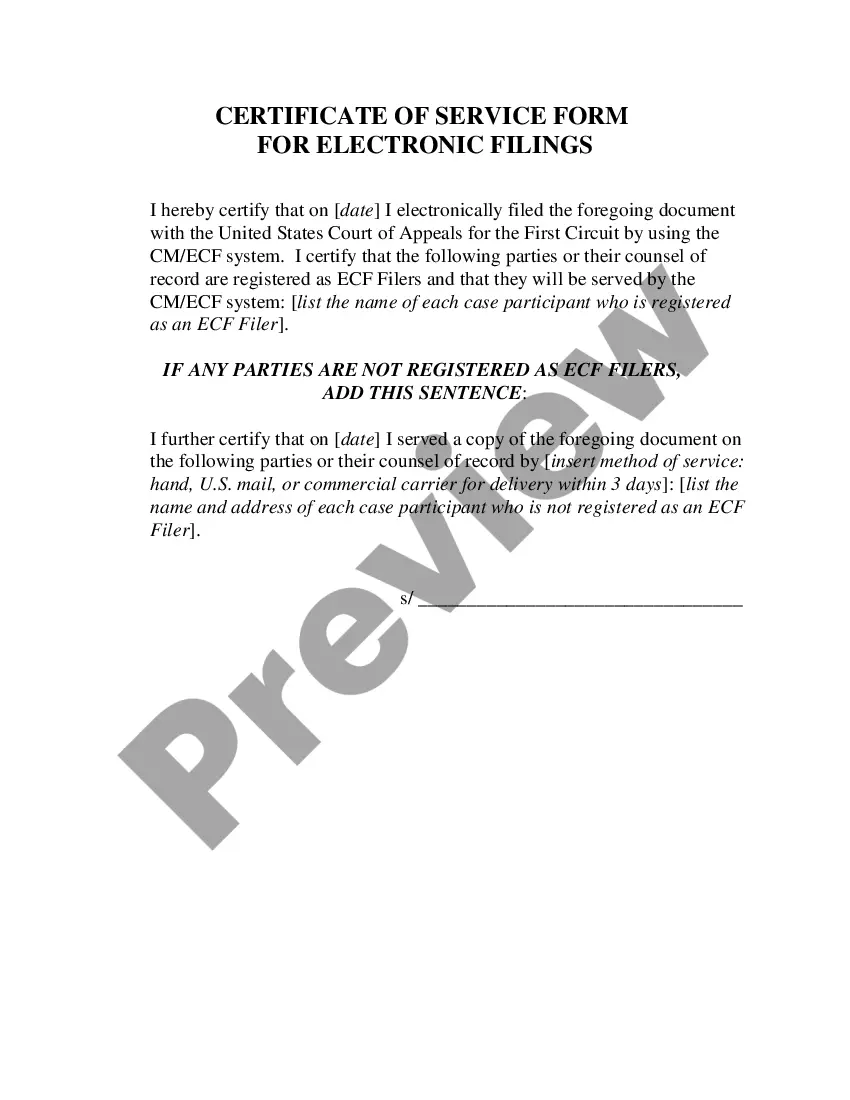

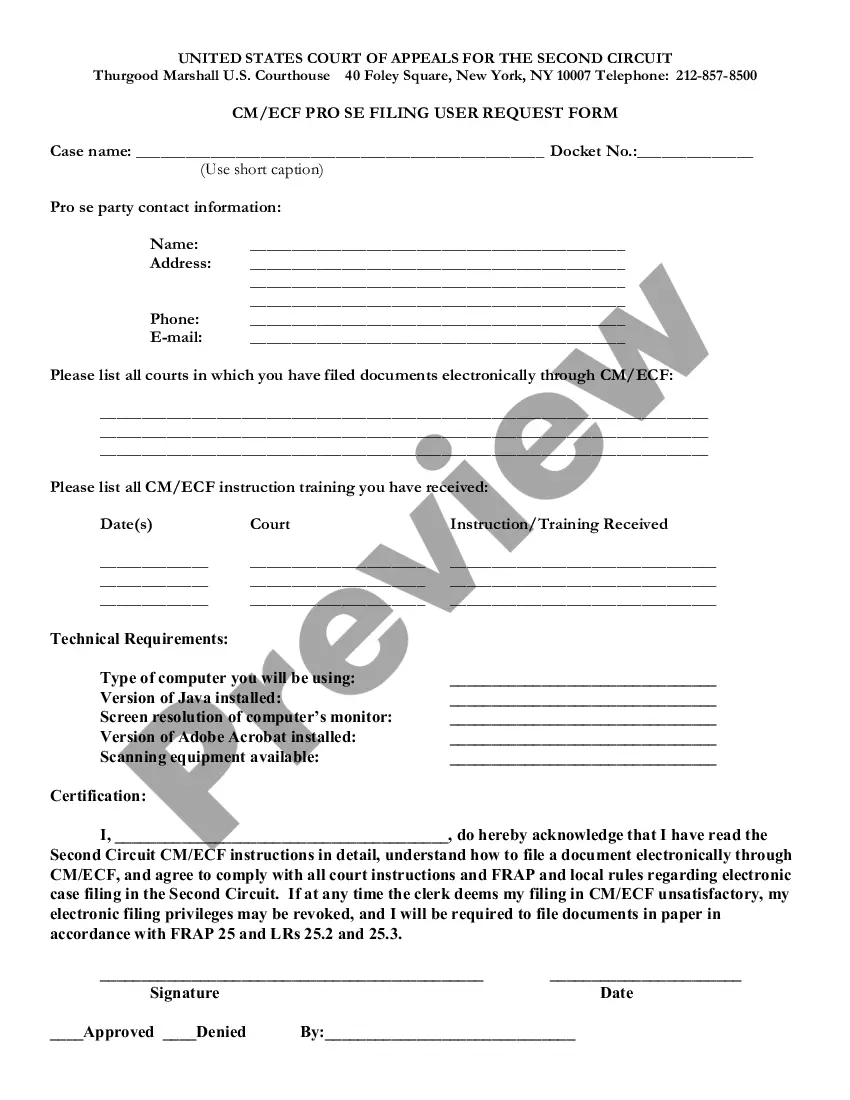

Minnesota Request For Exemption From Electronic Filing is a document that is filed with the Minnesota Department of Revenue (FOR) to receive an exemption from filing documents electronically. This form must be completed and submitted to the FOR in order to be considered for an exemption. The exemption may be required if the filer is unable to meet the requirements for electronic filing, such as due to a technical problem or lack of access to the internet. There are two types of Minnesota Request For Exemption From Electronic Filing: 1. Request for Extension of Time to File Electronically: This form is used to request an extension of time to file electronically, which may be granted if the filer is unable to meet the requirements for filing by the due date. 2. Request for Permanent Exemption From Electronic Filing: This form is used to request a permanent exemption from electronic filing. This exemption may be granted if the filer does not have access to the internet or is otherwise unable to meet the requirements.

Minnesota Request For Exemption From Electronic Filing

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Request For Exemption From Electronic Filing?

