This is an official form from the Virginia Judicial System, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Virginia statutes and law.

Virginia Probate Information Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Virginia Probate Information Form?

Looking for a Virginia Probate Information Form on the internet might be stressful. All too often, you find papers which you think are ok to use, but find out afterwards they are not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional lawyers in accordance with state requirements. Have any document you’re looking for in minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be added in to the My Forms section. In case you do not have an account, you need to sign up and select a subscription plan first.

Follow the step-by-step recommendations listed below to download Virginia Probate Information Form from the website:

- Read the document description and press Preview (if available) to check whether the form meets your expectations or not.

- If the form is not what you need, get others with the help of Search engine or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal forms from our US Legal Forms catalogue. Besides professionally drafted samples, users are also supported with step-by-step guidelines regarding how to find, download, and fill out templates.

Form popularity

FAQ

If no surviving spouse, children, or grandchildren are living at your death, or otherwise exist, then your assets would pass to collateral heirs. Collateral heirs include your parents, siblings, and grandparents along with any other next of kin such as aunts, uncles, nieces, nephews, and cousins.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

Applying for probate in New South Wales All applications must be filed at the Supreme Court of New South Wales Registry, either in person or by post. The application must be accompanied by supporting documents including the will and death certificate, as well as an application fee.

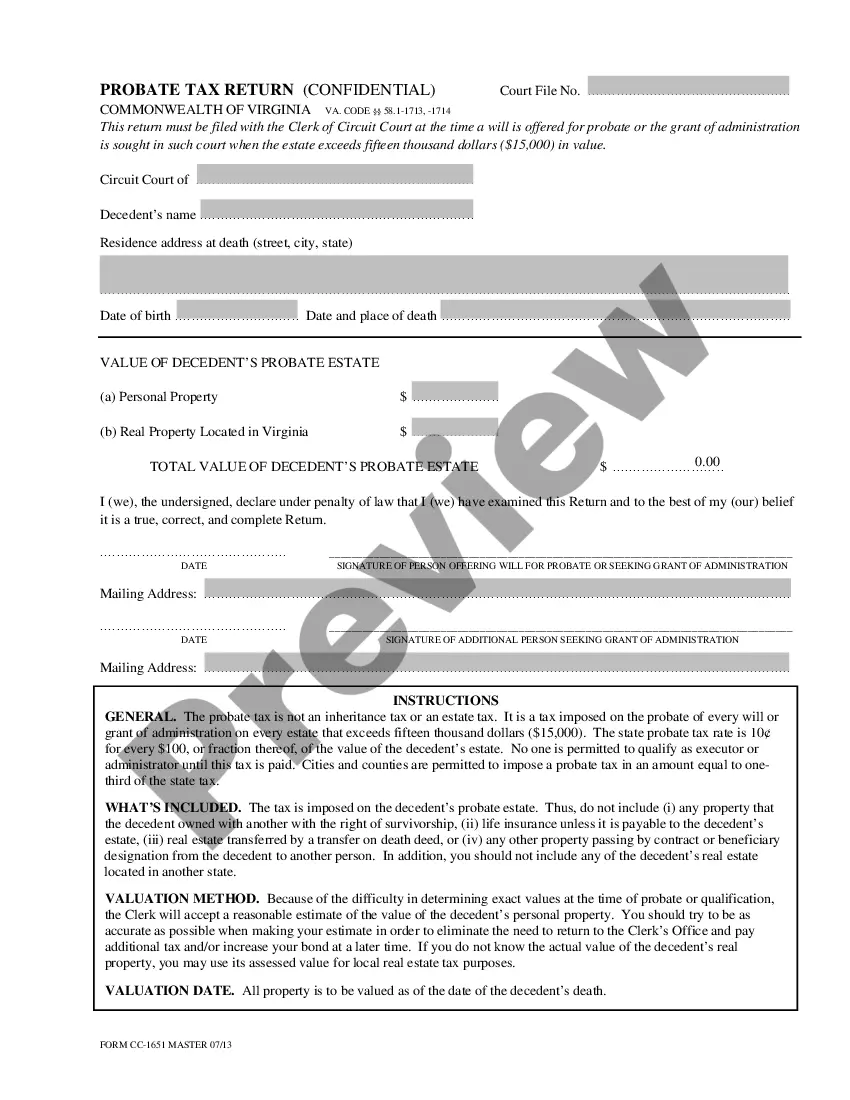

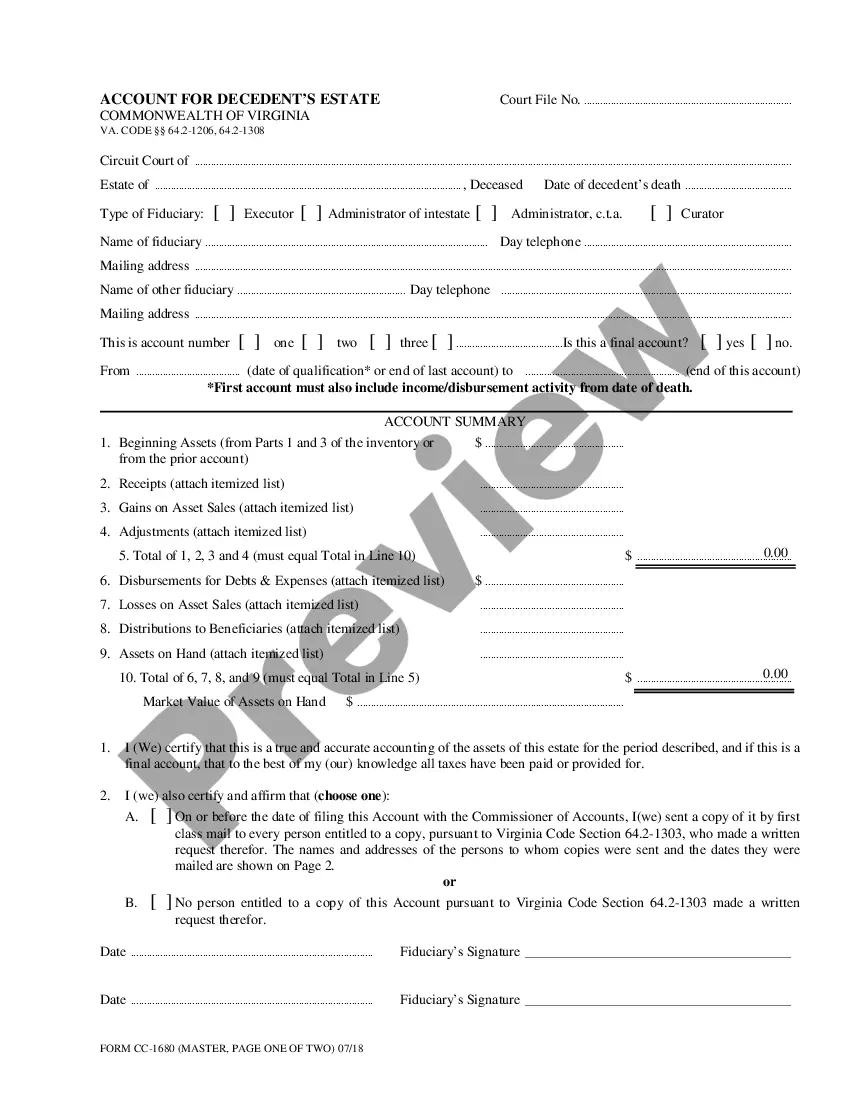

Probate in Virginia is a court-supervised legal process that may be required after someone dies. Probate gives someone, usually the surviving spouse or other close family member, authority to gather the deceased person's assets, pay debts and taxes, and eventually transfer assets to the people who inherit them.

The following persons are considered legal heirs and can claim a legal heir certificate under Indian Law: Spouse of the deceased. Children of the deceased (Son/ Daughter) Parents of the deceased.

