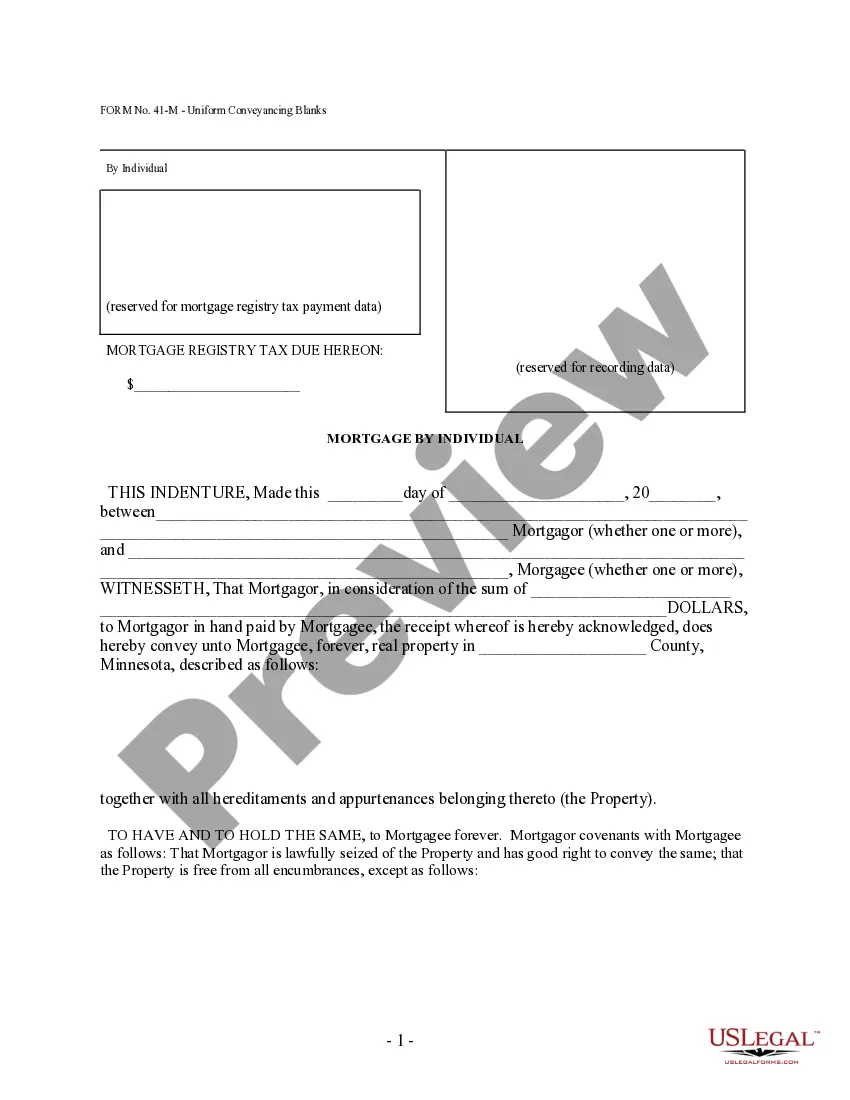

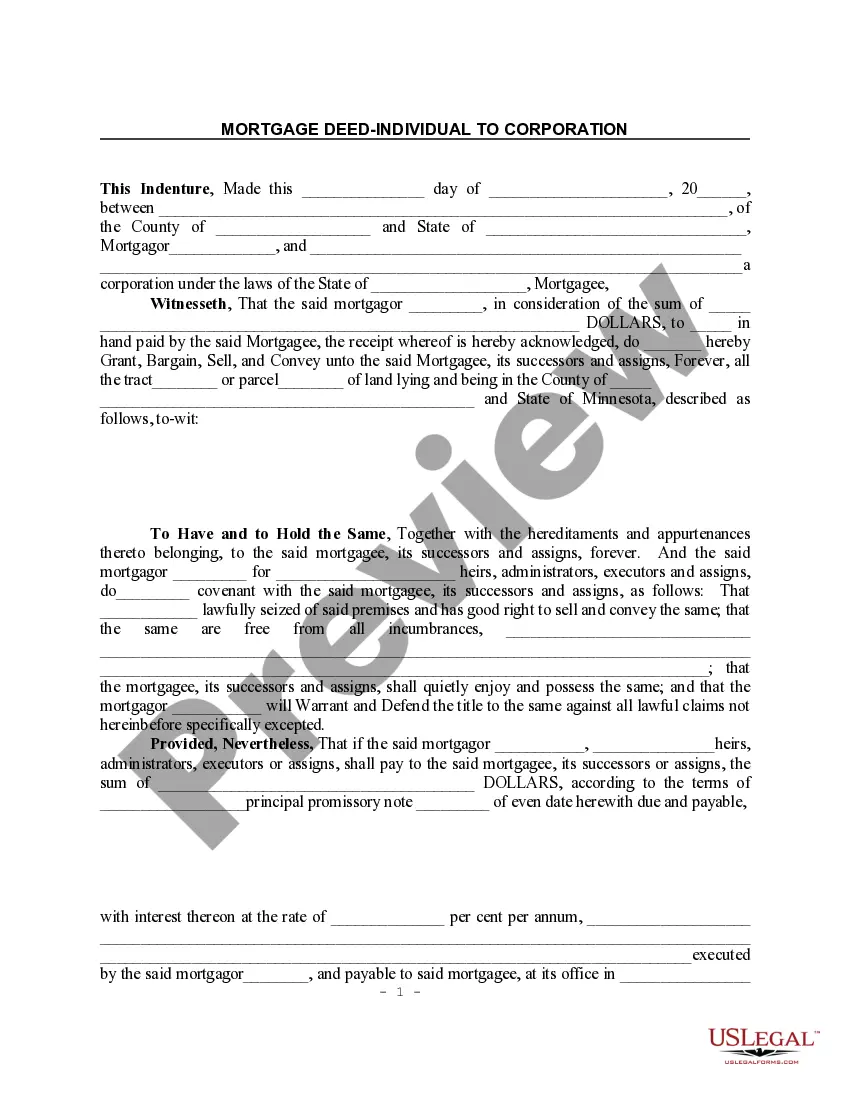

