This form is a Complaint For Declaratory Judgment To Determine ERISA Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage

Description

How to fill out Complaint For Declaratory Judgment To Determine ERISA Coverage?

US Legal Forms - one of the largest collections of sanctioned templates in the United States - provides a broad selection of legitimate document types that you can download or print.

By using the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage within minutes.

If you already possess a subscription, Log In and acquire the Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Make modifications. Fill out, edit, and print and sign the downloaded Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage.

Every template you added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage with US Legal Forms, one of the most extensive collections of legitimate document types. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are simple steps to get started:

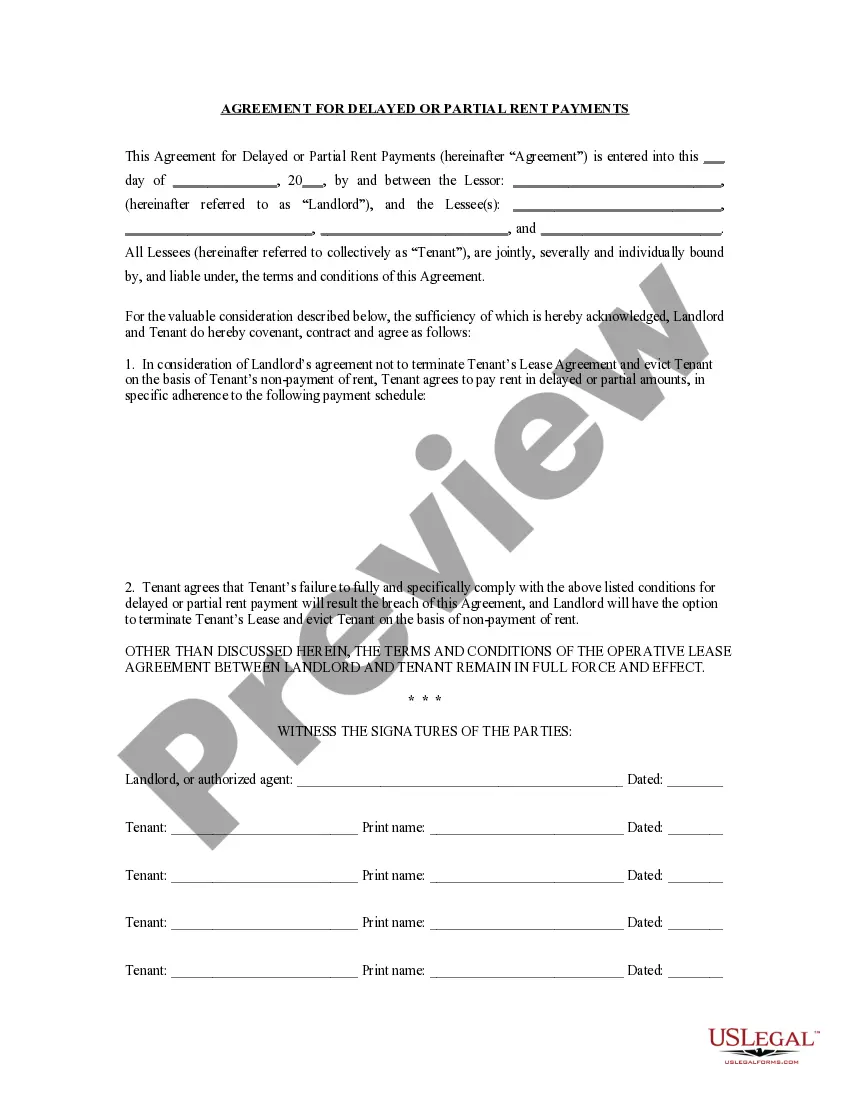

- Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Check the form summary to confirm that you have chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search box at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select the payment plan you prefer and enter your details to register for an account.

- Complete the payment. Use your Visa or Mastercard or PayPal account to finalize the purchase.

- Download the form and obtain it on your device.

Form popularity

FAQ

The insurance company with the most complaints can vary based on different factors such as coverage type and customer service ratings. Researching consumer reviews and state complaint data can provide insight into which companies frequently face issues. It’s important to consider this information when selecting an insurance provider, especially if you are dealing with a Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage. By being informed, you can make better choices for your insurance needs.

To file a complaint with the Missouri insurance commissioner, you can either submit a written complaint or use the online portal available on their website. Make sure to include specific details about your case, especially if it involves a Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage. Attach any relevant documents that support your complaint, such as correspondence with the insurance company. This process helps ensure that your concerns are addressed promptly and effectively.

Writing a complaint letter to the insurance commissioner involves clearly stating your issue and providing supporting documentation. Begin with a brief introduction of your situation, mentioning the Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage if applicable. Include your contact information, policy details, and a timeline of events leading to your complaint. This structured approach ensures that the insurance commissioner understands your concerns and can respond appropriately.

To file a complaint against an insurance company in Missouri, first gather all relevant documents related to your case. Next, you can complete the Missouri Complaint For Declaratory Judgment To Determine ERISA Coverage form, which helps clarify your legal position regarding the insurance coverage. After filling out the form, submit it to the appropriate court or agency that handles insurance disputes. For assistance in this process, consider using USLegalForms, where you can find the necessary forms and guidance.

A declaratory judgment is a binding judgment from a court defining the legal relationship between parties and their rights in a matter before the court. When there is uncertainty as to the legal obligations or rights between two parties, a declaratory judgment offers an immediate means to resolve this uncertainty.

The benefit of a declaratory judgment is that it prevents lawsuits that are likely to be unsuccessful, which saves the courts, and ultimately taxpayers, resources and time. A policyholder that receives an unfavorable declaratory judgment is unlikely to file a lawsuit, as the suit is much more likely to be dismissed.

In some instances, a declaratory judgment is filed because the statute of limitations against a potential defendant may pass before the plaintiff incurs damage (for example, a malpractice statute applicable to a certified public accountant may be shorter than the time period the IRS has to assess a taxpayer for ...

In order for a Missouri Court to even entertain a declaratory judgment, it must be presented with: (1) a justiciable controversy that presents a real, substantial, presently-existing controversy admitting of specific relief, as distinguished from an advisory decree upon a purely hypothetical situation; (2) a plaintiff ...

A plaintiff seeks a ?declaratory judgment? when some doubt or controversy exists regarding the plaintiff's rights, and the plaintiff desires to officially clarify those rights publicly. A declaratory judgment determines the rights of the plaintiff without awarding any sort of damages.