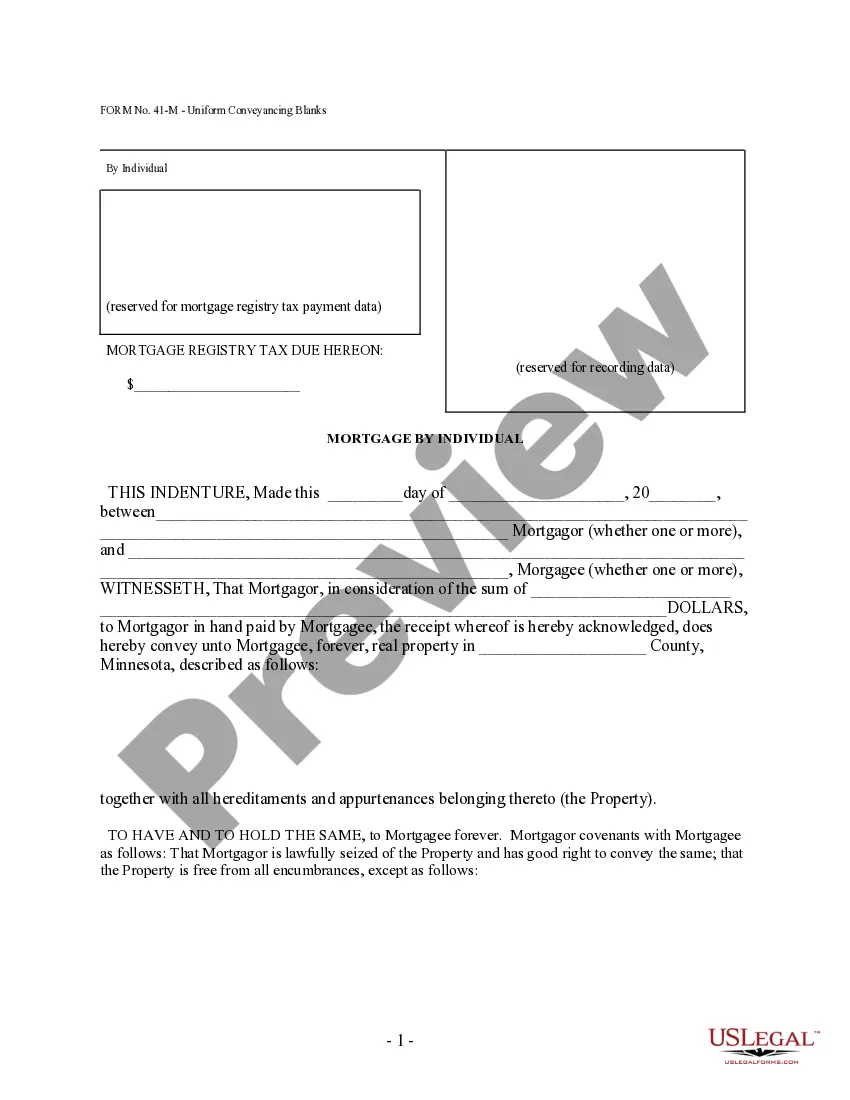

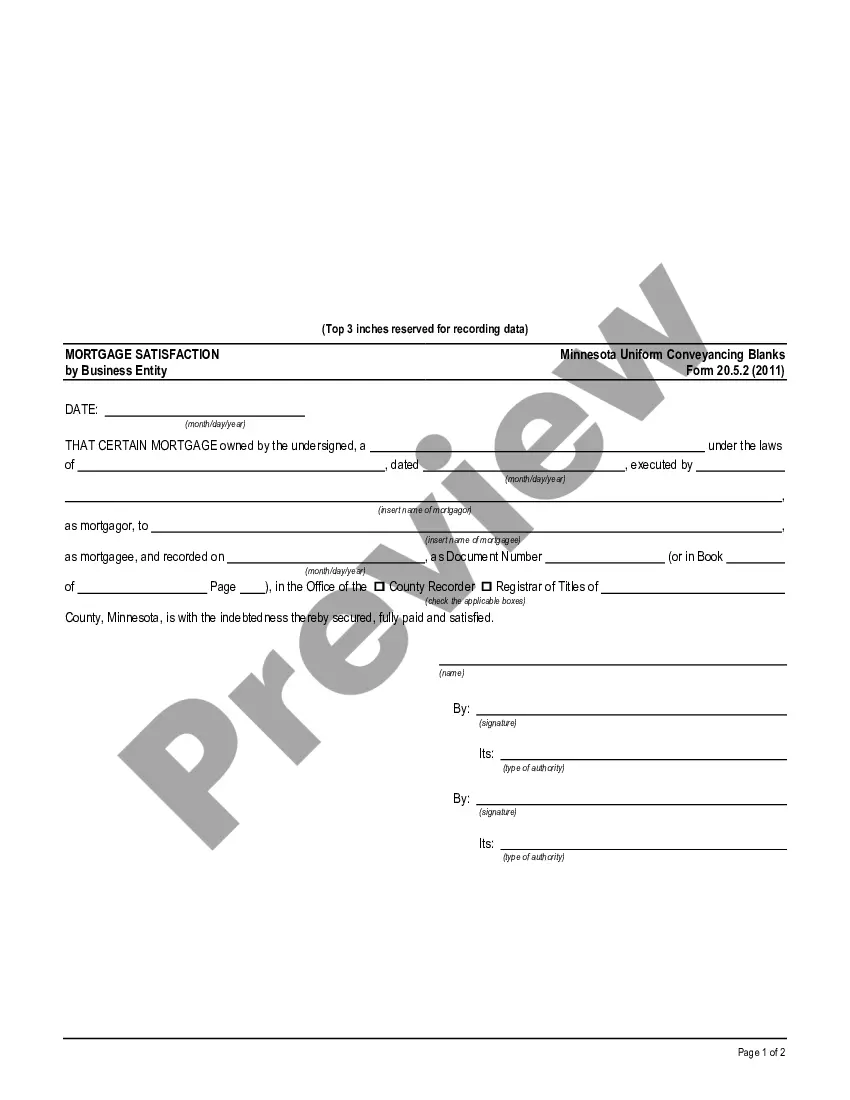

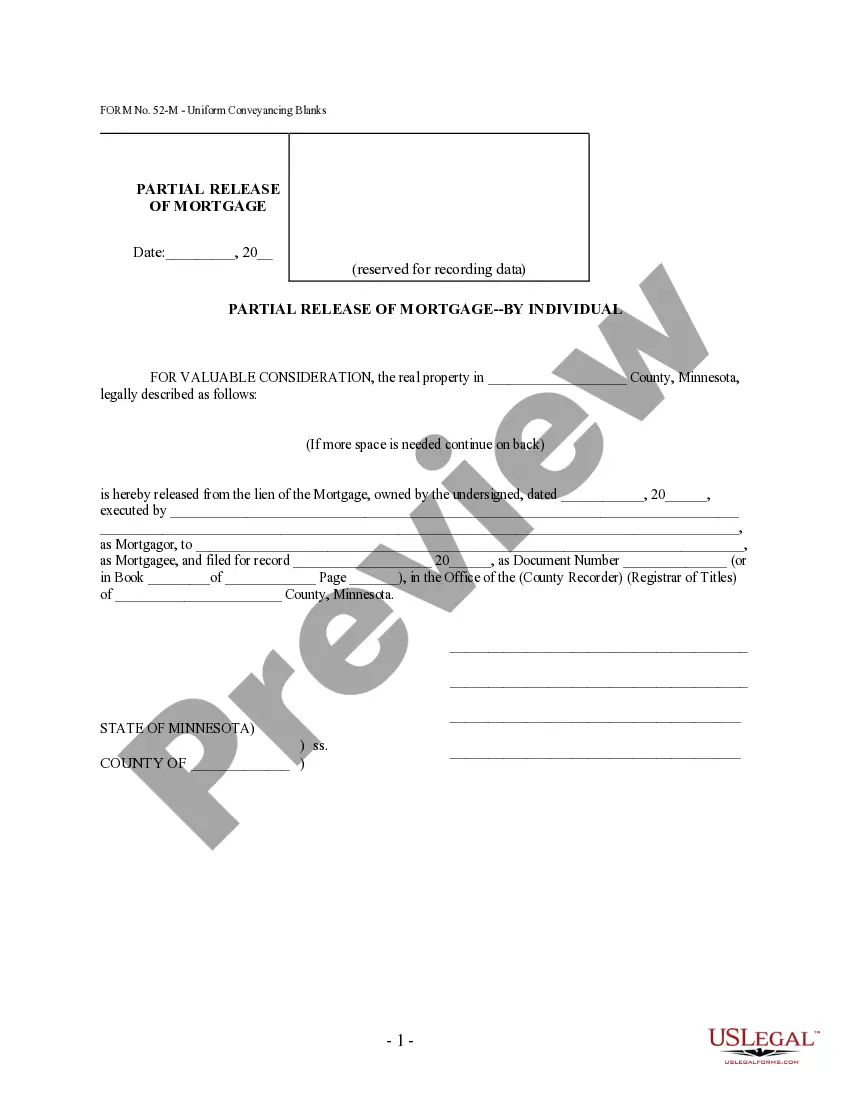

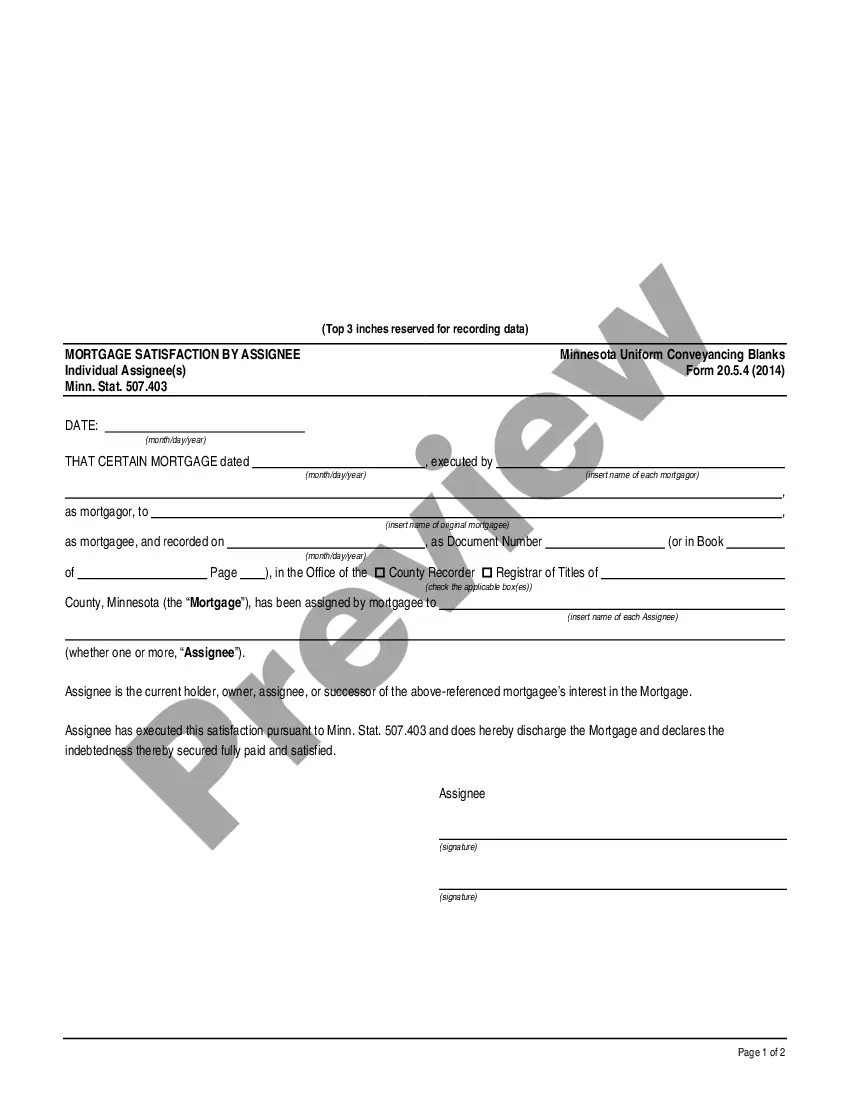

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minnesota Satisfaction of Mortgage by Individual - UCBC Form 20.5.1

Description

How to fill out Minnesota Satisfaction Of Mortgage By Individual - UCBC Form 20.5.1?

Obtain any type from 85,000 legal documents including Minnesota Satisfaction of Mortgage by Individual - UCBC Form 20.5.1 online with US Legal Forms. Each template is crafted and refreshed by state-licensed attorneys.

If you already possess a subscription, Log In. When you’re on the form’s page, click the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the steps outlined below: Check the state-specific prerequisites for the Minnesota Satisfaction of Mortgage by Individual - UCBC Form 20.5.1 you need to utilize. Review the description and preview the template. Once you are confident that the template meets your needs, click Buy