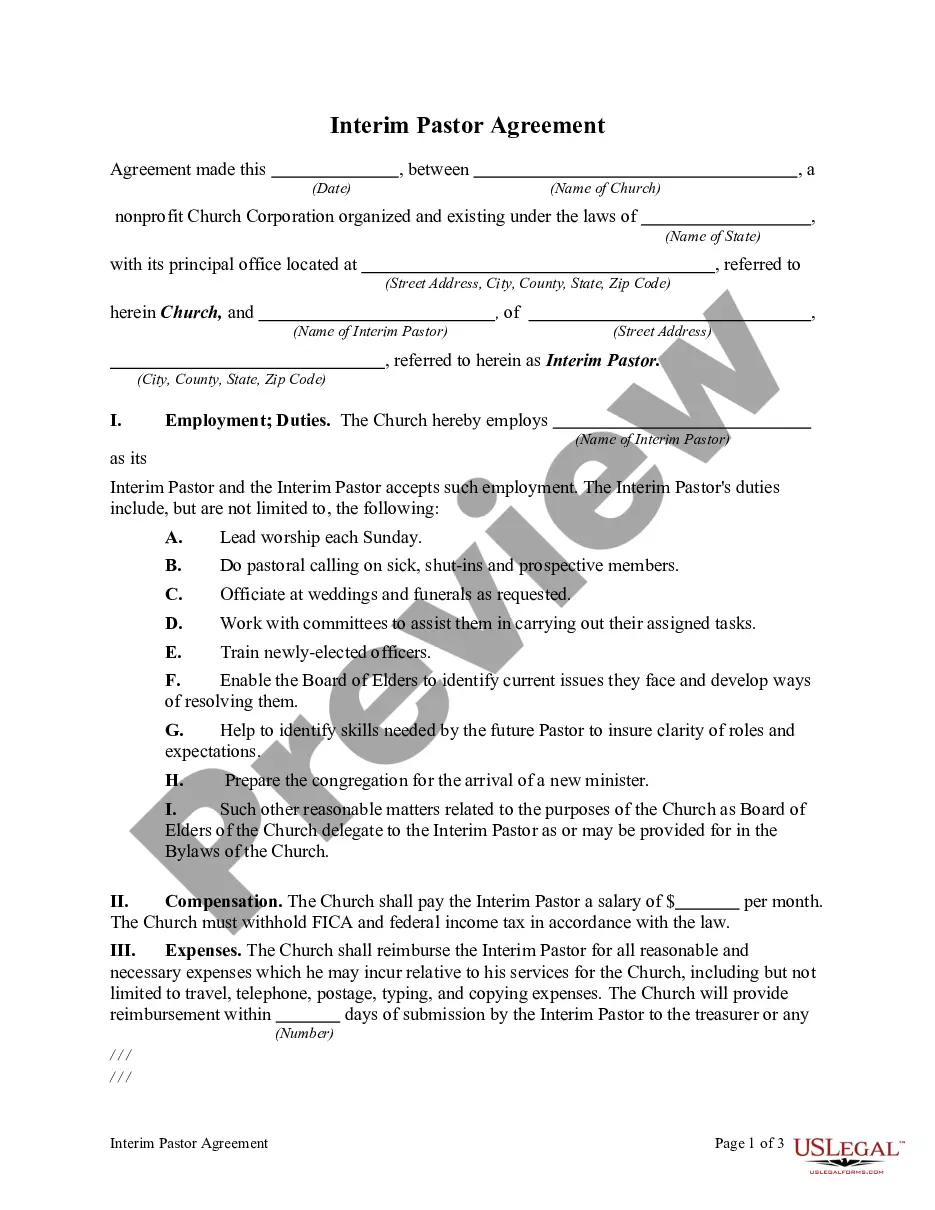

Engaging with legal documents necessitates focus, accuracy, and employing well-structured templates. US Legal Forms has been assisting individuals across the nation for 25 years, ensuring that when you select your Minnesota Request For Exemption From Electronic Filing template from our platform, it complies with federal and state regulations.

Utilizing our service is straightforward and efficient. To obtain the necessary documentation, all you require is an account with an active subscription. Here’s a brief guide for you to acquire your Minnesota Request For Exemption From Electronic Filing in just a few minutes.

All documents are designed for multiple uses, like the Minnesota Request For Exemption From Electronic Filing you see on this page. If you need them again, you can complete them without additional payment - just access the My documents tab in your profile and finalize your document whenever necessary. Experience US Legal Forms and prepare your business and personal documents swiftly and in complete legal adherence!

