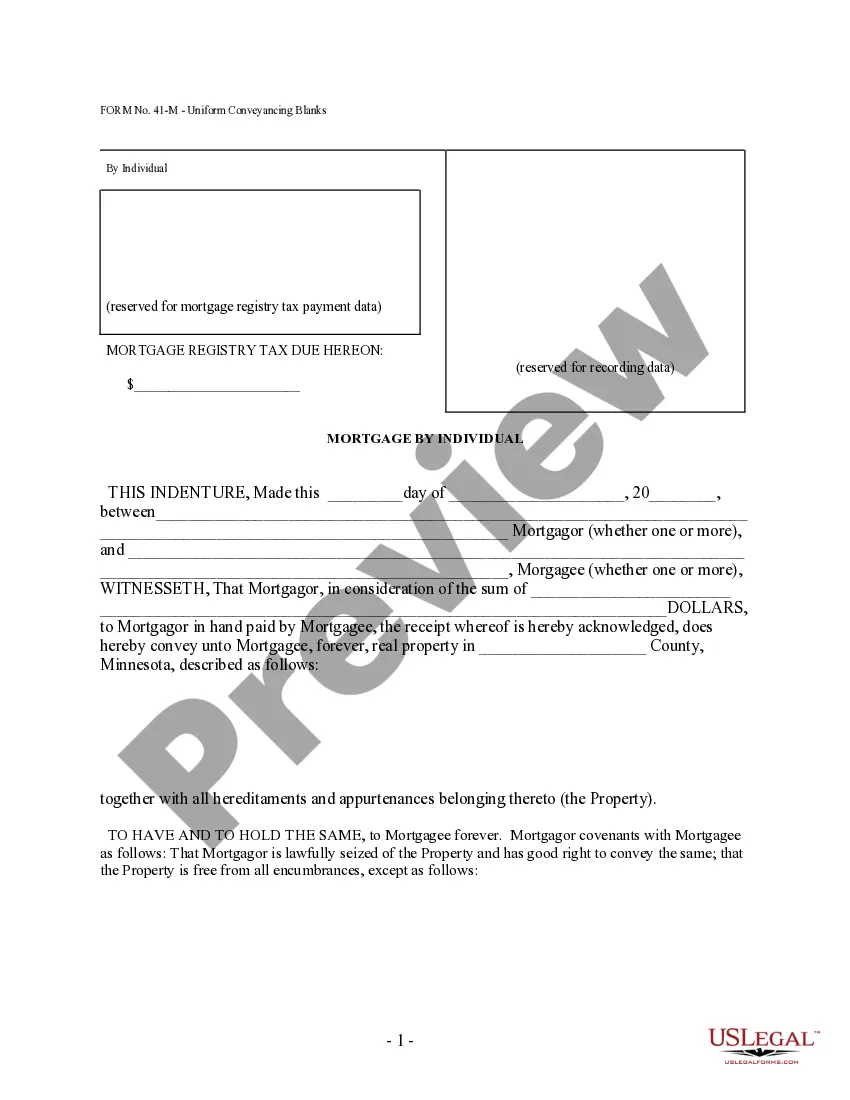

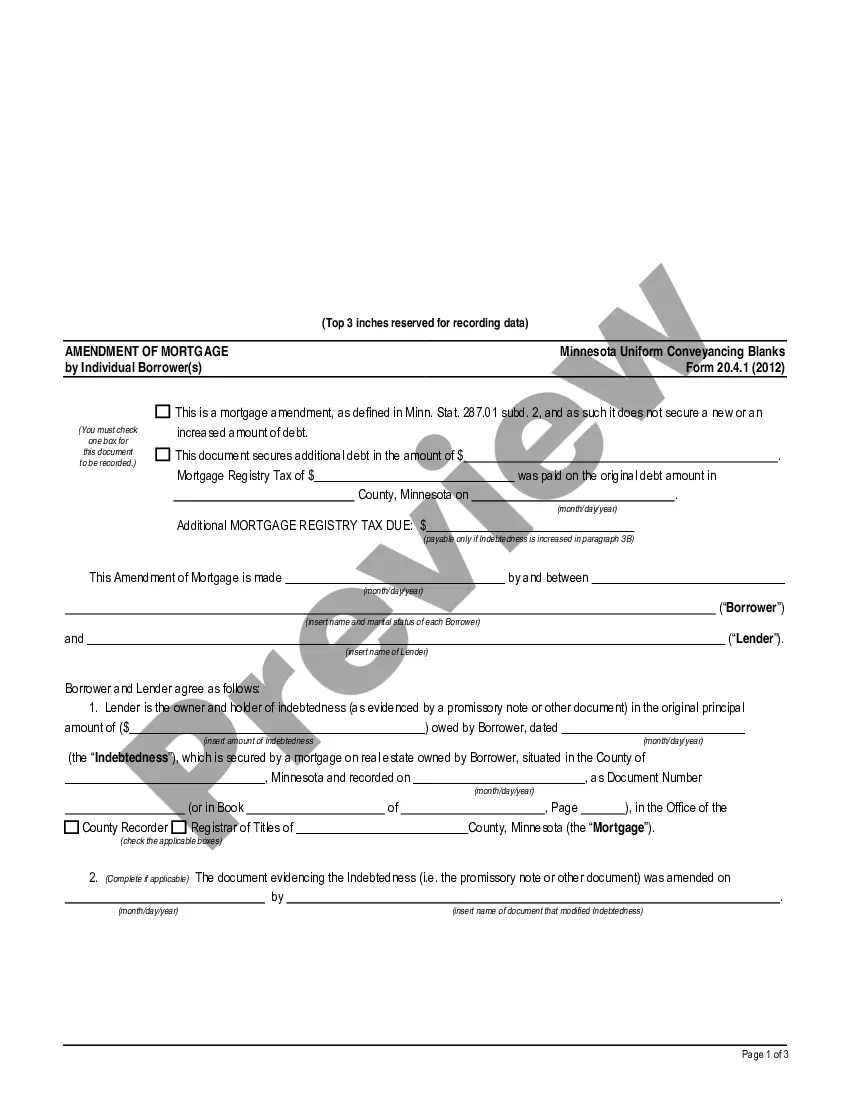

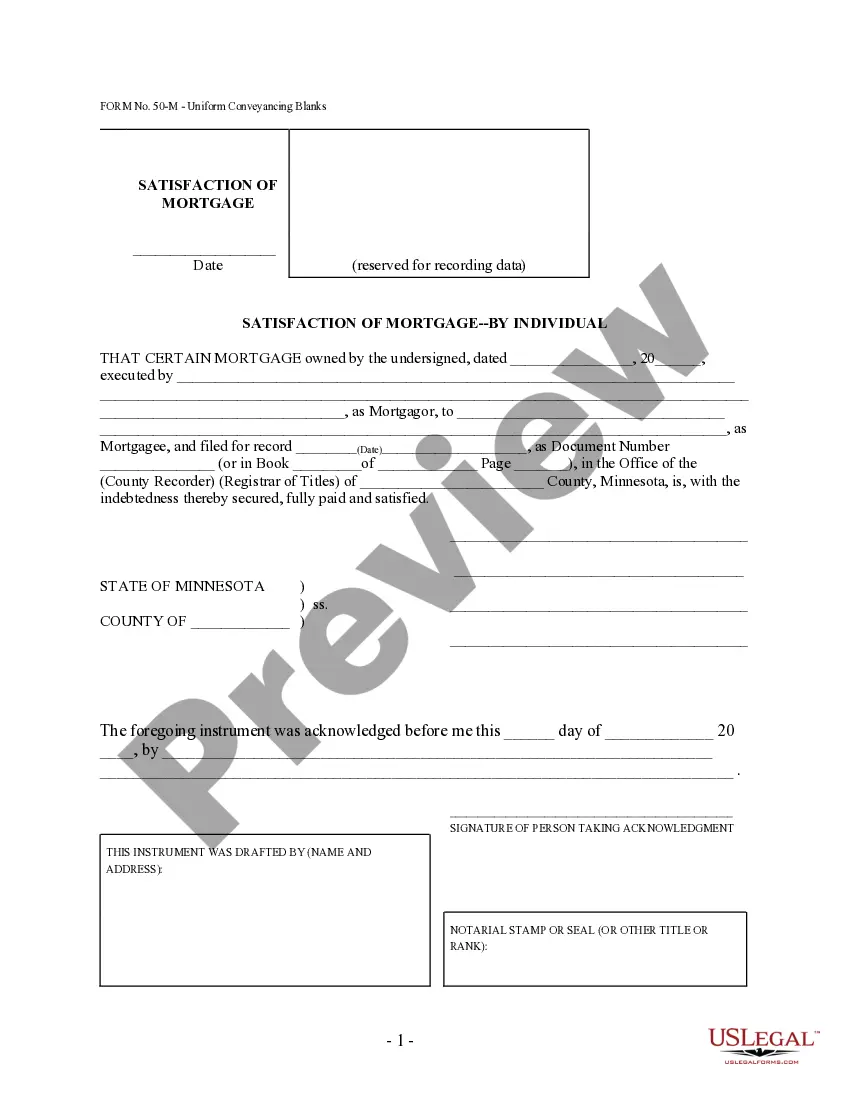

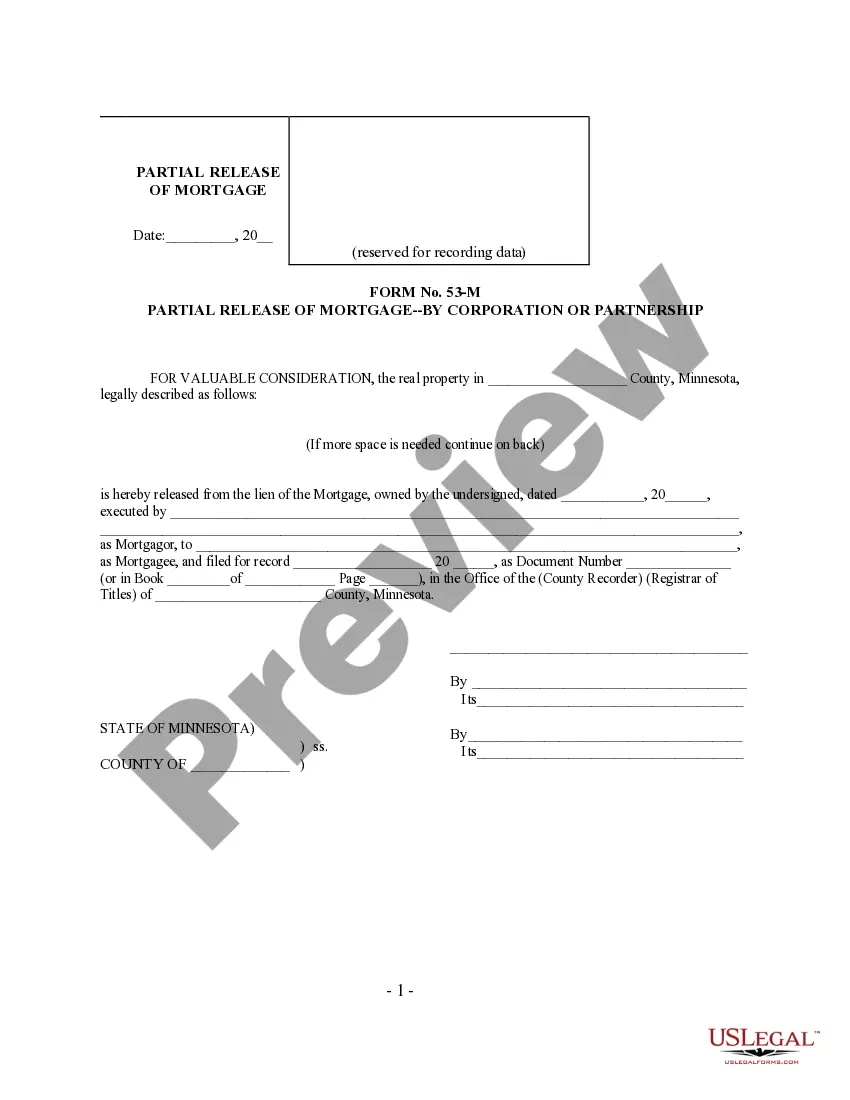

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1

Description

How to fill out Minnesota Partial Release Of Mortgage By Individual - UCBC Form 20.6.1?

Obtain any version from 85,000 lawful documents including Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1 online with US Legal Forms. Each template is prepared and refreshed by state-certified attorneys.

If you possess a subscription, sign in. Once you reach the form’s page, select the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, adhere to the instructions outlined below.

With US Legal Forms, you’ll consistently have prompt access to the correct downloadable sample. The service will provide you with documents and categorizes them to enhance your search. Utilize US Legal Forms to acquire your Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1 swiftly and effortlessly.

- Verify the state-specific criteria for the Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1 you intend to use.

- Examine the description and preview the template.

- When you are confident the sample meets your needs, click Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Remit payment in one of two suitable methods: by card or through PayPal.

- Select a format to download the document in; two choices are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

