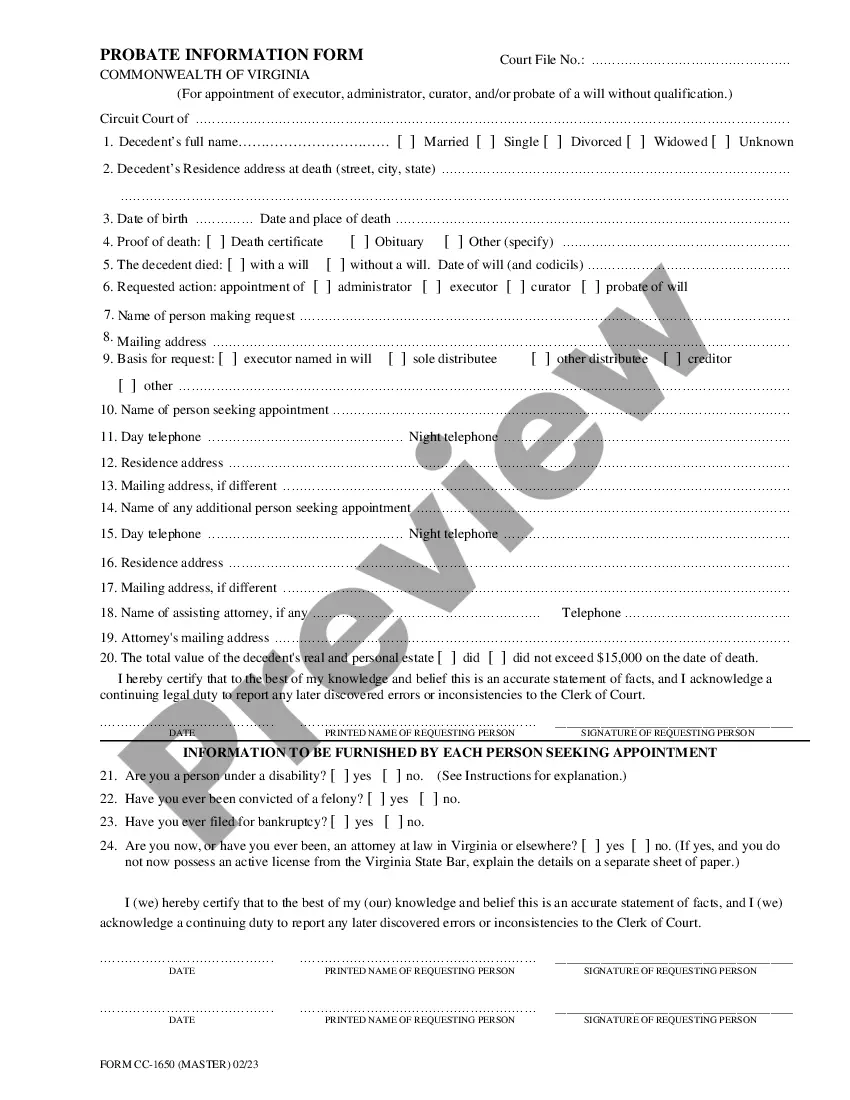

This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

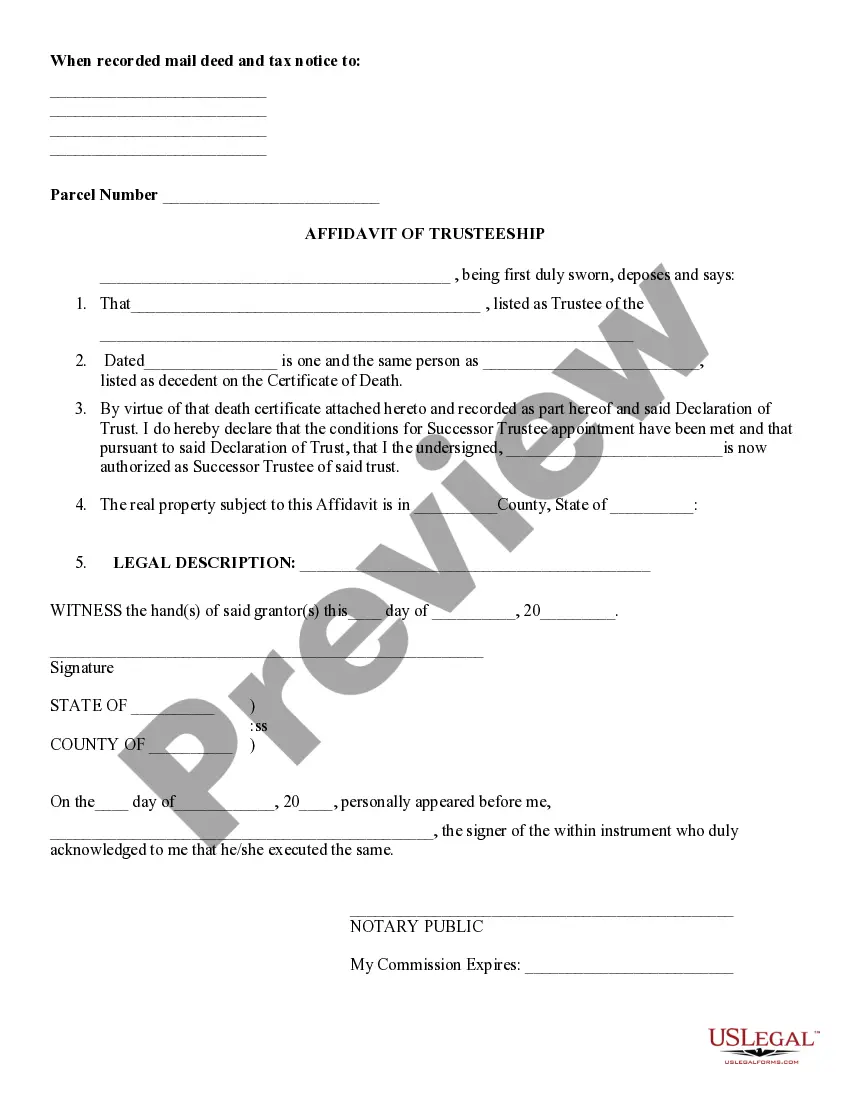

Virginia Trust Information Form

Description

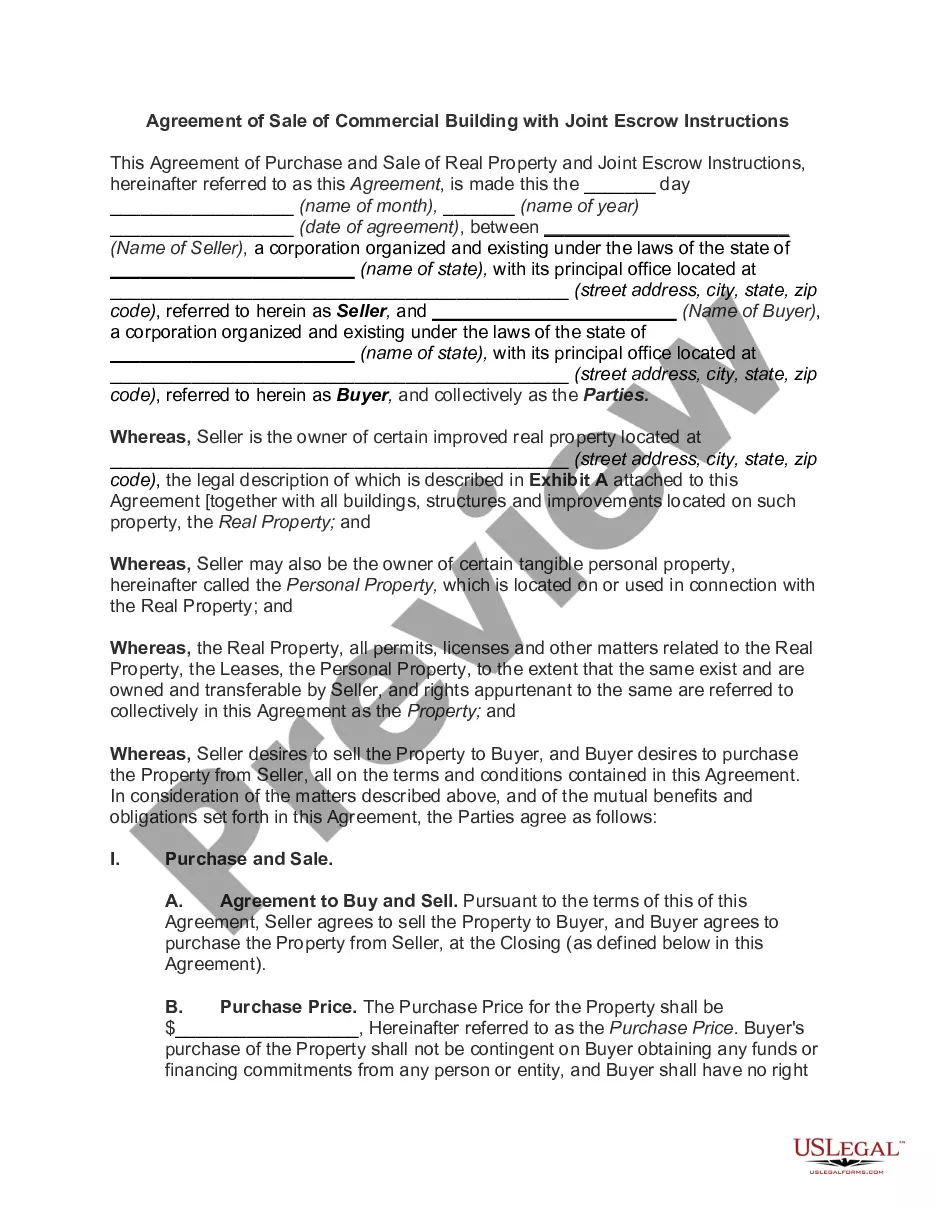

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Virginia Trust Information Form?

Looking for a Virginia Trust Information Form online might be stressful. All too often, you see files that you simply think are alright to use, but find out afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Have any document you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll automatically be added in to the My Forms section. In case you don’t have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step guidelines listed below to download Virginia Trust Information Form from the website:

- Read the form description and hit Preview (if available) to verify if the form suits your expectations or not.

- In case the document is not what you need, find others with the help of Search field or the listed recommendations.

- If it is appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the document in a preferable format.

- Right after downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted samples, users are also supported with step-by-step instructions concerning how to get, download, and complete templates.

