Missouri Deed in Lieu of Foreclosure

Description

How to fill out Missouri Deed In Lieu Of Foreclosure?

Obtain any type from 85,000 legal papers such as Missouri Deed in Lieu of Foreclosure online with US Legal Forms. Each template is crafted and revised by state-certified legal experts.

If you already possess a subscription, Log In. After reaching the form’s page, click on the Download button and navigate to My documents to access it.

If you have yet to subscribe, follow the instructions below.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable sample. The platform provides you with forms and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Missouri Deed in Lieu of Foreclosure quickly and effortlessly.

- Verify the state-specific criteria for the Missouri Deed in Lieu of Foreclosure you wish to utilize.

- Examine the description and preview the template.

- Once you confirm the template meets your needs, click Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Make payment in one of two suitable methods: by credit card or through PayPal.

- Select a format to download the file in; two choices are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

The process of obtaining a Missouri Deed in Lieu of Foreclosure typically takes several weeks, but it can vary based on your lender's policies and the complexity of your situation. Generally, after you submit your request, the lender must review your financial status and the property details. This review period can take anywhere from 30 to 60 days. To expedite the process, you may consider using platforms like US Legal Forms, which can guide you through the necessary documentation efficiently.

Several disadvantages come with a Missouri Deed in Lieu of Foreclosure, such as the risk of a negative impact on your credit score, which can affect future borrowing opportunities. Additionally, the homeowner may still be liable for any remaining mortgage balance if the home sells for less than the owed amount. Furthermore, this option may not be available if there are multiple liens on the property. Consulting with a trusted provider like US Legal Forms can help you explore these disadvantages and find the best path forward.

A Missouri Deed in Lieu of Foreclosure can be a good idea for homeowners seeking to avoid foreclosure. This option allows you to relinquish your property while potentially minimizing the emotional and financial stress associated with a foreclosure. However, it’s vital to weigh the pros and cons carefully and consider your overall financial situation. Engaging with resources like US Legal Forms can provide valuable insights to determine if this option is right for you.

