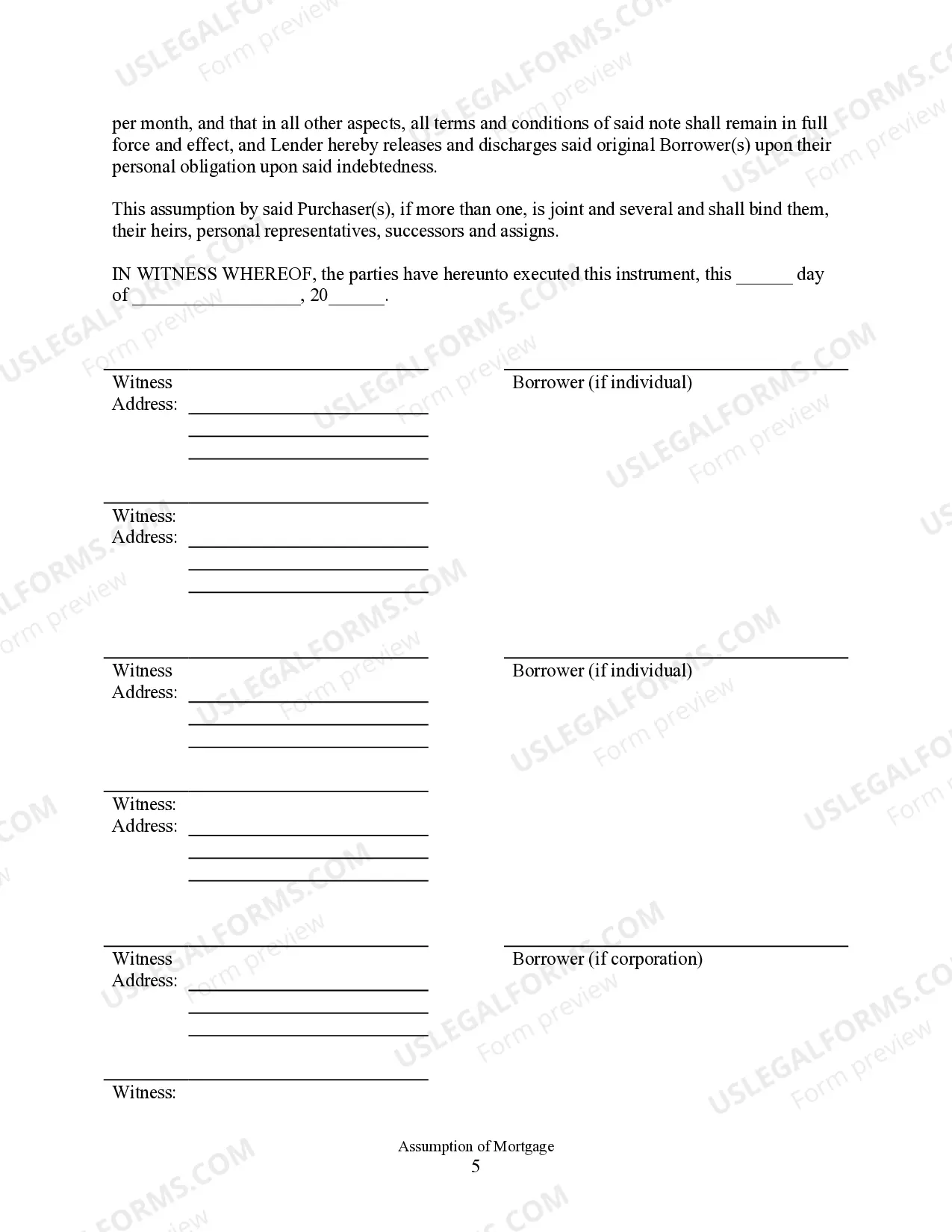

Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Minnesota Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Have any form from 85,000 legal documents such as Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors on-line with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you already have a subscription, log in. Once you are on the form’s page, click the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors you would like to use.

- Look through description and preview the sample.

- As soon as you’re sure the template is what you need, just click Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by credit card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have immediate access to the appropriate downloadable sample. The platform will give you access to forms and divides them into groups to streamline your search. Use US Legal Forms to get your Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors fast and easy.

