Michigan Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

Are you in a situation where you require documents for business or personal purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging. US Legal Forms offers a vast array of form templates, including the Michigan Liquidation of Partnership with Sale and Proportional Distribution of Assets, which can be tailored to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Michigan Liquidation of Partnership with Sale and Proportional Distribution of Assets template.

You can find all the document templates you have acquired in the My documents section. You may obtain an additional copy of the Michigan Liquidation of Partnership with Sale and Proportional Distribution of Assets whenever needed. Simply click on the desired template to download or print the document format.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates applicable for various purposes. Create an account on US Legal Forms and start simplifying your life.

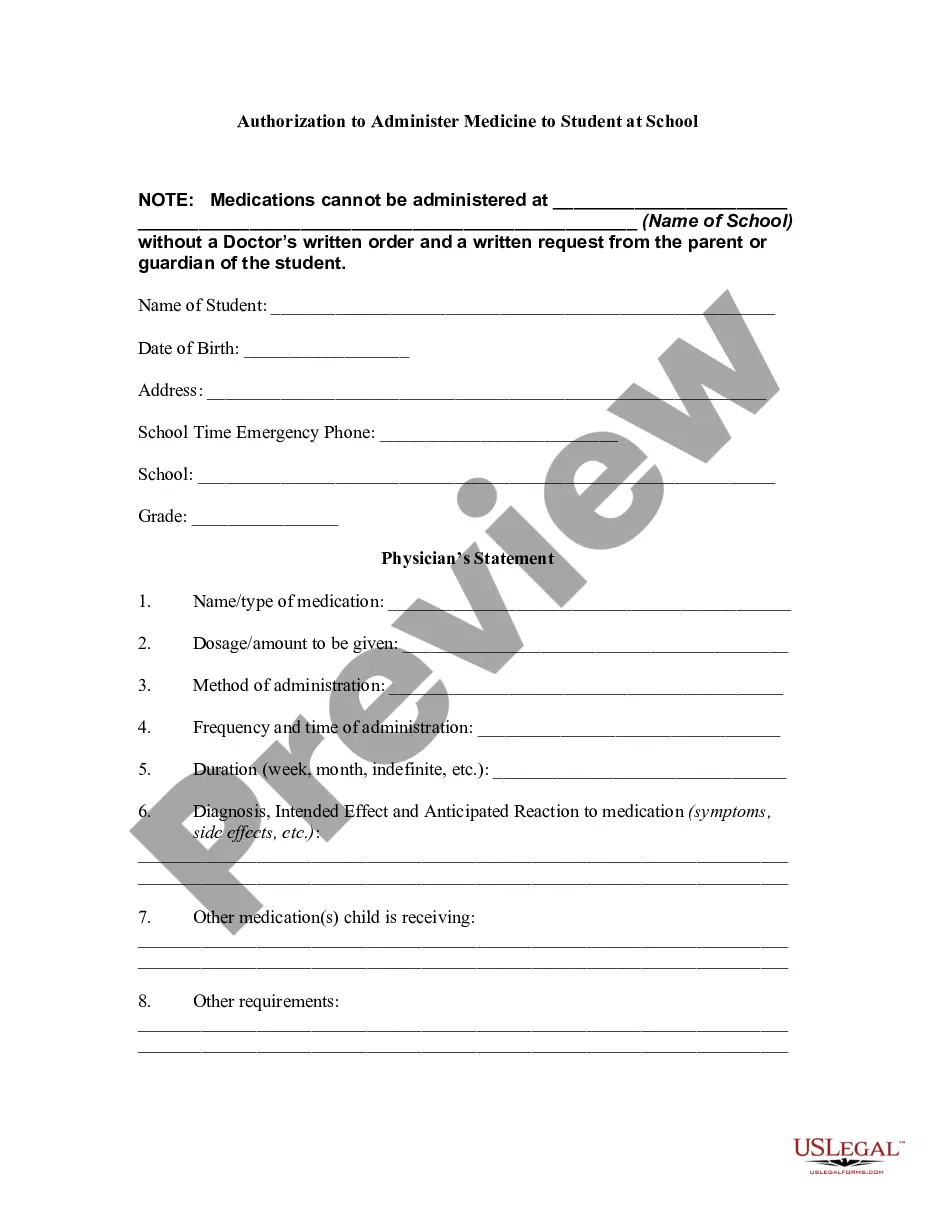

- Retrieve the template you need and ensure it is for the correct city/region.

