Minnesota Fee Agreement

About this form

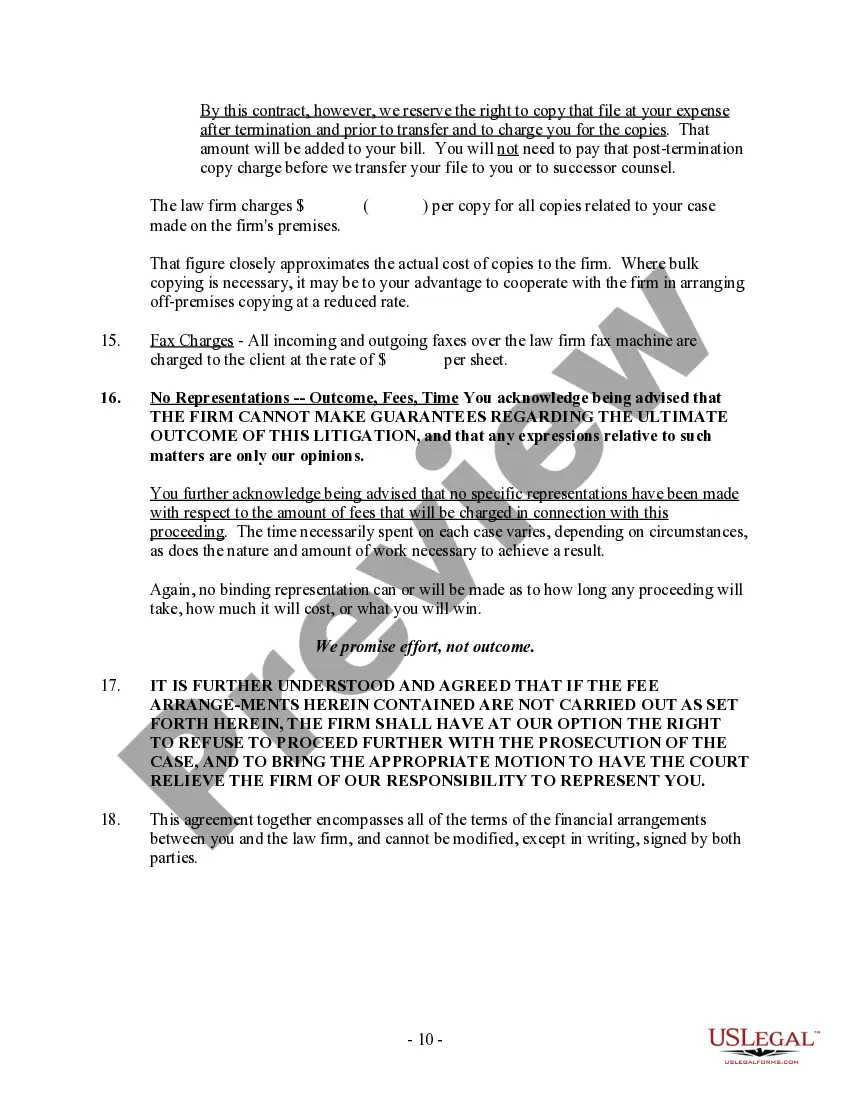

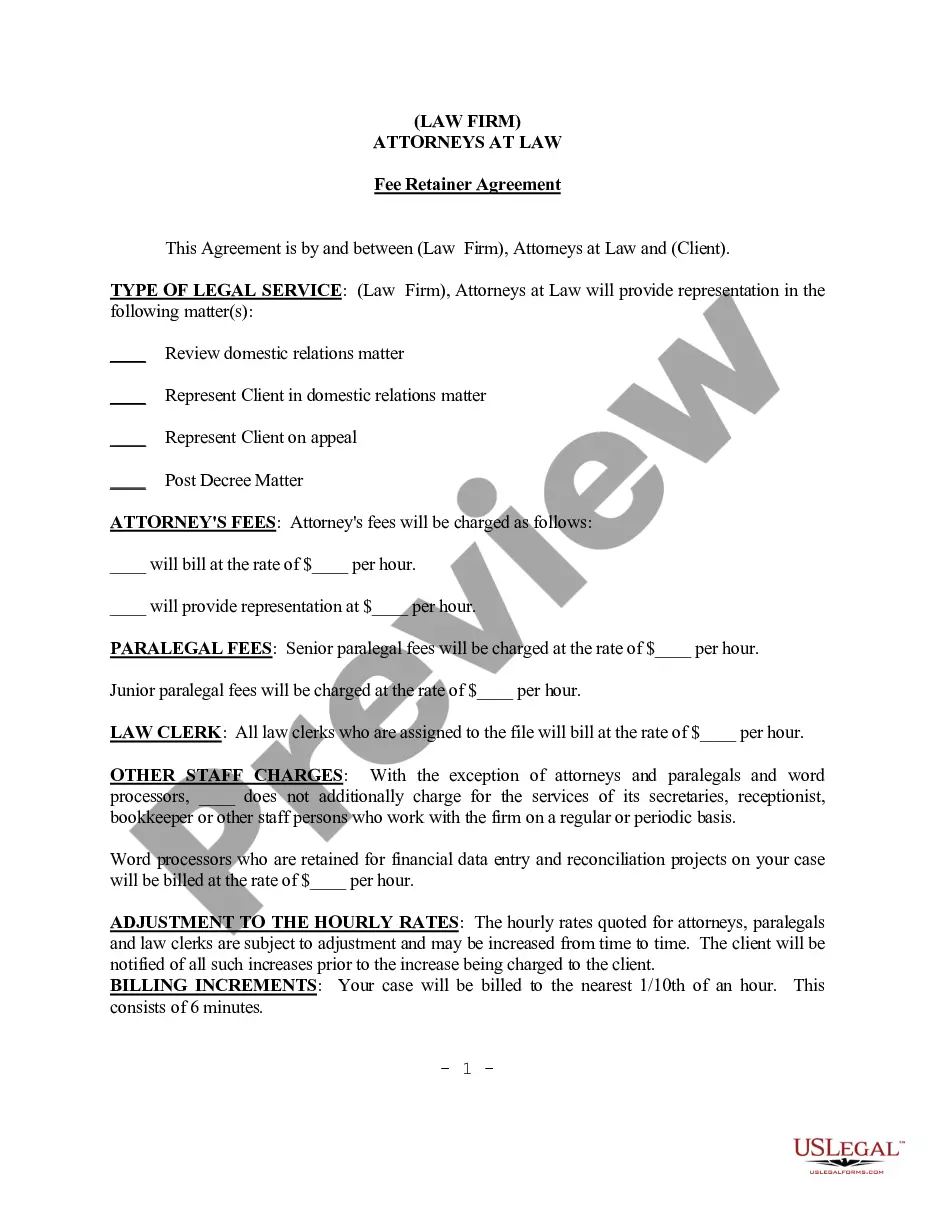

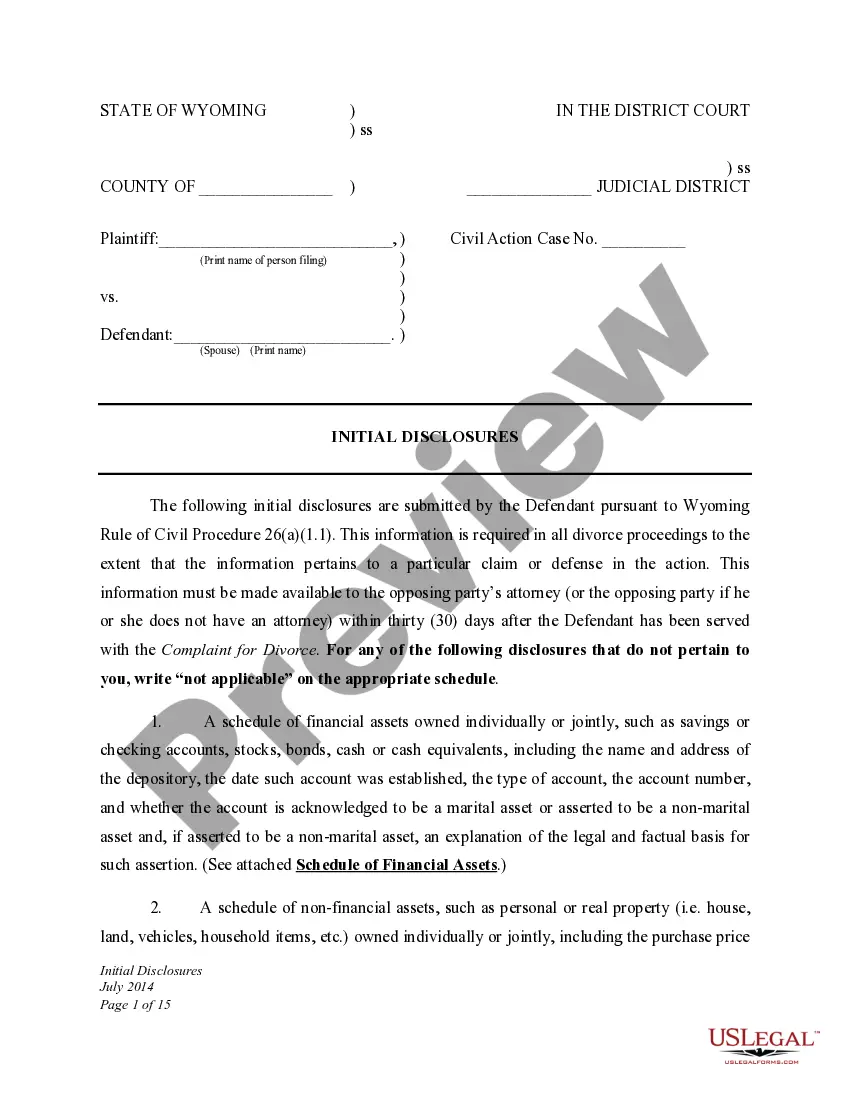

The Fee Agreement is a legal document outlining the terms of payment and services between a client and an attorney. This agreement specifies how the attorney will bill for services, including hourly rates and payment timelines, distinguishing it from other generic contracts or agreements focused solely on client engagement or services rendered. It is specifically designed to ensure clear understanding regarding payment obligations and legal representation parameters.