Form popularity

FAQ

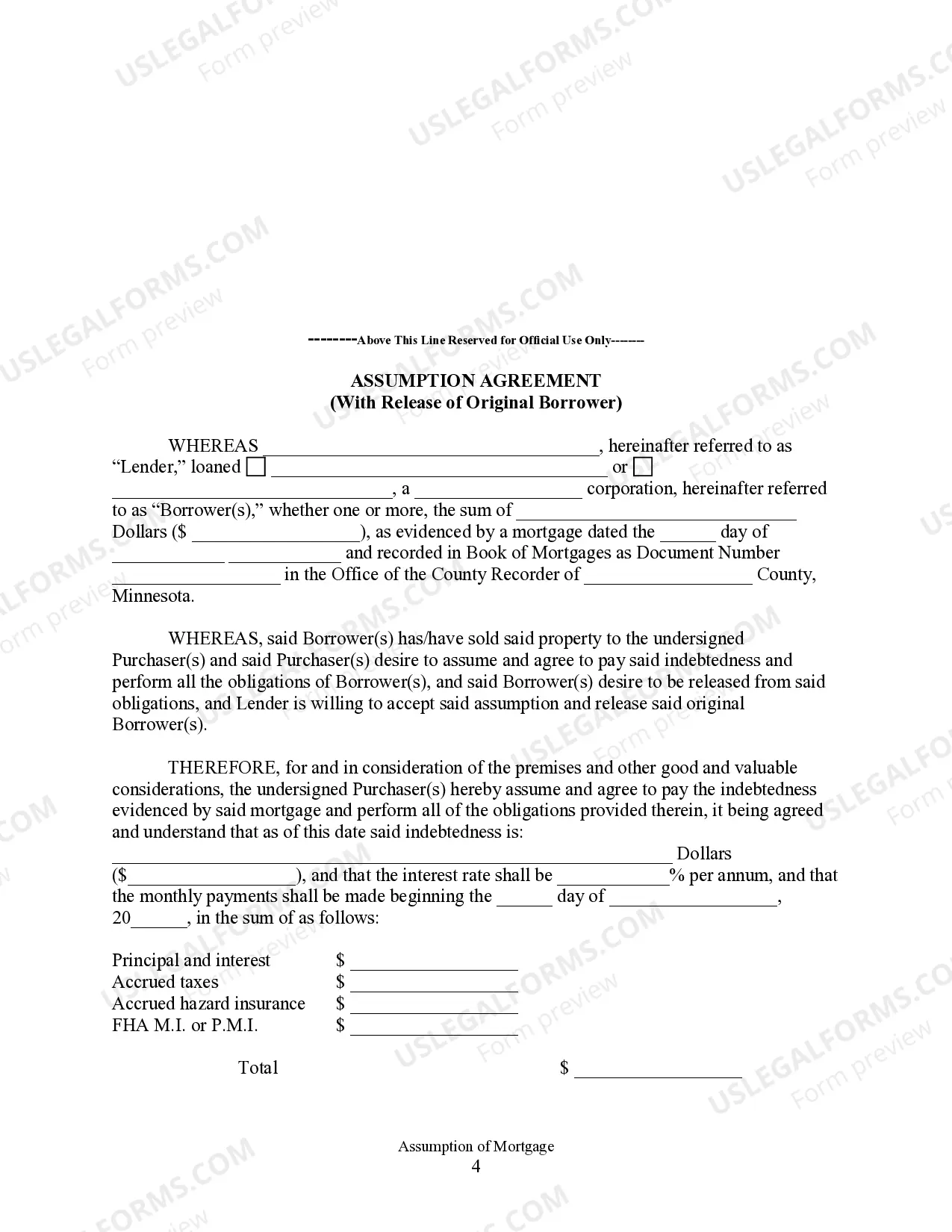

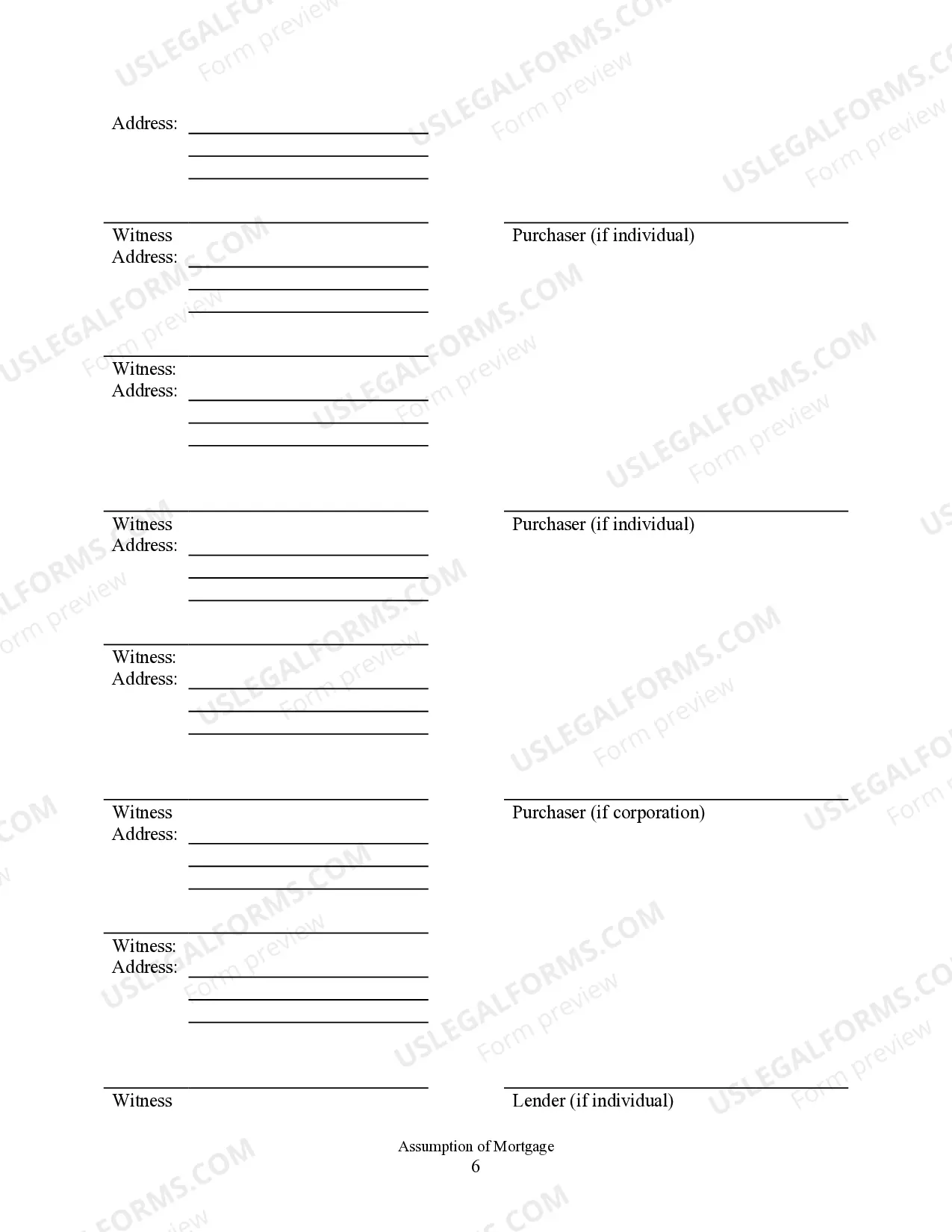

To assume a mortgage, you will typically need several key documents, including a completed mortgage assumption application, the original mortgage agreement, and any required financial disclosures. Additionally, the Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors may be necessary to formalize the process. Using platforms like US Legal Forms can simplify obtaining these documents and ensure you have everything required for a smooth mortgage assumption.

An example of a mortgage assumption occurs when a buyer takes over the existing mortgage of the seller. In this case, the buyer agrees to continue making the mortgage payments as per the original terms. This arrangement often requires a Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors to ensure that all parties are legally protected. Such agreements facilitate the transfer of responsibility for the mortgage, benefiting both the buyer and the seller.

An assumption and release agreement is a legal document that enables a borrower to transfer their mortgage obligations to another party. This agreement outlines the new borrower's responsibility for the mortgage, while releasing the original mortgagor from further liability. In Minnesota, the Minnesota Assumption Agreement of Mortgage and Release of Original Mortgagors is essential for this process, ensuring all parties are legally protected. By using platforms like USLegalForms, you can easily draft and finalize these important documents.

