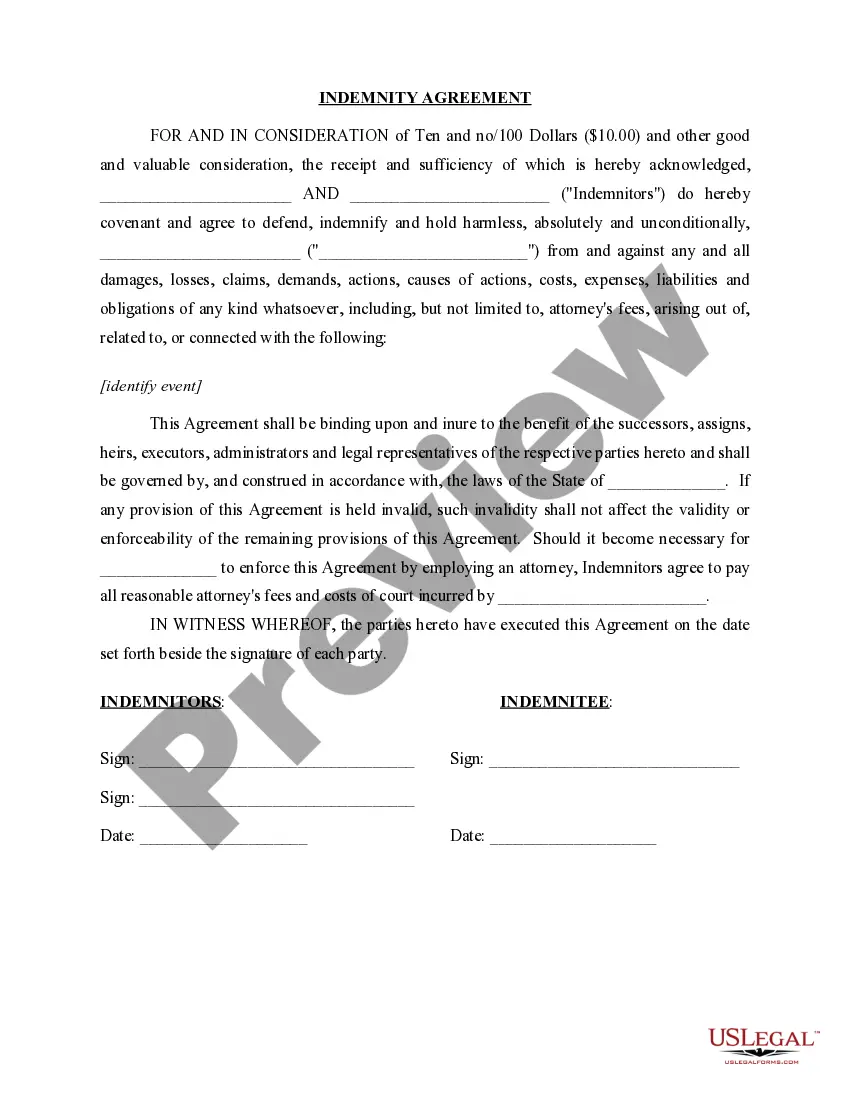

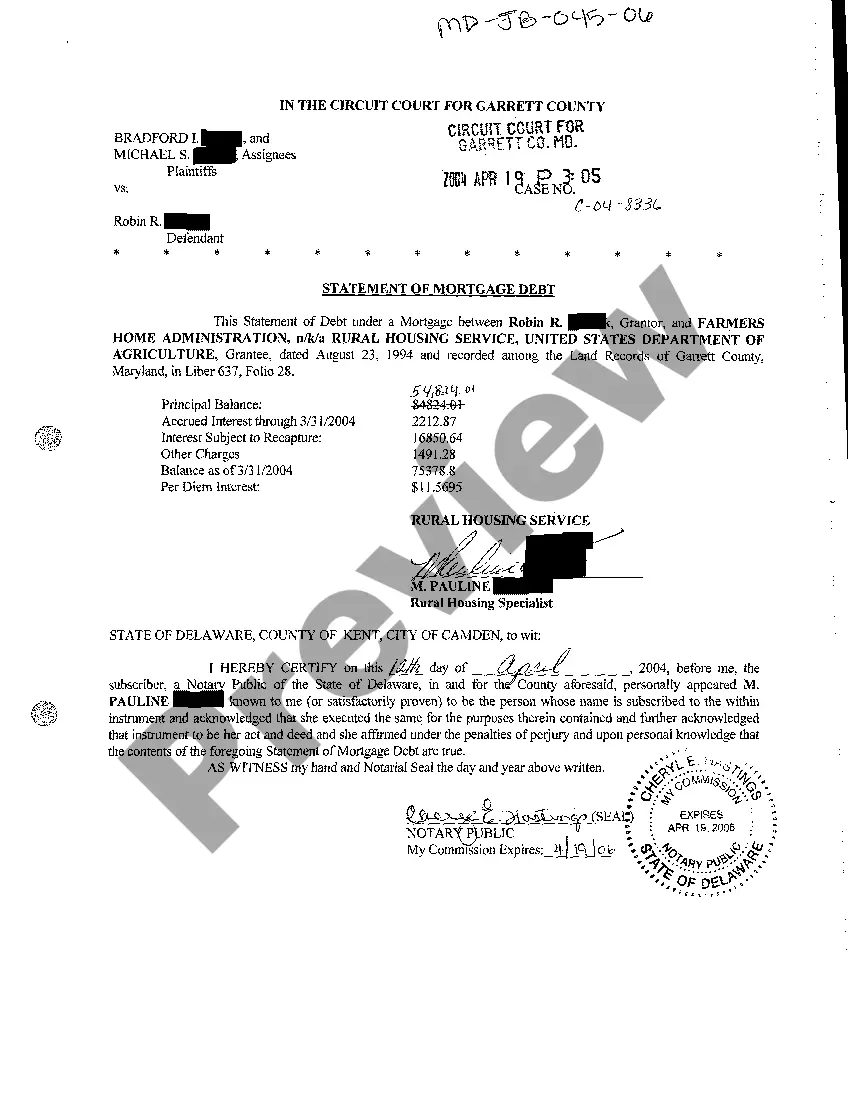

- Step 2. Make use of the Preview choice to look through the form`s content material. Do not overlook to read the description.

- Step 3. When you are not happy using the develop, make use of the Research area near the top of the screen to discover other types from the authorized develop web template.

- Step 4. Upon having identified the shape you want, click the Buy now option. Pick the rates strategy you prefer and add your references to sign up for an bank account.

- Step 5. Procedure the financial transaction. You should use your Мisa or Ьastercard or PayPal bank account to perform the financial transaction.

- Step 6. Choose the structure from the authorized develop and download it in your system.

- Step 7. Full, change and printing or indicator the Missouri Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan.

Every authorized file web template you buy is your own property forever. You possess acces to every single develop you delivered electronically with your acccount. Select the My Forms area and pick a develop to printing or download yet again.

Remain competitive and download, and printing the Missouri Security Agreement in Personal Property Fixtures regarding Securing a Commercial Loan with US Legal Forms. There are many professional and status-particular forms you may use to your enterprise or specific demands.

Form popularity

FAQ

There are three requirements for attachment: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in it to the secured party; (3) the parties have a security agreement ?authenticated? (signed) by the debtor, or the creditor has possession of the collateral.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Article 9 of the Uniform Commercial Code (UCC) governs security interests in personal property.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

A security agreement must contain a description of the collateral that reasonably identifies it. A security agreement that identifies the collateral as all the debtor's assets is sufficient under the UCC.

A security interest is not enforceable unless it has attached. Attachment of a security interest generally requires a written security agreement, description of collateral, secured party's giving value, and the debtor having rights in collateral.

The security agreement must: be signed (or authenticated) by the debtor and the owner of the property, contain a description of the collateral and. make it clear that a security interest is intended.

A security agreement creates the security interest, making it enforceable between the secured party and the debtor. A UCC-1 financing statement neither creates a security interest nor does it alter its scope; it only gives notice of the security interest to third parties.

Article 9 contains a statute of frauds which requires a security agreement to be in writing unless it is pledged. See § 9-203(1) of the code. A pledged security agreement arises when the borrower transfers the collateral to the lender in exchange for a loan (e.g., a pawnbroker).

(The UCC uses the term "authenticate" to include the possibility of electronic signatures.) A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods. The agreement also must provide a description of the collateral.