Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

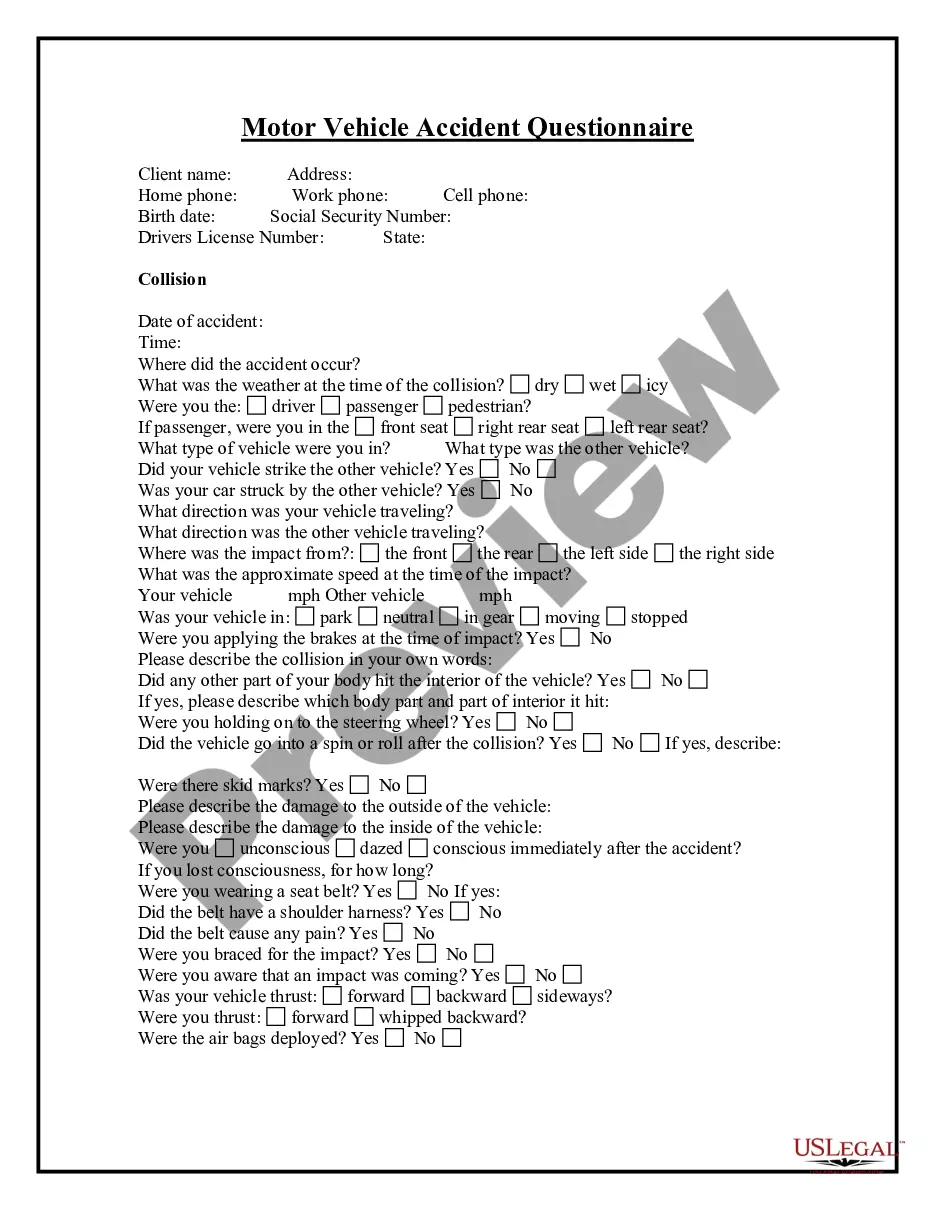

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

If you require extensive, acquire, or print out legal document templates, utilize US Legal Forms, the largest repository of legal forms that can be accessed online.

Employ the website's straightforward and convenient search to locate the documents you seek. Various templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to find the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner and Unequal Distribution of Assets with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Click the My documents section and choose a form to print or download again.

Stay competitive and secure, and print out the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner and Unequal Distribution of Assets with US Legal Forms. There are thousands of professional and state-specific forms you may utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and press the Download button to acquire the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner and Unequal Distribution of Assets.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, take advantage of the Search field at the top of the screen to find alternative variations in the legal form design.

- Step 4. Once you have located the form you want, click on the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, review, and print out or sign the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner and Unequal Distribution of Assets.

Form popularity

FAQ

How to Break Up Your Business Partnership Without Ruining Your FriendshipSpot the signs before it's too late. It's unlikely that the desire to end a business comes overnight.Make a fast, clear and decisive break.Keep the dialogue going.Be reasonable.Call in the experts.

How do you dissolve an Michigan Limited Liability Company? To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.25-Mar-2022

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

While it is legally possible to dissolve a partnership, ordinarily all partners must agree to do so while developing mutually acceptable terms for ending the business. The process of ending a partnership is known as dissolution and winding up.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

Effect of DissolutionA partnership continues after dissolution only for the purpose of winding up its business. The partnership is terminated when the winding up of its business is completed.

To dissolve an LLC in Michigan, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Michigan LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.08-Dec-2021