Main sections of this form

- Identification of the attorney and law firm.

- Detailed scope of representation, including limitations on services.

- Clear explanation of retainer fees and trust accounts.

- Billing rates and payment schedules.

- Responsibilities for costs and disbursements.

- Conditions for termination of services and collection processes.

Common use cases

This Fee Agreement should be used when engaging an attorney for legal representation. It is essential for formalizing the financial arrangements prior to commencing any legal services, especially in cases involving family law, where clear communication about fees and retainer expectations is critical. This document helps prevent misunderstandings about payment obligations and services provided.

Who this form is for

- Clients seeking legal representation from an attorney.

- Individuals who require clarification on costs associated with legal advice and services.

- Anyone entering into a retainer agreement for legal services, particularly in family law matters.

How to prepare this document

- Identify the law firm and the attorney providing representation.

- Specify the scope of legal services to be rendered.

- Detail the retainer fee and specify how it will be deposited and used.

- Outline the billing rates and payment terms.

- Ensure all parties sign the agreement, acknowledging its terms.

Does this document require notarization?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to clarify the scope of services, leading to potential misunderstandings.

- Not specifying payment deadlines, which can result in late fees.

- Overlooking the need for signatures from all parties involved.

Advantages of online completion

- Convenience of downloading and customizing the form to fit your specific needs.

- Accessibility to legal documents drafted by licensed attorneys.

- Ability to complete the form at your own pace, ensuring accuracy in details provided.

Looking for another form?

Form popularity

FAQ

In Minnesota, an operating agreement is not legally required for limited liability companies (LLCs), but it is highly recommended. An effective operating agreement can complement your Minnesota Fee Agreement by outlining the roles and responsibilities of members. This document serves to clarify expectations and prevent disputes within the LLC. You can find templates and guidance for creating these agreements on platforms like uslegalforms.

An attorney fee agreement is a contract between a client and an attorney that specifies the fees for legal services. This Minnesota Fee Agreement details the scope of work, payment schedule, and any additional costs that may arise. Having a written agreement helps avoid misunderstandings and allows clients to know exactly what to expect. It is essential for maintaining a good attorney-client relationship.

In Minnesota, it is highly recommended that a fee agreement be in writing to avoid any misunderstandings. While some verbal agreements may be legally binding, having a written document provides clarity on the terms of service and fees. A well-drafted Minnesota Fee Agreement can serve as a clear reference point for both parties. Utilizing tools from USLegalForms can help you create a compliant agreement easily.

The hidden fee law in Minnesota requires that all fees associated with a legal service be disclosed upfront. This law aims to protect clients from unexpected charges that may arise during the legal process. By understanding this law, you can ensure that your Minnesota Fee Agreement clearly outlines all potential costs involved. This transparency fosters trust between you and your legal representative.

Rule 68 in Minnesota relates to the offer of judgment in civil cases. It allows a party to make a formal settlement offer to the opposing party before the trial begins. If the opposing party rejects the offer and fails to obtain a better result at trial, they may be responsible for the costs incurred after the offer was made. Understanding how Rule 68 interacts with your Minnesota Fee Agreement can help you make informed decisions about your case.

A Minnesota Fee Agreement should clearly outline the scope of the legal services being provided, including the specific tasks and responsibilities of the attorney. Additionally, it should detail the fee structure, whether it is hourly, flat-rate, or contingent, along with any additional costs that may arise. Defining payment terms, such as due dates and accepted payment methods, is also essential. This clarity not only helps avoid misunderstandings but also builds trust between you and your attorney.

Minnesota Sales Tax on Car Purchases:Minnesota collects a 6.5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in Minnesota may be subject to other fees like registration, title, and plate fees. You can find these fees further down on the page.

At some dealerships, the out-the-door costs are abbreviated as "TTL fees" or tax, title and license. This means that, in addition to the price of the car, you typically have to pay the following costs: State and local sales tax. Department of Motor Vehicles title and registration fees.

Required Driver's License Renewal Fees To obtain or renew a Class D Minnesota driver's license, you'll have to pay a fee of $25.25. This fee is the same whether you're over or under 21. If you want to get a duplicate driver's license in case you lose yours, it will cost you $14.75.

See your vehicle registration renewal form issued by the Minnesota Department of Public Safety, Driver and Vehicle Services (DVS). Visit the DVS website's Motor Vehicle Registration Tax Paid page.