To fill out a Minnesota quit claim deed, first, ensure you have the correct form, which you can find on the US Legal platform. Begin by entering the names of the grantor and grantee, followed by a legal description of the property. Next, include the date of the transfer and any relevant consideration amount. Lastly, sign the document in front of a notary public to make it legally binding. Remember, if you're dealing with a Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1, ensure you complete it accurately to avoid any issues.

A deed in lieu of foreclosure in Minnesota allows homeowners to transfer ownership of their property to the lender instead of going through a lengthy foreclosure process. This option can help you avoid the negative impacts of foreclosure on your credit score. It's crucial to understand that this process may not release you from all mortgage obligations, so consulting with a legal expert is advisable. If you need guidance, consider using the Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1 to explore your options.

To obtain a copy of your mortgage lien release, start by contacting your lender or mortgage servicer. They should have a record of the Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1. If you need a more efficient process, consider using US Legal Forms, where you can easily access the necessary documents and forms. This platform simplifies the retrieval of mortgage-related paperwork, ensuring you have everything you need in one place.

Buying someone out of their half of a mortgage typically involves refinancing the mortgage in your name alone, or paying them off for their share. First, evaluate the current mortgage balance and the property’s value to determine a fair buyout amount. Consider using the Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1 to finalize the transition, ensuring your ownership is documented.

To file a quitclaim deed in Minnesota, you must first complete the deed form, ensuring that it includes the legal description of the property. Next, sign the document in the presence of a notary public. After notarization, file the quitclaim deed with the county recorder's office. This process is important if you are seeking a Minnesota Partial Release of Mortgage by Individual - UCBC Form 20.6.1, as it helps clarify ownership.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

A partial release of judgment lien is necessary to release a judgment from your home.Obtaining a partial release of a judgment typically means that you are releasing your homestead property from the judgment, but you are not releasing yourself from the judgment liability.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

A partial discharge is when you have more than one property that is secured by a loan, and you would like to release one of those properties as security, without repaying the full loan.