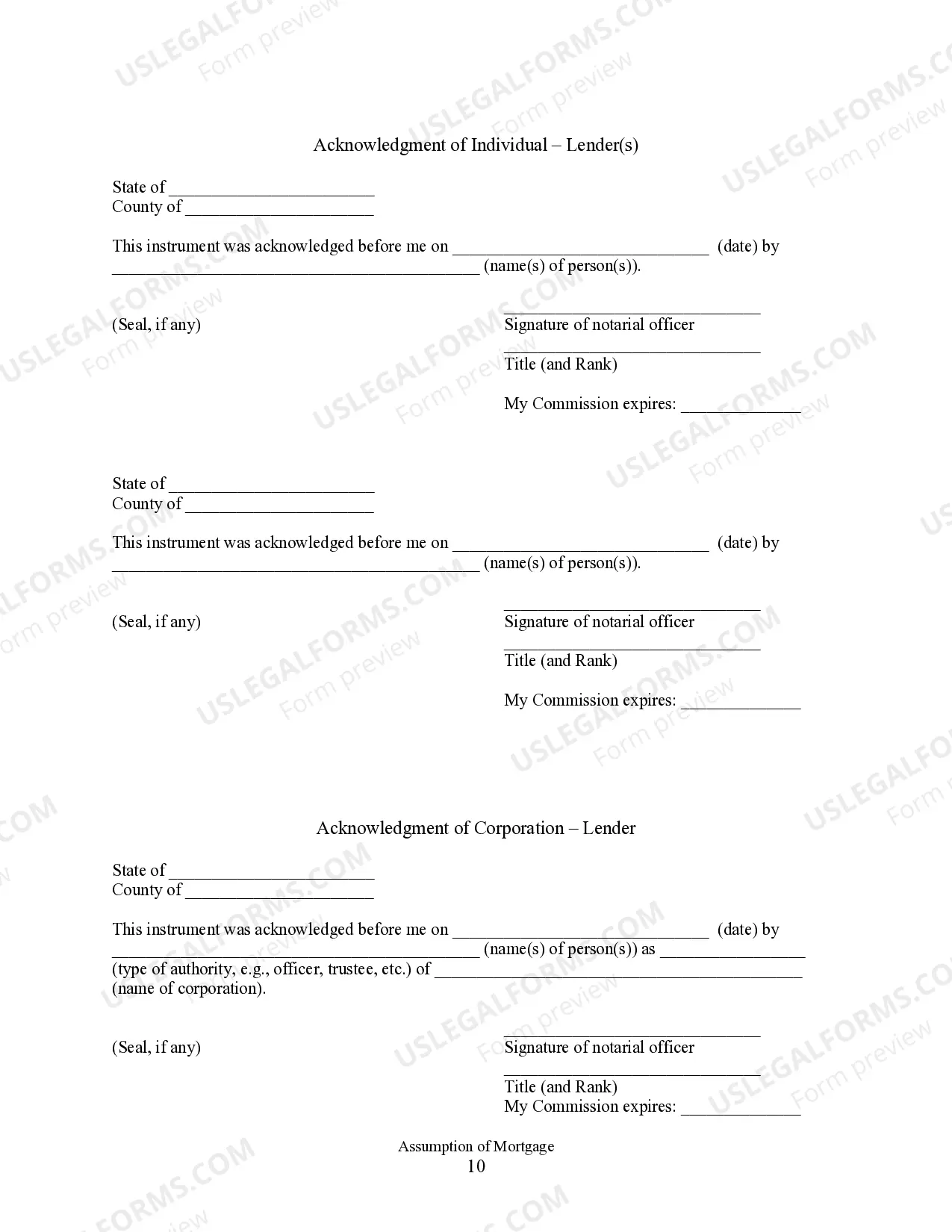

A Satisfaction of Mortgage is issued by the lender after they have received the final mortgage payment from the borrower. It's signed by the mortgagee (in the presence of a witness in some states and counties) and then notarized by a registered notary public.

You can easily see if this exists by simply calling the county clerk's office or by visiting their website. Those that have a page like this will list the property information, date of default and the balances owed on each of the mortgages on the property.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

A satisfaction of mortgage is a document that confirms a mortgage has been paid off and details the provisions for the transfer of collateral title rights.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

You may contact us at (407) 836-5115 to request a search of your Satisfaction of Mortgage. You may also utilize our web site (www.occompt.com) to see if your Satisfaction has been recorded. Your Satisfaction is recorded under the names of the borrower/mortgagor on the original loan.