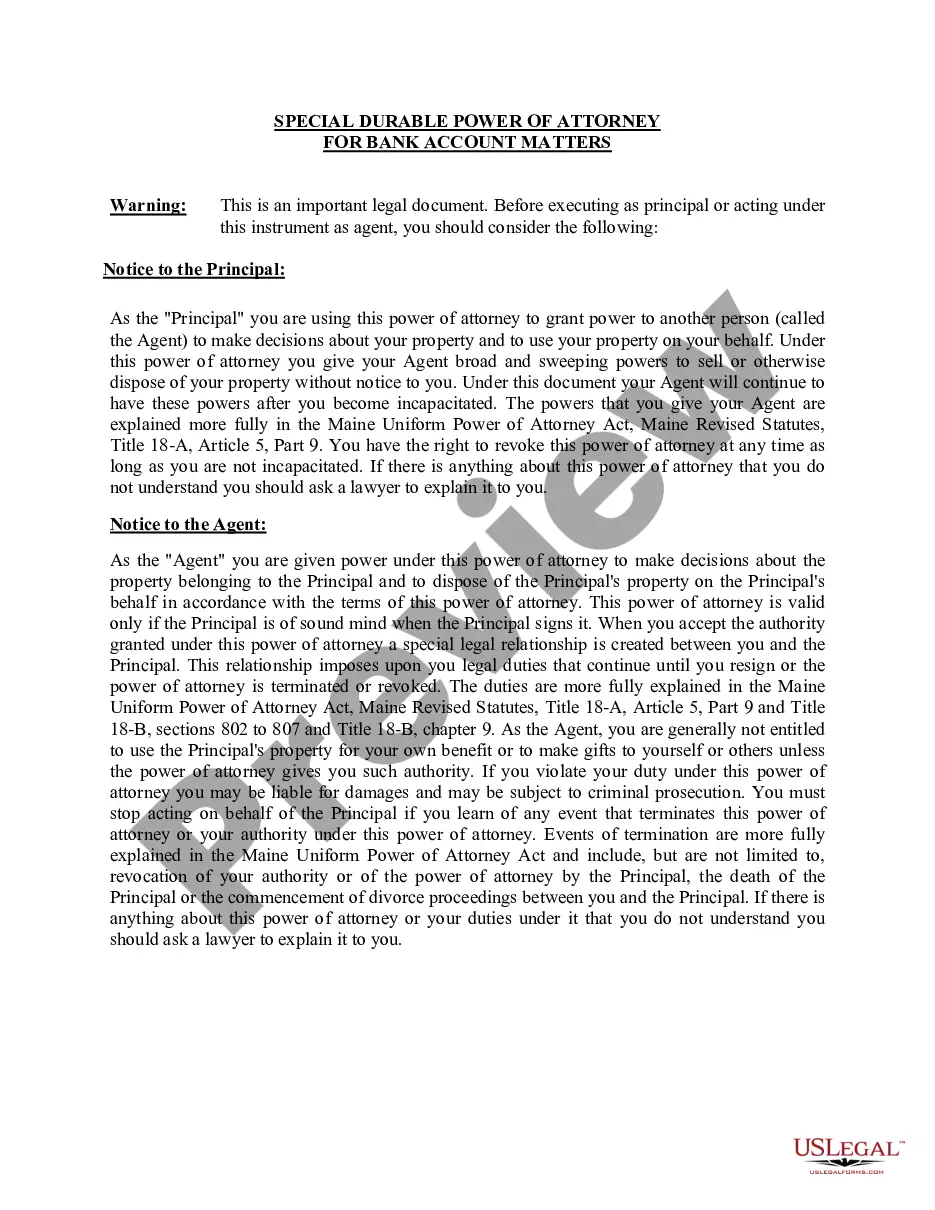

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so. This form contains amendments made by Chapter 618 of 2004 Public Law.

Maine Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Maine Special Durable Power Of Attorney For Bank Account Matters?