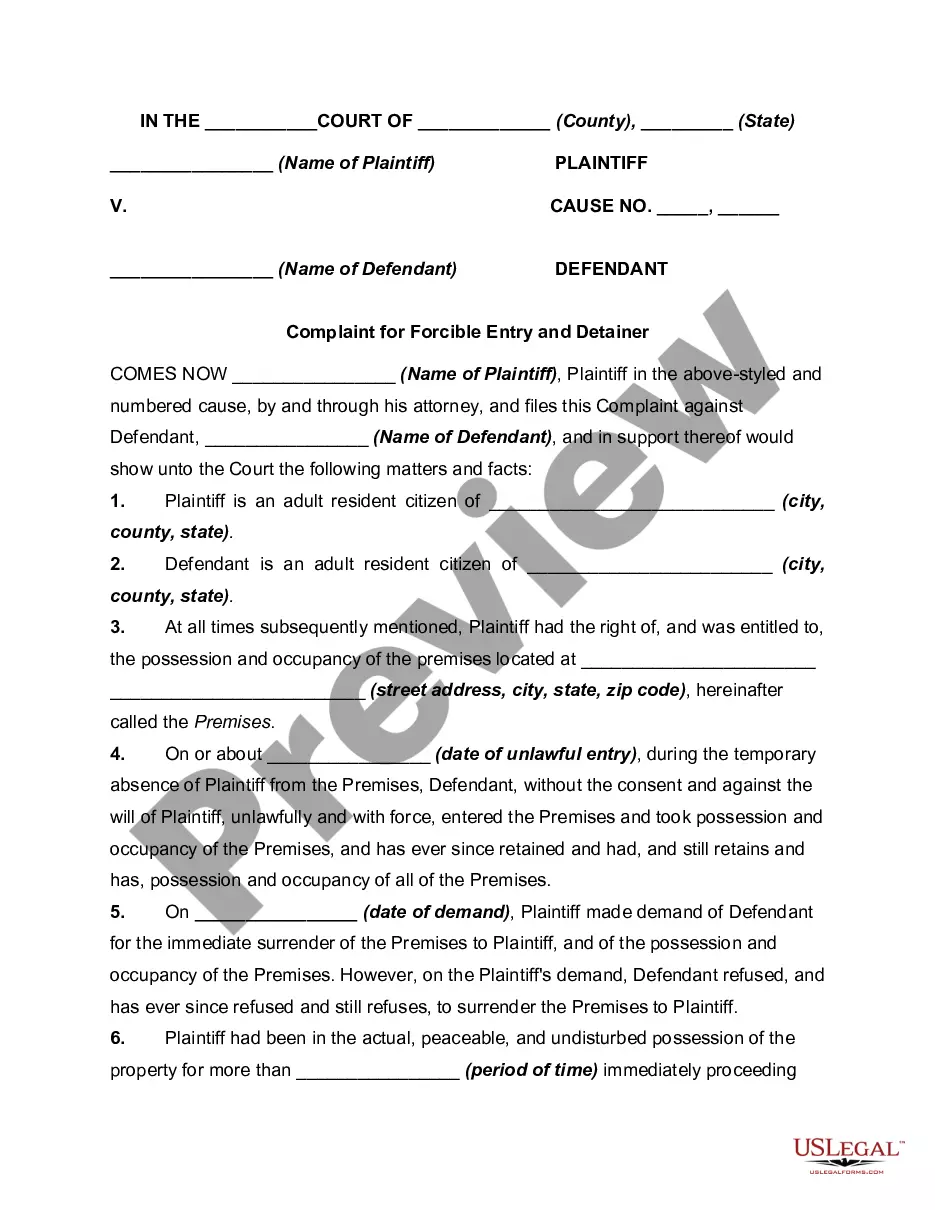

- Be sure to thoroughly review the form's content and its alignment with general and legal standards by previewing it or reading its summary.

- Seek an alternative formal template if the one you initially accessed doesn’t fit your circumstances or state laws (the option for that is located in the upper corner of the page).

- Log in to your account and download the Minnesota Request For Exemption From Electronic Filing in the desired format. If this is your first experience with our service, click Buy now to proceed.

- Establish an account, choose your subscription tier, and process your payment using your credit card or PayPal account.

- Choose the format in which you wish to save your document and click Download. Print the blank version or add it to a professional PDF editor to fill it out electronically.

Form popularity

FAQ

Yes, Minnesota does offer efile forms, including those related to the Minnesota Request For Exemption From Electronic Filing. Utilizing electronic filing can simplify the submission process and provide quicker processing times. Be sure to check the Minnesota Department of Revenue website for the latest efile options available. This can be a convenient way to manage your exemption application.

