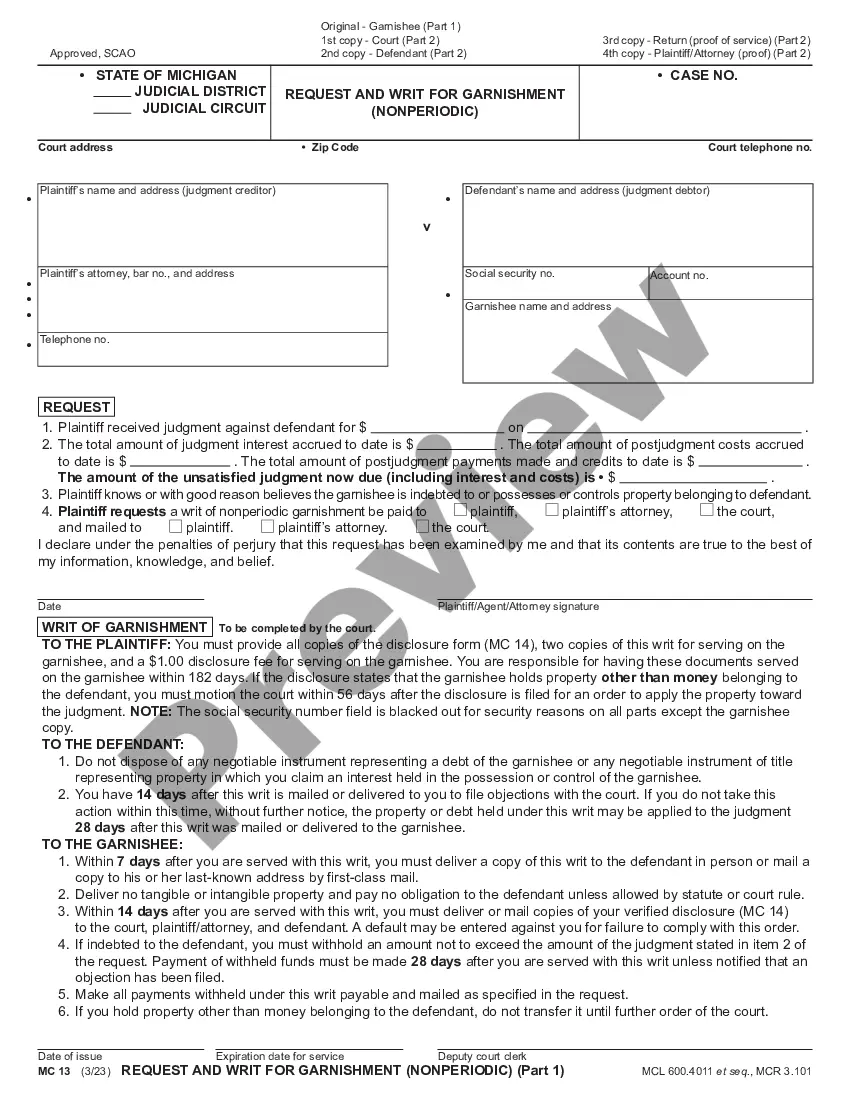

This Request and Writ for Garnishment - Periodic is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Request And Writ For Garnishment (Periodic)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Request And Writ For Garnishment (Periodic)?

Obtain any template from 85,000 legal documents such as Michigan Request and Writ for Garnishment - Periodic online with US Legal Forms. Each template is crafted and updated by state-certified lawyers.

If you already have a membership, Log In. When you are on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you have not yet subscribed, follow the instructions below.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The service provides you with access to forms and categorizes them to streamline your search. Utilize US Legal Forms to obtain your Michigan Request and Writ for Garnishment - Periodic efficiently and swiftly.

- Review the state-specific criteria for the Michigan Request and Writ for Garnishment - Periodic you intend to use.

- Browse the description and preview the sample.

- Once you are assured the sample meets your needs, click on Buy Now.

- Select a subscription plan that fits your budget.

- Establish a personal account.

- Make a payment in one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- Once your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

A periodic writ of garnishment in Michigan is a legal order that allows a creditor to collect a debt by directing an employer or financial institution to withhold a portion of a debtor's income or funds. This process helps ensure that creditors receive payment regularly without the need for additional court action. When you file a Michigan Request And Writ For Garnishment (Periodic), you set up a systematic method for recovering debts over time. Utilizing resources like US Legal Forms can simplify the completion and submission of required documents, ensuring you comply with Michigan's legal standards.