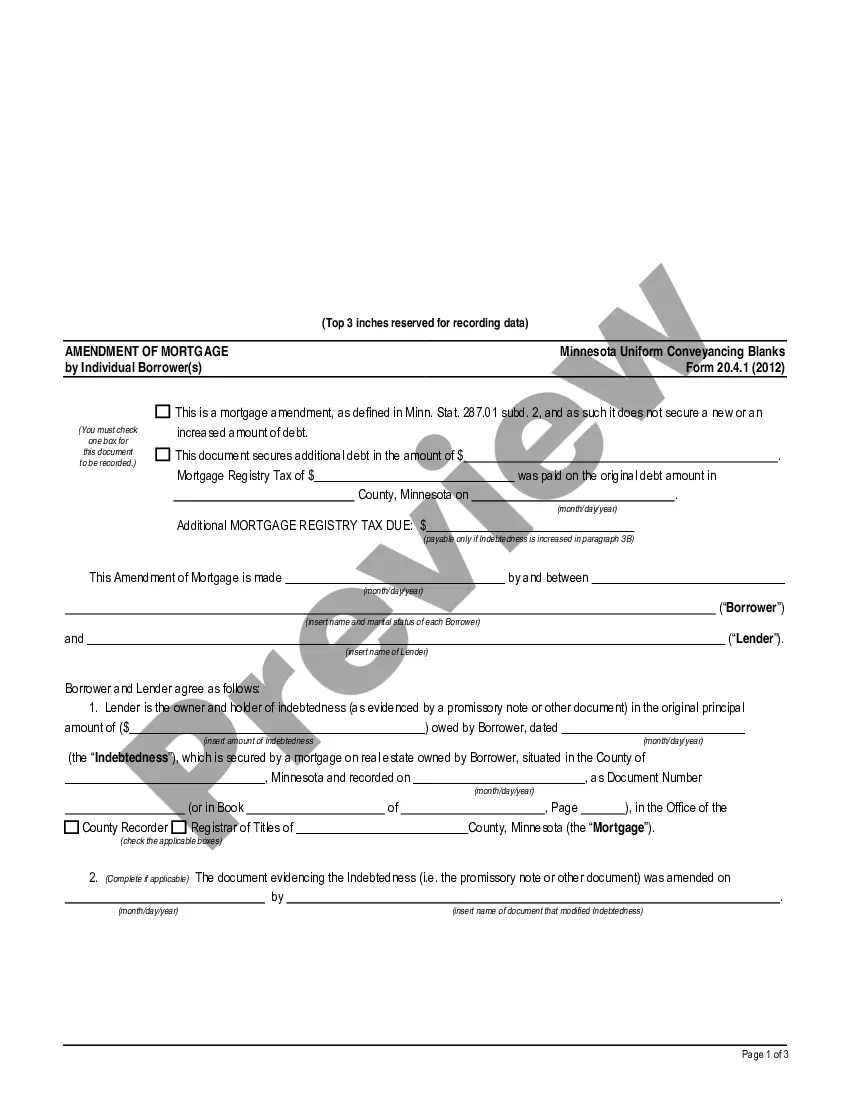

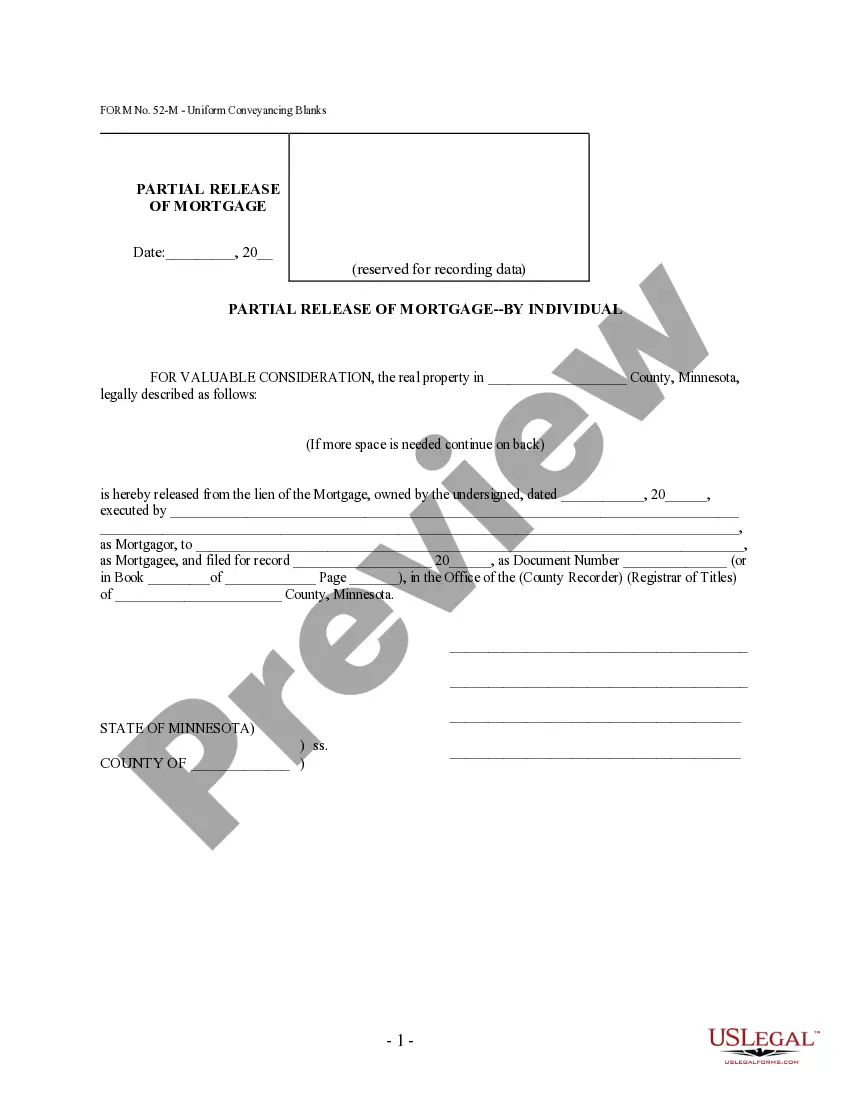

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms are to be used as a guide.

