This form is a Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith-Jury Trial Demand. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand

Description

How to fill out Complaint For Wrongful Termination Of Insurance Under ERISA And For Bad Faith - Jury Trial Demand?

Are you presently in a circumstance where you require documentation for either corporate or personal reasons nearly every business day.

There are numerous legal document templates accessible online, but finding reliable forms isn't easy.

US Legal Forms provides a vast array of template formats, such as the Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, which are designed to comply with state and federal requirements.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using your PayPal or credit card.

Choose a suitable document format and download your copy. Find all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand at any time, if needed. Just select the required form to download or print the document template. Use US Legal Forms, one of the largest collections of legal forms, to save time and minimize errors. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it corresponds to the correct area/region.

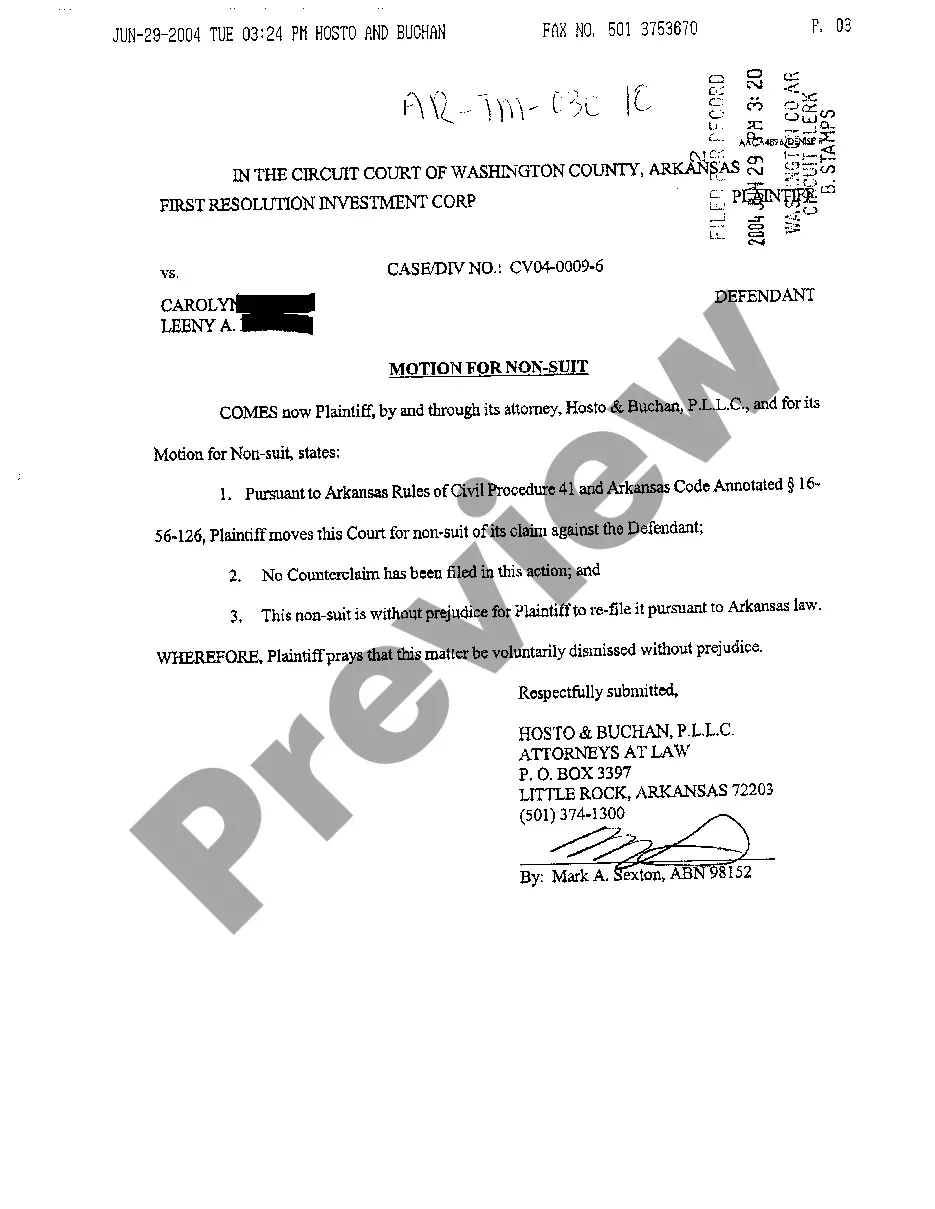

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the appropriate form.

- If the form isn't what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, just click Buy now.

Form popularity

FAQ

In Missouri, bad faith laws protect consumers from insurance companies that do not act in good faith. This includes failing to investigate claims properly, denying valid claims without justification, or delaying payments unnecessarily. If you believe you are a victim, filing a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand can serve as a powerful tool to seek justice. Utilizing platforms like uslegalforms can simplify the preparation and filing process, ensuring you meet all legal requirements.

Yes, you can sue someone for acting in bad faith, especially in insurance disputes. Under Missouri law, if an insurer fails to fulfill its contractual obligations or acts in a dishonest manner, you have the right to seek legal recourse. A Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand can be a critical step in holding the insurer accountable. Consulting with a legal expert can guide you through the process and enhance your chances of success.

The worth of a bad faith claim can vary widely based on the specifics of the case and the damages incurred. Typically, damages may include lost benefits, emotional distress, and sometimes punitive damages. When filing a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, the total amount often reflects both economic and non-economic losses. Seeking professional legal advice can provide a clearer picture of potential compensation.

Proving insurance bad faith involves demonstrating that the insurer acted unreasonably or failed to fulfill their contractual obligations. You will need to gather evidence such as communication records, policy documents, and any relevant correspondence that shows the insurer's misconduct. A Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand can serve as a foundation for your case. Working with experienced legal professionals can significantly enhance your chances of successfully proving your claim.

Winning a bad faith claim in a Missouri work comp case can lead to various types of compensation. You may receive not only the unpaid benefits but also damages for emotional distress and punitive damages. This compensation reflects the wrongful actions of the insurer, particularly in cases involving a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. It’s essential to consult with a qualified attorney who can guide you through the process and help maximize your potential recovery.

The four classifications of unfair claims settlement practices include misrepresentation of coverage, failure to investigate claims properly, unreasonable delays in claims processing, and inadequate communication regarding claims status. Familiarizing yourself with these classifications can aid you if you decide to file a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Knowledge is power in these situations.

Insurers can be liable for bad faith through unjustified claim denials, excessive delays in processing claims, and failing to conduct a thorough investigation of the claim. These actions can demonstrate that the insurer did not act in good faith towards their policyholders. If you encounter such issues, pursuing a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand might be your best course of action.

Unfair claims settlement practices involve actions by insurance companies that are deceptive or lack proper justification in handling claims. These practices can include delaying payments, denying claims without a valid reason, and not providing adequate communication. If you experience such practices, it may be wise to file a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand to seek justice.

The four classifications of unfair claims settlement practices include misrepresentation of policy provisions, failing to acknowledge and act on communications, delaying payments without reasonable cause, and offering less than the rightful claim amount. Understanding these classifications can be crucial if you are considering a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand. Recognizing these practices can empower you as a policyholder.

The Unfair Claims Practice Act in Missouri establishes guidelines to protect policyholders from unjust treatment by insurance companies. This law aims to ensure that insurers act fairly when handling claims. If you believe your insurer has violated this act while you pursue a Missouri Complaint For Wrongful Termination of Insurance Under ERISA and For Bad Faith - Jury Trial Demand, it may strengthen your case.