Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Michigan Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

Obtain any format from 85,000 legal documents such as Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children online with US Legal Forms.

Every template is crafted and revised by state-authorized legal experts.

If you have an active subscription, Log In.

After your reusable form is downloaded, print it or save it to your device. With US Legal Forms, you will always have prompt access to the correct downloadable template. The service provides you with access to forms and organizes them into categories to simplify your search. Use US Legal Forms to acquire your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children quickly and easily.

- When you are on the form’s page, click on the Download button and navigate to My documents to retrieve it.

- If you haven’t subscribed yet, follow the guidelines below.

- Check the state-specific criteria for the Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children you intend to utilize.

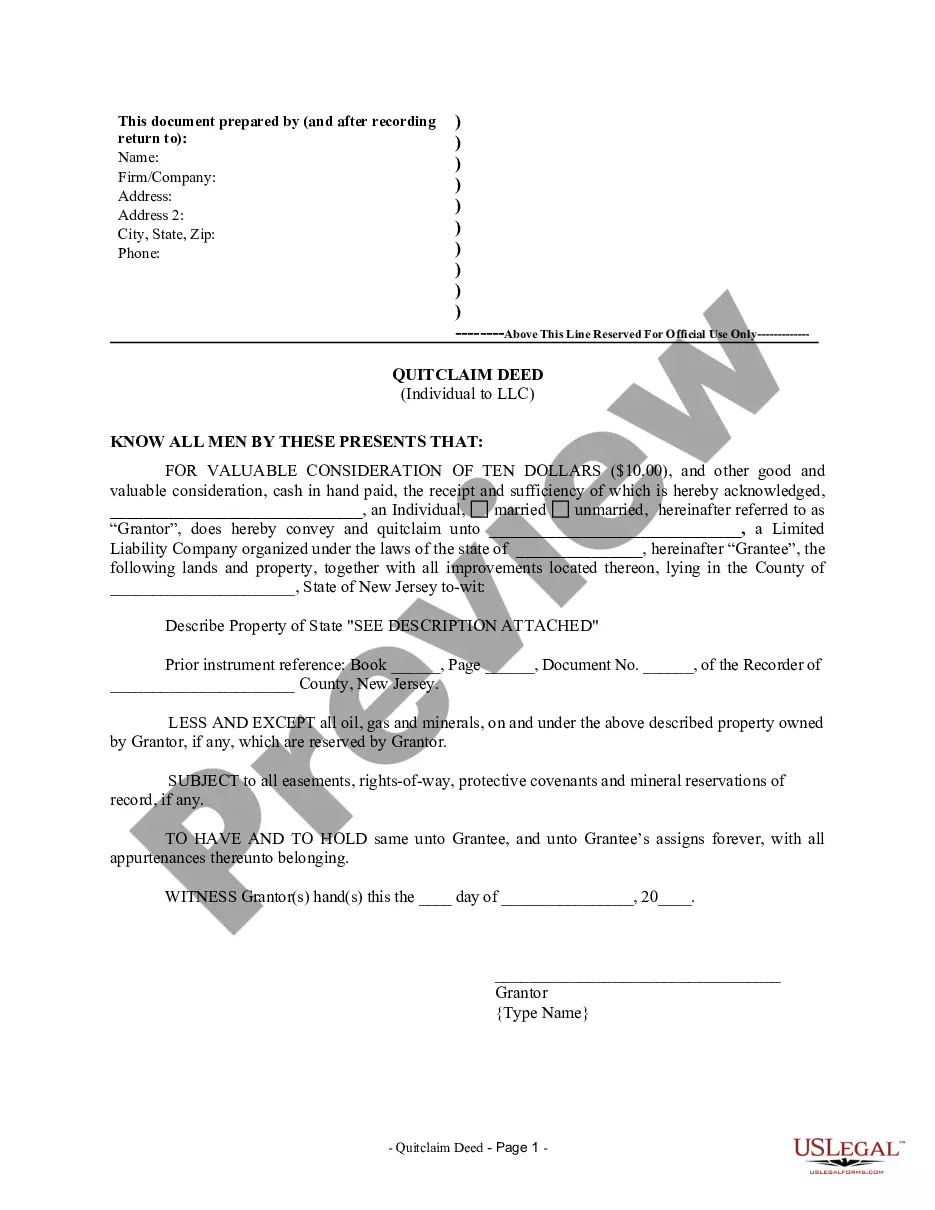

- Review the description and view the example.

- Once you are sure that the sample meets your needs, click on Buy Now.

- Select a subscription plan that fits your budget.

- Create a personal account.

- Complete the payment in one of two suitable methods: by card or via PayPal.

- Choose a format to download the file in; two alternatives are available (PDF or Word).

- Retrieve the document to the My documents tab.

Form popularity

FAQ

If you get divorced, a Michigan Living Trust for Individuals Who are Single, Divorced, or Widowed with Children may need adjustment. Typically, divorce proceedings can impact the trust, as assets within the trust might be subject to division. It’s crucial to revise the trust to reflect your new marital status and ensure that your children remain the intended beneficiaries. Consulting a legal professional can help you navigate these changes effectively.

No, a trust does not need to be filed with the court in Michigan. This includes your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children. Instead, you maintain it privately, which allows for more control and privacy over your estate plans. However, once you pass away, it may need to be provided to a probate court to clarify your intentions regarding asset distribution.

While you don't need to file a living trust with the court in Michigan, you must ensure that the trust document is legally valid. Create your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children by following proper drafting and signing procedures. It's wise to have your trust witnessed and notarized, providing an added layer of legitimacy. Use resources like US Legal Forms for assistance with proper documentation.

The 2-year rule typically refers to how long a trust must be established before certain actions can be taken. In Michigan, if a trust is created and subsequently modified, the 2-year period often applies to asset transfers to prevent issues related to fraudulent transfers. Understanding this rule can help maintain the integrity of your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children. Consulting with legal experts can clarify how this rule affects your situation.

Absolutely, you can create a living trust in Michigan without your spouse. A Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children allows you to control how your assets will be managed and distributed. This is especially beneficial if you want to establish a clear plan for your children. Choose a trustee you trust to manage the trust according to your wishes.

Yes, you can create your own Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children. However, it's important to ensure that you follow Michigan laws properly to avoid issues later. DIY options can work well, but many people prefer professional assistance to ensure all legal bases are covered. Platforms like US Legal Forms can provide templates and guidance to help you successfully navigate this process.

If you have a trust and get divorced, the trust remains in effect unless you decide to change it. You should review and possibly modify your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children to reflect your current situation and intentions regarding asset distribution. Using services like US Legal Forms can help streamline the revision process.

In Michigan, divorce does not automatically revoke a trust. However, it can affect the terms of the trust, especially if your spouse is a beneficiary. To ensure your wishes are upheld, revisit your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children and make any necessary adjustments after a divorce.

Yes, you can establish a living trust without your spouse. If you are single, divorced, or a widow (or widower) with children, you can create a Michigan Living Trust that reflects your specific wishes regarding your assets. This is particularly useful for ensuring your children's inheritance is managed according to your desires.

Yes, you can write your own trust in Michigan. However, it's important to ensure that your document meets all legal requirements to avoid issues later. A Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children can be complex, so consider using resources like US Legal Forms to guide you through the process.