Minnesota Sample Letter for Return of Late Payment and Denial of Discount

Description

How to fill out Sample Letter For Return Of Late Payment And Denial Of Discount?

If you need to gather, acquire, or print sanctioned document templates, utilize US Legal Forms, the largest compilation of legal forms, which is accessible online.

Leverage the site’s straightforward and user-friendly search feature to locate the documents you need.

An assortment of templates for business and personal purposes are organized by categories and states, or keywords. Employ US Legal Forms to find the Minnesota Sample Letter for Return of Late Payment and Denial of Discount in just a few clicks.

Every legal document template you acquire is yours indefinitely. You have access to all forms you saved within your account. Click the My documents section and choose a form to print or download again.

Compete and obtain, and print the Minnesota Sample Letter for Return of Late Payment and Denial of Discount with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to find the Minnesota Sample Letter for Return of Late Payment and Denial of Discount.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct region/state.

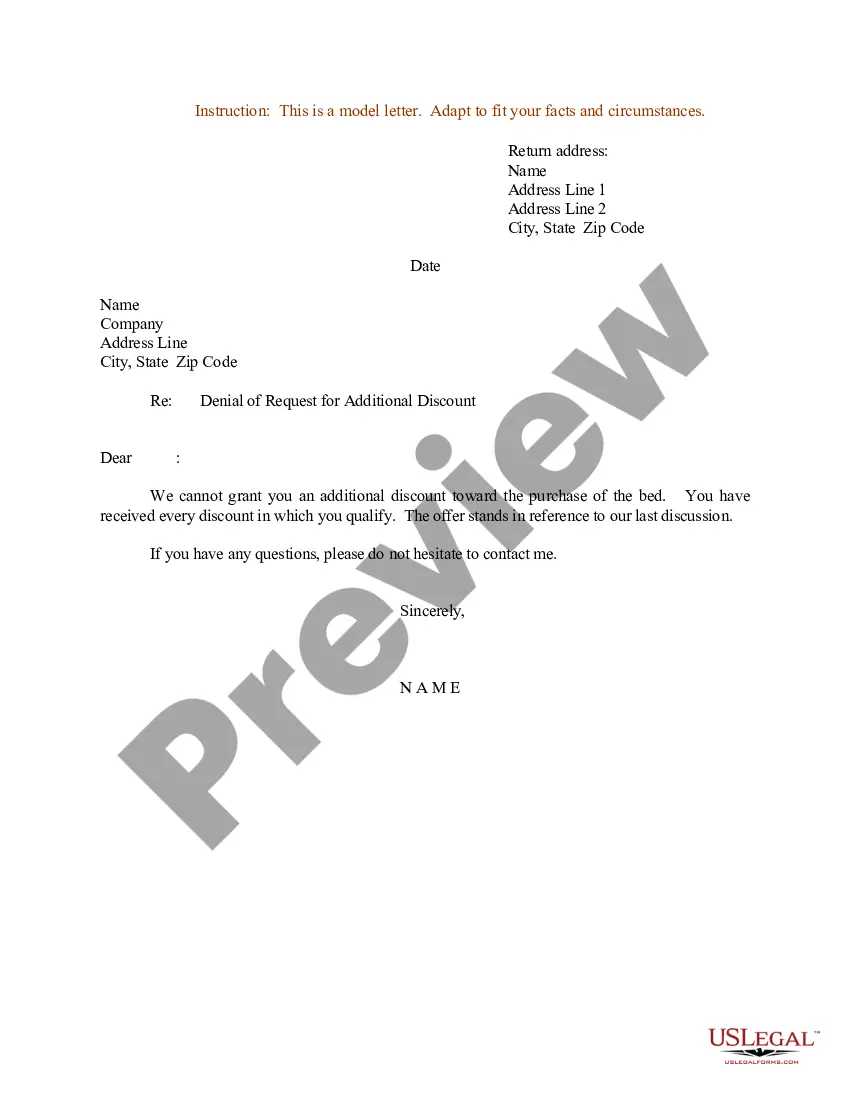

