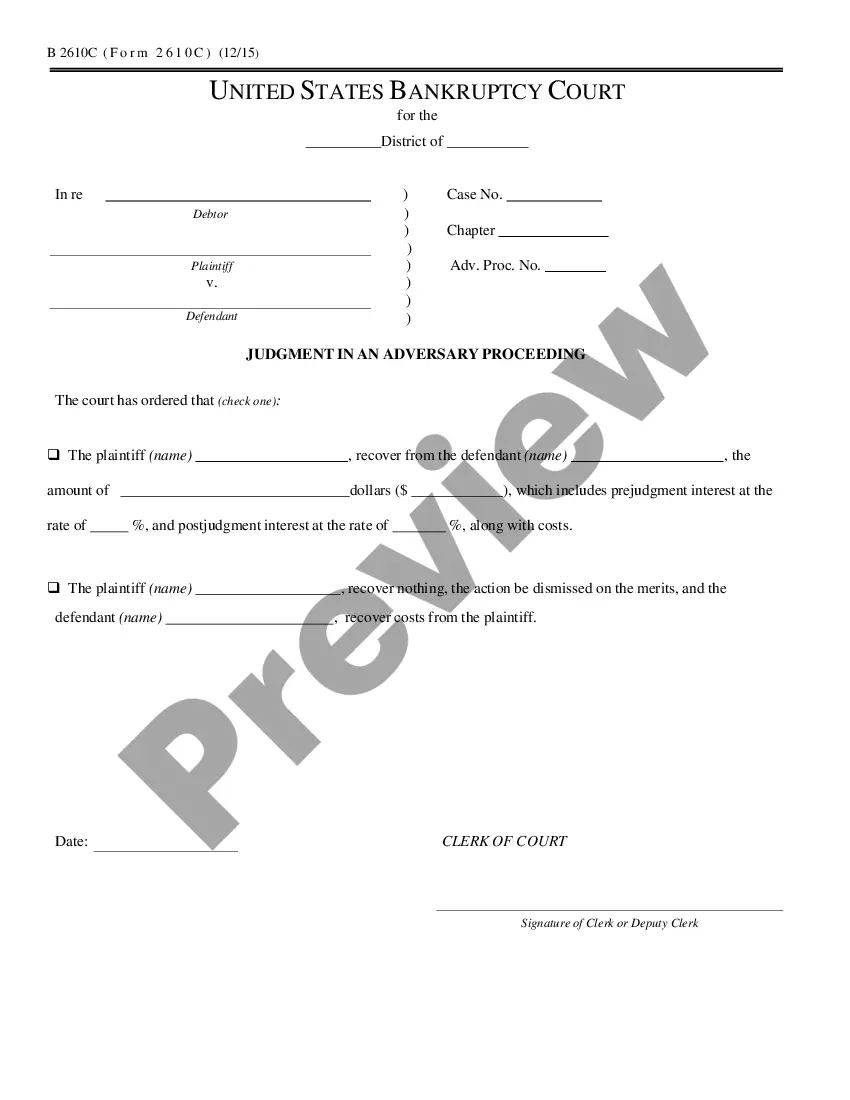

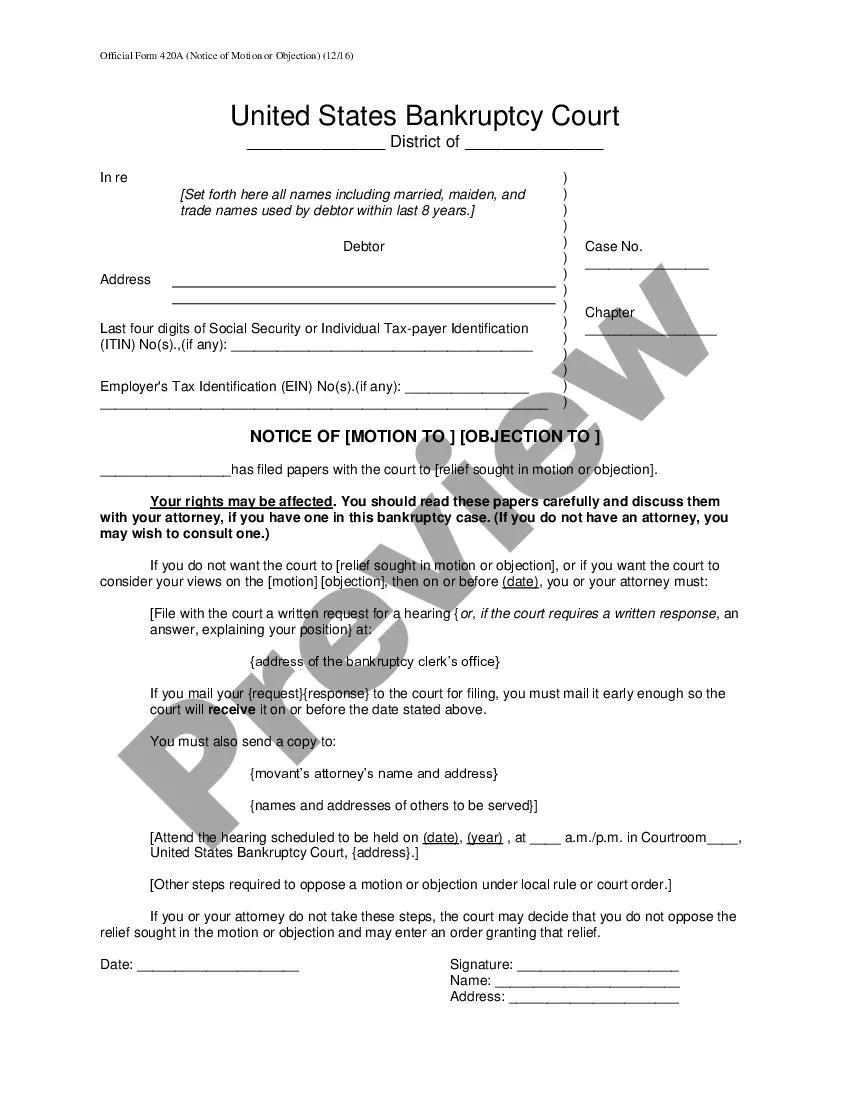

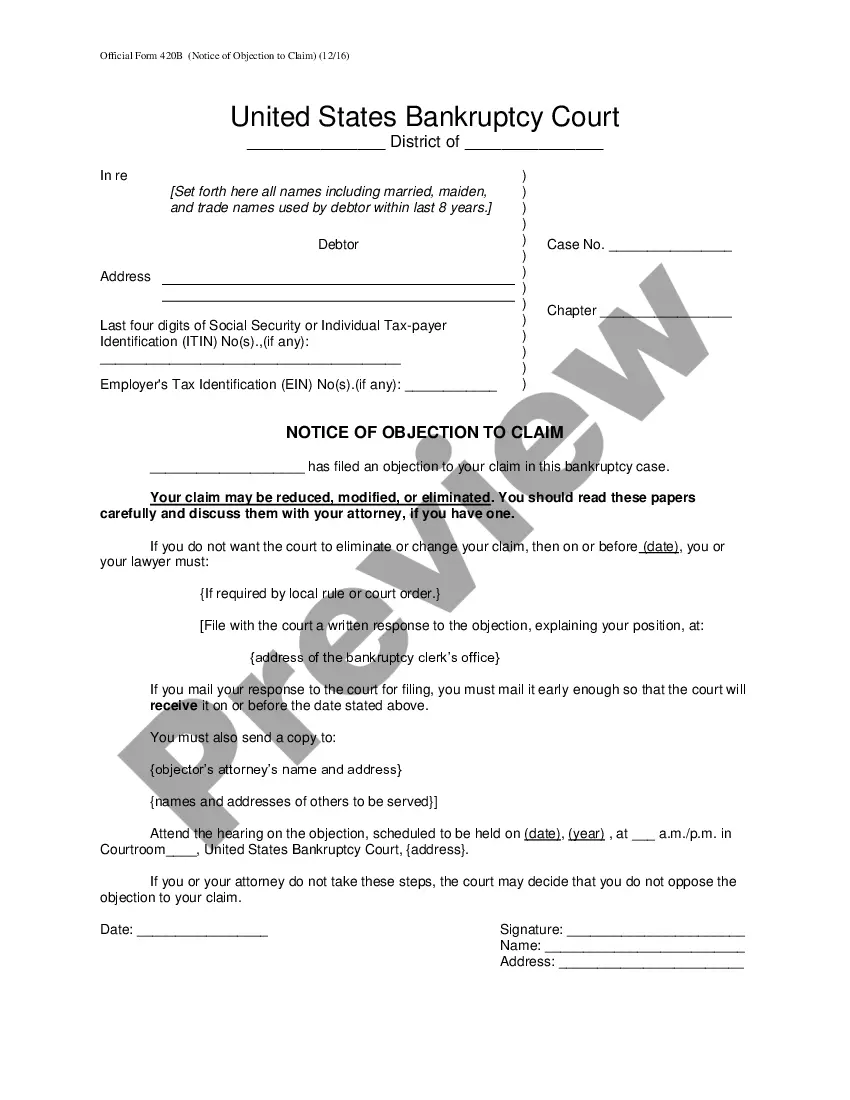

This is an official Minnesota court form for use in a civil case, a Creditors Objection. USLF amends and updates these forms as is required by Minnesota Statutes and Law.

Minnesota Creditors Objection

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Creditors Objection?

Obtain any version from 85,000 lawful documents like Minnesota Creditors Objection online with US Legal Forms. Each template is crafted and refreshed by state-certified lawyers.

If you possess a subscription already, Log In. When you reach the form’s page, click the Download button and proceed to My documents to access it.

If you have yet to subscribe, follow the steps outlined below.

With US Legal Forms, you will consistently have instant access to the correct downloadable sample. The platform provides you access to documents and categorizes them to enhance your search. Utilize US Legal Forms to acquire your Minnesota Creditors Objection quickly and effortlessly.

- Review the state-specific requirements for the Minnesota Creditors Objection you intend to utilize.