- Use the Review button to inspect the document.

- Read the description to confirm that you have selected the appropriate template.

- If the document isn't what you're looking for, utilize the Lookup section to find the template that meets your needs.

- Once you find the right document, click Purchase now.

- Select the pricing plan you prefer, fill in the necessary information to set up your payment, and complete the order using either PayPal or a credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

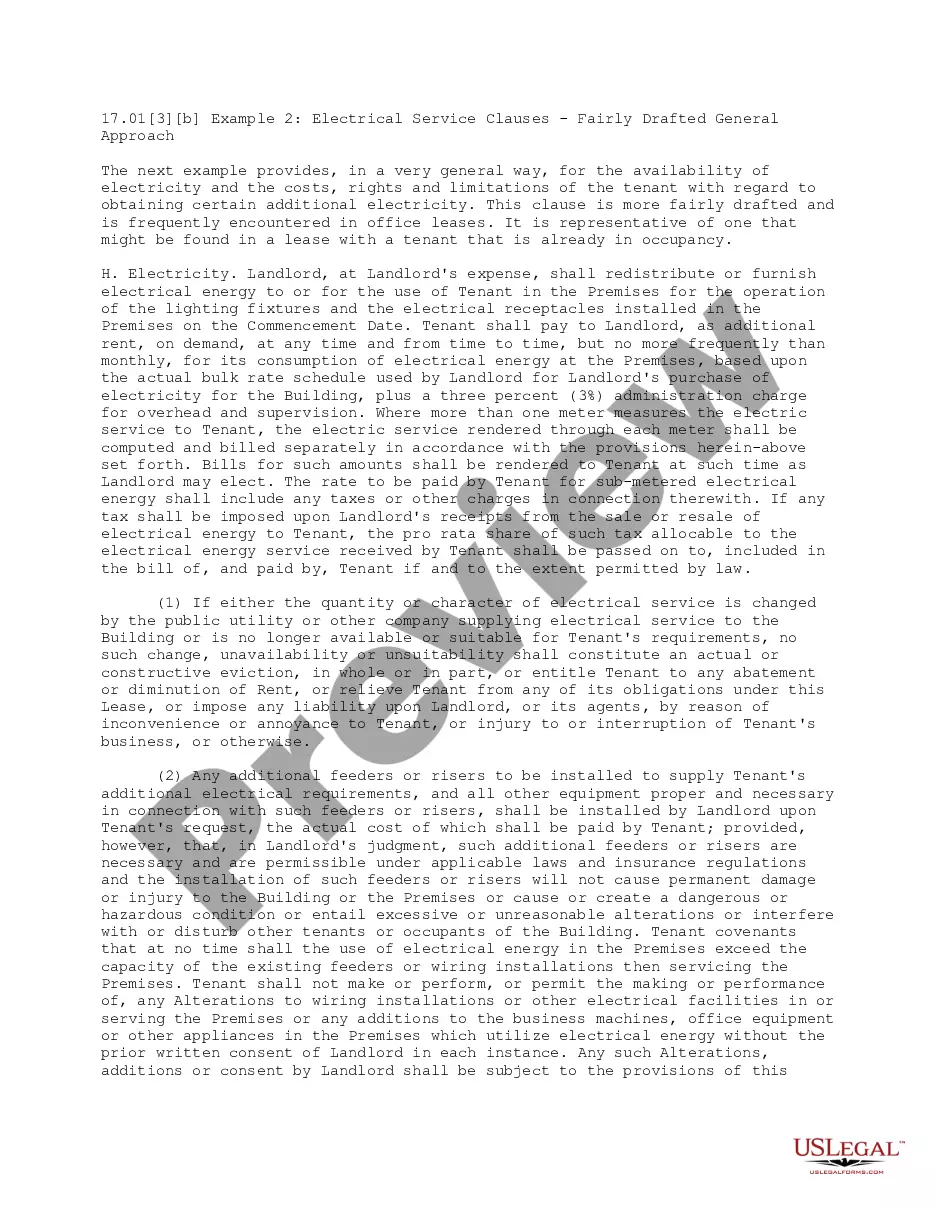

In the Michigan Liquidation of Partnership with Sale and Proportional Distribution of Assets, the basis a partner takes in property received in a liquidating distribution typically reflects their adjusted basis in the partnership interest. This includes considering any liabilities assumed by the partner. It is crucial for partners to understand this calculation, as it affects future tax implications. Clearly documenting this basis helps in ensuring compliance and ease in managing tax responsibilities.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

