Michigan Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor

Description

How to fill out Jury Instruction - 10.10.3 Employee Vs. Self-Employed Independent Contractor?

Have you been within a place in which you need papers for possibly business or personal functions just about every working day? There are tons of lawful papers web templates available online, but finding versions you can rely isn`t simple. US Legal Forms provides a large number of form web templates, just like the Michigan Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor, which are composed to satisfy federal and state specifications.

Should you be currently knowledgeable about US Legal Forms website and get a merchant account, basically log in. Next, it is possible to acquire the Michigan Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor design.

Should you not come with an bank account and need to start using US Legal Forms, follow these steps:

- Find the form you require and ensure it is for your proper area/region.

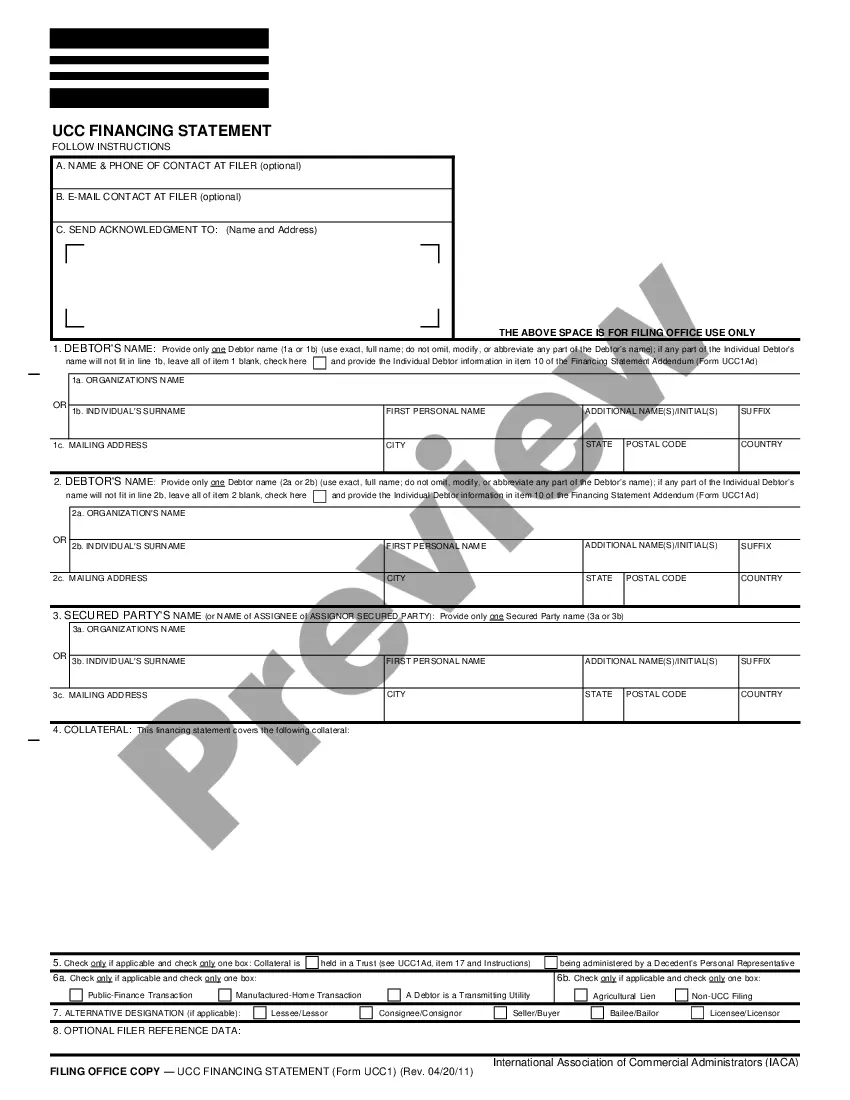

- Make use of the Review key to examine the shape.

- Look at the description to actually have selected the proper form.

- When the form isn`t what you are searching for, take advantage of the Research industry to discover the form that meets your requirements and specifications.

- Whenever you find the proper form, just click Buy now.

- Select the costs strategy you want, fill out the specified details to make your money, and purchase the transaction with your PayPal or credit card.

- Pick a convenient paper format and acquire your copy.

Locate all of the papers web templates you might have bought in the My Forms menu. You may get a more copy of Michigan Jury Instruction - 10.10.3 Employee vs. Self-Employed Independent Contractor any time, if required. Just click on the needed form to acquire or print the papers design.

Use US Legal Forms, probably the most substantial selection of lawful kinds, to save lots of time and steer clear of errors. The assistance provides professionally created lawful papers web templates that can be used for a variety of functions. Generate a merchant account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

As a 1099 contractor, you receive more tax deductions like business mileage, meal deductions, home office expenses, and work phone and internet costs, as well as other business expenses that can lower your taxable income. Therefore, contractors might end up paying fewer taxes than a traditional employee would.

The 1099 form, by contrast, records income you received as an independent contractor or for some other source of income.

House Bill 4390 would define an "independent contractor" as a worker who meets all three of the following criteria: The individual is free from the employer's control and direction in connection with the performance of the work. The individual performs work that is outside the usual course of the employer's business.

2 is a separate form from a 1099, the primary difference being that the W2 is issued to employees on the company payroll, whereas a 1099 is given to independent contractors and other nonpayroll workers.

Regarding taxes and IRS requirements, there are differences between 1099 and W-2 employees. Workers (W-2 employees) typically enjoy amenities like benefits packages, paid time off, and a fixed income. While independent contractors (1099 workers) typically have to fund their own health insurance and retirement expenses.

Employees work for someone else's business, whereas contractors run their own business. Employees are paid hourly or salary, contractors are paid upon the completion of a project. Employees use materials and tools provided by an employer; independent contractors use their own.

If you file taxes with a 1099, you must pay that additional 7.65% in taxes. This comes to a total of 15.3% in payroll taxes. Of that total payroll tax, the IRS allows you to deduct between 50% and 57% from your taxable income.