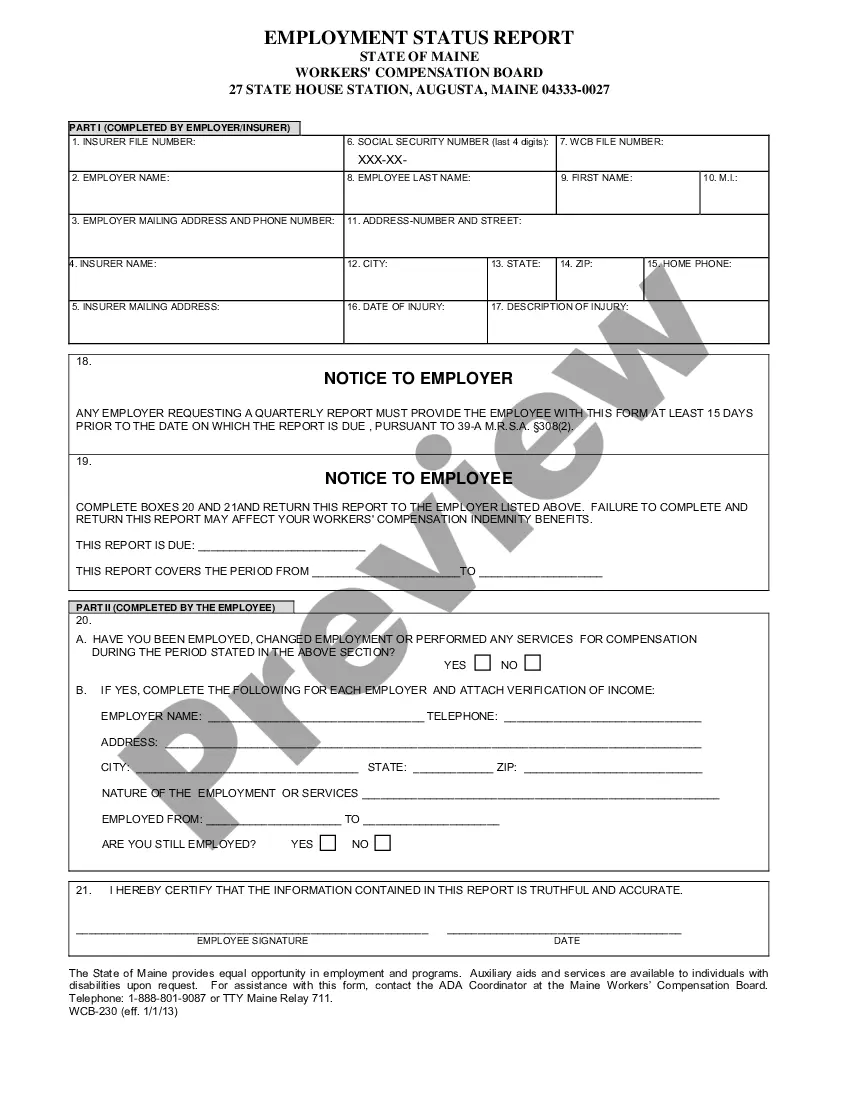

This is one of the official Workers' Compensation forms for the state of Maine.

Maine Independent Status Application for Workers' Compensation

Description

How to fill out Maine Independent Status Application For Workers' Compensation?

