Minnesota Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

Are you currently in a situation where you require documents for both professional and personal purposes almost every day? There are numerous trustworthy document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast collection of document templates, such as the Minnesota Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment, which can be printed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the Minnesota Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment template.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Minnesota Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment anytime if needed. Just select the necessary form to download or print the document template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify it is for the correct city/county.

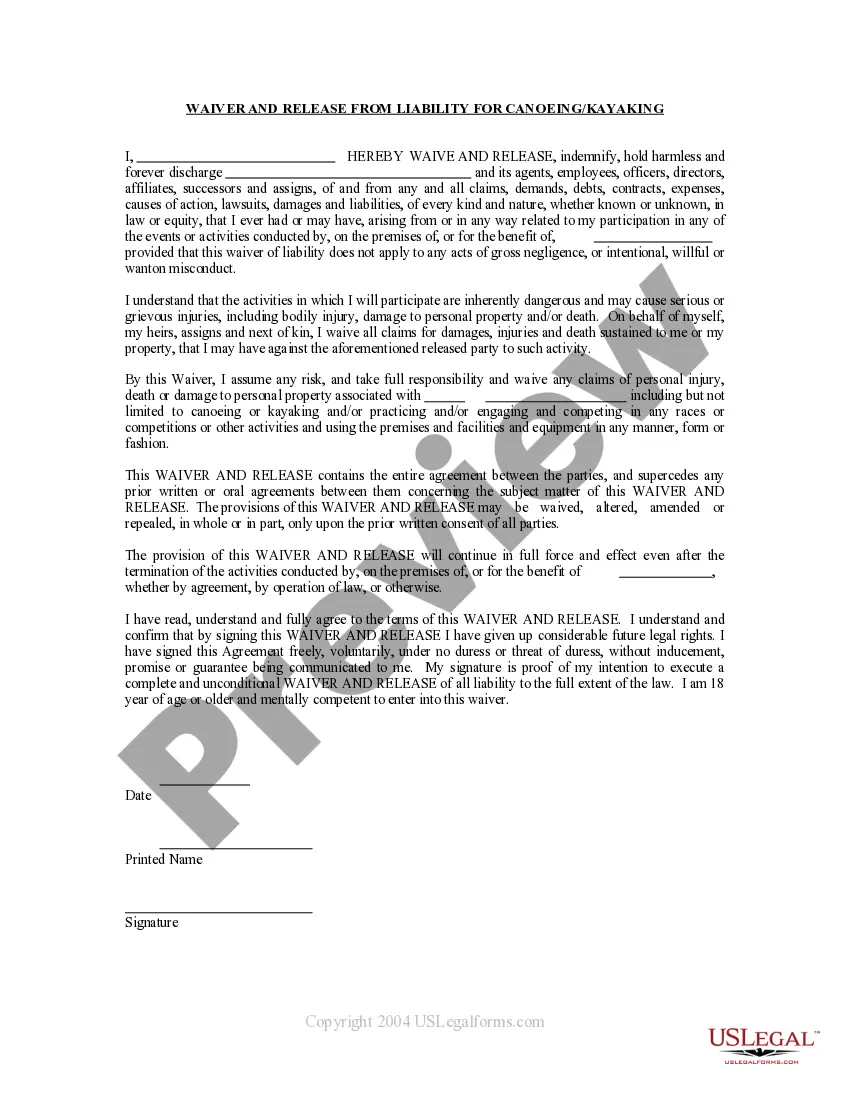

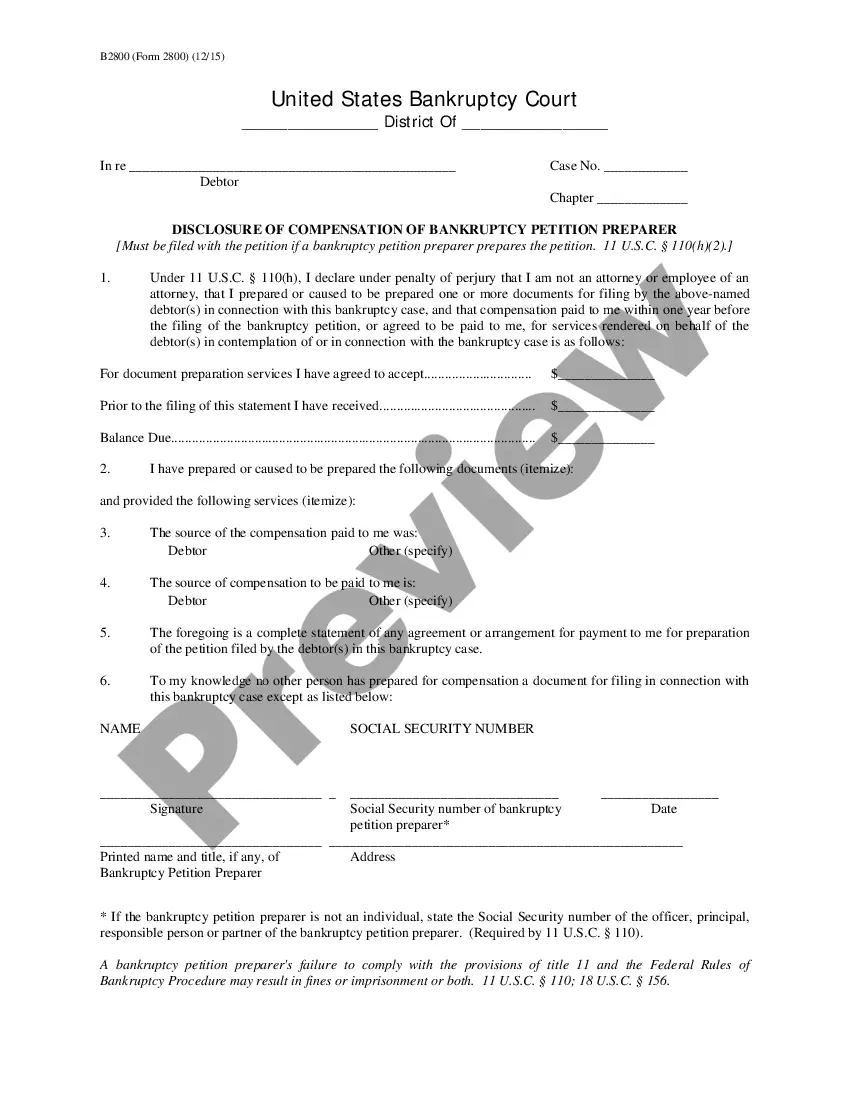

- Use the Preview button to view the form.

- Read the description to ensure you have selected the right form.

- If the form isn't what you're looking for, utilize the Search field to find the document that fits your needs.

- Once you find the suitable form, click Purchase now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete your order using PayPal or a credit card.

Form popularity

FAQ

Whether the former partner dies or otherwise quits the firm, the noncontinuing one or his, her, or its legal representative is entitled to an accounting and to be paid the value of the partnership interest, less damages for wrongful dissolution.

The distribution of payments of the Company in the process of winding-up shall be made in the following order: (i) All known debts and liabilities of the Company, excluding debts and liabilities to Members who are creditors of the Company; (ii) All known debts and liabilities of the Company owed to Members who are

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

NOTE: To cancel your Limited Liability Partnership registration, you must write Cancellation on the form in box four. A signature of at least 2 partners or authorized agent is required. Use this form to file your annual renewal once every calendar year.

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

Debt to parties, account of capital of each partner, advances given by partners, residue to be divided amongst partners in profit sharing ratio.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Dissolution by Agreement Any partnership firm can be dissolved by issuing a notice agreement to all the partners of the firm. If all the partners are in agreement on dissolution, then the partnership firm can be dissolved. This type of dissolution is the most common type and is called as voluntary dissolution.