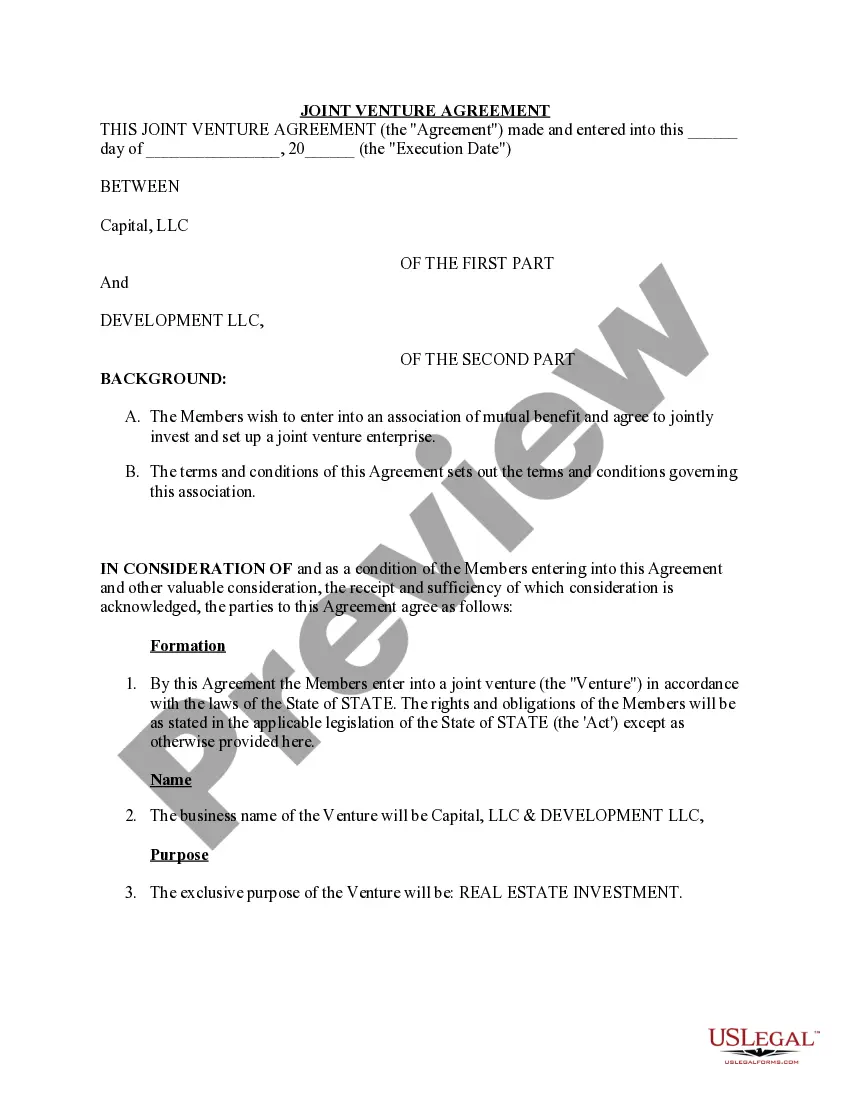

Filing an exempt status in Minnesota involves submitting a Minnesota Request For Exemption From Electronic Filing. Begin by gathering all necessary information and documents required for the application. After completing the forms, submit them to the Minnesota Department of Revenue. Once your application is processed, you will receive notification regarding your exempt status.

To claim exempt on your Minnesota W4, you must indicate your exempt status clearly on the form. This involves completing the Minnesota Request For Exemption From Electronic Filing and ensuring that you meet the criteria for exemption. Once your request is approved, you can confidently submit your W4 with the exempt claim. Remember to keep a copy of your exemption confirmation for your records.

Properly filing an exempt status in Minnesota requires you to follow the guidelines outlined in the Minnesota Request For Exemption From Electronic Filing. This includes completing the necessary forms and submitting them to the appropriate state agency. Make sure to include any supporting documents that validate your exemption claim. By adhering to these guidelines, you can streamline the process and increase the likelihood of approval.

To get on the tax exempt list in Minnesota, start by submitting a Minnesota Request For Exemption From Electronic Filing. This request will need to include specific details about your organization and its purpose. After reviewing your application, the Minnesota Department of Revenue will notify you of your status. It's important to ensure that all information provided is complete and accurate to avoid delays.

To become tax exempt in Minnesota, you need to complete the Minnesota Request For Exemption From Electronic Filing. This involves filling out the appropriate forms and submitting them to the Minnesota Department of Revenue. It’s essential to provide accurate information and documentation to support your request. Once approved, you will receive confirmation of your tax-exempt status.

To efile your state return, you first need to gather all necessary documents and information, including your income and deductions. After that, you can use approved efiling software or services to submit your return electronically. If you encounter any issues, such as needing to file a Minnesota Request For Exemption From Electronic Filing, platforms like US Legal Forms can guide you through the process, ensuring you complete your filing accurately and on time.

Most common tax forms can be filed electronically in Minnesota, including the Minnesota Individual Income Tax Form. However, specific forms may require a Minnesota Request For Exemption From Electronic Filing. Always check the Minnesota Department of Revenue’s official website for the latest updates on which forms are eligible for electronic submission, as this can change from year to year.

You can obtain MN state tax forms directly from the Minnesota Department of Revenue website. They offer a comprehensive list of downloadable forms for various tax needs. Additionally, if you require assistance, platforms like US Legal Forms provide easy access to these forms and guidance on how to fill them out, ensuring you have everything you need for your filing.

You may not be able to efile your MN state return due to specific eligibility requirements set by the Minnesota Department of Revenue. If you have certain exceptions, such as being a first-time filer or having special circumstances, you might need to submit a Minnesota Request For Exemption From Electronic Filing. It’s essential to review your situation carefully to determine if you qualify for this exemption.