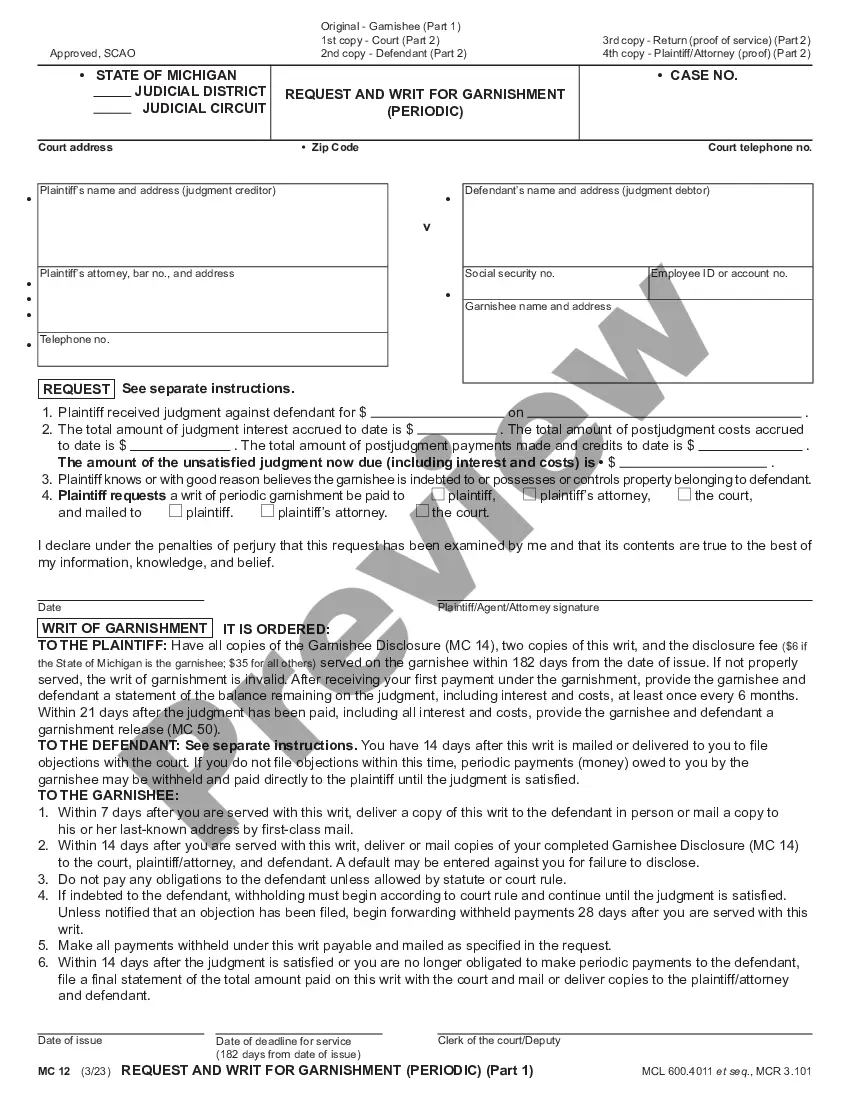

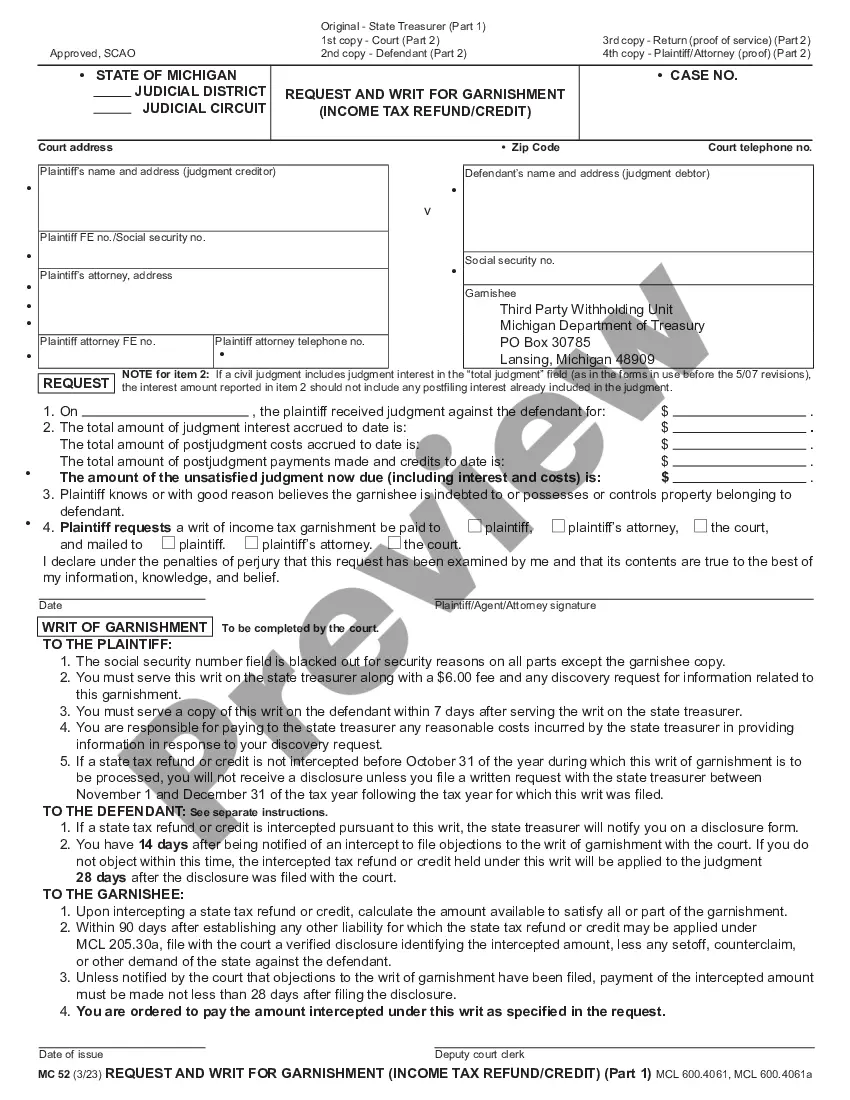

This Request and Writ for Garnishment - Non-Periodic is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Request And Writ For Garnishment (Non Periodic)

Description

How to fill out Michigan Request And Writ For Garnishment (Non Periodic)?

Obtain any type from 85,000 lawful documents such as Michigan Request and Writ for Garnishment - Nonperiodic online with US Legal Forms. Each template is crafted and revised by state-certified attorneys.

If you possess a subscription, Log In. When you arrive at the form’s page, click the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the instructions below.

With US Legal Forms, you will consistently have swift access to the correct downloadable template. The service will provide you access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Michigan Request and Writ for Garnishment - Nonperiodic swiftly and effortlessly.

- Verify the state-specific criteria for the Michigan Request and Writ for Garnishment - Nonperiodic you wish to utilize.

- Review the description and view the sample.

- When you’re confident the sample meets your needs, click Buy Now.

- Select a subscription plan that aligns with your finances.

- Establish a personal account.

- Make a payment using one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the file in; two formats are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

To file a motion to stop wage garnishment in Michigan, you first need to prepare the appropriate forms, which include the Michigan Request And Writ For Garnishment (Non Periodic). Next, gather any supporting documents that demonstrate your case for stopping the garnishment. Once you have completed the forms and collected your documents, file them with the court that issued the original garnishment order. You may also want to consider using a service like USLegalForms to help streamline the process and ensure that you have everything you need for a successful motion.

The key difference between periodic and non-periodic garnishment lies in the timing and method of payment recovery. Periodic garnishment involves regular deductions from a debtor’s income, such as a paycheck, while non-periodic garnishment allows for a one-time seizure of funds, typically from bank accounts. Understanding this distinction is essential when deciding which method to use for debt collection. Choosing the right approach, such as the Michigan Request And Writ For Garnishment (Non Periodic), ensures more effective resolution of your financial claims.