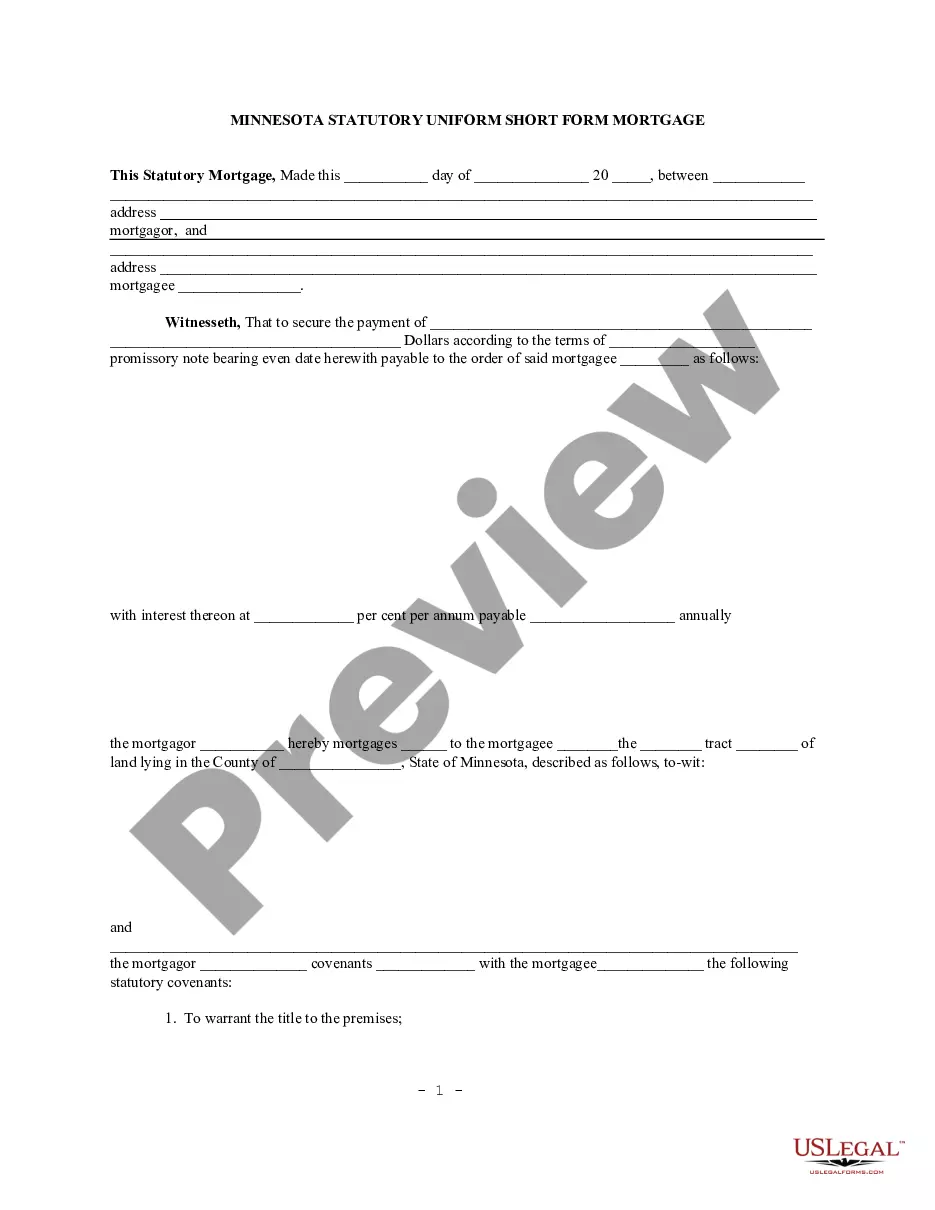

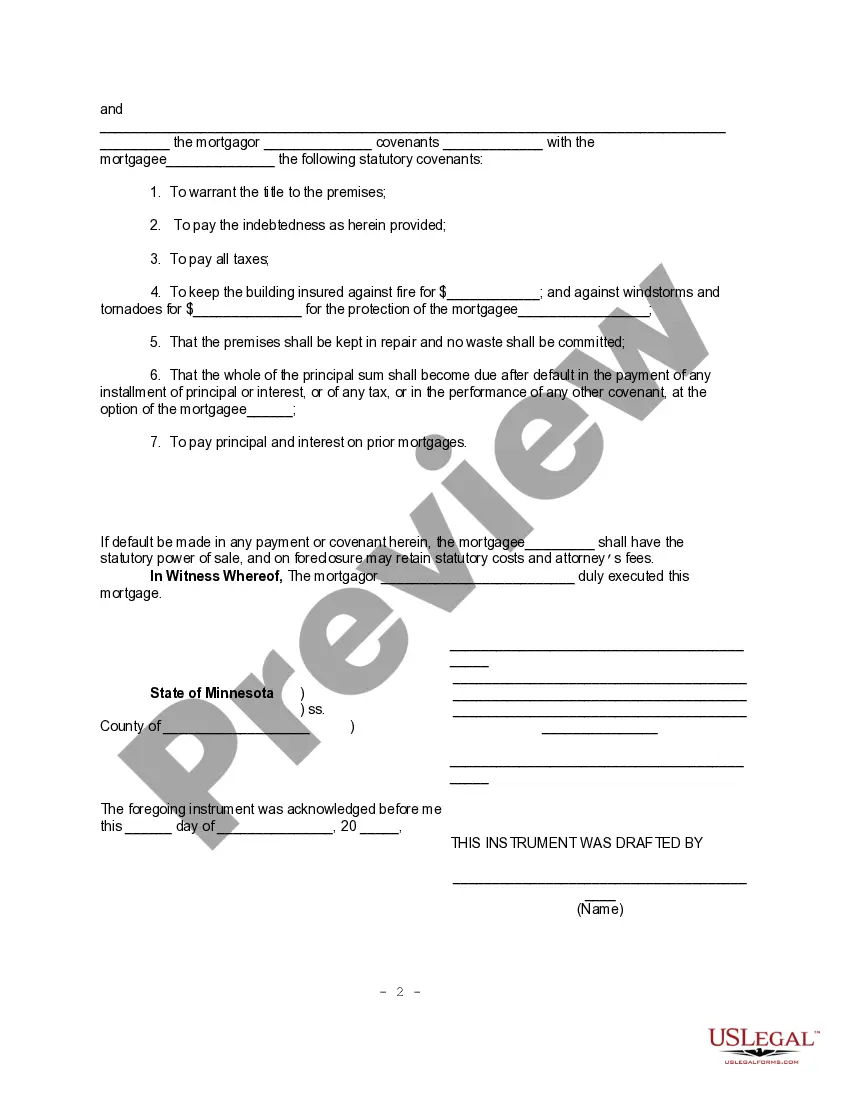

Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M

Description

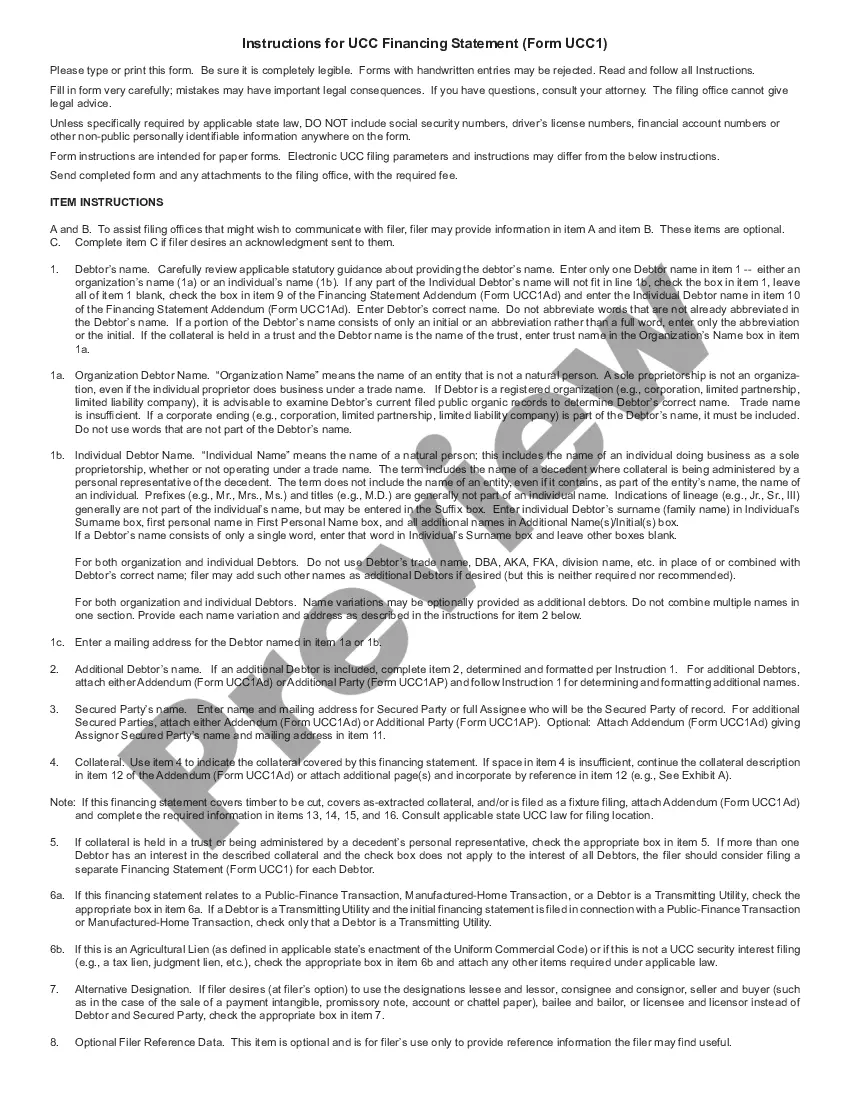

How to fill out Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M?

Obtain any type from 85,000 lawful documents including Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M online with US Legal Forms. Each template is crafted and refreshed by state-qualified lawyers.

If you already possess a subscription, Log In. Once on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, adhere to the instructions listed below.

With US Legal Forms, you’ll always have rapid access to the relevant downloadable template. The platform provides access to forms and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M efficiently and swiftly.

- Verify the state-specific prerequisites for the Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M you intend to utilize.

- Examine the description and preview the template.

- When you’re assured the template meets your needs, simply click Buy Now.

- Choose a subscription plan that genuinely suits your budget.

- Establish a personal account.

- Make payment in one of two convenient methods: via credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

To fill out a Minnesota quit claim deed, start by entering the names of the grantor and grantee, along with the property description. It’s vital to ensure that the deed complies with state requirements, such as including the Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M for clarity. After completing the details, sign the deed in front of a notary. Finally, record the quit claim deed with the county recorder to make the transfer official.

