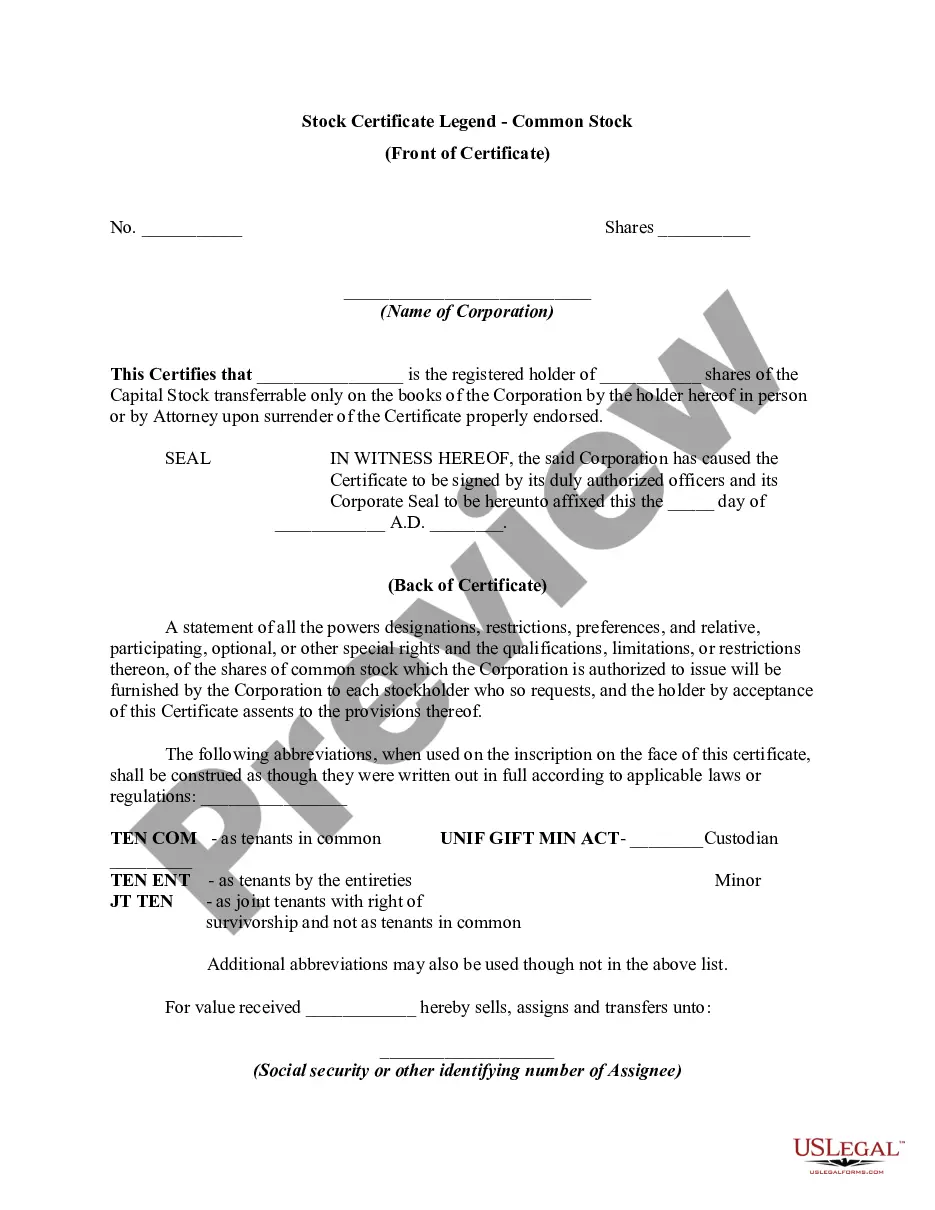

Arkansas Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders

Description

How to fill out Legend On Stock Certificate Giving Notice Of Restriction On Transfer Due To Stock Redemption Agreement Requiring First An Offer To The Corporation And Then An Offer To Other Stockholders?

US Legal Forms - among the biggest libraries of authorized forms in the United States - delivers a wide array of authorized file templates it is possible to acquire or print. Utilizing the site, you may get a large number of forms for business and individual uses, categorized by groups, says, or keywords and phrases.You will discover the latest models of forms much like the Arkansas Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders within minutes.

If you already possess a monthly subscription, log in and acquire Arkansas Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders through the US Legal Forms library. The Download key can look on each and every develop you look at. You get access to all in the past acquired forms from the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, listed here are straightforward instructions to obtain started out:

- Make sure you have picked out the proper develop for the metropolis/region. Select the Preview key to examine the form`s articles. Look at the develop description to ensure that you have chosen the correct develop.

- In the event the develop doesn`t suit your demands, utilize the Lookup area on top of the monitor to obtain the one which does.

- If you are content with the form, affirm your option by clicking on the Purchase now key. Then, select the rates strategy you favor and offer your credentials to sign up for the accounts.