Access any format from 85,000 legal records, including the Maine Special Durable Power of Attorney for Banking Matters online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you possess a subscription, sign in. When you arrive at the form’s page, select the Download button and visit My documents to retrieve it.

If you haven’t signed up yet, adhere to the instructions below.

Once your reusable form is downloaded, print it or store it on your device. With US Legal Forms, you will consistently have swift access to the correct downloadable template. The platform provides access to documents and classifies them into categories to simplify your search. Use US Legal Forms to quickly and easily obtain your Maine Special Durable Power of Attorney for Banking Matters.

- Review the state-specific criteria for the Maine Special Durable Power of Attorney for Banking Matters you intend to utilize.

- Examine the description and preview the template.

- When you are confident that the template meets your needs, select Buy Now.

- Choose a subscription plan that truly fits your financial plan.

- Establish a personal account.

- Make a payment using either of the two suitable methods: via credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Save the file to the My documents section.

Form popularity

FAQ

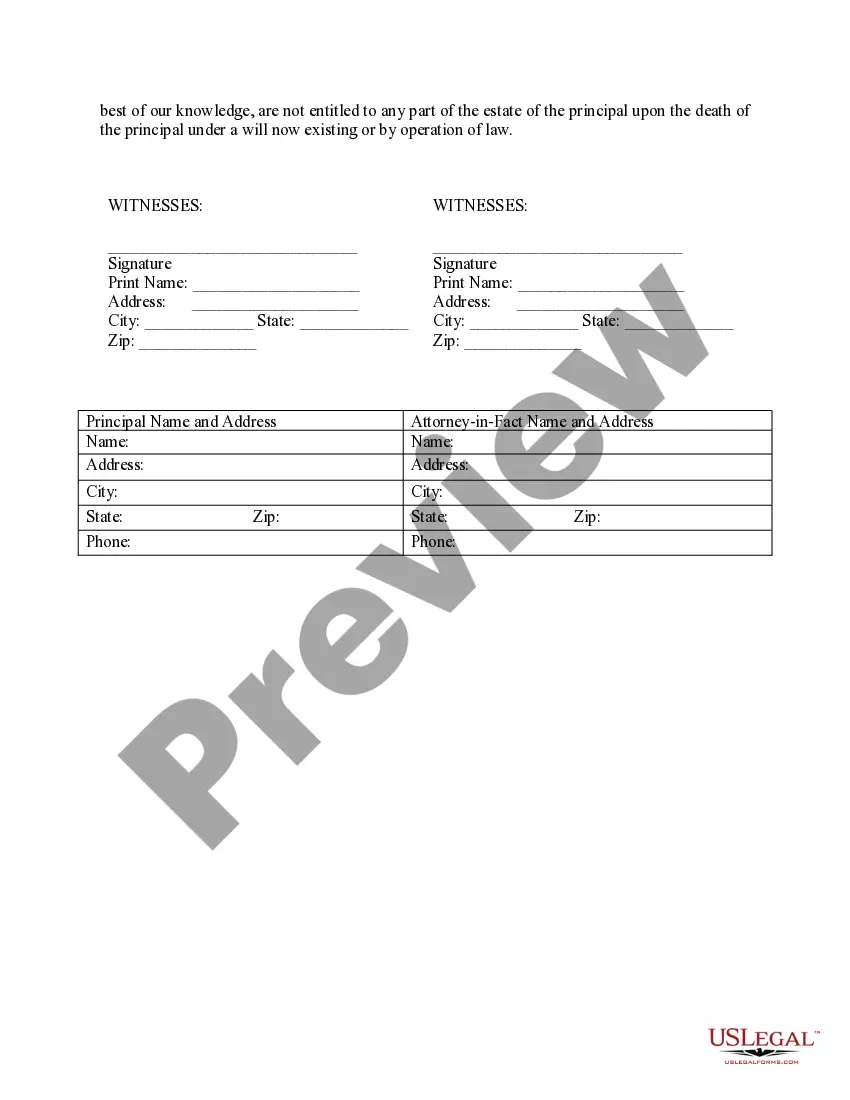

Contact the bank before having a financial power of attorney drafted by a lawyer. Send or deliver your previously drafted financial power of attorney document to the bank. Provide identification and a copy of the financial power of attorney to the bank teller when you ready to complete a transaction.

