Minnesota UCC1AP Financing Statement Additional Party (National) is a type of financing statement that is required to be filed in Minnesota when a creditor is extending credit to a debtor that is a national entity. The statement must include the debtor’s name, address, type of business entity, jurisdiction of organization, and the name of the secured party, as well as the secured party's address and type of business entity. It must also include the description of the collateral or the type of collateral being used to secure the loan. There are two types of Minnesota UCC1AP Financing Statement Additional Party (National): UCC 1AP-1 and UCC 1AP-2. UCC 1AP-1 applies to original financing statements, and UCC 1AP-2 applies to continuation and amendment statements. Both types of statements must be filed with the Minnesota Secretary of State in order to be effective.

Minnesota UCC1AP Financing Statement Additional Party (National)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota UCC1AP Financing Statement Additional Party (National)?

If you’re looking for a method to suitably prepare the Minnesota UCC1AP Financing Statement Additional Party (National) without employing a lawyer, then you’re in the perfect place.

US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every personal and commercial scenario. Every document you discover on our web service is crafted in alignment with federal and state statutes, so you can rest assured that your documents are in order.

Another significant benefit of US Legal Forms is that you never lose the documents you purchased - you can access any of your downloaded forms in the My documents tab of your profile whenever you need them.

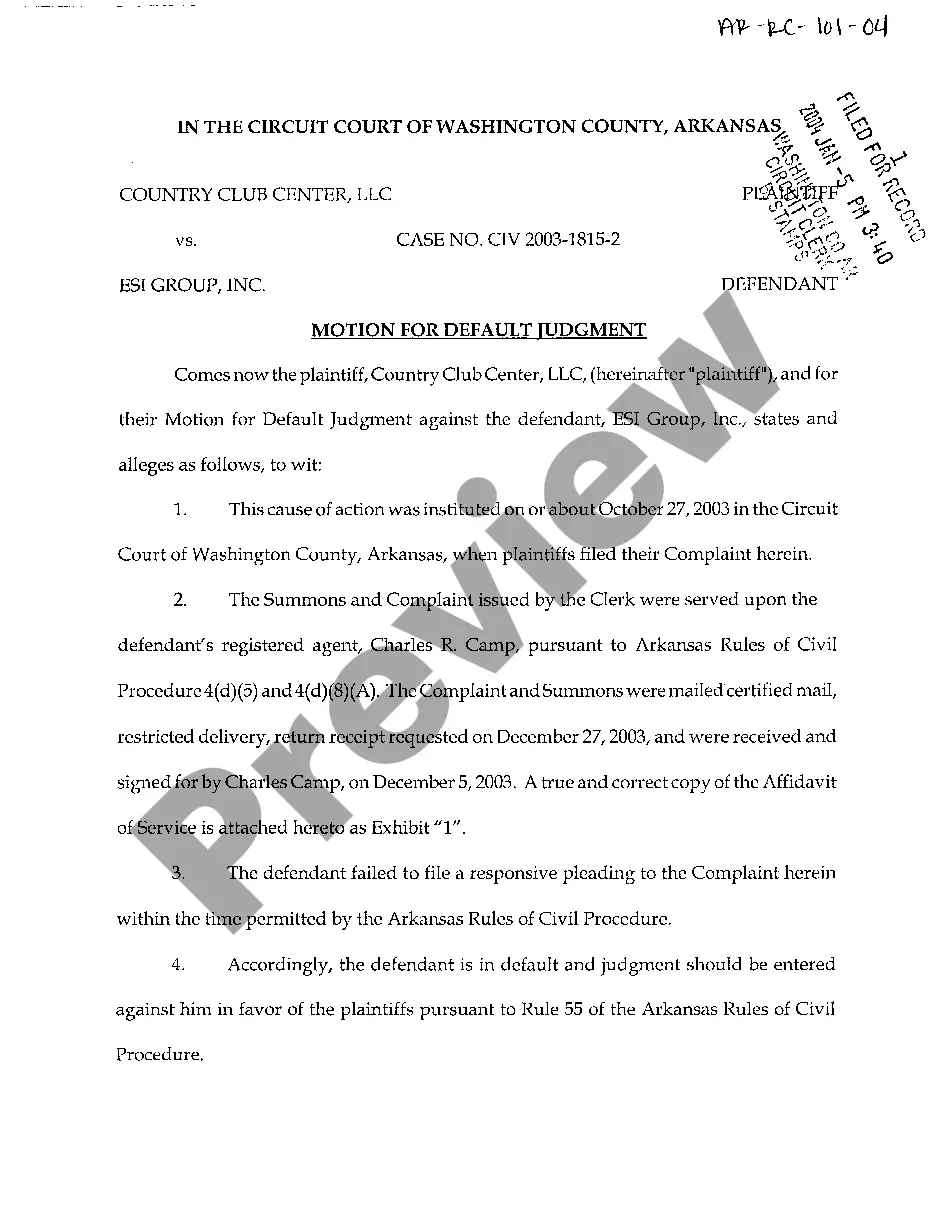

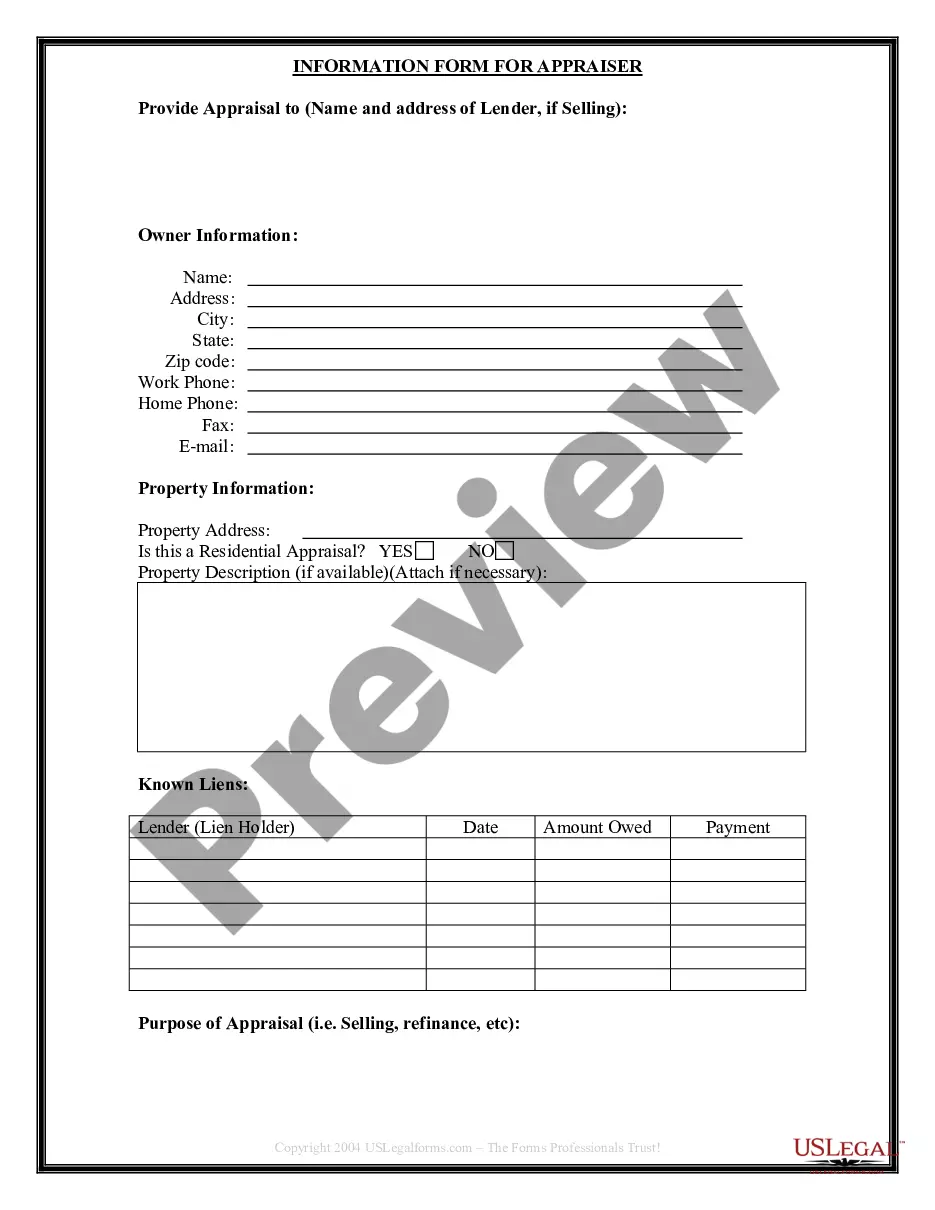

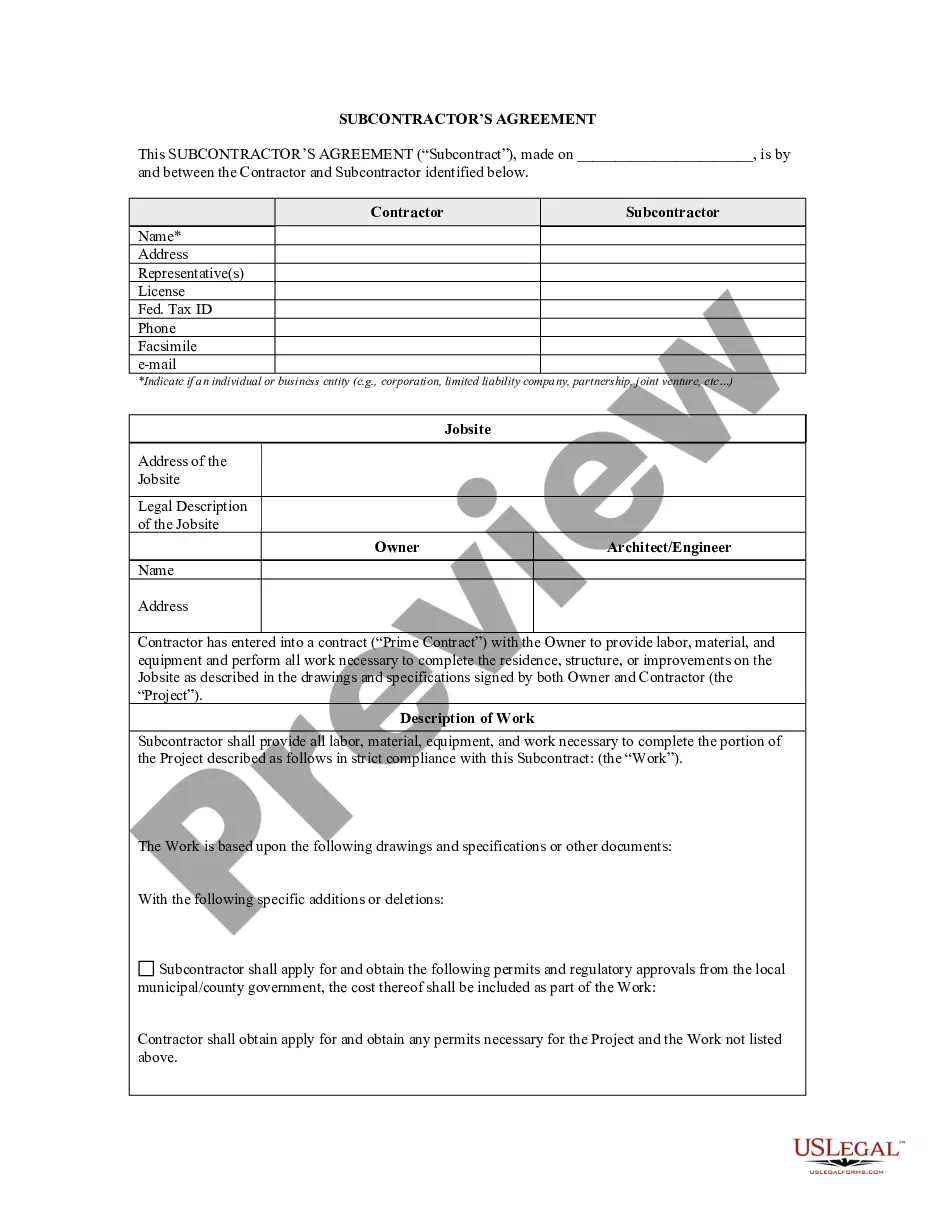

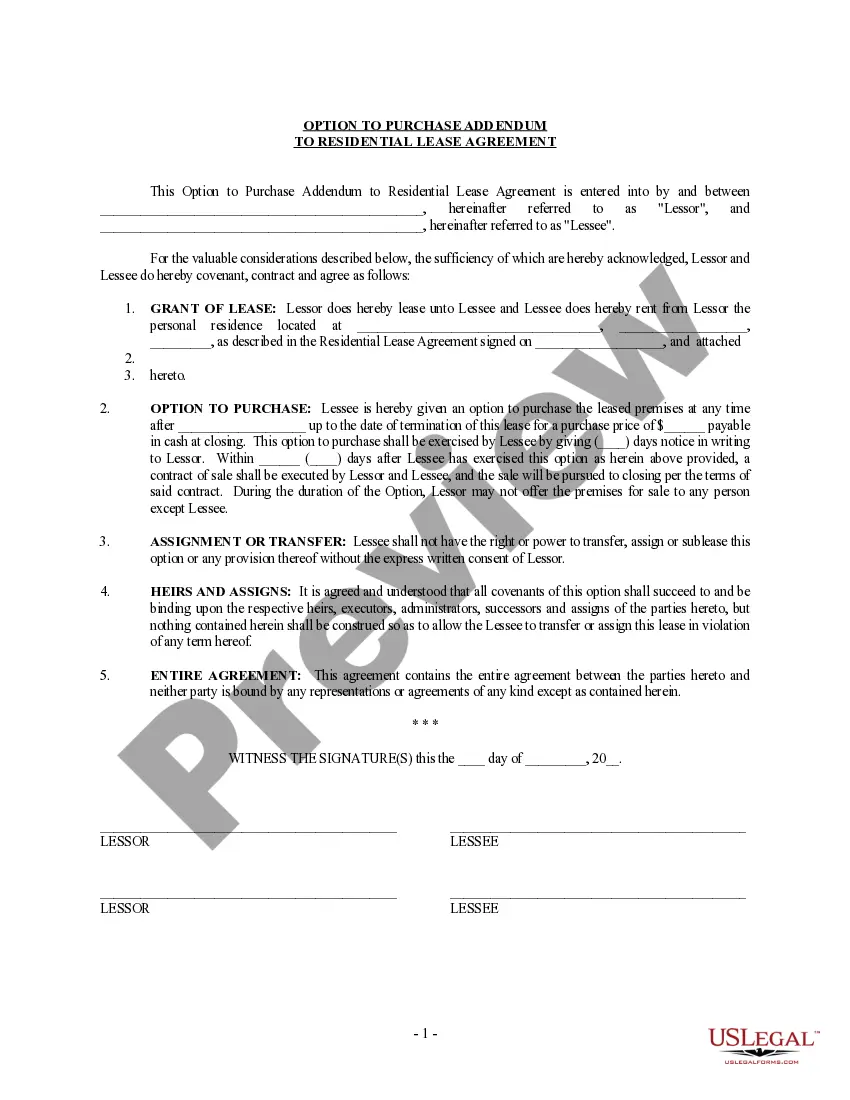

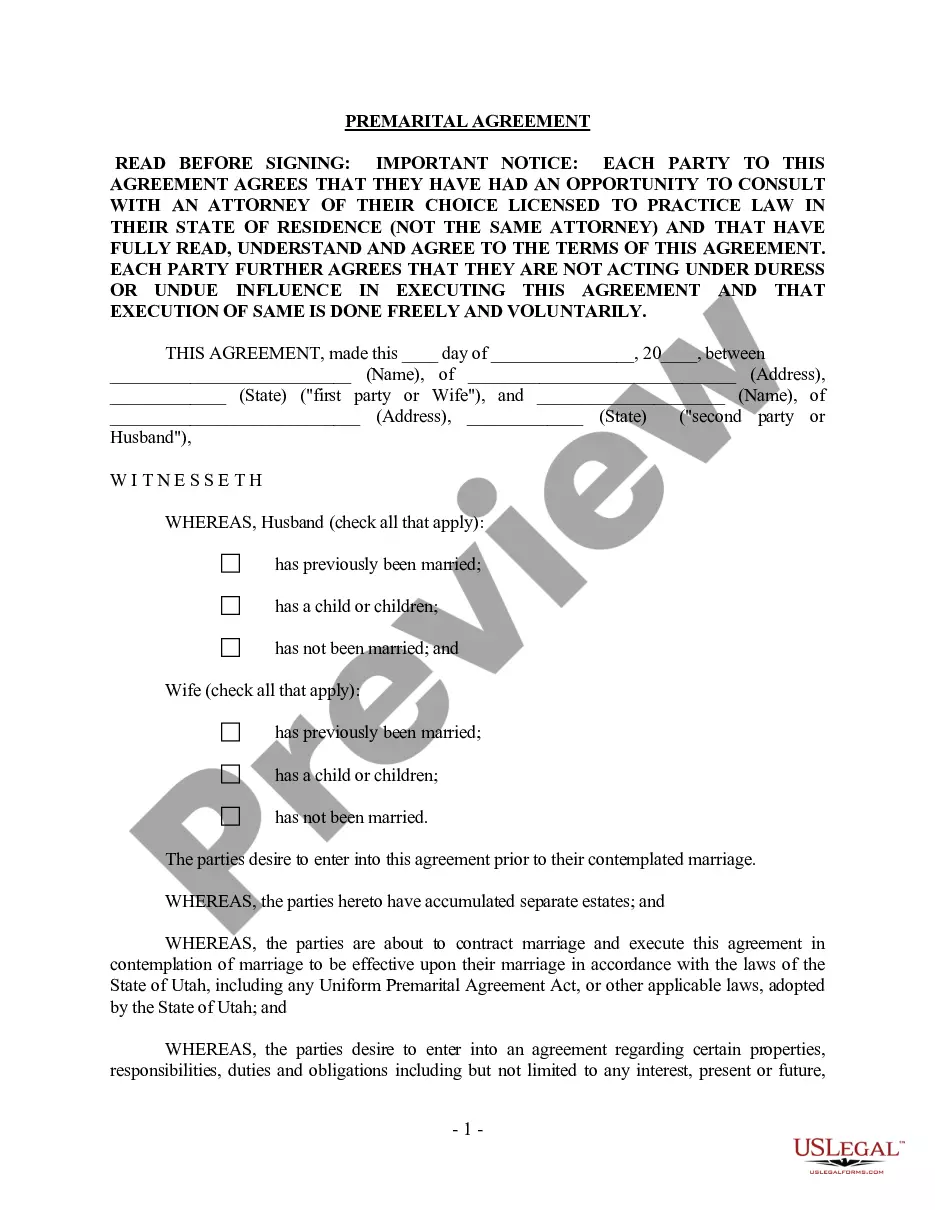

- Verify that the document you view on the page aligns with your legal circumstances and state laws by reviewing its text description or browsing through the Preview mode.

