Minnesota Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

US Legal Forms - one of the most extensive collections of legal documents in the USA - offers a range of legal template records that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Minnesota Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment in just a few moments.

If the form does not meet your needs, utilize the Search section at the top of the screen to find the one that fits.

If you are satisfied with the form, confirm your selection by clicking on the Get now button. Then, choose the payment plan you prefer and provide your credentials to register for an account.

- If you already have a subscription, Log In and download the Minnesota Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously obtained forms in the My documents tab of your account.

- To utilize US Legal Forms for the first time, here are basic guidelines to get you started.

- Make sure you have selected the correct form for your city/state.

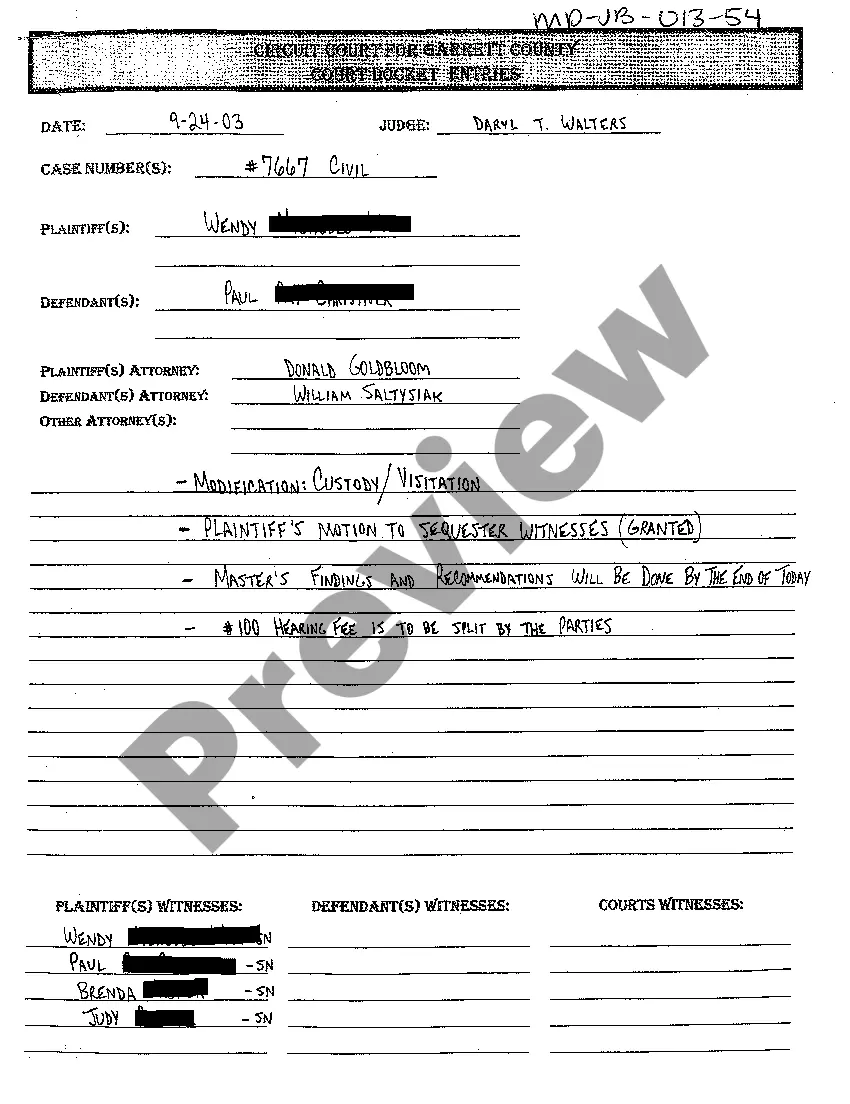

- Click the Review button to examine the contents of the form.

Form popularity

FAQ

If they continue, the old creditors remain as creditors of the new firm, the former partner remains liable for obligations incurred while she was a partner (she may be liable for debts arising after she left, unless proper notice is given to creditors), and the former partner or her estate is entitled to an accounting

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Winding up ends all outstanding legal and financial obligations of the partnership so that the business can be terminated. Winding up is a process and will be conducted according to the partnership agreement and according to applicable state laws. Once winding up is complete, the partnership is terminated.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

NOTE: To cancel your Limited Liability Partnership registration, you must write Cancellation on the form in box four. A signature of at least 2 partners or authorized agent is required. Use this form to file your annual renewal once every calendar year.

To terminate a partnership, a partner must sell or exchange a 50% or greater interest in both the capital and profits of the partnership. Thus, if a partner sells a 60% capital interest but only a 30% profits interest, the partnership will not terminate.

Dissolution by Agreement Any partnership firm can be dissolved by issuing a notice agreement to all the partners of the firm. If all the partners are in agreement on dissolution, then the partnership firm can be dissolved. This type of dissolution is the most common type and is called as voluntary dissolution.

Separation Agreement to Prevent Partnership Dissolution When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves.

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.