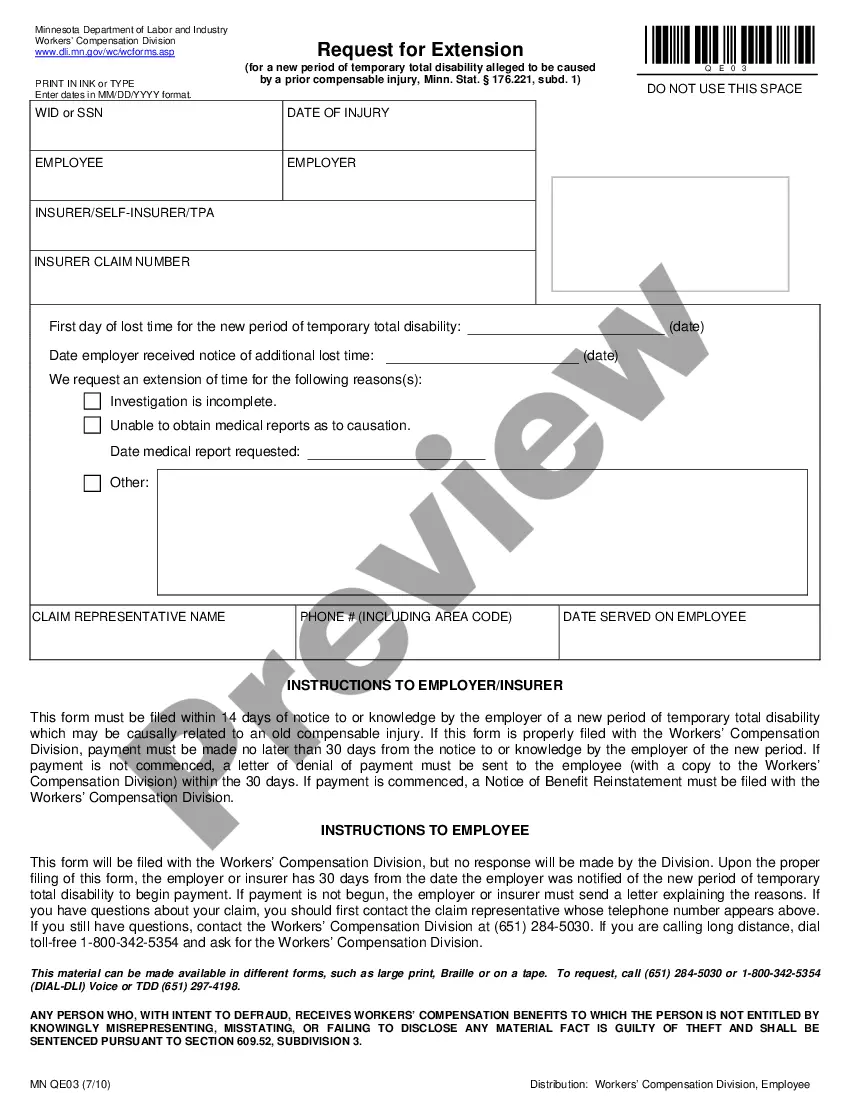

Minnesota Request For Extension (MN RFE) is an online filing system offered by the Minnesota Department of Revenue that allows individuals and businesses to apply for an extension of time to file their taxes. There are two types of MN RFE: 1. Automatic Extension: An Automatic Extension provides an additional seven months (until October 15) to file your tax returns. This type of extension does not require you to submit any paperwork or payment. 2. Extension Request: An Extension Request allows you to request an additional six months (until December 15) to file your tax returns. This type of extension requires you to submit a completed Extension Request form and payment to the Minnesota Department of Revenue. When applying for a Minnesota Request For Extension, taxpayers must provide their name, address, Social Security number, and the type of tax return they are filing. Once the request is approved, taxpayers will receive a confirmation letter and have the additional time to submit their returns.

