False Income Tax Return — Defendant's Knowledge of Falsity is when a person willfully and knowingly files a false income tax return with the intention of avoiding paying taxes. This is a criminal offense and is prosecuted under the United States Code, Title 26, Subtitle F, Chapter 75. Types of False Income Tax Return — Defendant's Knowledge of Falsity include: knowingly filing a false return with the intent to evade taxes, claiming false deductions or credits, inflating income, underreporting income, and omitting sources of income.

False Income Tax Return - Defendant's Knowledge of Falsity

Description

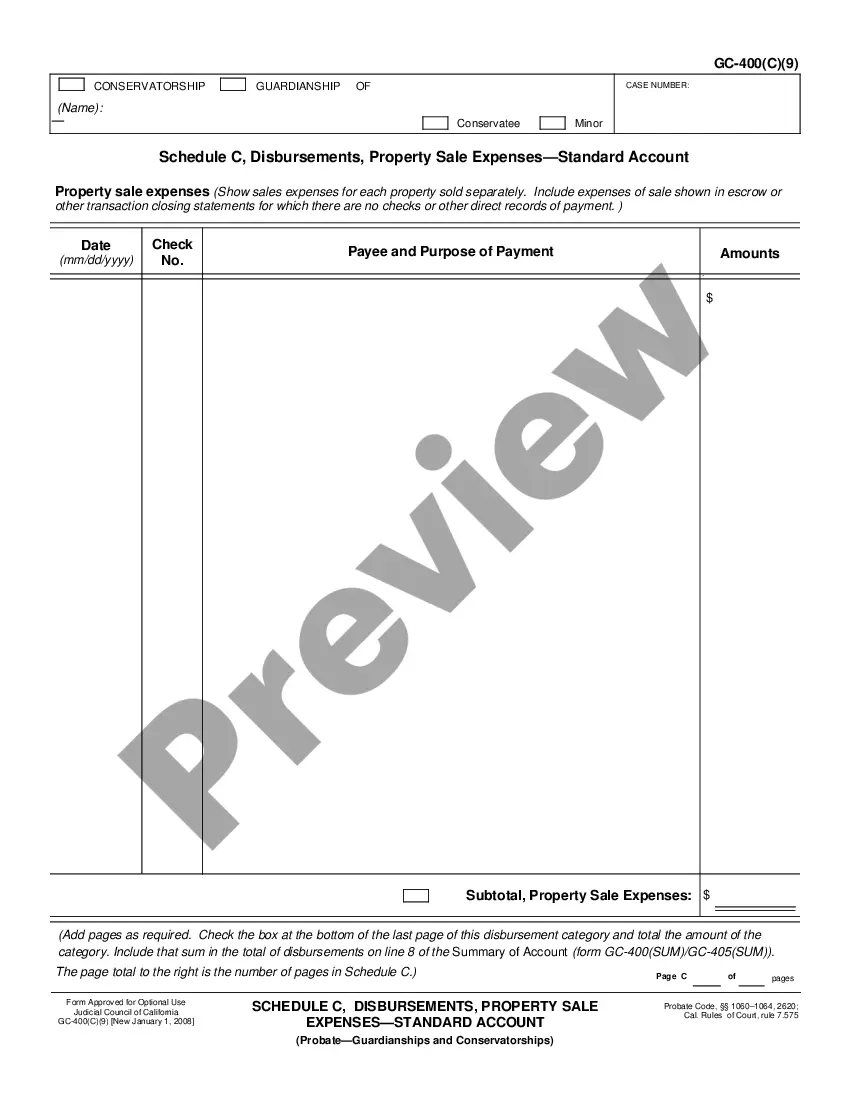

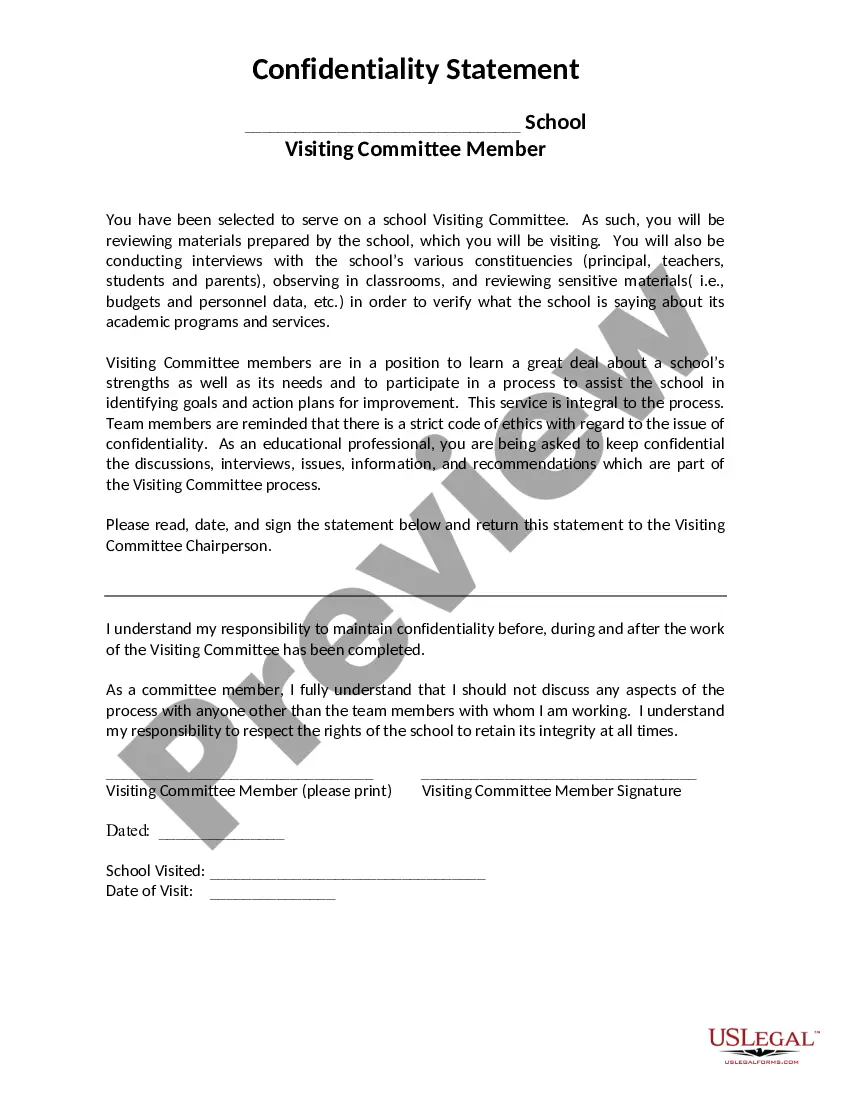

How to fill out False Income Tax Return - Defendant's Knowledge Of Falsity?

Working with legal paperwork requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your False Income Tax Return - Defendant's Knowledge of Falsity template from our service, you can be certain it meets federal and state laws.

Working with our service is easy and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your False Income Tax Return - Defendant's Knowledge of Falsity within minutes:

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the False Income Tax Return - Defendant's Knowledge of Falsity in the format you need. If it’s your first time with our website, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the False Income Tax Return - Defendant's Knowledge of Falsity you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

If you delay in responding promptly and correct errors or provide information, it can lead to: Additional tax; Possible penalties and interest; A different refund amount than expected; or.

In order for the government to achieve a conviction under § 7201, it must prove the following three elements beyond a reasonable doubt: an affirmative act constituting an attempt to evade or defeat a tax or the payment thereof, an additional tax due and owing, and. willfulness.

The IRS Penalizes Tax Preparers Who Make Mistakes. Under Sections 6695 and 6695 (the exact same section is listed twice?) BP1 of the Internal Revenue Code, tax preparers can face IRS penalties for making mistakes on their clients' returns. Similar penalties apply under California state law as well.

If you made a mistake on your tax return, you need to correct it with the IRS. To correct the error, you would need to file an amended return with the IRS. If you fail to correct the mistake, you may be charged penalties and interest. You can file the amended return yourself or have a professional prepare it for you.

No matter who prepares it, the accuracy of a tax return is ultimately the responsibility of the taxpayer.

Tax fraud occurs when an individual or business entity willfully and intentionally falsifies information on a tax return to limit the amount of tax liability.