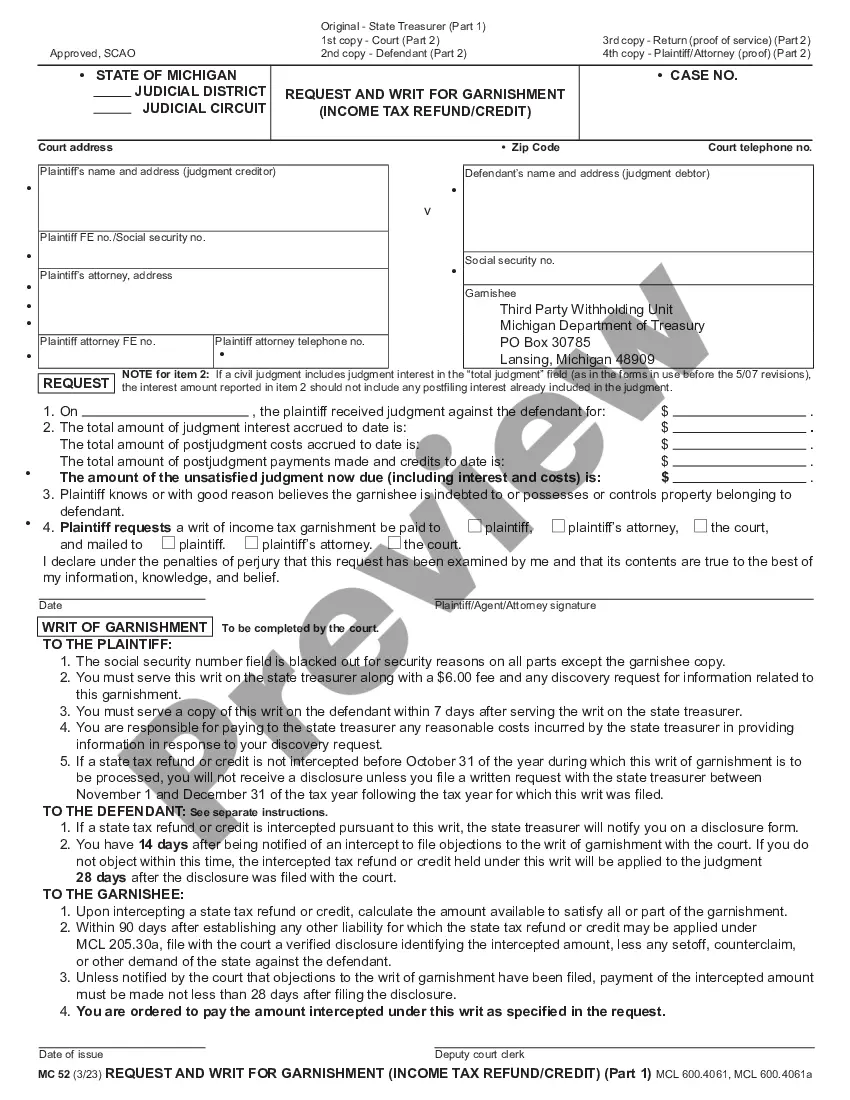

periodic writ of garnishment in Michigan permits creditors to seize funds from a debtor's bank account or other assets rather than ongoing income. This type of garnishment can provide a quicker resolution to debt recovery but may catch debtors off guard. Understanding both types of garnishments is essential, which is why utilizing resources like a Michigan Request And Writ For Garnishment (Periodic) can support you in navigating these legal avenues effectively.

A writ of periodic garnishment in Michigan allows creditors to collect debts directly from the debtor's recurring income, such as wages or benefits. This legal document ensures that creditors receive timely payments over a set period, enhancing the chances of recovering the owed amount. Filing a Michigan Request And Writ For Garnishment (Periodic) is crucial, as it initiates this process and helps you understand your rights.

To apply for garnishment hardship in Michigan, start by gathering necessary financial documents that demonstrate your current financial situation. You will need to file a Michigan Request And Writ For Garnishment (Periodic) with the court. Additionally, using a platform like USLegalForms can simplify this process, providing you with the required forms and guidance to ensure your application is complete.

A writ of non-periodic garnishment is in effect for 182 days. This means the non-periodic garnishment expires on the 183rd day after the court issued it. After that you must request another writ of garnishment to keep collecting this way. It can only be used once; it expires when it is used.

What Can You Do When Your Account is Garnished? To lift the garnishment, you can try to contact the collection agency to negotiate alternative payment options. You may be able to lower interest payments, reduce the amount you owe, or make partial payments for a certain amount of time.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

The Final Statement on Garnishment is a form that your employer completed upon making a final payment on your garnishment. So, yes, your employer should not continue withholding money from your check for this garnishment.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

A non-periodic writ of garnishment, referred to in the Michigan court system as MC 13, is used to collect money held by a debtor in a bank account. Additionally, a non-periodic writ of garnishment can be used to collect or levy other property to satisfy outstanding debt.