Now. Select a subscription plan that truly fits your budget. Create a personal account. Make a payment in one of two suitable ways: by card or through PayPal. Choose a format for downloading the file; two options are available (PDF or Word). Download the file to the My documents tab. After your reusable form is downloaded, print it out or save it to your device.

- With US Legal Forms, you will consistently have swift access to the correct downloadable template.

- The service provides access to forms and categorizes them into groups to ease your search.

- Utilize US Legal Forms to acquire your Minnesota Satisfaction of Mortgage by Individual - UCBC Form 20.5.1 swiftly and effortlessly.

Form popularity

FAQ

No, a satisfaction of a mortgage is not the same as a deed. While a deed transfers ownership of property, a satisfaction of mortgage confirms that the borrower has satisfied their debt obligation. The Minnesota Satisfaction of Mortgage by Individual - UCBC Form 20.5.1 specifically addresses the completion of mortgage payments and the release of the lender’s claim. Understanding this distinction helps ensure that property records are accurately maintained.

Typically, the mortgage lender is responsible for filing the satisfaction of a mortgage. However, once you receive the Minnesota Satisfaction of Mortgage by Individual - UCBC Form 20.5.1, you may also have the option to file it yourself with the county recorder's office. It's essential to ensure that this form is filed correctly to avoid any future complications regarding property ownership.

You can obtain a Minnesota Satisfaction of Mortgage by Individual - UCBC Form 20.5.1 from various sources. Many individuals choose to use online legal form services, such as US Legal Forms, which provide easy access to the necessary documents. Additionally, you can find this form at local county offices or through real estate professionals who can guide you through the process. Using these resources ensures that you have the correct form and understand how to properly file it.