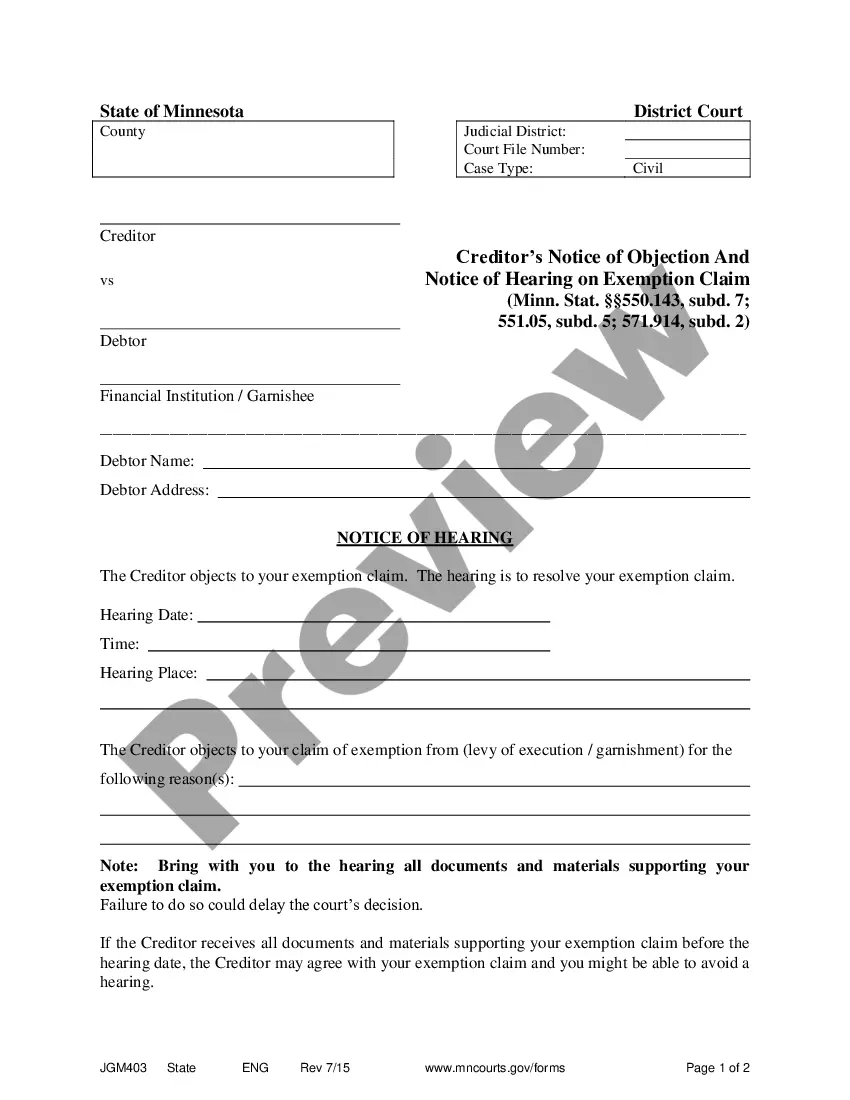

Minnesota Creditors Objection to Exemption Claim is an objection made by a creditor to a debtor's claim for bankruptcy exemption. When a debtor files for bankruptcy, they have the option to claim certain assets as exempt from creditors' claims. If a creditor believes that the debtor should not be allowed to exempt the asset in question, they can file a creditors' objection to the debtor's claim. The types of Minnesota Creditors Objection to Exemption Claim include objection to a debtor's homestead exemption, objection to a debtor's vehicle exemption, and objection to a debtor's wildcard exemption.

Minnesota Creditors Objection To Exemption Claim

Description

How to fill out Minnesota Creditors Objection To Exemption Claim?

Handling official paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Minnesota Creditors Objection To Exemption Claim template from our service, you can be certain it meets federal and state regulations.

Dealing with our service is straightforward and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Minnesota Creditors Objection To Exemption Claim within minutes:

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Minnesota Creditors Objection To Exemption Claim in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Minnesota Creditors Objection To Exemption Claim you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

Service of garnishment summons on debtor. A copy of the garnishment summons and copies of all other papers served on the garnishee must be served by mail at the last known mailing address of the debtor not later than five days after the service is made upon the garnishee.

Deadline in Years The statute of limitations for most debts in Minnesota is six years, including open accounts and written contracts. Creditors and debt collectors can file a lawsuit for breach of contract under Minnesota law within this period to hold you legally responsible for an unpaid debt.

There are 2 exemptions that are automatic. Your employer can't garnish money from your paycheck if you earn less than $380 a week ($1,520 a month). This is full-time pay at the state minimum wage. If you earn more than $380 a week, at least 75% of your earnings after taxes are automatically protected.

It's unlikely you'll get your medical debt forgiven, but there are ways to get some financial relief for those who qualify. Consider hospital forgiveness programs, assistance from specialized organizations and government assistance programs.

Debt Collectors A doctor or hospital may refer your bill to a third party debt collection agency if you do not pay. If you cannot afford to pay the entire bill at once, you may wish to try to negotiate a payment plan with the hospital or clinic.

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

Minnesota Statute § 336.3-118, which applies to negotiable instruments, including promissory notes, states that "an action to enforce the obligation of a party to pay a note payable at a definite time must be commenced within six years after the due date or dates stated in the note." Minn. Stat.