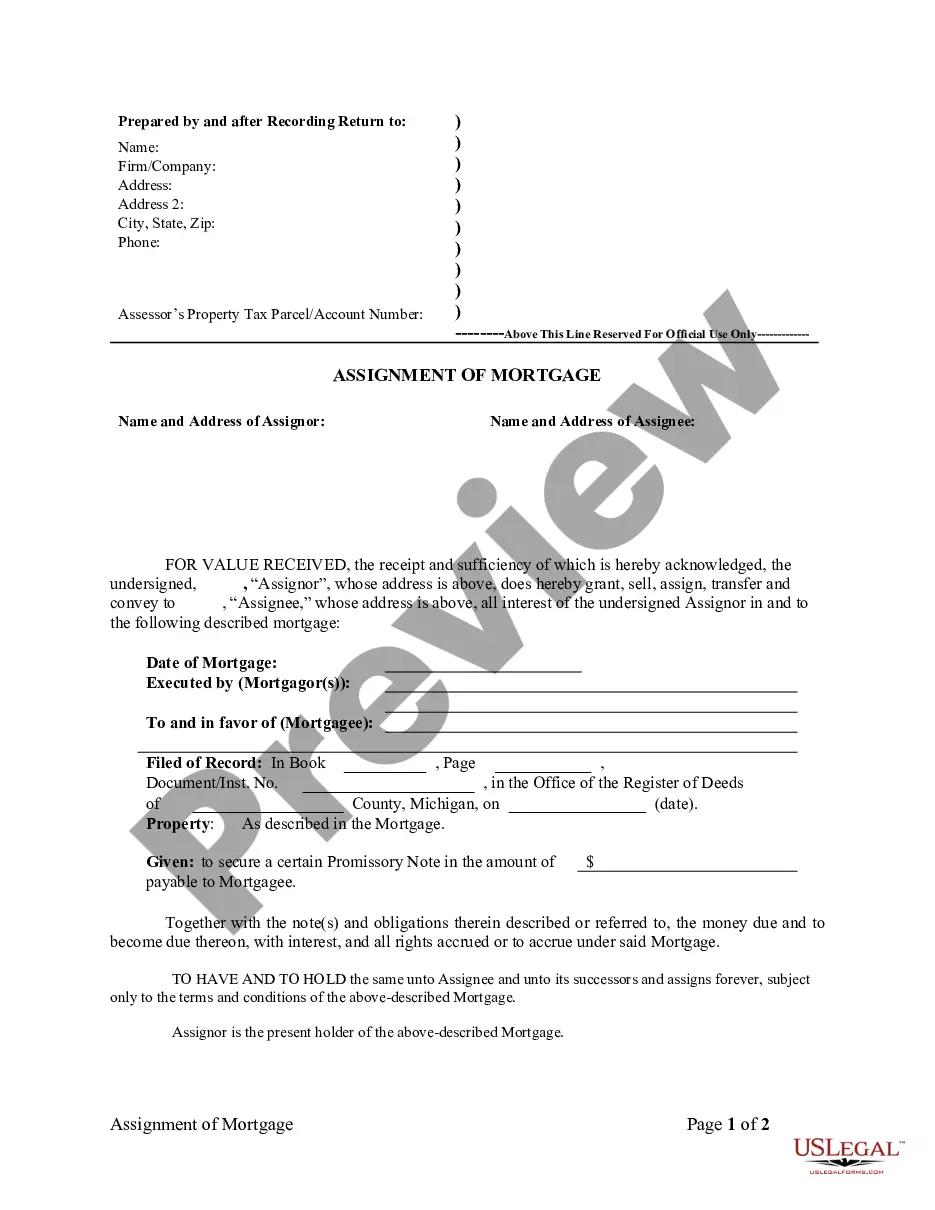

Michigan Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Michigan Assignment Of Mortgage By Individual Mortgage Holder?

Obtain any version from 85,000 legal documents including Michigan Assignment of Mortgage by Individual Mortgage Holder online through US Legal Forms. Each template is crafted and revised by state-certified attorneys.

If you already possess a subscription, Log In. When you reach the form’s page, press the Download button and navigate to My documents to retrieve it.

If you have not yet subscribed, adhere to the steps outlined below.

With US Legal Forms, you will consistently have prompt access to the suitable downloadable template. The platform grants you access to documents and organizes them into categories to ease your search. Utilize US Legal Forms to acquire your Michigan Assignment of Mortgage by Individual Mortgage Holder efficiently and swiftly.

- Verify the state-specific criteria for the Michigan Assignment of Mortgage by Individual Mortgage Holder you wish to utilize.

- Examine the description and preview the template.

- When you are assured that the template meets your requirements, simply click Buy Now.

- Select a subscription plan that fits your financial plan.

- Establish a personal account.

- Make the payment using one of two suitable methods: by credit card or through PayPal.

- Choose a format for downloading the document; two options are available (PDF or Word).

- Download the document to the My documents tab.

- After your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Execute the mortgage documents. Affidavit to be sworn by two witnesses in the deed. Visit the notary public who will get the document notarized. Pay for the stamp duty. Pay for the registration in the Registrar of Deeds office. Obtain the title for the mortgage.

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

While you have a mortgage, the lender has rights to the property title until the loan is paid. If you buy a home without a mortgage, the real estate attorney or title company records the deed and issues a copy to you.

You will need to sign a promissory note and a mortgage or trust deed.The document should be signed and dated by the borrower, and you will need to file or record the document at the local recorder of deeds office or other office responsible for the filing of real estate documents.