Form popularity

FAQ

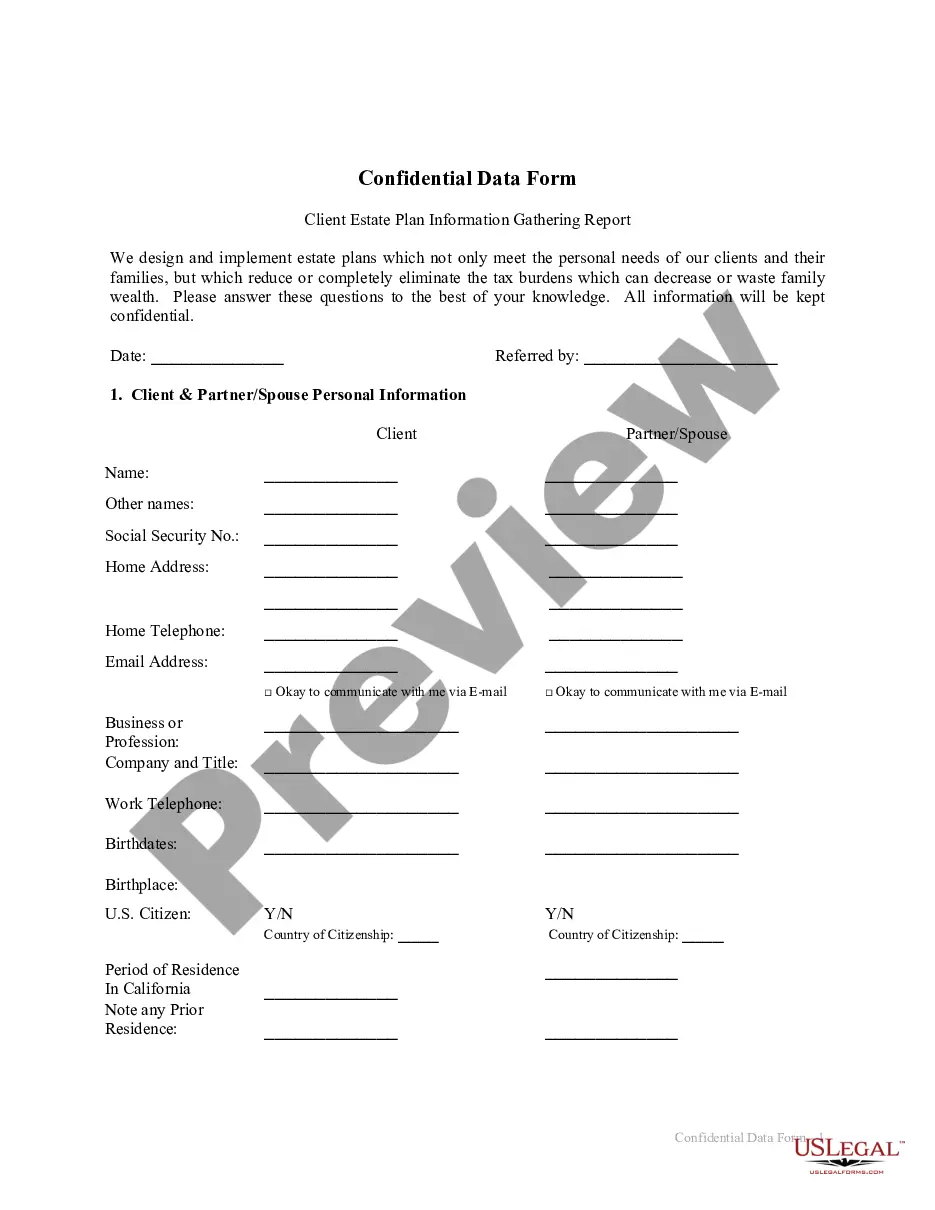

To manage and control spending and investments to protect beneficiaries from poor judgment and waste; To avoid court-supervised probate of trust assets and be private; To protect trust assets from the beneficiaries' creditors;To reduce income taxes or shelter assets from estate and transfer taxes.

Wills and Trusts FAQs Deciding between a will or a trust is a personal choice, and some experts recommend having both. A will is typically less expensive and easier to set up than a trust, an expensive and often complex legal document.

Registration of a living trust doesn't give the court any power over the administration of the trust, unless there's a dispute.To register a revocable living trust, the trustee must file a statement with the court where the trustee resides or keeps trust records.

The main difference is that a will is simply a set of instructions about the distribution of your assets to be implemented after your death, whereas a trust allows your or someone designated by you as a legal representative to use your wealth according to your instructions even while you are alive.

A Virginia living trust is established by you, the grantor, the person setting up the trust and placing assets into it. The assets in the trust are managed for your benefit during your life.A living trust Virginia allows you to keep your trust assets out of probate, a court process required for approving a will.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

Select a type of trust. Inventory your assets and property. Choose a trustee. Put together your trust document. Visit a notary public and sign your living trust in front of them. Fund your trust.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.