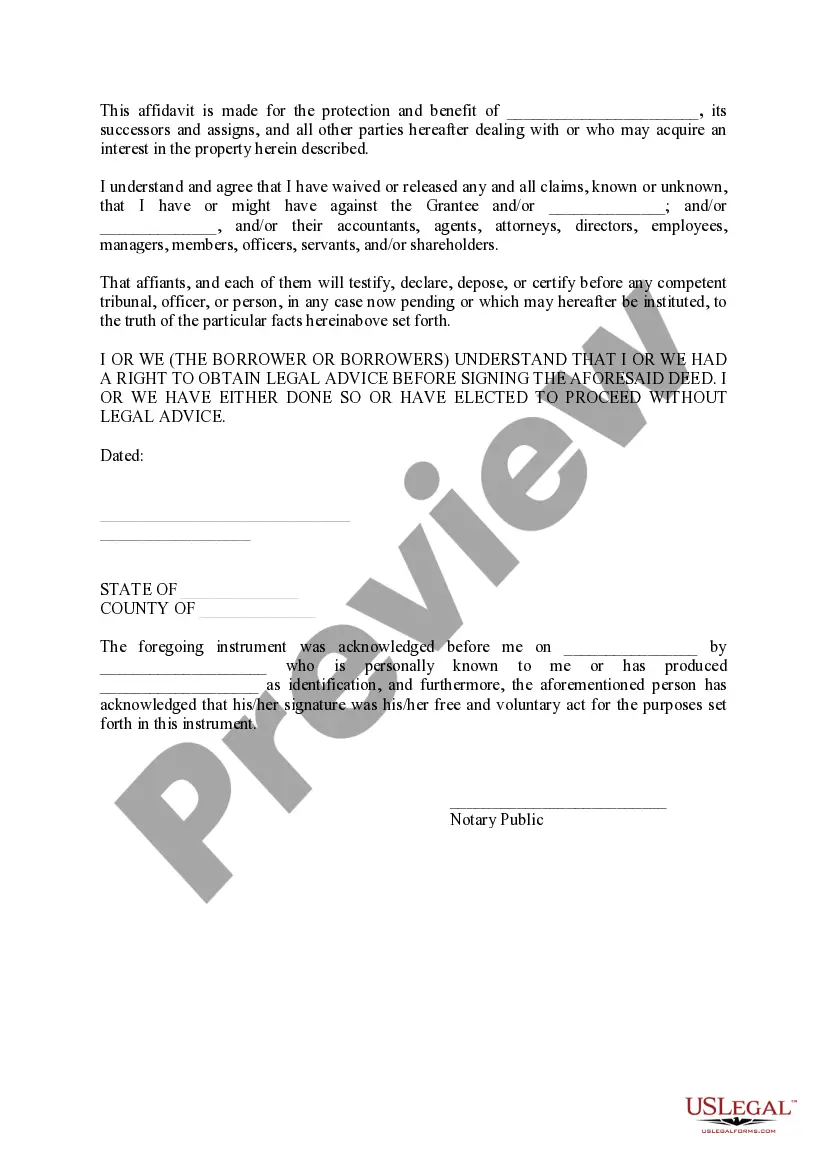

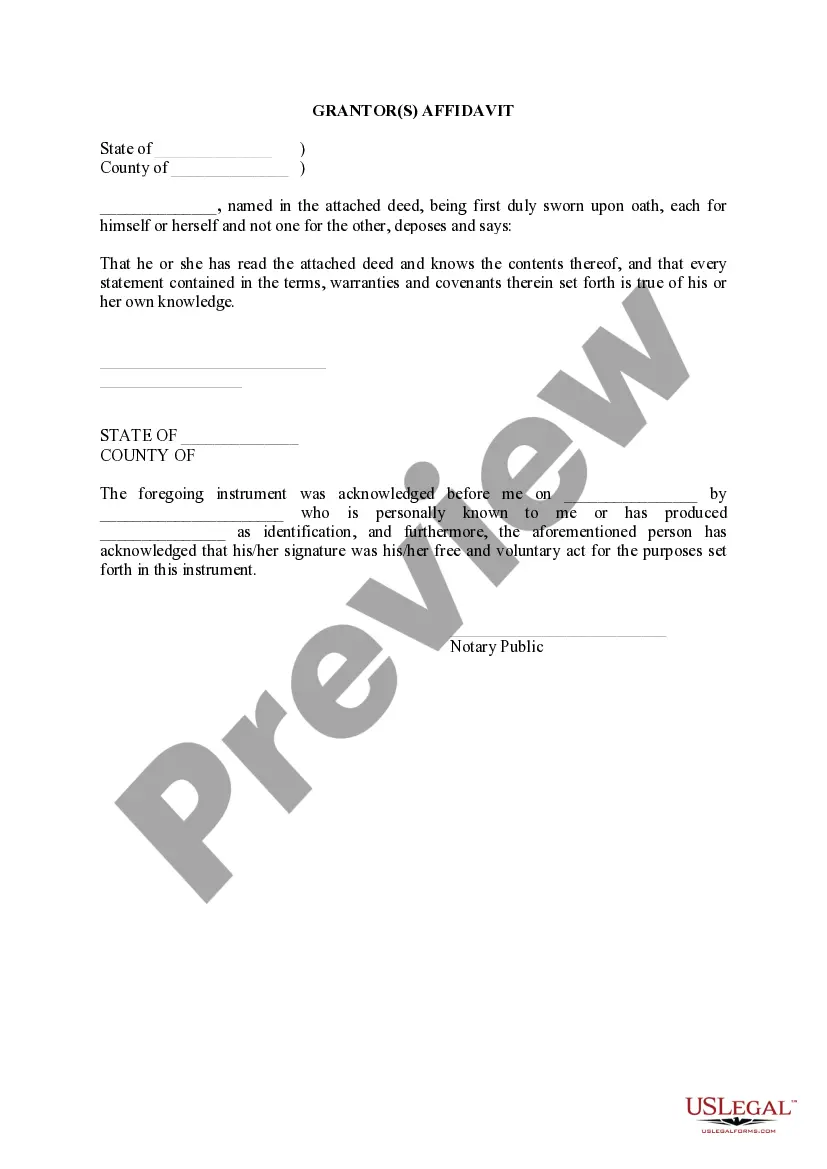

A Missouri Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers their property title to the lender to avoid foreclosure. This option can be a preferable solution when a homeowner cannot keep up with mortgage payments. By agreeing to this arrangement, the homeowner may avoid the lengthy and damaging foreclosure process. It’s essential to consult legal professionals or platforms like US Legal Forms to guide you through the process.

