Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

If you wish to finalize, obtain, or print authorized document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have located the form you need, click the Buy Now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Utilize US Legal Forms to acquire the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to retrieve the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

- You can also access forms you have previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

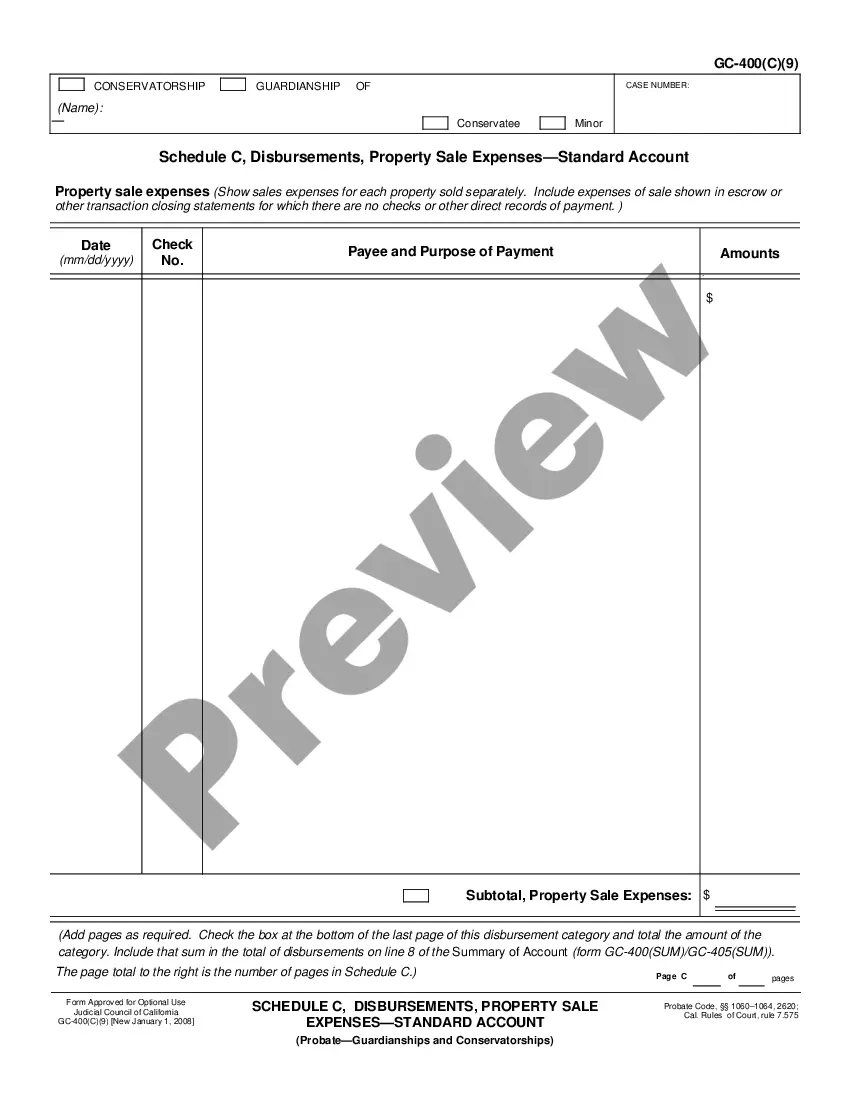

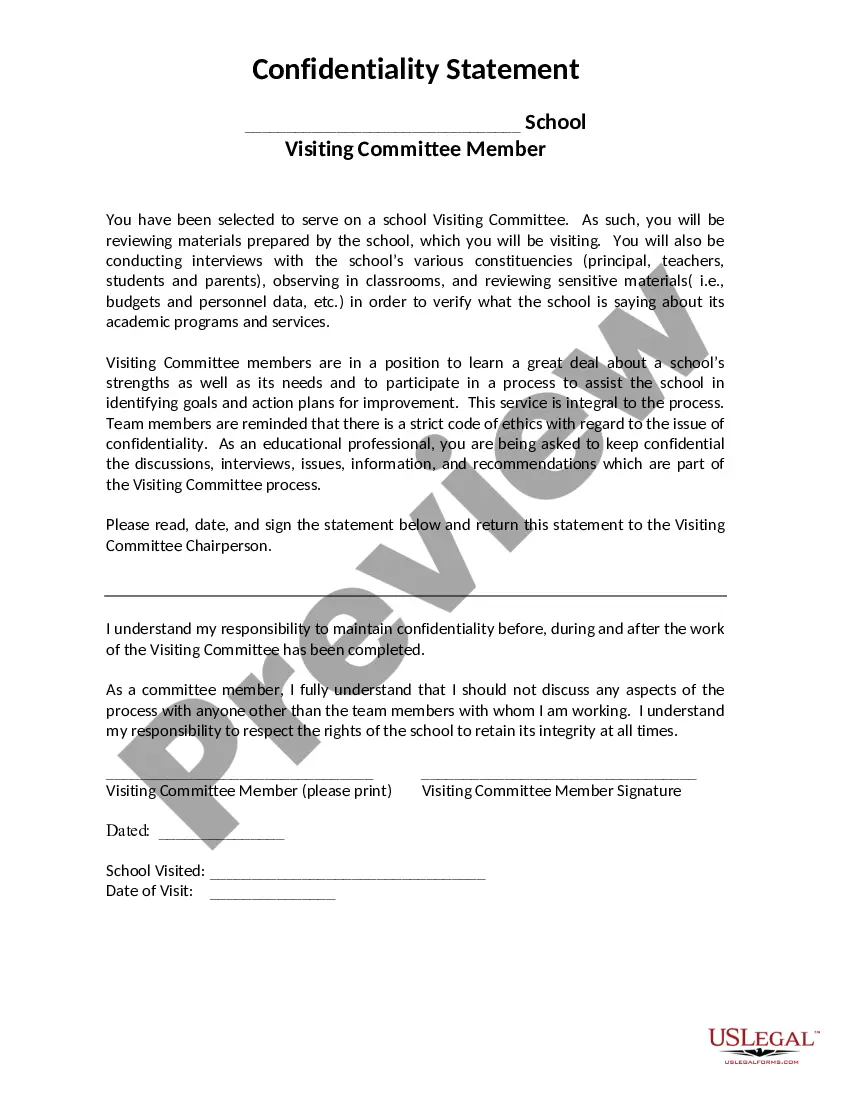

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

Form popularity

FAQ

To dissolve your partnership, start by discussing the decision with your fellow partners to ensure consensus. Then, draft a clear plan, potentially through a Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, to outline the process. Finally, follow through by settling finances and notifying relevant stakeholders to conclude the partnership effectively.

Partnerships can dissolve under various circumstances, including mutual agreement among partners, completion of the partnership's purpose, or a partner deciding to retire. If a partner retires, the remaining partners can consider a Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner to facilitate this transition. Always ensure that legal requirements are met during this process.

Dissolving a partnership in Michigan requires a clear agreement between partners. You must decide on the method of dissolution and document this decision, ideally creating a Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. After completing this agreement, notify any third parties involved, settle finances, and distribute remaining assets.

To dissolve a partnership LLC in Michigan, you need to follow a few steps. First, members should agree on the decision to dissolve the partnership, preferably in writing. Next, file a Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner to formally initiate the dissolution process. Finally, settle any outstanding debts and distribute assets according to the agreement.