Minnesota Request For Extension

Description

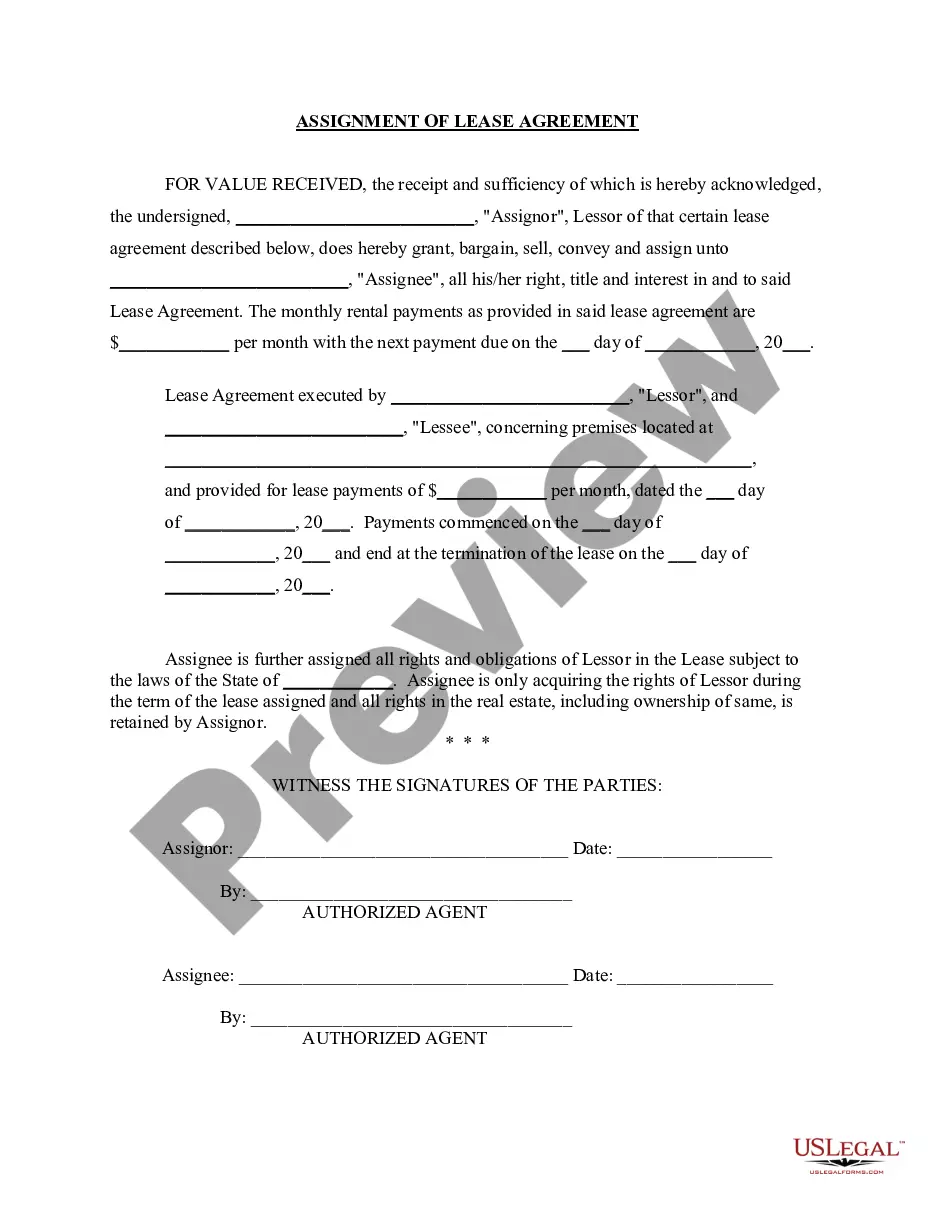

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

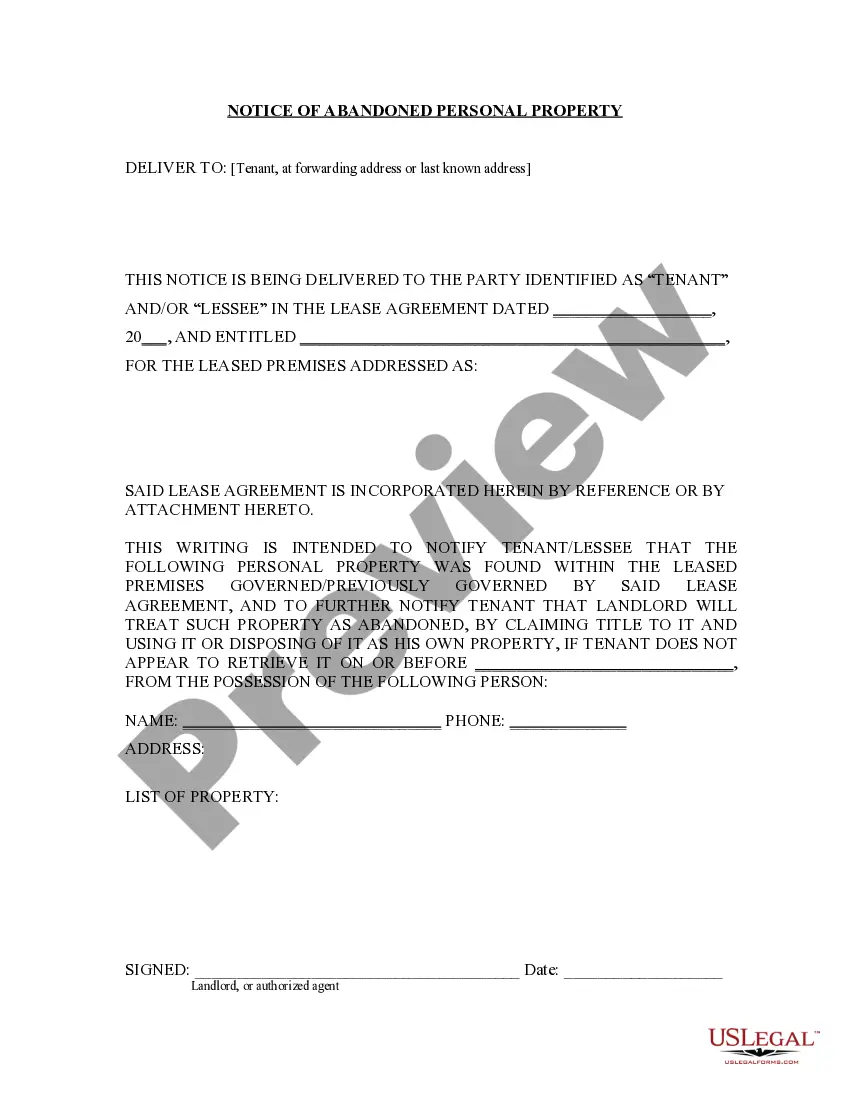

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

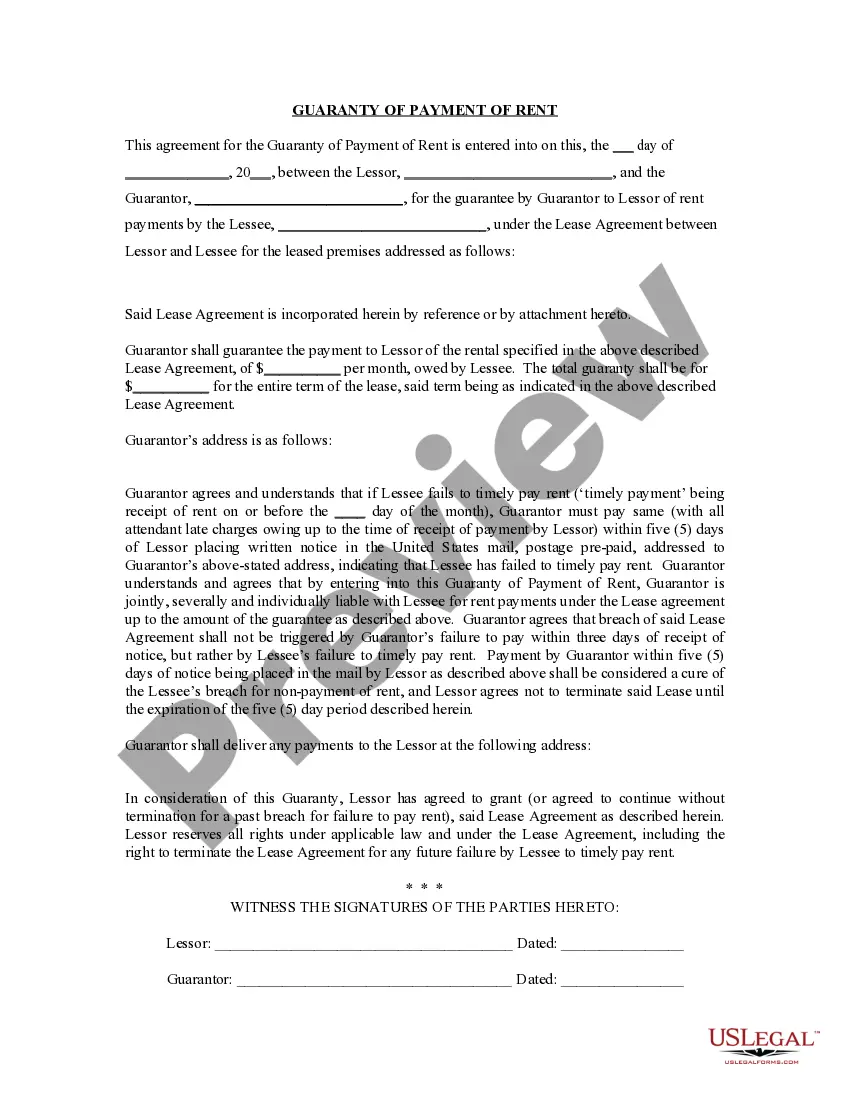

Looking for another form?

How to fill out Minnesota Request For Extension?

How much duration and resources do you generally allocate to creating official documentation.

There’s a more efficient method to obtain such forms than employing legal professionals or spending hours searching online for an appropriate template. US Legal Forms is the leading online repository that offers professionally crafted and validated state-specific legal documents for any objective, including the Minnesota Request For Extension.

Another benefit of our service is that you can access previously downloaded documents that you securely store in your profile in the My documents tab. Retrieve them anytime and redo your paperwork as often as necessary.

Save time and energy completing official paperwork with US Legal Forms, one of the most trustworthy online solutions. Sign up with us now!