To file a Missouri Deed in Lieu of Foreclosure, start by contacting your lender to discuss your situation and express your intent. Next, gather necessary documents, including your mortgage agreement and a signed deed. It is crucial to have the deed prepared according to state laws, which you can do easily with the help of platforms like US Legal Forms. Finally, submit the deed to your county recorder's office to officially transfer the property title and complete the process.

The deed in lieu of foreclosure offers several advantages to both the borrower and the lender. The principal advantage to the borrower is that it immediately releases him/her from most or all of the personal indebtedness associated with the defaulted loan.

A deed in lieu can eliminate your deficiency if you owe more on your home than the home is worth. In exchange for giving the lender your deed voluntarily and keeping the home in good condition, your lender may agree to forgive your deficiency or greatly reduce it.

The impact that a deed in lieu has on your score depends primarily on your credit history.According to FICO, if you start with a score of around 780, a deed in lieu (without a deficiency balance) shaves 105 to 125 points off your score; but if you start with a score of 680, you'll lose 50 to 70 points.

If your lender agrees to a short sale or to accept a deed in lieu of foreclosure, you might owe federal income tax on any forgiven deficiency. The IRS learns of the deficiency when the lender sends it a Form 1099-C, which reports the forgiven debt as income to you.

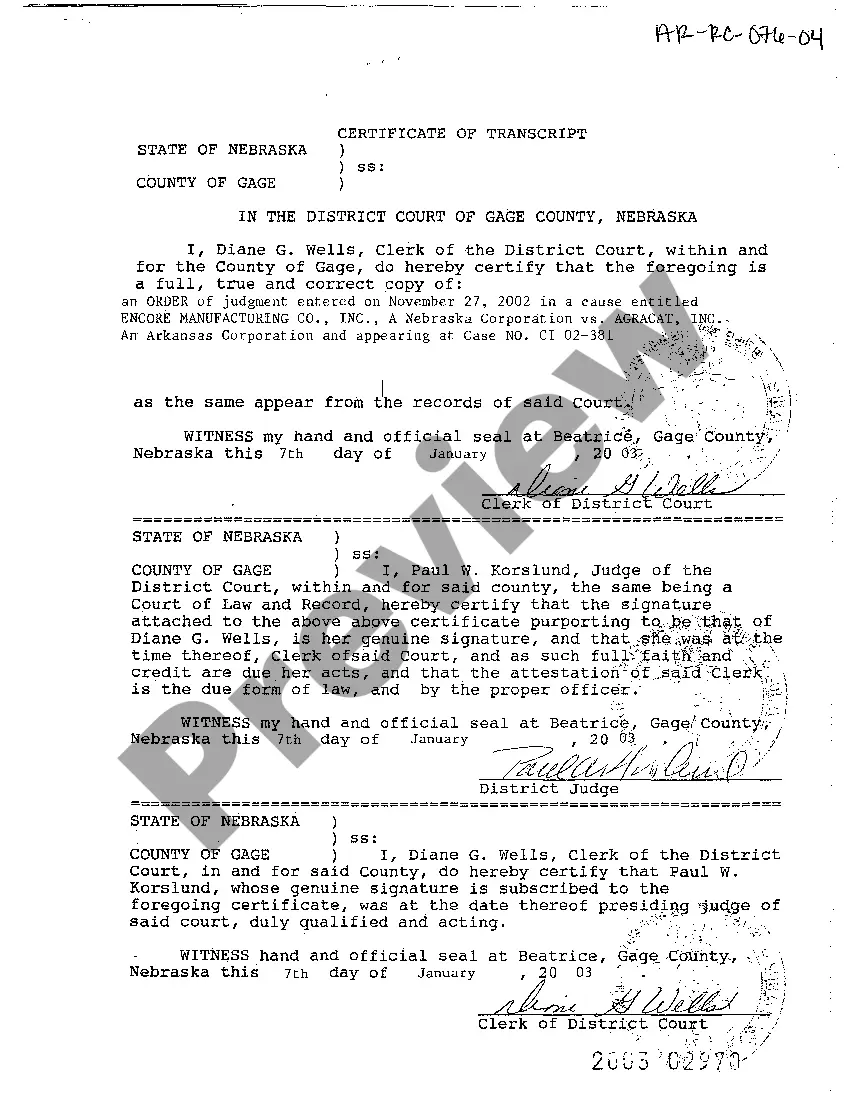

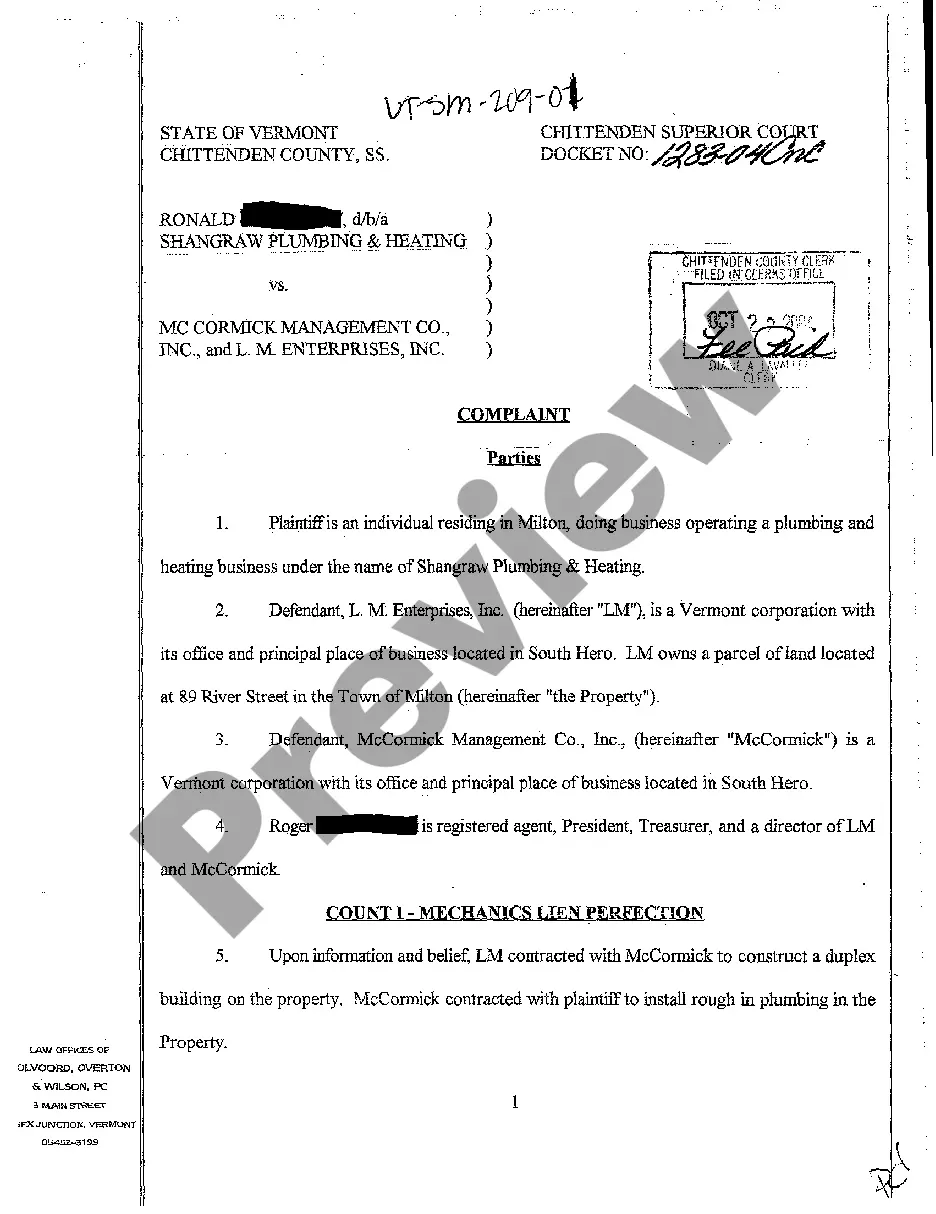

C. The purchaser must pay off both the mortgage and junior lienholders after the sale. What is a major disadvantage to lenders of accepting a deed in lieu of foreclosure?The lender gains rights to private mortgage insurance.