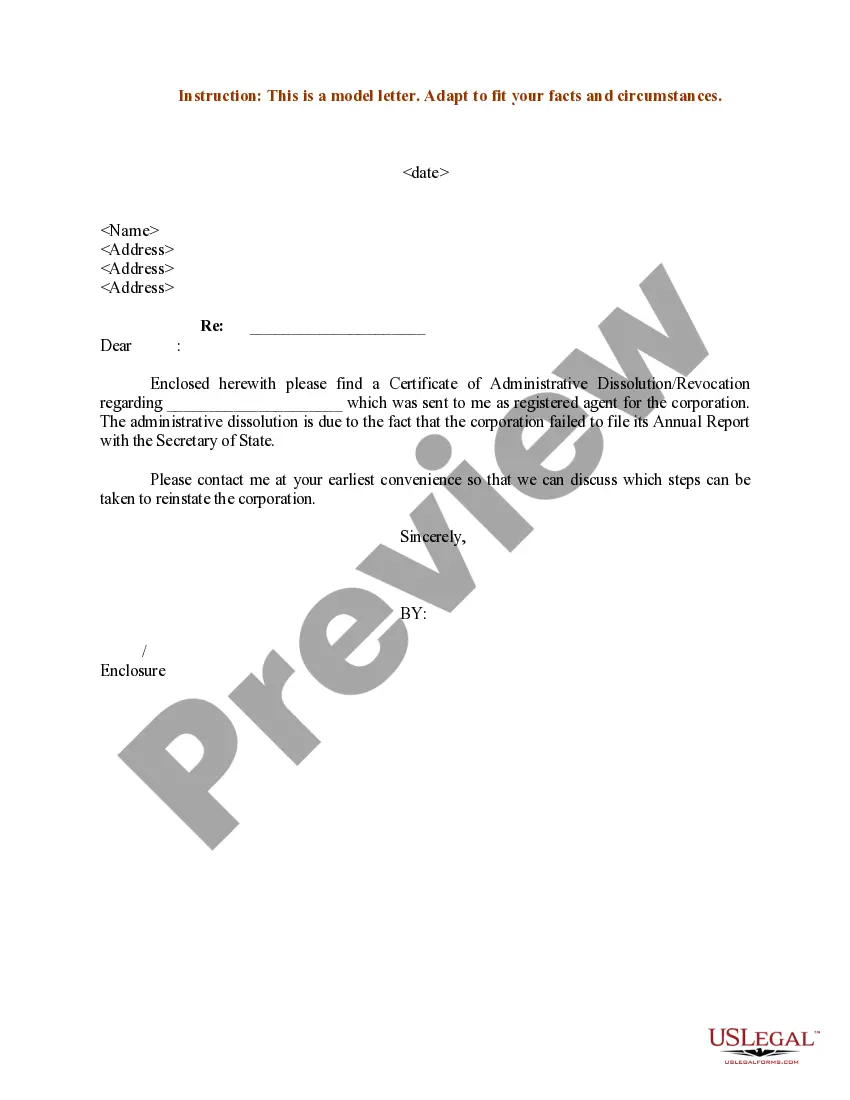

Minnesota Sample Letter for Dissolution and Liquidation

Description

How to fill out Sample Letter For Dissolution And Liquidation?

It is possible to spend hours on the Internet trying to find the legitimate file web template which fits the federal and state specifications you require. US Legal Forms provides a huge number of legitimate kinds that happen to be evaluated by pros. It is simple to down load or produce the Minnesota Sample Letter for Dissolution and Liquidation from our service.

If you already have a US Legal Forms profile, you are able to log in and then click the Acquire button. Afterward, you are able to complete, modify, produce, or sign the Minnesota Sample Letter for Dissolution and Liquidation. Every single legitimate file web template you buy is yours forever. To acquire yet another version of the acquired type, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms website for the first time, adhere to the straightforward guidelines below:

- First, ensure that you have chosen the best file web template for your region/area of your choice. Look at the type outline to ensure you have picked the right type. If offered, take advantage of the Preview button to search from the file web template too.

- If you wish to get yet another version of the type, take advantage of the Search field to obtain the web template that fits your needs and specifications.

- Once you have located the web template you want, click on Purchase now to move forward.

- Choose the prices program you want, type in your qualifications, and register for an account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal profile to purchase the legitimate type.

- Choose the formatting of the file and down load it to the product.

- Make changes to the file if possible. It is possible to complete, modify and sign and produce Minnesota Sample Letter for Dissolution and Liquidation.

Acquire and produce a huge number of file themes utilizing the US Legal Forms web site, which offers the greatest selection of legitimate kinds. Use skilled and express-specific themes to tackle your business or personal demands.

Form popularity

FAQ

Any nonprofit group or organization, unless exempt, located in Minnesota must register with the Minnesota Attorney General. Any non-exempt nonprofit, in any state, intending to solicit in Minnesota must also register, along with anyone intending to solicit in Minnesota on behalf of a nonprofit.