Filling out an affidavit of identity and survivorship in Minnesota involves providing essential details about the property and the individuals involved. You will need to include information such as names, addresses, and the relationship between the parties. Using the Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M can streamline this process. After completing the affidavit, ensure it is signed in front of a notary public before submitting it to the appropriate authority.

To transfer ownership of a property in Minnesota, you need to execute a deed that conveys the property to the new owner. Commonly used forms include the Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M, which simplifies the process. It's important to ensure the deed is properly signed and notarized. After that, you must record the deed with the county recorder's office to finalize the transfer.

To properly fill out a quitclaim deed, gather all necessary information about the property and the parties. Use the Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M to ensure compliance with state requirements. Clearly state the grantor’s and grantee’s names, provide a thorough description of the property, and make sure to sign in front of a notary. For additional help, check out resources like US Legal Forms to ensure your document is filled out correctly and efficiently.

Completing a quit claim deed in Minnesota involves filling out the correct form with information about the property and the parties involved. You can find the Minnesota Statutory Uniform Short Form Mortgage - UCBC Form 100-M on platforms like US Legal Forms, which ensures you have the right details. Make sure to include the legal description of the property, the exact names of the grantor and grantee, and the signing of the document before a notary. Once completed, file it with the county to make it official.

To file a quit claim deed in Minnesota, you first need to complete the necessary paperwork accurately. You can obtain the forms from your local county recorder’s office or use resources like US Legal Forms for guidance. After filling out the form, you must sign it in front of a notary public. Finally, submit the completed quit claim deed to your county recorder along with the required fees.

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

A statutory form is a form created by a government, usually designed to serve as a model form or a free form for the public. The text of the form resides within the government's statutes. For example, many states have statutory durable powers of attorney forms written into their laws.

Under the Minnesota power of attorney statutes, the principal's signature on a Minnesota Power of Attorney document need not be acknowledged before a notary public. However, third parties may require it, and a Minnesota Statutory Short Form Power of Attorney document will look incomplete without such an acknowledgment.

1. Durable Power of Attorney. A durable power of attorney, or DPOA, is effective immediately after you sign it (unless stated otherwise), and allows your agent to continue acting on your behalf if you become incapacitated.