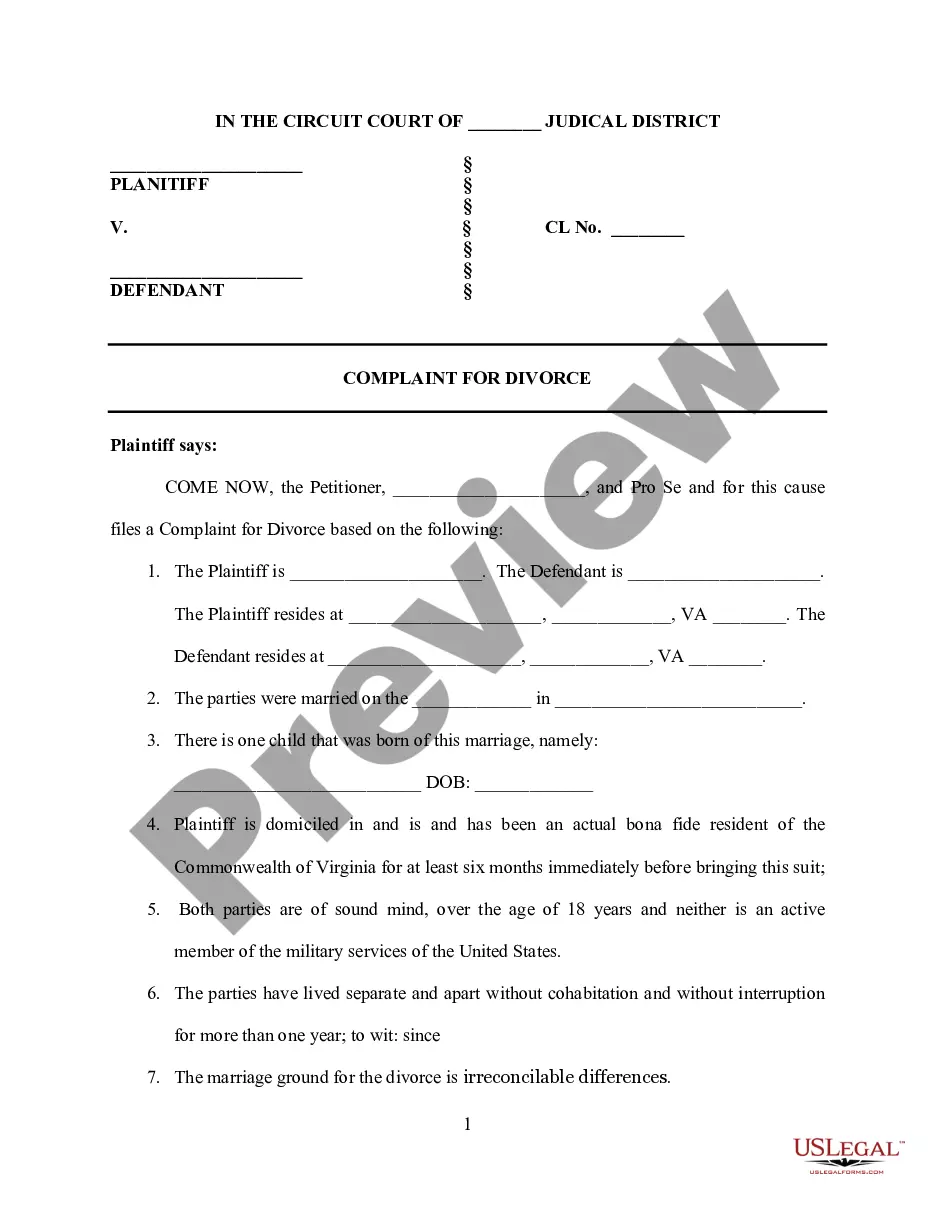

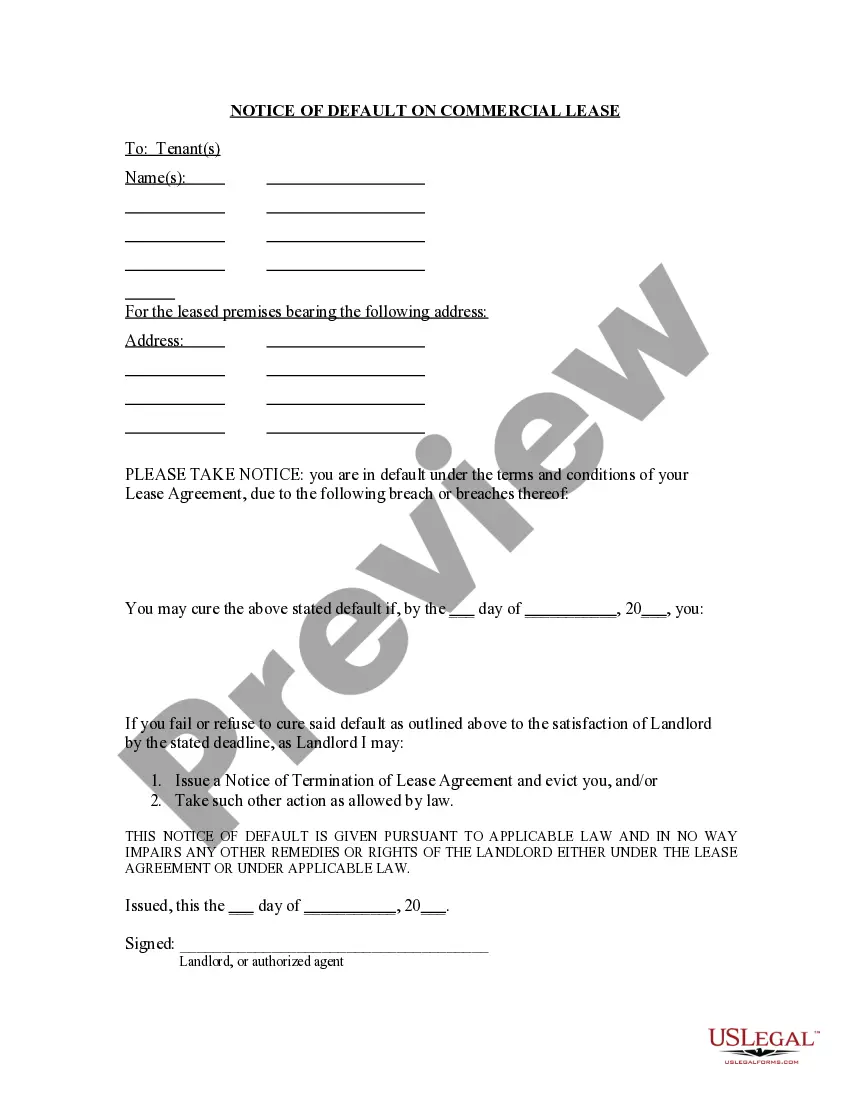

- Review the form content to confirm it adheres to your state regulations. To accomplish this, read the form description or utilize the Preview option.

- If your legal template does not meet your requirements, search for another one using the search bar at the top of the page.

- If you are already signed up with our service, Log In and download the Minnesota Request For Extension. If not, continue to the next steps.

- Click Buy now once you locate the correct template. Choose the subscription plan that fits you best to gain access to our library’s complete service.

- Create an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is completely secure for that.

- Download your Minnesota Request For Extension onto your device and complete it on a printed hard copy or digitally.

Form popularity

FAQ

Minnesota does not offer an automatic extension for filing your tax return. You must submit a Minnesota Request For Extension to receive additional time. However, if you file this request on time, you can extend your deadline for up to six months. Using platforms like uslegalforms can simplify the process of filing your extension, ensuring you meet all requirements efficiently.

You cannot file for a Minnesota Request For Extension after the October 15th deadline. The extension allows you additional time to file your tax return, but it must be requested before this date. If you miss this deadline, you may face penalties and interest on any unpaid taxes. It is always best to file your extension as early as possible to avoid any last-minute issues.