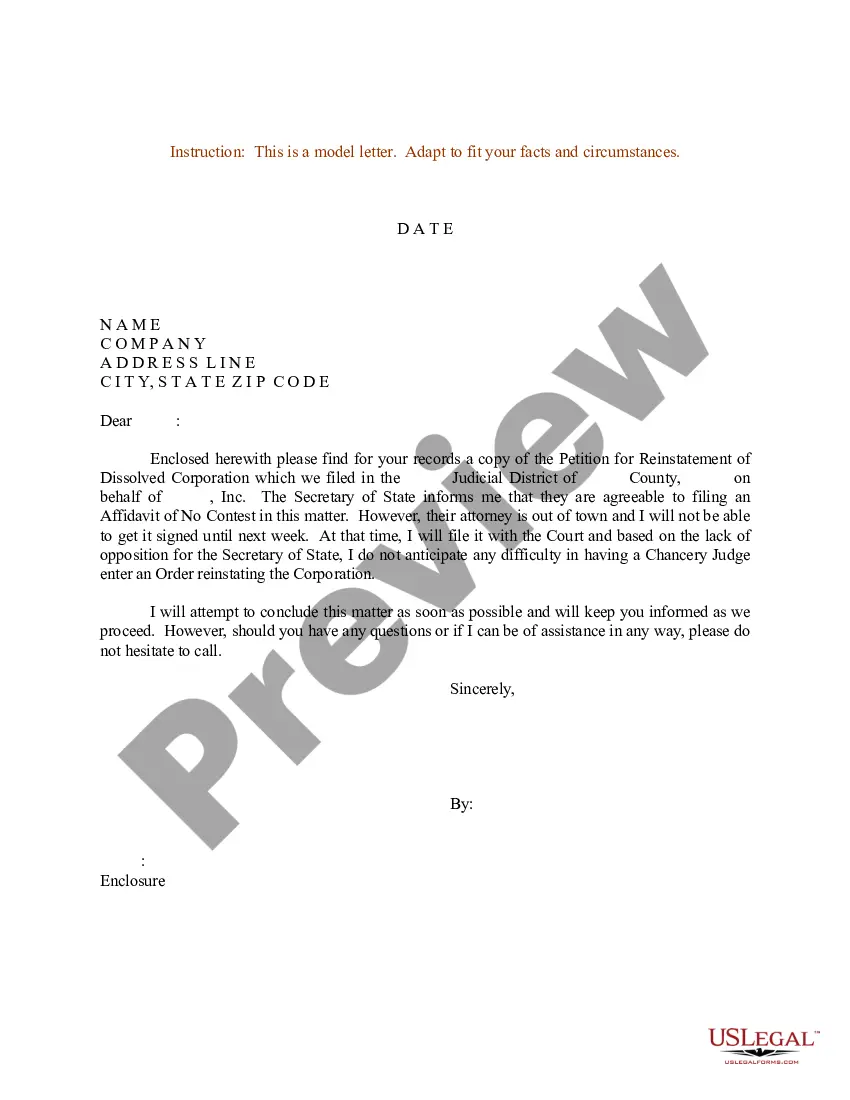

If you choose to close down a Minnesota nonprofit corporation, you will need to go through a process called dissolution. Dissolution requires a vote or other formal authorization, the filing of key documents with government agencies, and a group of other tasks collectively known as winding up the corporation.

To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A. 7291 or 302A. 727.