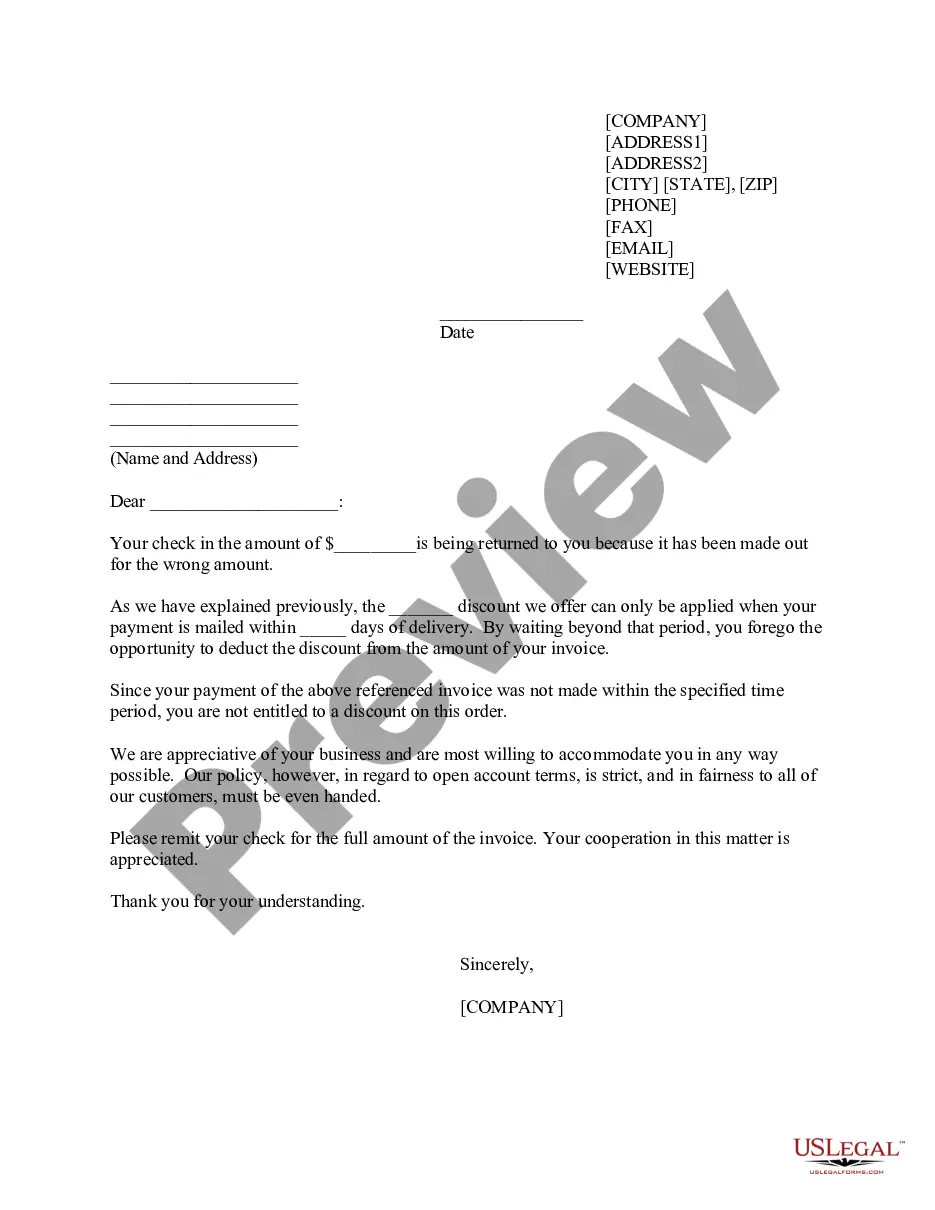

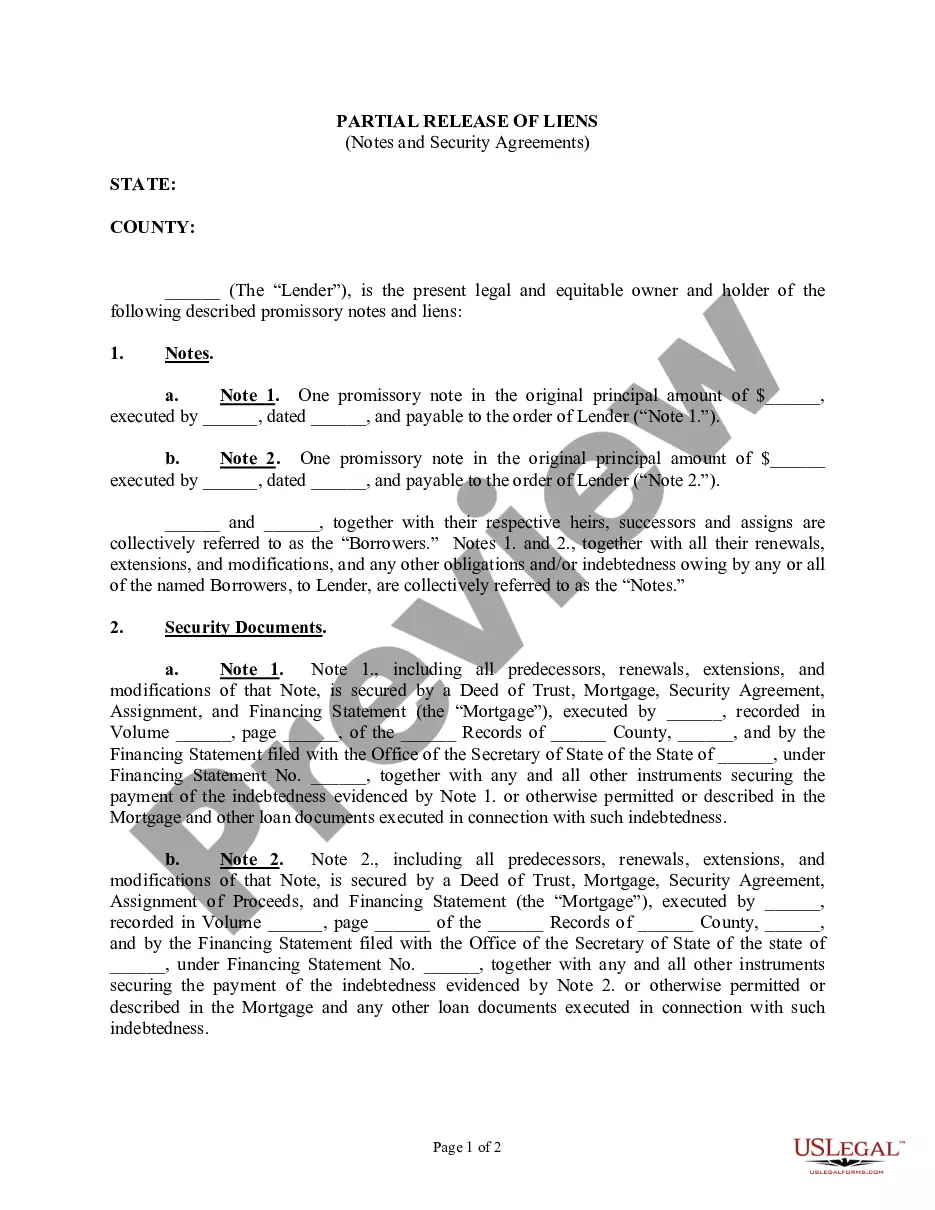

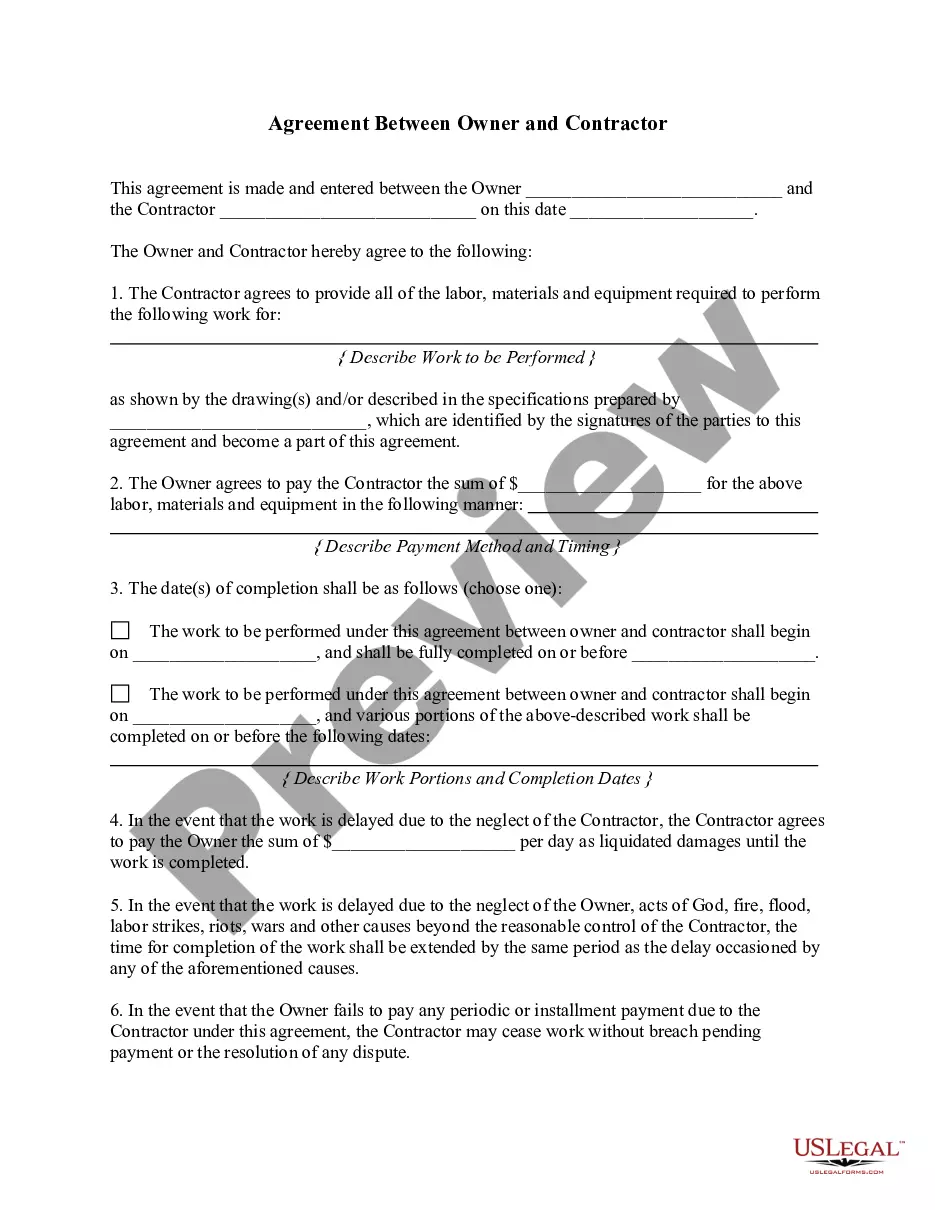

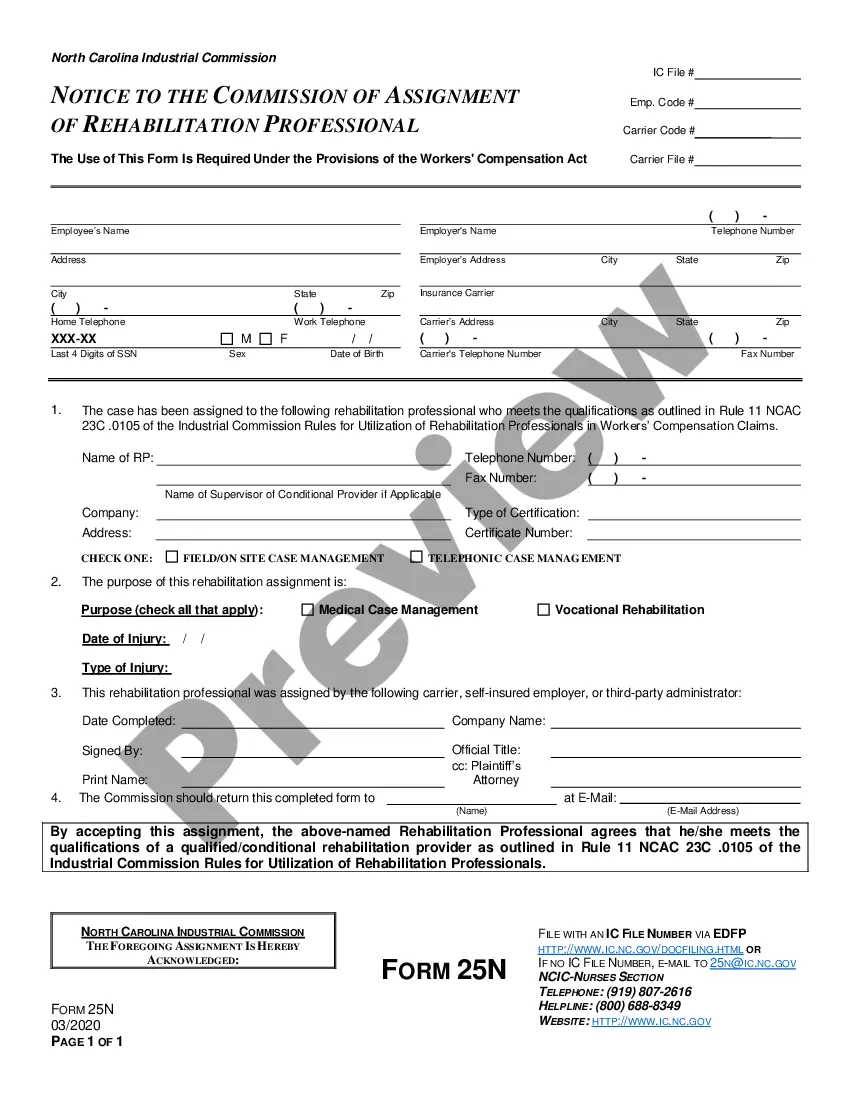

- Step 2. Use the Preview option to browse through the form’s content. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have identified the form you need, select the Acquire now button. Choose the payment plan you prefer and input your information to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Minnesota Sample Letter for Return of Late Payment and Denial of Discount.

Form popularity

FAQ

In Minnesota, the penalty for late sales tax can be quite significant. The state imposes penalties based on the amount of tax due and the length of the delay in payment. Procrastination can lead to increased fees and interest on the unpaid tax balance, which can accumulate quickly. To avoid these penalties, you may consider using a Minnesota Sample Letter for Return of Late Payment and Denial of Discount, which can help you formally address any issues with late payments.

Writing a reasonable cause letter involves explaining the circumstances that prevented you from fulfilling your tax obligations. Clearly state the factors involved, such as emergencies or