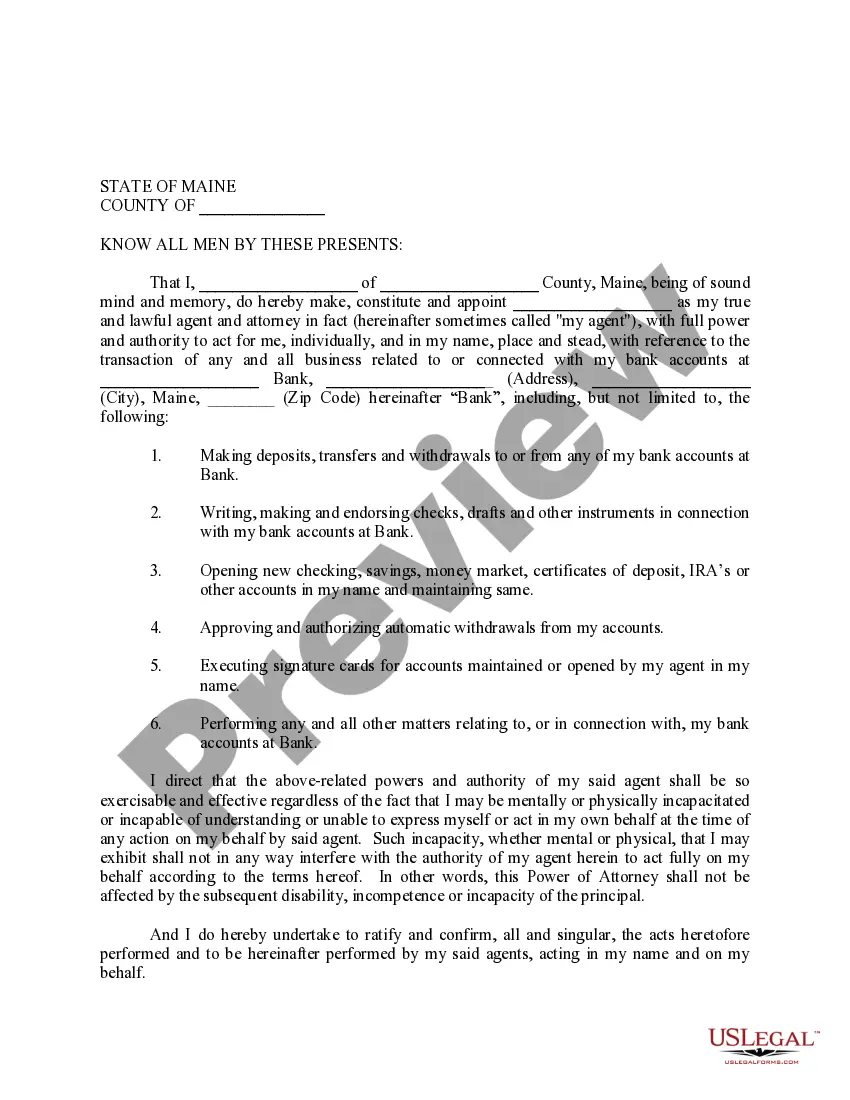

Choose an agent. Before you begin to fill out the form, you have some decisions to make. Decide on the type of authority. You can choose whether you want your POA to be broad or narrow. Identify the length of time the POA will be in effect. Fill out the form. Execute the document.

Determine if one is needed. Under a few circumstances, a power of attorney isn't necessary. Identify an agent. Take a look at the standard forms. Notarize the written POA, keep it stored safely, and provide copies to important people. Review the POA periodically.

