Vermont Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp

Description

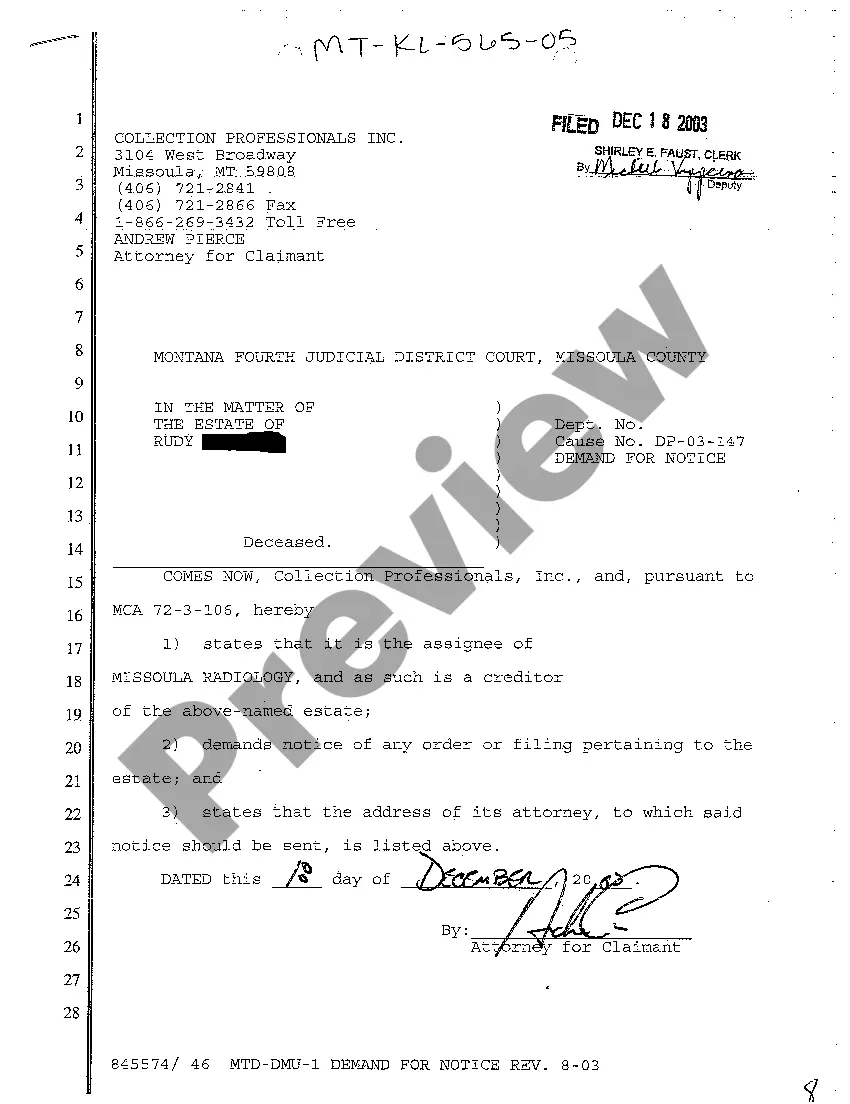

How to fill out Credit Agreement Between Unilab Corp, Various Lending Institutions, Bankers Trust Co And Merrill Lynch Capital Corp?

If you wish to complete, obtain, or print legal record templates, use US Legal Forms, the largest selection of legal varieties, which can be found on-line. Use the site`s easy and hassle-free research to find the files you need. Numerous templates for company and person purposes are categorized by categories and states, or keywords and phrases. Use US Legal Forms to find the Vermont Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp in a handful of mouse clicks.

If you are previously a US Legal Forms consumer, log in to the accounts and then click the Acquire key to obtain the Vermont Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp. You can even entry varieties you earlier downloaded within the My Forms tab of your respective accounts.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape to the correct town/nation.

- Step 2. Take advantage of the Preview option to check out the form`s information. Don`t forget about to learn the outline.

- Step 3. If you are not satisfied using the kind, use the Look for field at the top of the screen to find other models in the legal kind template.

- Step 4. Once you have found the shape you need, go through the Buy now key. Opt for the costs program you choose and include your qualifications to sign up for an accounts.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Find the format in the legal kind and obtain it on your device.

- Step 7. Complete, edit and print or indication the Vermont Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp.

Each and every legal record template you acquire is yours eternally. You possess acces to every kind you downloaded within your acccount. Go through the My Forms area and choose a kind to print or obtain yet again.

Remain competitive and obtain, and print the Vermont Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp with US Legal Forms. There are thousands of expert and state-particular varieties you may use for your company or person demands.