periodic writ of garnishment in Michigan is designed to seize a specific amount from the debtor's account or assets, rather than from wages over time. This approach is typically used for onetime debt collection, such as from bank accounts or other financial assets. Utilizing the Michigan Request And Writ For Garnishment (Non Periodic) can help you effectively access funds that your debtor may have without requiring ongoing deductions from their paycheck. It provides a straightforward solution for quick debt recovery.

A periodic writ of garnishment in Michigan is a legal mechanism that allows creditors to collect debts over time from a debtor’s income or funds. This type of writ targets regular payments like wages or salaries. It simply means the creditor can receive a set amount from the debtor's paycheck at certain intervals. For those interested in understanding how the Michigan Request And Writ For Garnishment (Non Periodic) differs, this writ focuses more on one-time collections rather than regular payments.

To apply for garnishment hardship in Michigan, you must demonstrate to the court that the garnishment significantly affects your ability to meet basic living expenses. This often requires filing a request that includes financial documentation and a statement outlining your situation. If you are facing this challenge, a Michigan Request And Writ For Garnishment (Non Periodic) could provide clarity on your options. Additionally, platforms like UsLegalForms offer resources to help you understand the process and complete necessary forms efficiently.

Non-periodic garnishment refers to a legal action that allows a creditor to obtain a one-time payment from a debtor's assets or income without the regular, ongoing deductions seen in periodic garnishments. In the context of a Michigan Request And Writ For Garnishment (Non Periodic), this type of garnishment targets specific amounts owed rather than a consistent portion of wages. Understanding this distinction helps you better navigate your financial obligations and rights. For those in Michigan, seeking guidance on this process can simplify the steps involved.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off. Non-Periodic Garnishment: This is used to remove money from your bank account or other property.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

The writ gives the Sheriff the authority to seize property of the judgment debtor and is valid for 180 days after its issuance. You must give the Sheriff signed, written instructions to levy on (seize) and sell, if necessary, specific property belonging to the debtor to satisfy your judgment.