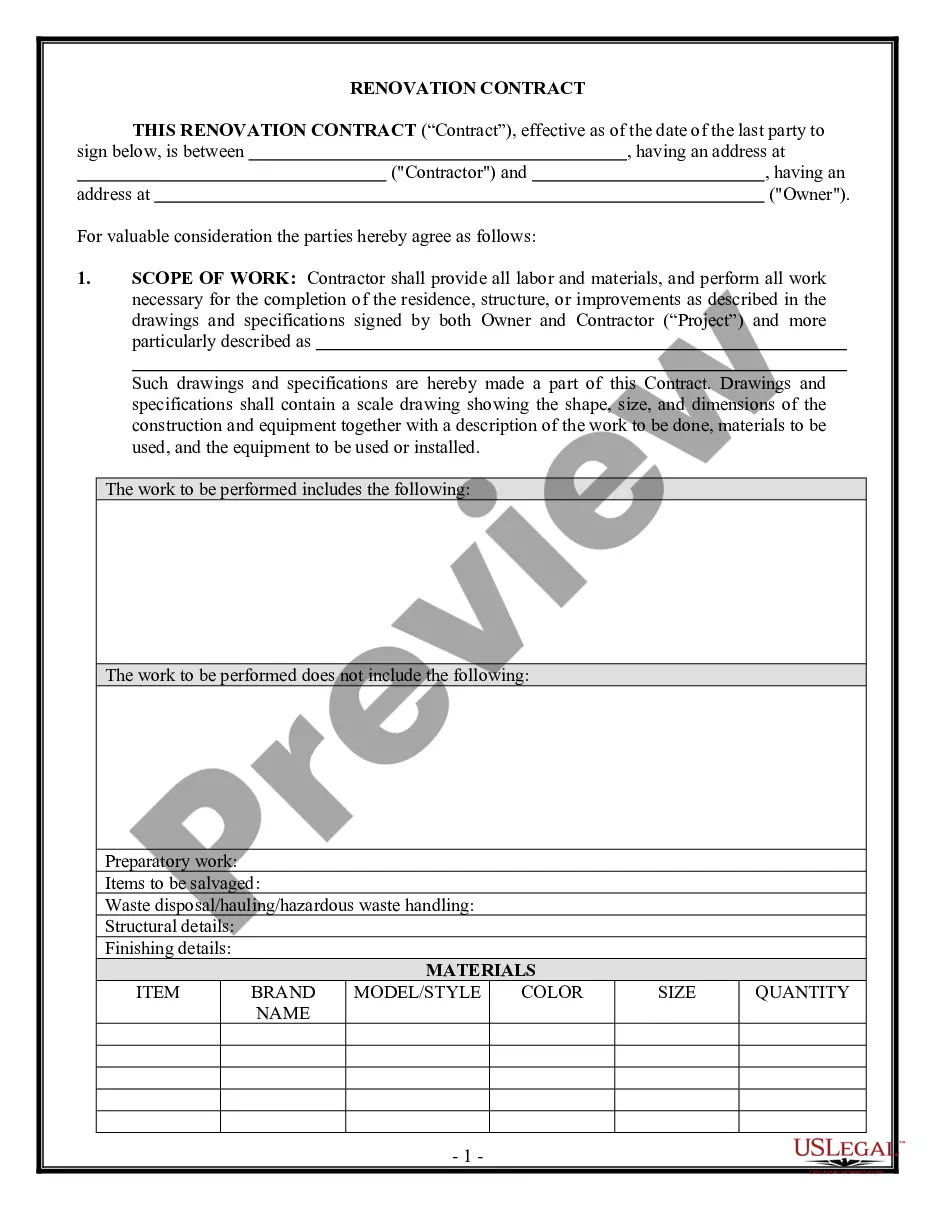

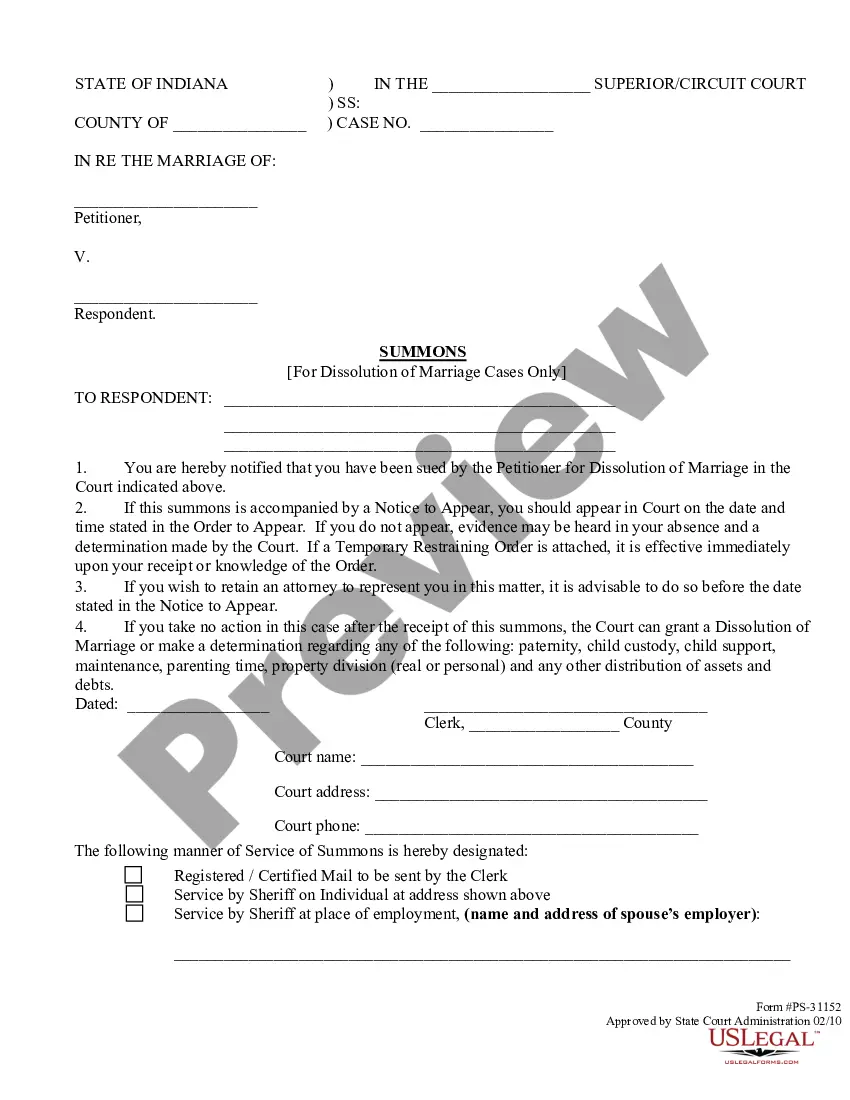

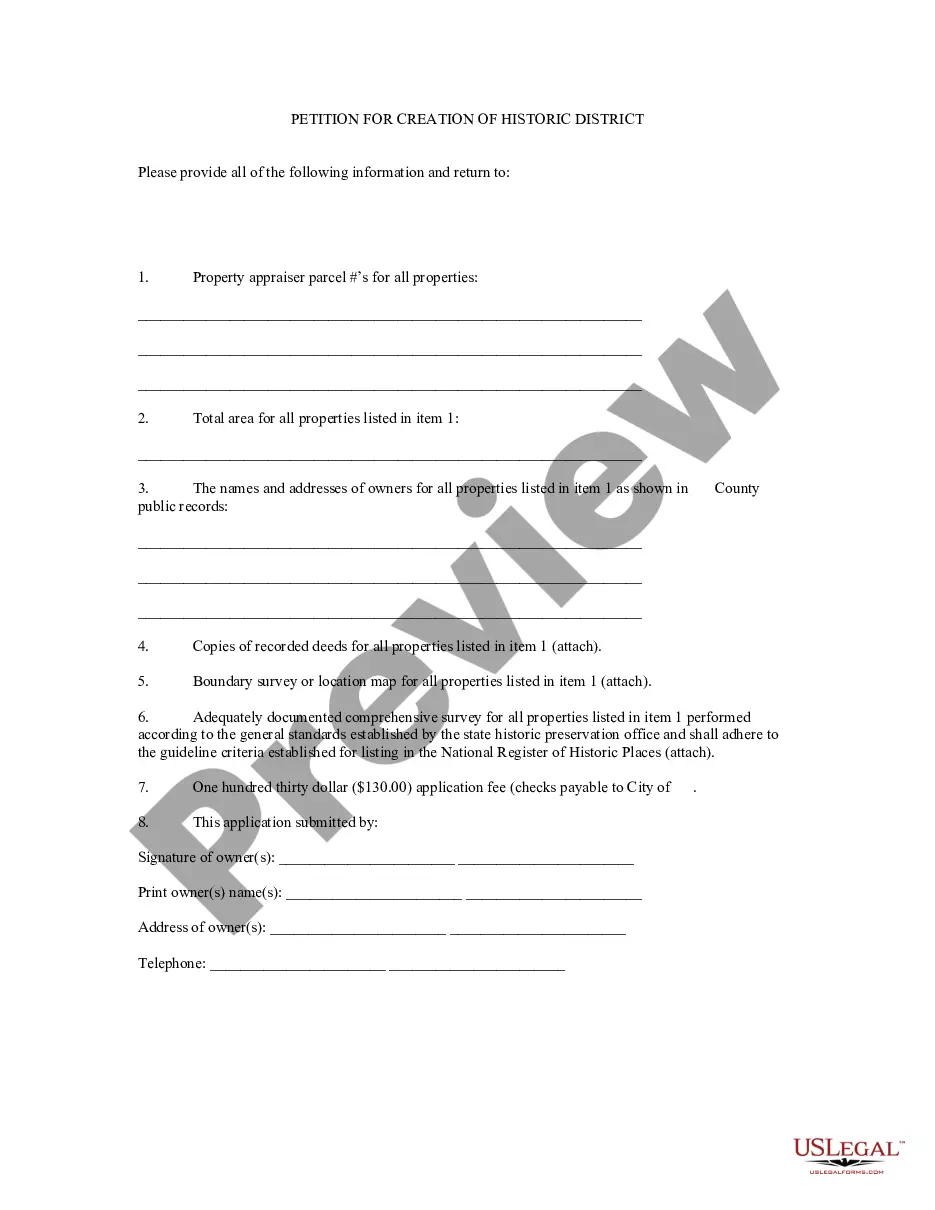

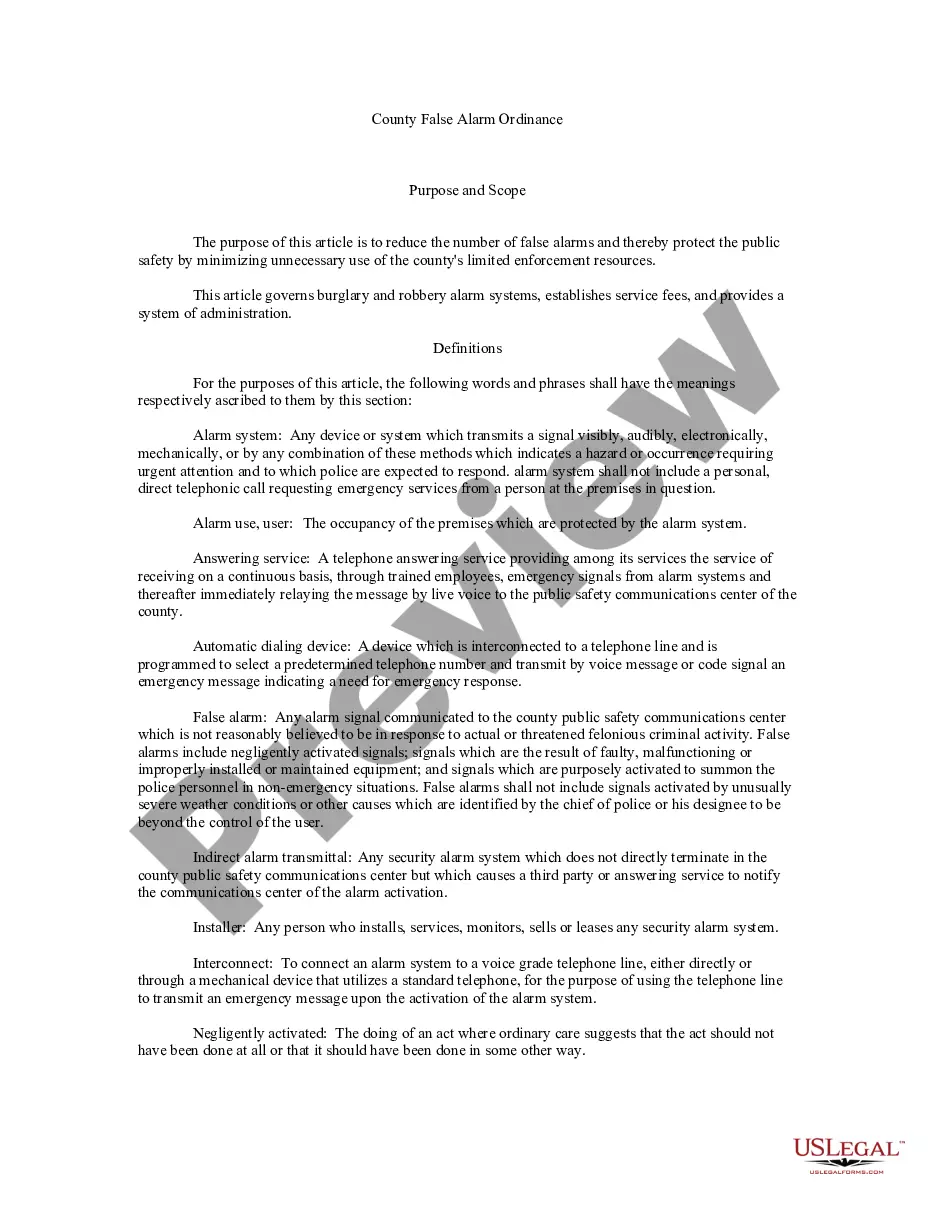

- Examine the description and preview the template.

- Once you are assured the template meets your needs, simply click Buy Now.

- Choose a subscription plan that truly fits your budget.

- Establish a personal account.

- Make payment using one of two suitable methods: by card or through PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Retrieve the document to the My documents section.

- After your reusable form is prepared, print it or save it to your device.

Form popularity

FAQ

In Minnesota, the statute of limitations for collecting most debts is generally six years. After this period, the debt may become uncollectible, meaning creditors can no longer pursue legal