other hardships, and include any supporting evidence. Make your case clearly and confidently to increase your chances of acceptance. A Minnesota Sample Letter for Return of Late Payment and Denial of Discount can serve as an excellent resource to help structure your letter.

To write a letter asking for a penalty waiver, clearly outline the reason for your request and include any supporting documentation. Describe the circumstances that led to the penalty and explain why you believe a waiver is justified. Make sure your letter is professional and straightforward. Utilizing a Minnesota Sample Letter for Return of Late Payment and Denial of Discount can streamline your writing process and improve your chances of success.

The Schedule M15 in Minnesota is a form used for reporting income adjustments that differ from federal adjustments. This form details certain tax credits and deductions specific to Minnesota taxpayers. Understanding how to complete this form properly is vital for your tax filing process. For additional guidance, you might reference templates like the Minnesota Sample Letter for Return of Late Payment and Denial of Discount to communicate any inquiries you have.

When you write a first-time abatement letter, begin with your complete contact information followed by a description of your request. State that you have a clean compliance history and explain why you believe a penalty should be waived. Ensure that you detail your legitimate reasons clearly. Consider using a Minnesota Sample Letter for Return of Late Payment and Denial of Discount as a guide for your letter.

A penalty abatement letter is a formal request to the IRS asking for the reduction or cancellation of penalties due to specific circumstances. For instance, if you experienced a severe illness that caused delays in your tax filings, you would explain this in your letter. Make sure to provide a clear and concise narrative backed by evidence. A well-structured Minnesota Sample Letter for Return of Late Payment and Denial of Discount can be beneficial in crafting your letter.

To write a letter of explanation to the IRS, start by stating your name, address, and the reason for your correspondence. Be direct and specific about the issue you are addressing and provide any necessary details. Lastly, reference any supporting documents you are including with your letter. A Minnesota Sample Letter for Return of Late Payment and Denial of Discount can serve as a solid template to guide your writing.

When writing a letter to the IRS, begin with your contact information followed by the IRS address. Clearly state the subject of your letter in a concise manner. You might also want to include any relevant tax identification numbers to avoid confusion. For further assistance, consider utilizing a Minnesota Sample Letter for Return of Late Payment and Denial of Discount to ensure your message is clear and professional.

Reasonable cause refers to a legitimate reason for failing to comply with tax obligations. An example might be a natural disaster that prevented someone from meeting their tax responsibilities. The IRS considers each case individually, so ensure you document your situation clearly. Using a Minnesota Sample Letter for Return of Late Payment and Denial of Discount can help explain your circumstances effectively.

Filing sales tax late in Minnesota can lead to penalties and interest charges on the unpaid amount. Each month, a 1.5% interest is added to the overdue tax, compounding the amount owed. If you find yourself in this situation, a Minnesota Sample Letter for Return of Late Payment and Denial of Discount can serve as an effective tool to clarify your position and request resolution.