To fill out a tax extension form, start by visiting the official IRS website or a trusted platform like US Legal Forms. You need to provide your personal information, including your name, address, and Social Security number. Follow the instructions carefully, ensuring you include your estimated tax liability. Finally, submit your Minnesota Request For Extension form before the deadline to secure your extension.

Yes, you can request an extension online in Minnesota through the Minnesota Department of Revenue's e-file system. This convenient option allows you to complete your request quickly and efficiently from the comfort of your home. Additionally, platforms like US Legal Forms offer resources to help you navigate the online process. A Minnesota Request For Extension submitted online ensures your request is processed swiftly.

Minnesota does not offer an automatic extension for tax returns. You must actively request an extension by submitting the necessary forms to the state. This proactive step is crucial for ensuring that you can file your taxes without facing late penalties. Utilizing a Minnesota Request For Extension helps you stay compliant and provides peace of mind during the tax season.

Filing an extension for Minnesota taxes involves completing Form M-1, which is the state's official extension request form. You can easily find this form on the Minnesota Department of Revenue website or through platforms like US Legal Forms. Be sure to send in your request before the tax deadline to ensure you avoid penalties. A Minnesota Request For Extension allows you additional time to prepare your tax return without incurring late fees.

To request an extension date in Minnesota, you need to submit a formal request to the appropriate state office. You can do this by using forms provided by the Minnesota Department of Revenue. Make sure to specify the reason for your extension request and include any necessary documentation. Remember that a Minnesota Request For Extension must be submitted before the original due date.