Minnesota Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Division Of Assets Between Partners?

You can spend multiple hours online searching for the appropriate legal document template that fulfills both federal and state regulations you require.

US Legal Forms offers a vast array of legal forms that are vetted by experts.

It is easy to obtain or print the Minnesota Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners from the platform.

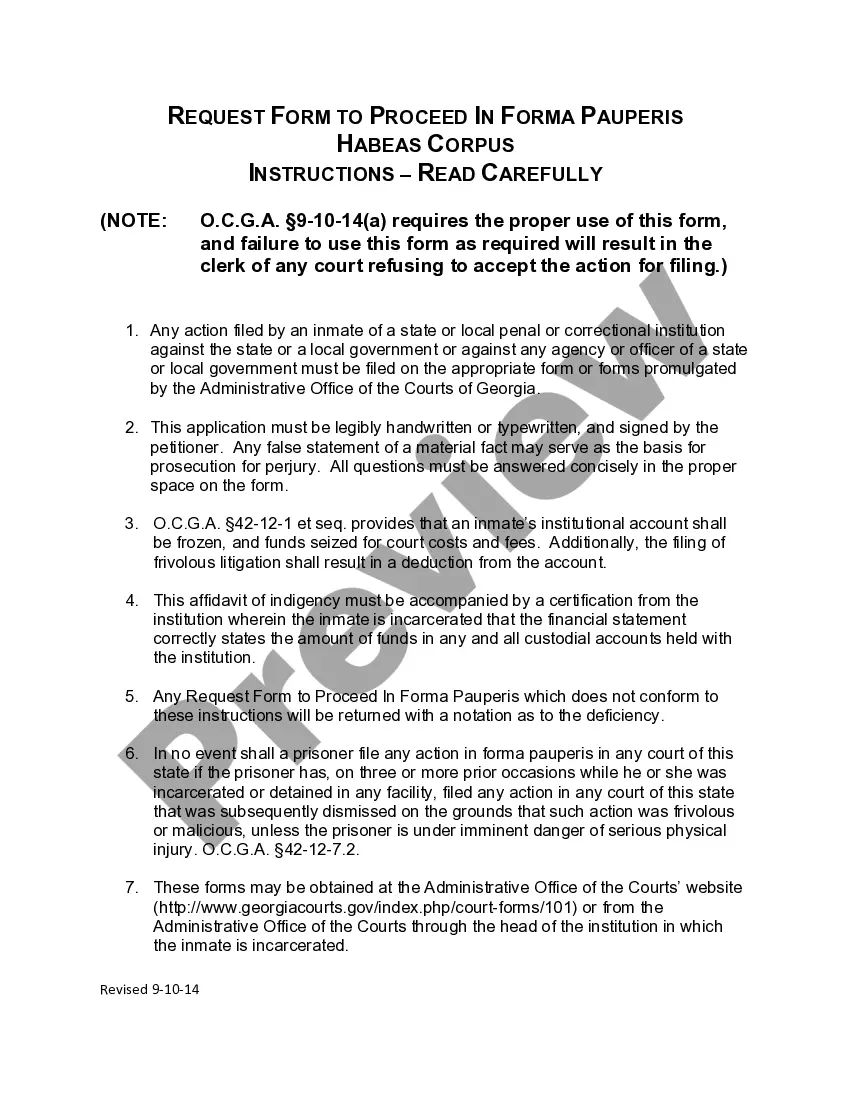

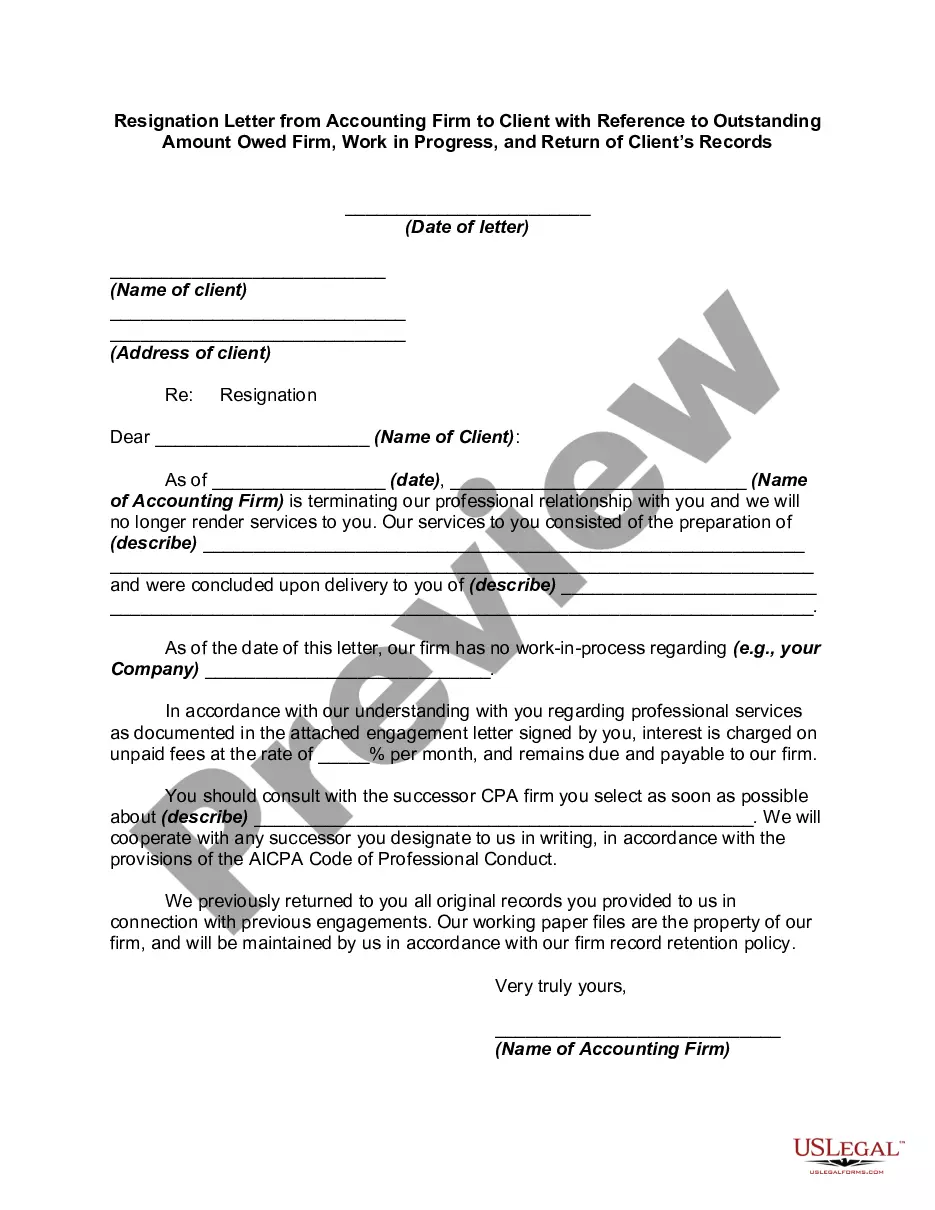

If available, use the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Minnesota Agreement to Dissolve and Wind up Partnership with Division of Assets between Partners.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents section and click on the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to ensure you have selected the appropriate template.

Form popularity

FAQ

File a Dissolution Form. You'll have to file a dissolution of partnership form in the state your company is based in to end the partnership and make it public formally. Doing this makes it evident that you are no longer in the partnership or held liable for its debts. Overall, this is a solid protective measure.

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

Dissolution by Agreement Any partnership firm can be dissolved by issuing a notice agreement to all the partners of the firm. If all the partners are in agreement on dissolution, then the partnership firm can be dissolved. This type of dissolution is the most common type and is called as voluntary dissolution.

In California, a general partnership is an association of two or more persons, acting as co-owners of a business for profit. Any partner in a partnership is free to dissociate, or leave the partnership, at any time.

NOTE: To cancel your Limited Liability Partnership registration, you must write Cancellation on the form in box four. A signature of at least 2 partners or authorized agent is required. Use this form to file your annual renewal once every calendar year.

Take a Vote or Action to Dissolve In most cases, dissolution provisions in a partnership agreement will state that all or a majority of partners must consent before the partnership can dissolve. In such cases, you should have all partners vote on a resolution to dissolve the partnership.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.