- Approach the financial transaction. Make use of bank card or PayPal accounts to complete the financial transaction.

- Select the format and acquire the form in your system.

- Make adjustments. Load, edit and print and signal the acquired Arkansas Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders.

Each and every web template you included in your money does not have an expiry date and is also the one you have permanently. So, in order to acquire or print yet another version, just visit the My Forms area and then click around the develop you will need.

Get access to the Arkansas Legend on Stock Certificate Giving Notice of Restriction on Transfer due to Stock Redemption Agreement Requiring First an Offer to the Corporation and then an Offer to other Stockholders with US Legal Forms, by far the most considerable library of authorized file templates. Use a large number of expert and state-distinct templates that fulfill your organization or individual demands and demands.

Form popularity

FAQ

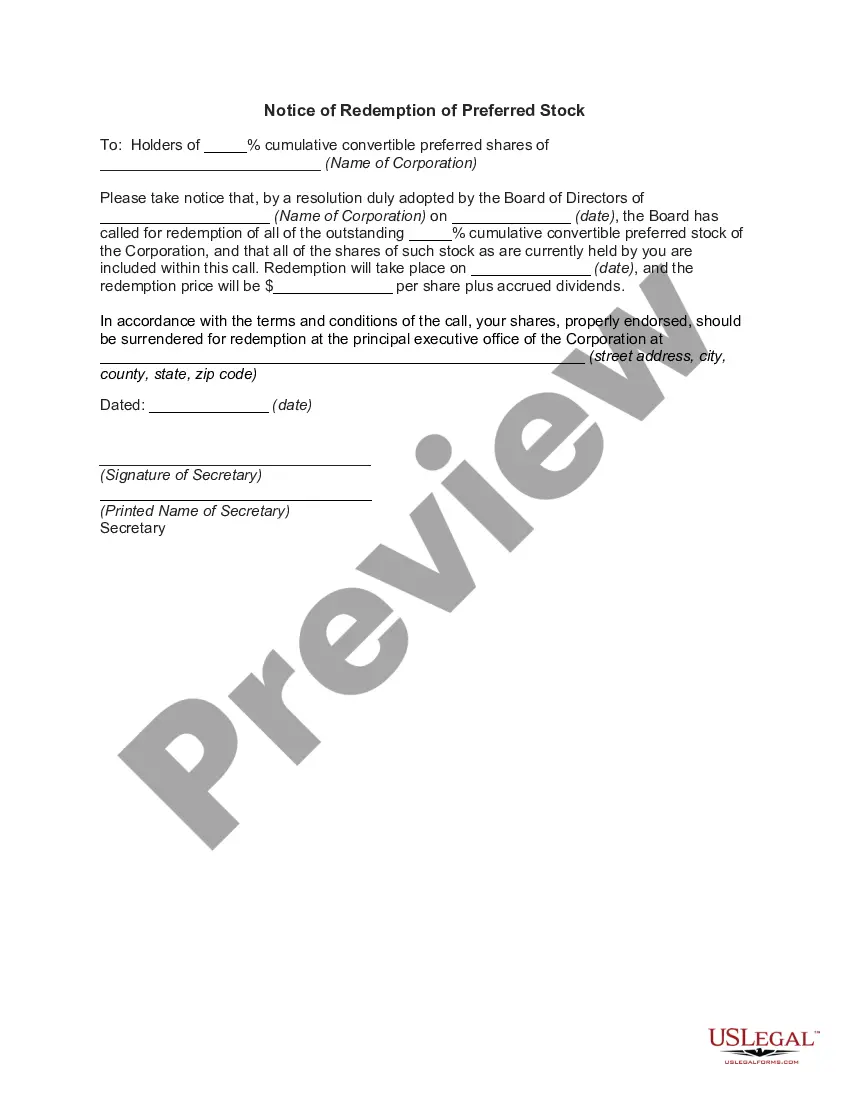

A stock redemption agreement is a buy-sell agreement between a private corporation and its shareholders. The agreement stipulates that if a triggering event occurs, the company will purchase shares from the shareholder upon their exit from the company.

Most importantly, a stock redemption plan provides tax-free, cash resources to pay a deceased owner's surviving family for their share of the business. Without extra funds available, a business might otherwise have to liquidate or sell assets in order to stay afloat during such a challenging time.

When a corporation purchases the stock of a departing shareholder, it's called a ?redemption.? When the other stockholders purchase the stock, it's called a cross-purchase. Typically, the redemption versus cross-purchase decision doesn't impact the ultimate control results.

Unlike a redemption, which is compulsory, selling shares back to the company with a repurchase is voluntary. However, a redemption typically pays investors a premium built into the call price, partly compensating them for the risk of having their shares redeemed.

Another common type of buy-sell agreement is the ?stock redemption? agreement. This is an agreement between shareholders in a company that states when a shareholder leaves the business, whether it be due to retirement, disability, death, or other reason, the departing members shares will be bought by the company.