- Enter the document name in the Search tab at the top of the page and choose your state from the list to find an alternative template if there are any discrepancies.

- Repeat the content review and click Buy now when you are confident in the paperwork's compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and choose the subscription plan if you don’t already have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available for download immediately after.

- Select the format in which you wish to save your Minnesota UCC1AP Financing Statement Additional Party (National) and download it by clicking the relevant button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

1 must be filed with the Secretary of State's office in the state where the debtor is located. For a Minnesota UCC1AP Financing Statement Additional Party (National), you would file it in Minnesota if the debtor resides there. Filing in the correct state is crucial for ensuring the legal validity of your financing statement. U.S. Legal Forms can assist you by providing the necessary forms and instructions for filing in your state.

To file a UCC statement, start by gathering the necessary information about the transaction and the parties involved. You will need to complete the Minnesota UCC1AP Financing Statement Additional Party (National) form, ensuring all details are accurate. Once completed, you can submit the form to the appropriate state office, either online or by mail. Using U.S. Legal Forms makes this process easier, as they provide templates and guidance to help you file correctly.

You file a UCC-1 financing statement at the appropriate state office, typically the Secretary of State's office, where the debtor is located. For Minnesota, you should ensure that your filing aligns with the Minnesota UCC1AP Financing Statement Additional Party (National) requirements. Utilizing the US Legal Forms platform can simplify this process by guiding you on where to submit your filings and ensuring compliance with state regulations.

To fill out a UCC-1 financing statement, start by entering the debtor's name and address accurately. Next, provide the secured party's name and address. Be sure to include a description of the collateral involved in the transaction. For specific guidance, you can use the US Legal Forms platform, which offers templates and detailed instructions for completing the Minnesota UCC1AP Financing Statement Additional Party (National).

A UCC filing won't impact your business credit scores directly because it doesn't indicate anything about your ability to repay your debts. However, it can affect your ability to get credit again in the future.

First, the debtor must send an authenticated demand to the secured party. The demand should be sent to the name/address of the secured party as indicated on the financing statement. The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file.

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

An Example of a UCC Lien Filing If you secure equipment financing, the lender will file a UCC lien to state that if the debt for the espresso machine is not repaid, the lender has the right to repossess the espresso machine or seize other assets from your business.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.