When a partnership is dissolved, the business ceases to operate as a partnership. The winding up process begins, which includes resolving debts, settling accounts, and distributing the remaining assets. It’s essential to reference the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner to ensure the process is legally compliant and fair to all partners involved.

The easiest way to dissolve a partnership firm is to have a clear and mutual understanding among partners about the decision. Create and sign the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, which outlines the process and the distribution of assets. Utilizing legal services like uslegalforms can streamline this process, making it straightforward and efficient.

Ending a partnership gracefully requires open communication among partners. Discuss the decision to dissolve, and involve all partners in creating the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. By addressing concerns and ensuring fairness, you can maintain professional relationships even after the partnership concludes.

The winding up process follows the dissolution of a partnership and entails settling the financial obligations of the business. First, gather all assets and settle any debts owed to creditors. Then, the remaining assets can be divided among the partners according to the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, ensuring all terms are met for an orderly transition.

Dissolving a partnership involves several clear steps. First, review your partnership agreement, as it usually outlines the procedure for dissolution. Next, ensure all partners agree on the terms of the dissolution, and then prepare the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner to formalize the process. Finally, settle any outstanding debts and distribute the partnership’s assets according to the agreement.

Yes, you can dissolve a partnership, but you must follow the procedures laid out in the Michigan Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. This ensures that all financial matters are settled and that you maintain a professional relationship with your partners. Proper dissolution allows for a clean break and can prevent misunderstandings or conflicts in the future. You may also consider using platforms like uslegalforms to facilitate this process effectively.