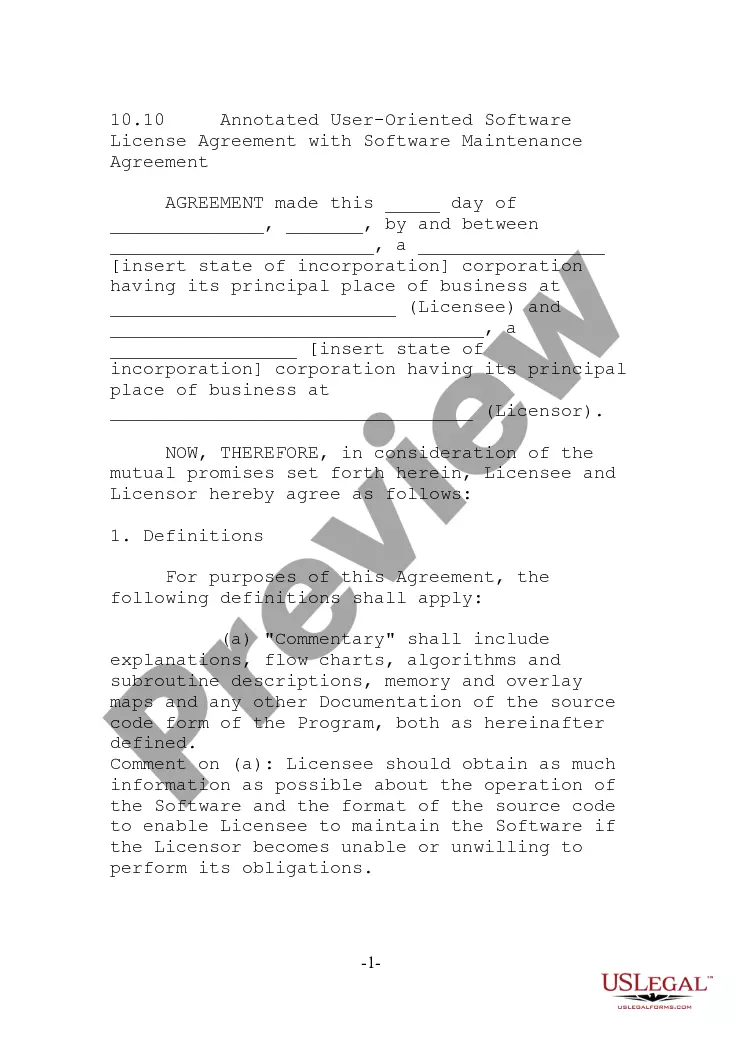

Obtain any template from 85,000 legal documents, including the Maine Independent Status Application for Workers' Compensation, online with US Legal Forms. Each template is crafted and updated by state-certified legal professionals.

If you already have a subscription, sign in. When you are on the form’s page, press the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the steps outlined below.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable sample. The platform provides access to forms and categorizes them to enhance your search experience. Utilize US Legal Forms to acquire your Maine Independent Status Application for Workers' Compensation quickly and effortlessly.

- Verify the state-specific criteria for the Maine Independent Status Application for Workers' Compensation you wish to utilize.

- Review the description and preview the template.

- Once you’re sure the template meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your financial needs.

- Establish a personal account.

- Complete the payment using one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two choices are available (PDF or Word).

- Download the document to the My documents section.

- When your reusable form is downloaded, print it or save it to your device.

Form popularity

FAQ

Independent contractors are not eligible for workers' compensation coverage; employers are not required by state law to purchase coverage for independent contractors. However, some employers misclassify employees as independent contractors to avoid paying payroll taxes and workers' comp premiums for them.

No. Independent contractors do not receive workers' compensation benefits. The workers' compensation system only applies to employees.

No. Independent contractors do not receive workers' compensation benefits. The workers' compensation system only applies to employees. The difference is important if you are injured doing work for an employer.

In most states, consulting firms must provide workers' compensation insurance as soon as they hire their first employee. Without this policy, you can face heavy fines and even jail time.

If an independent contractor can show that his employer's negligence caused his injuries, he would be entitled to the same compensation as an employee working for the non-subscriber employer. This includes damages for his medical bills, lost wages, and pain and suffering.

Do Contractors Need Workers Compensation For Their Employees? As a general rule, the answer is yes-for an independent contractor, workers compensation insurance is required when hiring employees.

In the state of California, workers' compensation insurance is optional for most self-employed workers. If you are a roofer or a self-employed individual in other highly hazardous fields, you may need to obtain a workers' compensation policy for your own injuries.

In Maine, nearly every employer is required to have workers compensation insurance. Workers' compensation coverage helps provide benefits to your employees if they become injured or ill on the job. This coverage also limits the amount of liability you could face if an injury or illness happens.