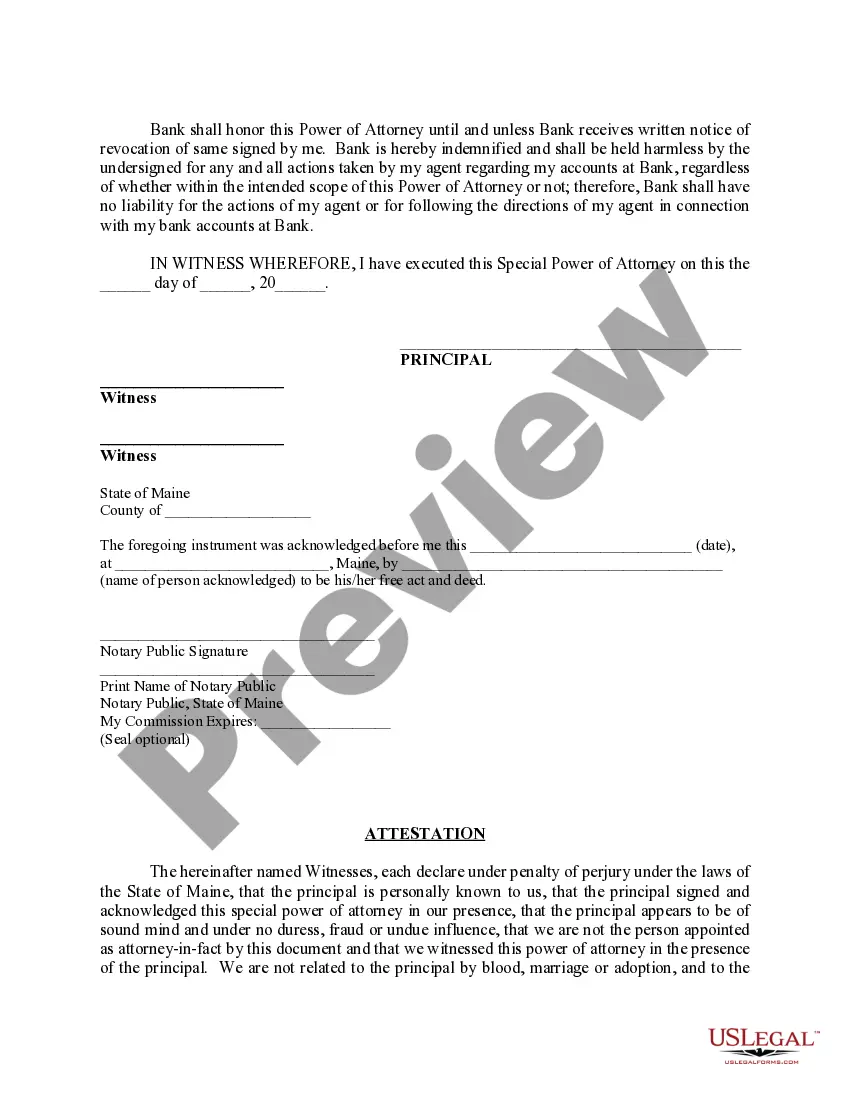

While almost any document can be notarized, some of the most common ones include sworn statements, powers of attorney, deeds of trust, rental agreements, copy certifications, beneficiary designations for retirement accounts, promissory notes, and motor vehicle bills of sale.

Before you can manage the donor's account, you must show the bank the original registered lasting power of attorney ( LPA ) or a copy of it signed on every page by the donor, a solicitor or notary.

A power of attorney, or POA, is one of the most commonly used legal documents because of the numerous purposes a POA can serve.Banks, for example, are notorious for refusing to honor, or at least questioning, the authority of an Agent when presented with a power of attorney.

While laws vary between states, a POA can't typically add or remove signers from your bank account unless you include this responsibility in the POA document.If you don't include a clause giving the POA this authority, then financial institutions won't allow your POA to make ownership changes to your accounts.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.