Michigan Amendment to Living Trust

Overview of this form

The Amendment to Living Trust is a legal document used to modify certain provisions of an existing living trust. A living trust, established during an individual's lifetime, holds that person's assets for purposes of estate planning. This amendment allows the Trustor to make specific changes without altering the overall purpose of the trust. Importantly, all other sections of the trust remain unchanged unless specified in the amendment.

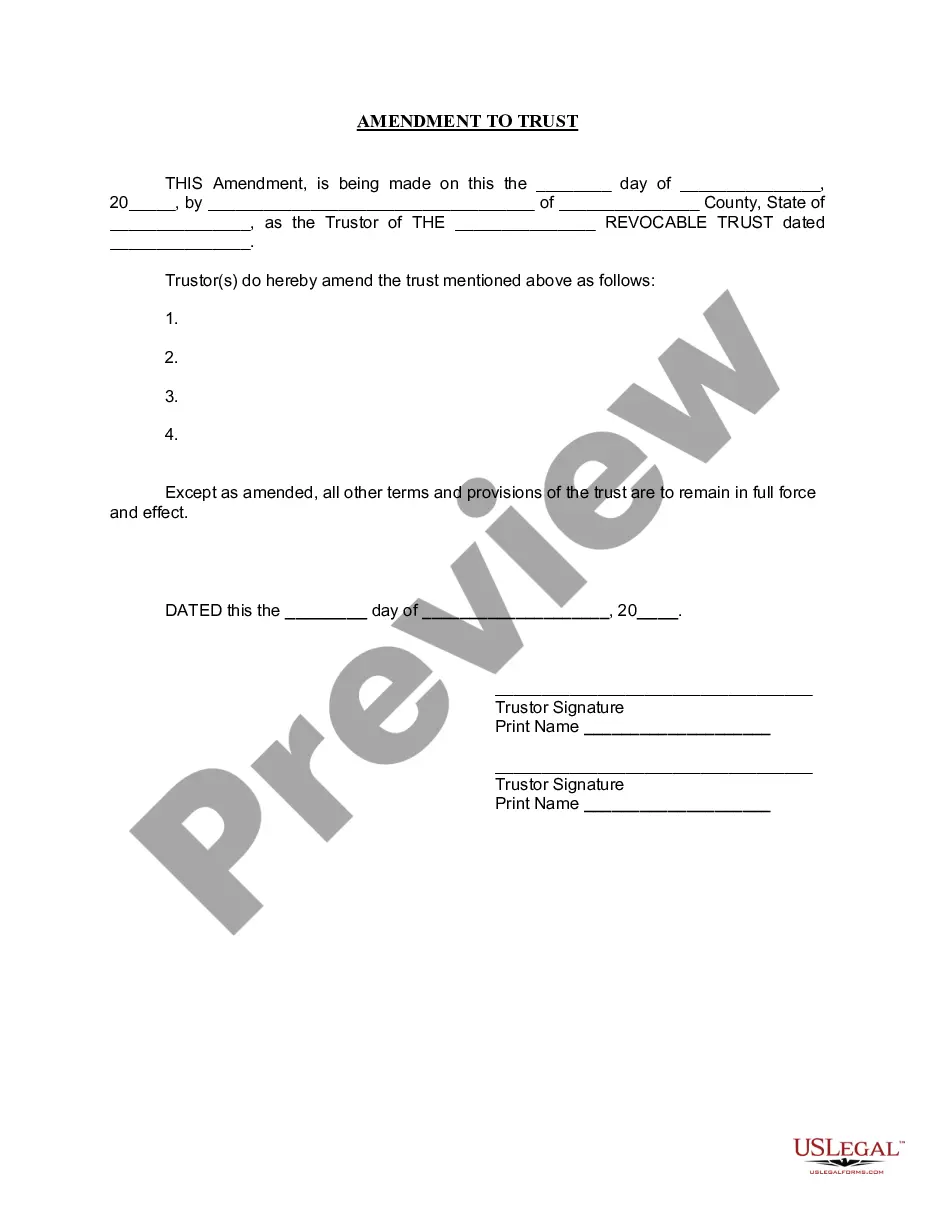

What’s included in this form

- Date of the amendment.

- Name and address of the Trustor.

- Identification of the existing revocable trust, including its creation date.

- Specific modifications being made to the trust.

- Signature lines for the Trustor(s).

- Notary acknowledgment section.

When to use this form

This form is necessary when the Trustor wants to change specific aspects of their living trust, such as adding or removing beneficiaries, adjusting asset distributions, or modifying other key provisions. It is beneficial during life changes like marriage, divorce, or birth of a child, occasions that might prompt the Trustor to update their estate planning documents.

Who should use this form

- Individuals who have an existing living trust and wish to amend it.

- Trustors looking to modify the terms or beneficiaries of their trust.

- Anyone involved in estate planning who needs to address changes in circumstances or intentions.

How to complete this form

- Identify the date of the amendment at the top of the form.

- Fill in the name and county of the Trustor.

- Specify the name of the existing revocable trust and its creation date.

- Clearly describe the amendments being made to the trust.

- Sign the document in the designated areas for the Trustor(s).

- Have the form notarized to ensure it is legally valid.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to clearly specify the changes made to the trust.

- Not having the form notarized, if required.

- Omitting signatures or failing to date the document properly.

Why use this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability to customize the form according to specific needs.

- Access to reliable legal templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Yes, a living trust in Michigan generally avoids probate, allowing for a seamless transfer of assets upon your passing. This means your beneficiaries can access trust assets without the delays and costs typically associated with probate. By utilizing a Michigan Amendment to Living Trust, you can manage and streamline your estate effectively, ensuring your wishes are honored quickly.

Making an amendment to a living trust involves drafting a clear document that specifies the changes you wish to implement. The Michigan Amendment to Living Trust should be signed and dated, ideally in the presence of a notary. It’s critical to retain the original trust document alongside the amendment to ensure clarity and legal compliance.

In Michigan, a codicil needs to be signed by the testator and two witnesses, but it does not need to be notarized to be valid. However, if you choose to notarize your codicil, it may provide an extra layer of authenticity. This is distinct from the process for a Michigan Amendment to Living Trust, where notarization typically adds value.

To execute a Michigan Amendment to Living Trust, you must create a written document detailing the changes you intend to make. It should clearly state which sections of the original trust are being amended. Once you complete the document, sign it in front of a notary to validate the changes and retain a copy for your records.

A codicil is a document that alters an existing will, while an amendment to a trust specifically changes the terms of a living trust. When considering a Michigan Amendment to Living Trust, you directly modify the trust’s provisions. This customization ensures the trust aligns with your current wishes, unlike a codicil, which is limited to wills.

To obtain a trust amendment form for your Michigan Amendment to Living Trust, you can use online resources such as US Legal Forms. This platform offers a variety of customizable legal forms, including trust amendments, that adhere to Michigan laws. Simply access the site, search for the trust amendment form, and follow the instructions to download or complete it. This process simplifies your efforts to amend your trust effectively.

Yes, you can write your own amendment to your Michigan Amendment to Living Trust. However, it is important to follow the legal requirements to ensure the amendment is valid. You should clearly identify the specific provisions you want to change or add. After drafting your amendment, consider consulting a legal professional to review it and ensure it aligns with your original trust document.