Minnesota Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

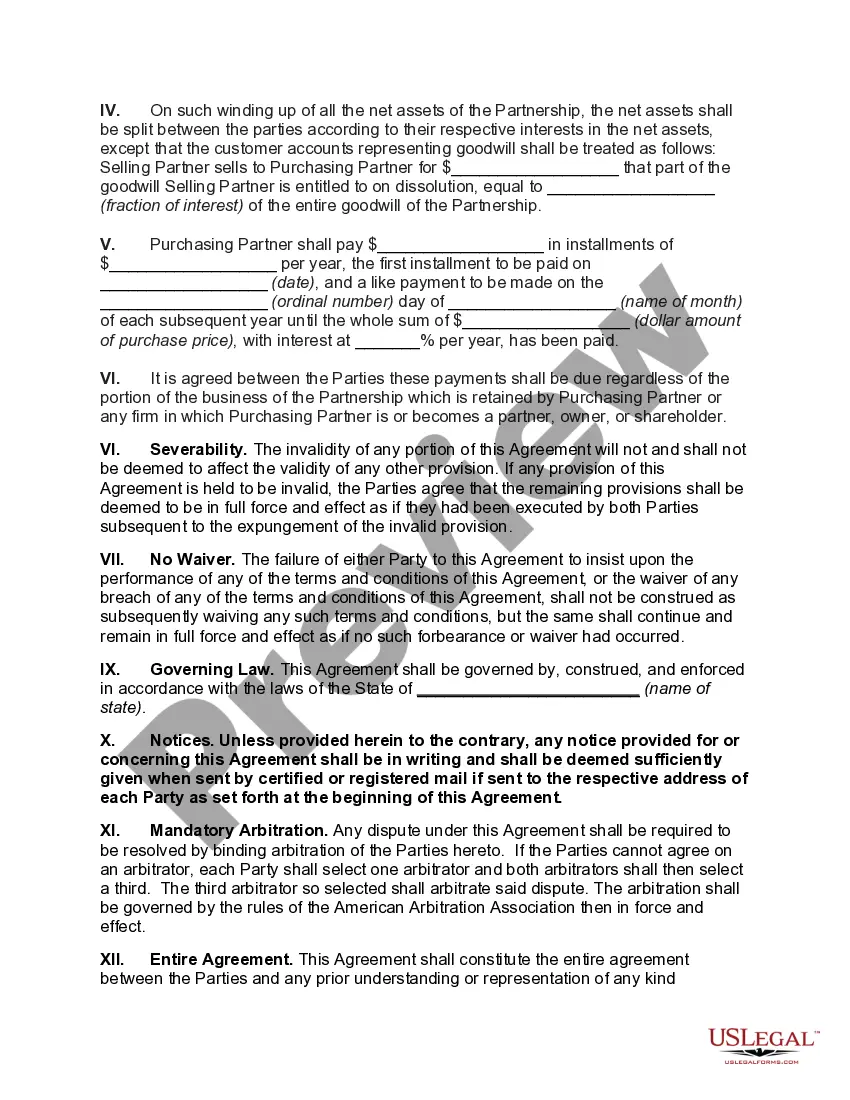

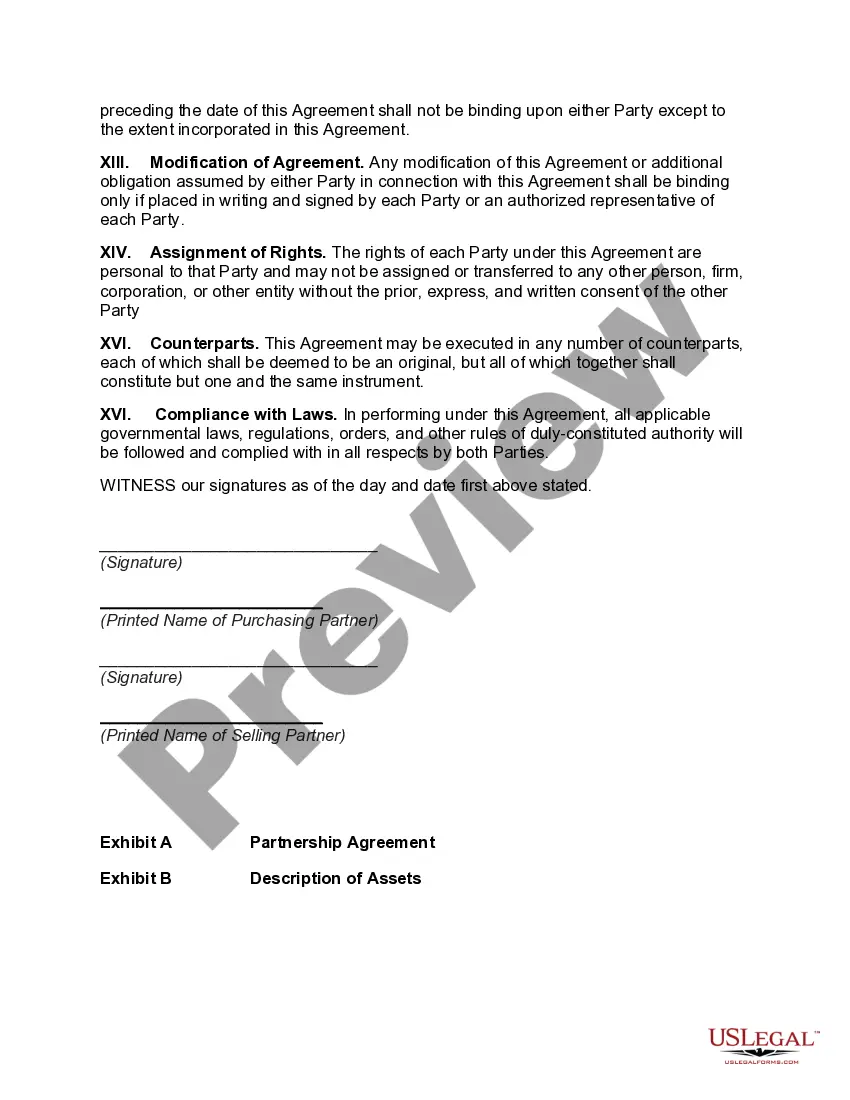

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the most recent versions of documents like the Minnesota Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets in just seconds.

If you already have a subscription, Log In to download the Minnesota Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets from the US Legal Forms library. The Download option will be available on every document you view. You can access all previously saved documents from the My documents tab of your account.