action. However, it is essential to understand that certain debts, like mortgages, may have different timelines. If you're facing collection issues, consider exploring options like a Minnesota Creditors Objection.

To stop garnishment as soon as possible, promptly file a Minnesota Creditors Objection with the court. Include any evidence that supports your case, such as proof of financial hardship or errors in the garnishment process. Quick action is essential to halt the garnishment effectively. Using US Legal Forms can expedite this process by providing the necessary templates and resources.

To terminate a garnishment, you must file a request with the court that issued the garnishment order. This request should include valid reasons, such as payment of the debt or an error in the garnishment process. A Minnesota Creditors Objection can be a crucial part of this request. You can find helpful forms and instructions on platforms like US Legal Forms.

Filing a motion to stop garnishment involves submitting a formal request to the court. You will need to include your reasons for the motion and any supporting documentation. A Minnesota Creditors Objection can be an effective way to frame your motion. US Legal Forms offers templates that can guide you through this process, making it easier to prepare your motion.

To stop a garnishment in Minnesota, you can file a Minnesota Creditors Objection, which challenges the garnishment order. This process involves submitting the objection to the court that issued the garnishment. You may also need to provide evidence supporting your claim. Utilizing a platform like US Legal Forms can simplify this process by providing templates and guidance.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).You may even be able to win the case.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Arrange a Repayment Plan. One option you have for stopping a judgement against you is to speak to the creditor before they file any court documents. Dispute the Debt. File for Bankruptcy.

A judgment may allow creditors to seize personal property, levy bank accounts, put liens on real property, and initiate wage garnishments. Generally, judgments are valid for several years before they expire. The statute of limitations dictates how long a judgment creditor can attempt to collect the debt.

Don't Ignore Debt Collectors. Have Government Assistance Funds Direct Deposited. Don't Transfer Your Social Security Funds to Different Accounts. Know Your State's Exemptions and Use Non-Exempt Funds First.