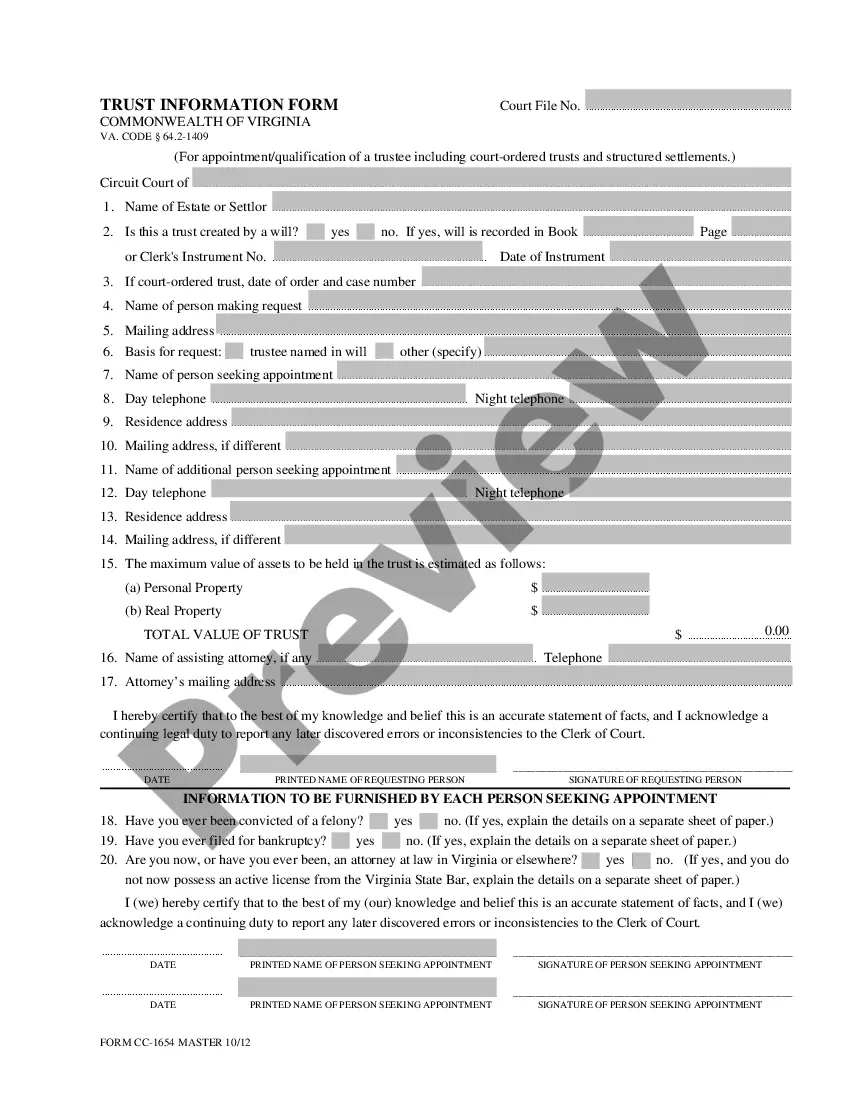

The list of heirs is given under oath on a form provided by the Clerk of Court. The heirs identified on the list are the heirs of the decedent as provided under Virginia law for a person who dies without a will. The form requires the name, address, relationship to the decedent, and age of each heir.

Grandchildren will typically be next in the order, followed by the deceased's parents, then siblings, then nieces and nephews, grandparents, aunts, uncles, and cousins. Adopted children are the same as biological children for inheritance purposes, while stepchildren and foster children are not.

A person can expect for the probate process in Virginia to take anywhere from six months up to a year or more. Generally, there is a creditor period, so an estate cannot be completely distributed and closed prior to the expiration of the six-month period.

Probate will always be necessary if the deceased died owning real estate except if it is owned as joint tenants (see If the deceased owned property with someone else in the After the Grant of Probate or Letters of Administration chapter).