Process the transaction. Use your Visa, Mastercard, or PayPal account to complete the payment.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved Minnesota Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets.

Every document you add to your account has no expiration date and belongs to you indefinitely. So, if you want to download or print an additional copy, simply go to the My documents section and click on the document you need.

Access the Minnesota Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/region.

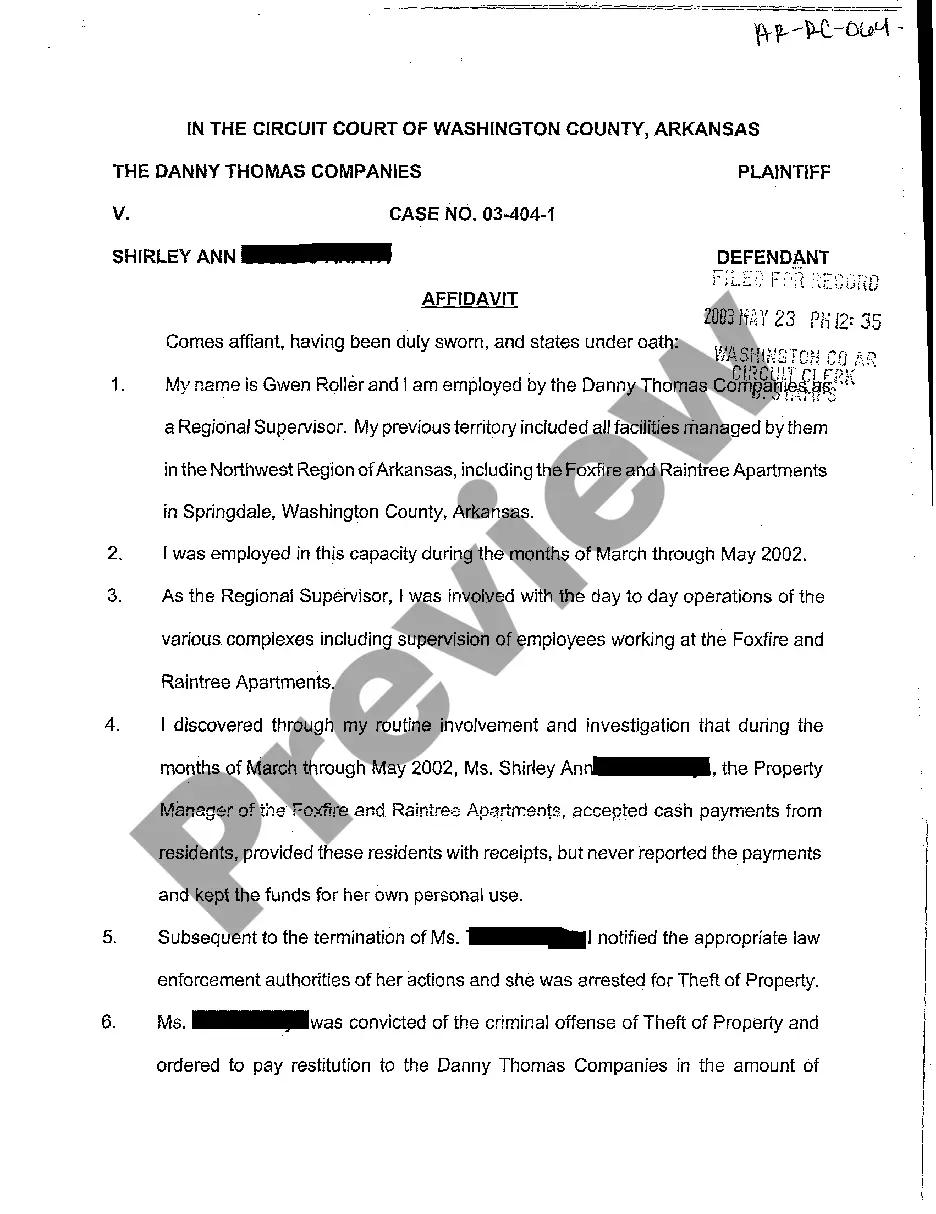

- Choose the Preview option to review the document's content.

