Michigan Sale of Partnership to Corporation

Description

How to fill out Sale Of Partnership To Corporation?

Are you presently in a situation where you need documents for both business and personal purposes almost every time.

There are numerous legitimate document templates available online, but finding reliable ones isn't simple.

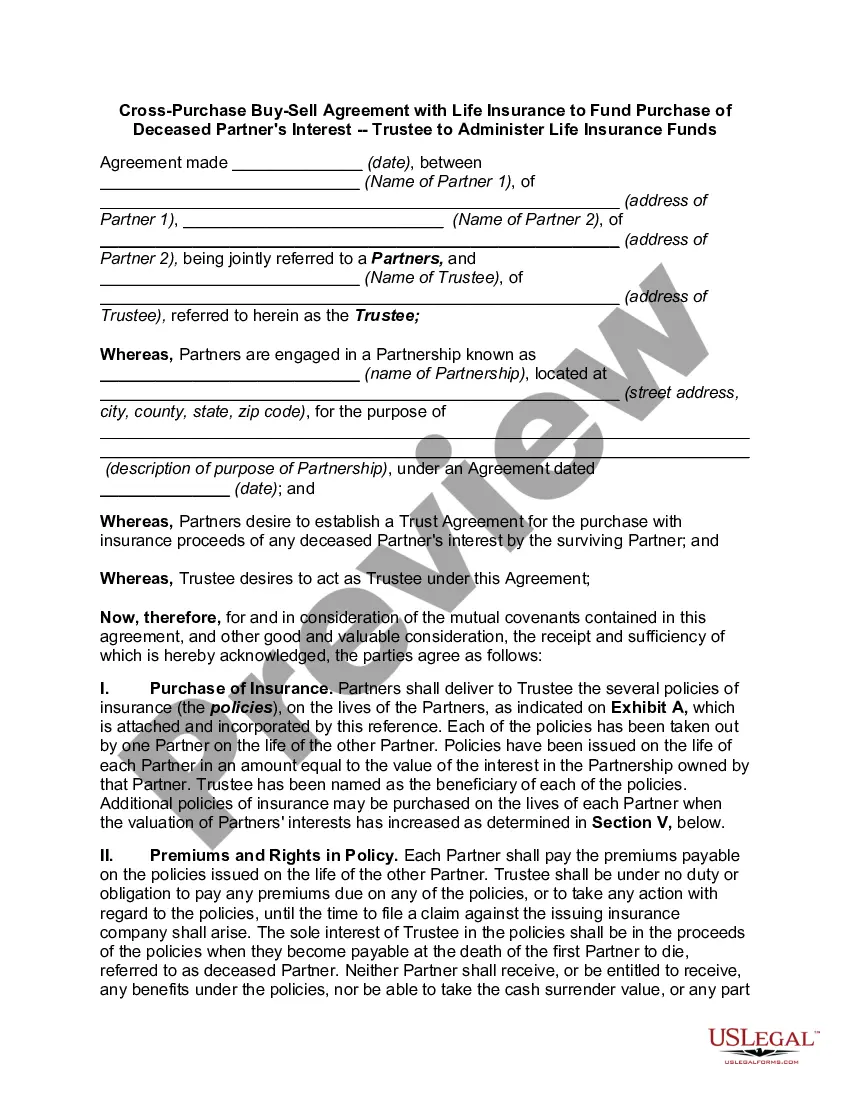

US Legal Forms provides a wide range of form templates, including the Michigan Sale of Partnership to Corporation, crafted to meet federal and state regulations.

Select a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of Michigan Sale of Partnership to Corporation at any time. Simply click the necessary form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess your account, simply Log In.

- Then, you can download the Michigan Sale of Partnership to Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and verify that it is for the correct area/region.

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right form.

- If the form isn't what you are looking for, use the Lookup field to find a form that meets your needs and requirements.

- Once you find the correct form, click Get now.

- Choose the payment plan you need, fill in the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Filing Form 163 in Michigan involves preparing the necessary paperwork to report various financial activities to the state. Ensure you collect all relevant documents and information related to your partnership or corporation. If the Michigan Sale of Partnership to Corporation applies to your case, be attentive to specific instructions related to your situation. Utilize U.S. Legal Forms to simplify the filing process and ensure accuracy.

Receiving correspondence from the Michigan Department of Treasury typically relates to tax matters, such as overdue payments or requests for additional information. If you have recently engaged in a transaction involving the Michigan Sale of Partnership to Corporation, it may trigger additional scrutiny. It is important to review any communication carefully and respond promptly to avoid complications. Consider using our platform for streamlined document preparation and assistance.

You may be exempt from Michigan withholding if you meet certain criteria, such as being a resident of Michigan who expects to owe no tax for the year. Additionally, if you qualify as a nonresident in specific situations, you might also receive exemptions. Understand how the Michigan Sale of Partnership to Corporation process might influence your tax obligations to avoid unexpected withholding. Consulting a tax professional can provide clarity on your specific circumstances.

To legally close your business in Michigan, you must file the appropriate documents with the state. This process may involve notifying creditors, paying off debts, and filing final tax returns. If your business is registered as a partnership, consider consulting legal advice on how the Michigan Sale of Partnership to Corporation impacts your closure. Taking these steps helps ensure a smooth and lawful exit.

Some tax forms in Michigan cannot be electronically filed, often due to their complexity or unique requirements. These may include specific forms for certain transactions or situations that require additional documentation, which is crucial when navigating the Michigan Sale of Partnership to Corporation. To avoid confusion, it is wise to consult the Michigan Department of Treasury or use uslegalforms for clear guidance.

Indeed, Michigan form 807 can be filed electronically. This form is essential for reporting certain tax situations, especially when dealing with specific transactions like the Michigan Sale of Partnership to Corporation. E-filing this form enhances efficiency and ensures secure submission. For straightforward access to the necessary forms, check out uslegalforms.

Yes, filing an amended return electronically in Michigan is possible. This option is particularly useful when you need to correct errors in your original submission, such as issues related to the Michigan Sale of Partnership to Corporation. It streamlines the correction process, allowing you to maintain compliance with state regulations. You can rely on uslegalforms for the right tools and forms to make this easy.

Yes, you can electronically file for a Michigan tax extension. This feature allows you to request more time to submit your taxes without facing immediate penalties. When considering the Michigan Sale of Partnership to Corporation, filing an extension can provide you with the extra time needed to ensure accuracy. Using uslegalforms can help guide you through this process seamlessly.

Yes, Michigan offers e-filing options for various state forms, which simplifies the process of submitting your tax documents. When dealing with the Michigan Sale of Partnership to Corporation, using e-file forms can save time and reduce errors. It's important to ensure that you are using the correct form to reflect your partnership's status. By leveraging the resources available on uslegalforms, you can find the necessary e-file forms quickly.

Nexus in Michigan is typically triggered by physical presence, such as having an office, employees, or significant business activities within the state. Additionally, economic presence can also establish Nexus, particularly for businesses engaging in sales or services to Michigan residents. Understanding Nexus is crucial for the Michigan Sale of Partnership to Corporation, as it affects tax obligations and business registration. If you're navigating these complexities, consider using the US Legal Forms platform for tailored guidance.