Minnesota Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

If you require thorough, acquire, or printed legal documents templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's user-friendly and efficient search to find the documents you need.

Various templates for business and individual purposes are categorized by types and topics or keywords.

Step 4. Once you have located the form you need, select the Get now button. Choose your preferred pricing plan and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the Minnesota Qualified Written RESPA Request to Dispute or Validate Debt within a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and hit the Download button to obtain the Minnesota Qualified Written RESPA Request to Dispute or Validate Debt.

- You can also access forms you previously acquired from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your appropriate area/country.

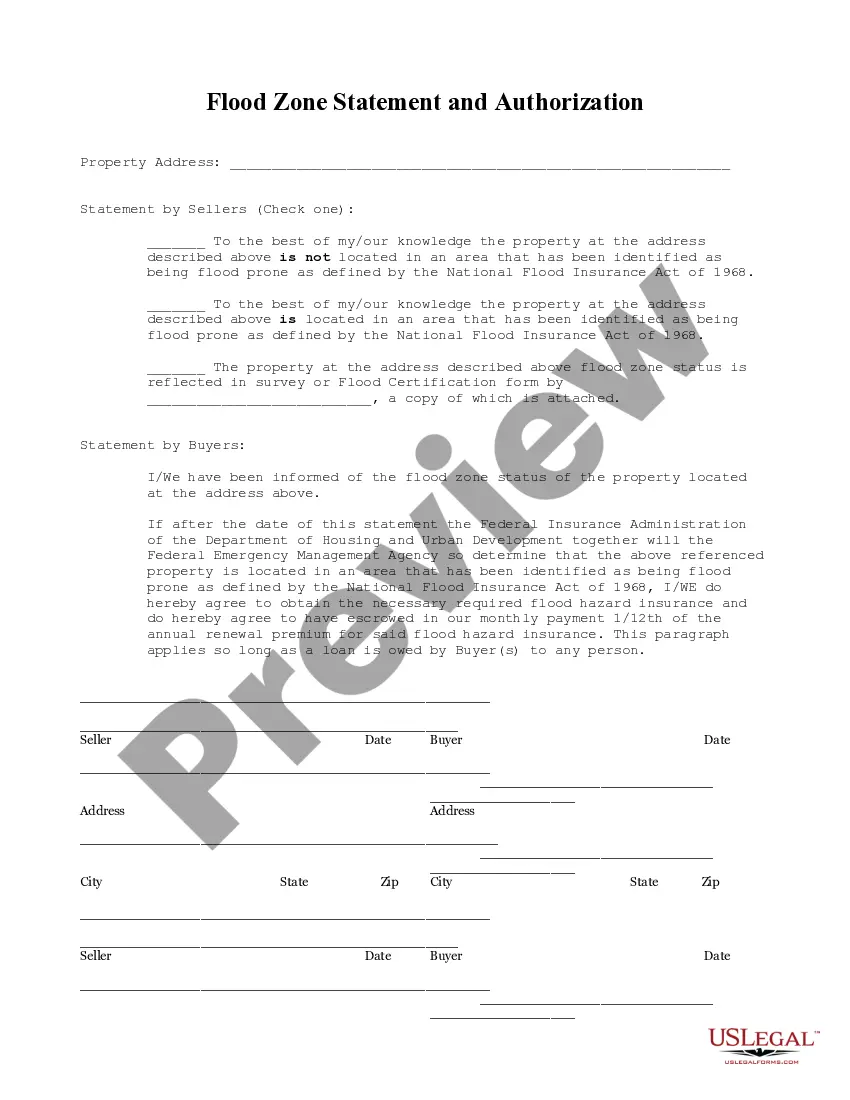

- Step 2. Use the Review option to inspect the form’s content. Don’t forget to read through the information.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternate versions of your legal form template.

Form popularity

FAQ

To obtain a debt validation letter, you should send a Minnesota Qualified Written RESPA Request to Dispute or Validate Debt to the creditor or debt collector. This letter should specify your request for validation and include your identification information, such as your name and account number. Once they receive your request, the creditor is required by law to provide you with a debt validation letter detailing the amount owed and the original creditor. Utilizing the uslegalforms platform can streamline this process, making it easier for you to understand your rights and responsibilities.

To write a Minnesota Qualified Written RESPA Request to Dispute or Validate Debt, start with your name and address at the top. Next, state clearly that this is a qualified written request under RESPA. Be specific about the debt you are disputing, and include any relevant account numbers and details. Finally, request the information you need to validate the debt, ensuring that your request is concise and to the point.

A Qualified Written Request (QWR) does not automatically stop foreclosure proceedings. However, submitting a Minnesota Qualified Written RESPA Request to Dispute or Validate Debt can delay the process while your request is being addressed. It provides you with an opportunity to clarify your situation and resolve any disputes. By acting quickly, you can gain some breathing room to explore your options.

A qualified written request, according to RESPA, is a written request that identifies the nature of your inquiry about the mortgage or debt. It must include your account information and a statement of the issues you want to dispute. When you use a Minnesota Qualified Written RESPA Request to Dispute or Validate Debt, you can expect a timely response from your servicer or debt collector. This process is vital for securing your rights as a consumer.

A RESPA qualified written request is a formal communication you send to your servicer or debt collector. It demands information or clarification about your mortgage or the validity of a debt. Submitting a Minnesota Qualified Written RESPA Request to Dispute or Validate Debt helps ensure you receive accurate information. This act can also improve your chances of resolving disputes effectively.

The new debt law in Minnesota focuses on transparency and consumer protection. It requires debt collectors to give clear disclosures, making it easier for you to understand and challenge any debts. Such laws enhance your ability to submit a Minnesota Qualified Written RESPA Request to Dispute or Validate Debt. This process not only protects you but also provides clarity regarding your financial obligations.

A debt collector must provide the written validation notice within five days of their initial contact with you. This Minnesota Qualified Written RESPA Request to Dispute or Validate Debt gives you important information about the debt. It helps you understand your rights and the details of the debt owed. Knowing this can empower you to take necessary actions.

The best sample for a debt validation letter includes a clear statement of the debt being disputed and a request for verification. You can find templates that utilize the Minnesota Qualified Written RESPA Request to Dispute or Validate Debt on platforms like uslegalforms. These templates guide you in structuring your letter to ensure it meets legal requirements.

Yes, you can dispute a valid debt if you believe there are inaccuracies or if certain details are incorrect. Using the Minnesota Qualified Written RESPA Request to Dispute or Validate Debt can help you articulate your concerns effectively. It's crucial to send your dispute letter promptly to ensure that your rights are protected throughout the process.

When responding to a debt validation letter, first review the validity and details provided in the letter. If you still believe the debt is invalid, respond in writing, referencing the Minnesota Qualified Written RESPA Request to Dispute or Validate Debt. Clearly outline your reasons and ensure you keep a copy of your response for future reference.