- Examine the document outline to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

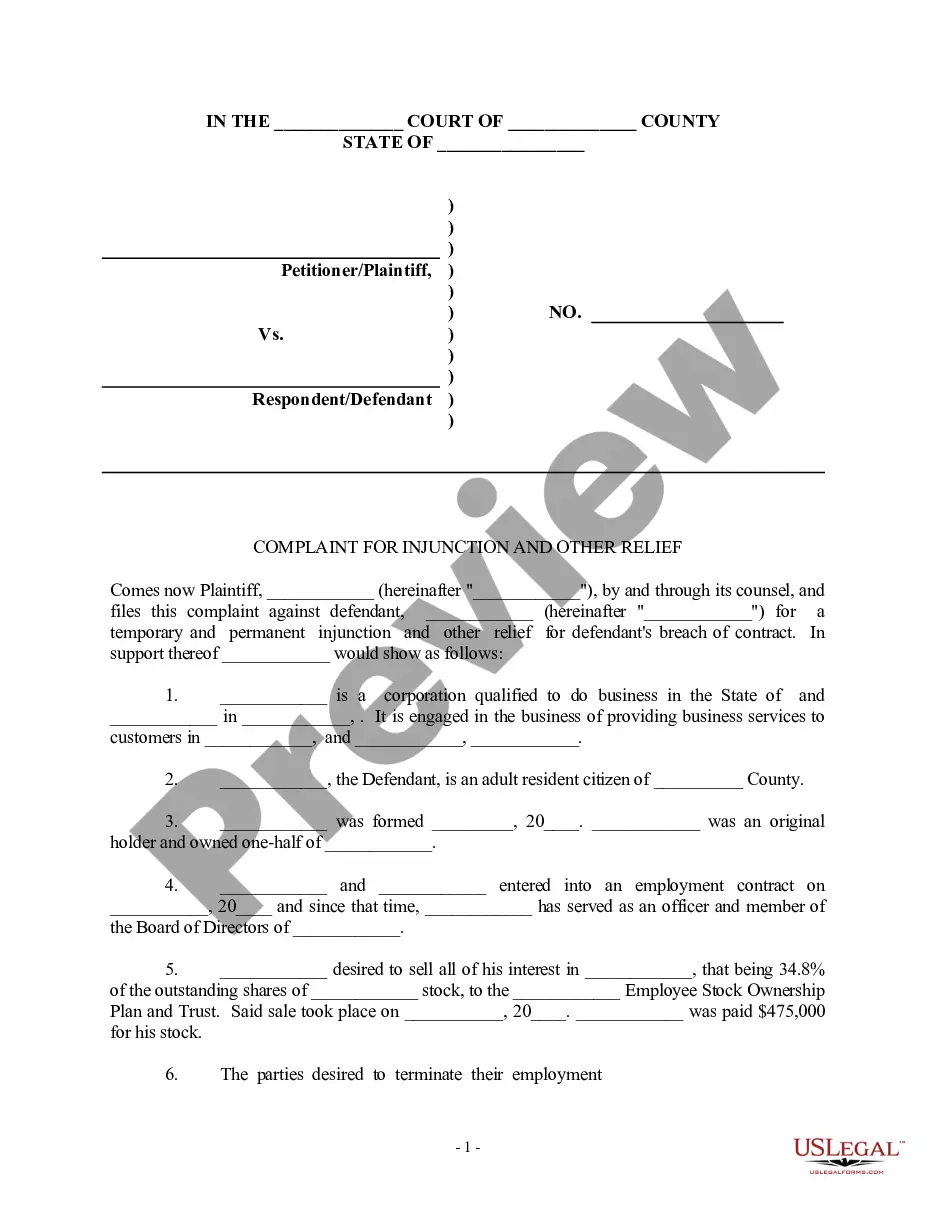

When one business partner buys out the other partners, the business ownership passes to a new entity. Depending on the legal structure under which the business is registered, this may mean that the company becomes a new business.

NOTE: To cancel your Limited Liability Partnership registration, you must write Cancellation on the form in box four. A signature of at least 2 partners or authorized agent is required. Use this form to file your annual renewal once every calendar year.

It is common for general partnerships to dissolve if any partner withdraws, dies, or becomes otherwise unable to continue their duties as a business partner.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

Dissolution by Agreement Any partnership firm can be dissolved by issuing a notice agreement to all the partners of the firm. If all the partners are in agreement on dissolution, then the partnership firm can be dissolved. This type of dissolution is the most common type and is called as voluntary dissolution.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.