This Acceptance of Appointment is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Acceptance of Appointment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Acceptance Of Appointment?

Obtain any version from 85,000 legal records like Michigan Acceptance of Appointment online with US Legal Forms. Every template is prepared and refreshed by state-licensed attorneys.

If you already possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow these instructions.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable sample. The service offers access to documents and categorizes them to ease your search. Utilize US Legal Forms to obtain your Michigan Acceptance of Appointment swiftly and effortlessly.

- Verify the state-specific prerequisites for the Michigan Acceptance of Appointment you require.

- Examine the description and preview the template.

- When you’re certain the sample meets your needs, click on Buy Now.

- Choose a subscription plan that aligns with your budget.

- Establish a personal account.

- Make a payment using one of two convenient methods: by card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is downloaded, print it or save it to your device.

Form popularity

FAQ

The power of appointment in Michigan allows a person to designate who will receive benefits from their estate or assets after their death. This legal mechanism plays a crucial role in estate planning, as it enables individuals to have control over the distribution of their property. By utilizing Michigan Acceptance of Appointment, you can ensure that your desires are honored and effectively communicated in your legal documents.

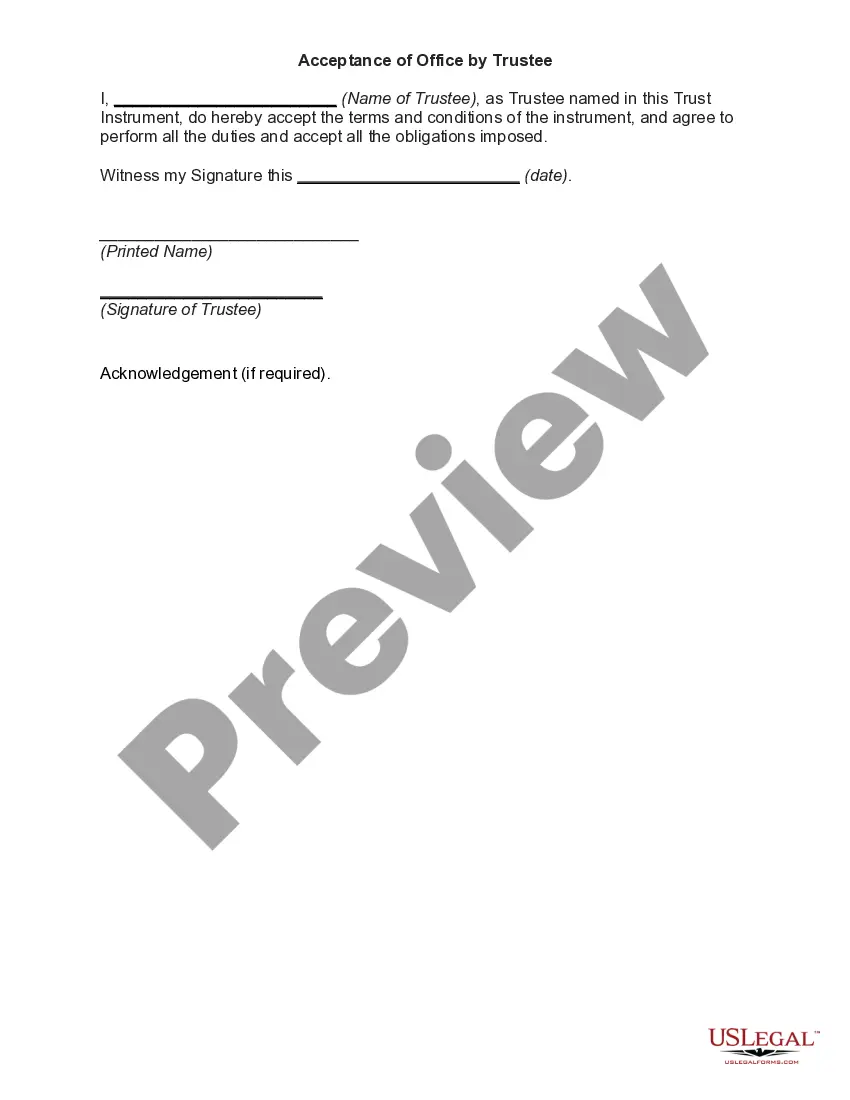

The acceptance of an appointment refers to the formal agreement by an individual to serve in a designated position or role, such as a trustee or attorney-in-fact. In terms of Michigan Acceptance of Appointment, this process ensures that the appointed person acknowledges their responsibilities and consents to perform them. Understanding this concept is vital for individuals setting up legal arrangements or ensuring that their decisions are properly executed.

In Michigan, you do not need an appointment to visit the Secretary of State. However, it is advisable to check specific services or documents you require, as some processes may evolve. Familiarizing yourself with the Michigan Acceptance of Appointment can help streamline your visit, particularly if you need to manage estate-related documents. USLegalForms offers tools that can simplify this process for you.

Acceptance of appointment as a personal representative is a formal process that confirms your role in managing a deceased person's estate. This appointment allows you to settle debts, distribute assets, and handle legal matters on behalf of the deceased. Understanding the Michigan Acceptance of Appointment is crucial for fulfilling your responsibilities effectively. Utilizing resources from USLegalForms can guide you through the necessary paperwork.

Renunciation of the right to appointment refers to the act of formally declining a position or role that one is entitled to accept, particularly in the context of the Michigan Acceptance of Appointment. This legal action allows the individual to withdraw from the responsibilities associated with being appointed, ensuring that the decision is officially recorded. When someone renounces their right, it may open the door for another to assume the appointment, aiding in the seamless transition of duties. Utilizing resources like U.S. Legal Forms can provide the necessary documentation to facilitate this process efficiently.

In the State of Michigan, probate is necessary when someone passes away while owning property or assets that are listed under their name alone. If the deceased individual has joint ownership over certain property, it's possible the assets may be transferred to the other owner with little to no court involvement.

In Michigan, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

No probate at all is necessary if the estate is worth less than $15,000 and doesn't contain any real estate. Instead, inheritors can use a simple affidavit (sworn statement) to claim assets held by a bank or other institution.

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim.

Executors have also traditionally set fees as a percentage of the overall estate value. So for example, a $600K estate which required 850 hours of work might generate $22K in executor fees (see calculator below). The executor may pay himself or herself this compensation as earned, without prior court approval.