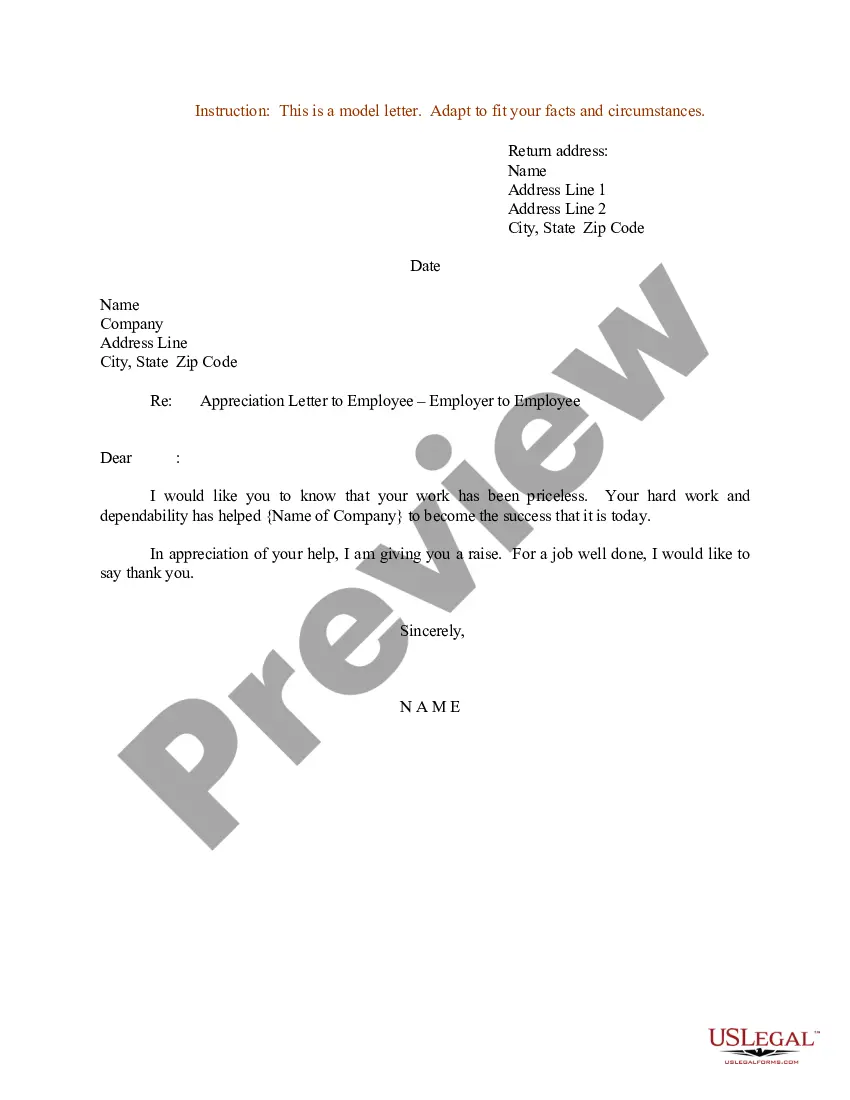

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

317A. A nonprofit corporation's purpose and activities must serve the organization's mission to benefit the public, and may not be operated to profit other persons or entities.

How do you dissolve a Minnesota Corporation? Corporations which have issued shares: To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A.

Minnesota law exempts certain nonprofit organizations from paying Sales and Use Tax. To get this exemption, an organization must apply to the Minnesota Department of Revenue for authorization, known as Nonprofit Exempt Status.

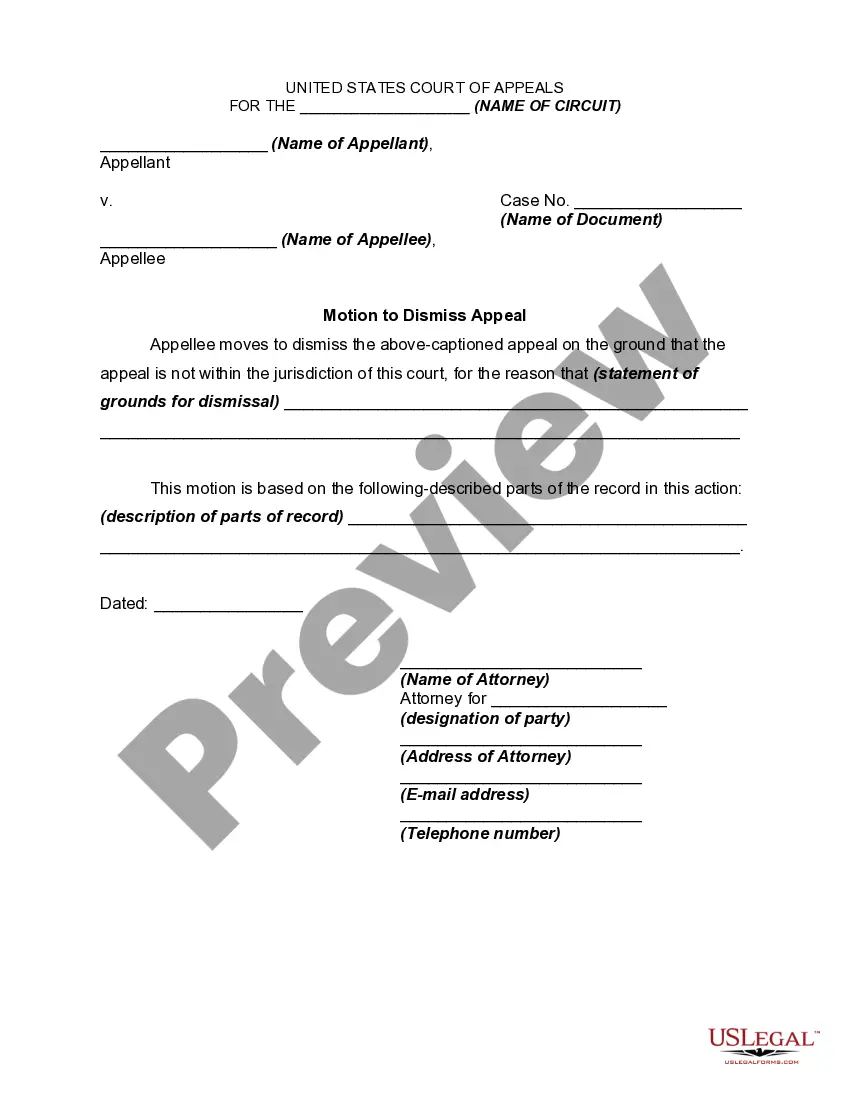

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.