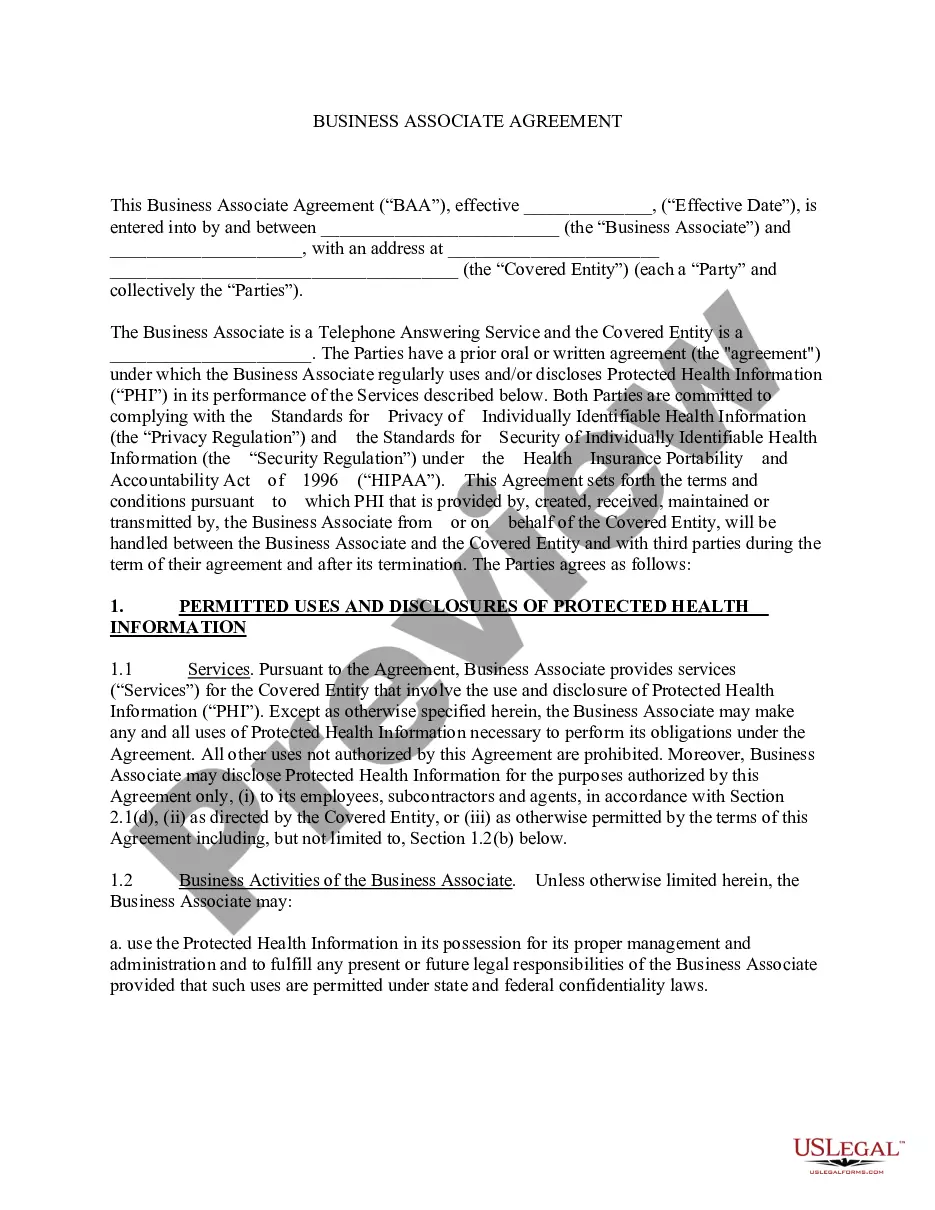

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

On the dissolution of a partnership every partner is entitled, as against the other partners in the firm, and all persons claiming through them in respect of their interests as partners, to have the property of the partnership applied in payment of the debts and liabilities of the firm, and to have the surplus assets

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.