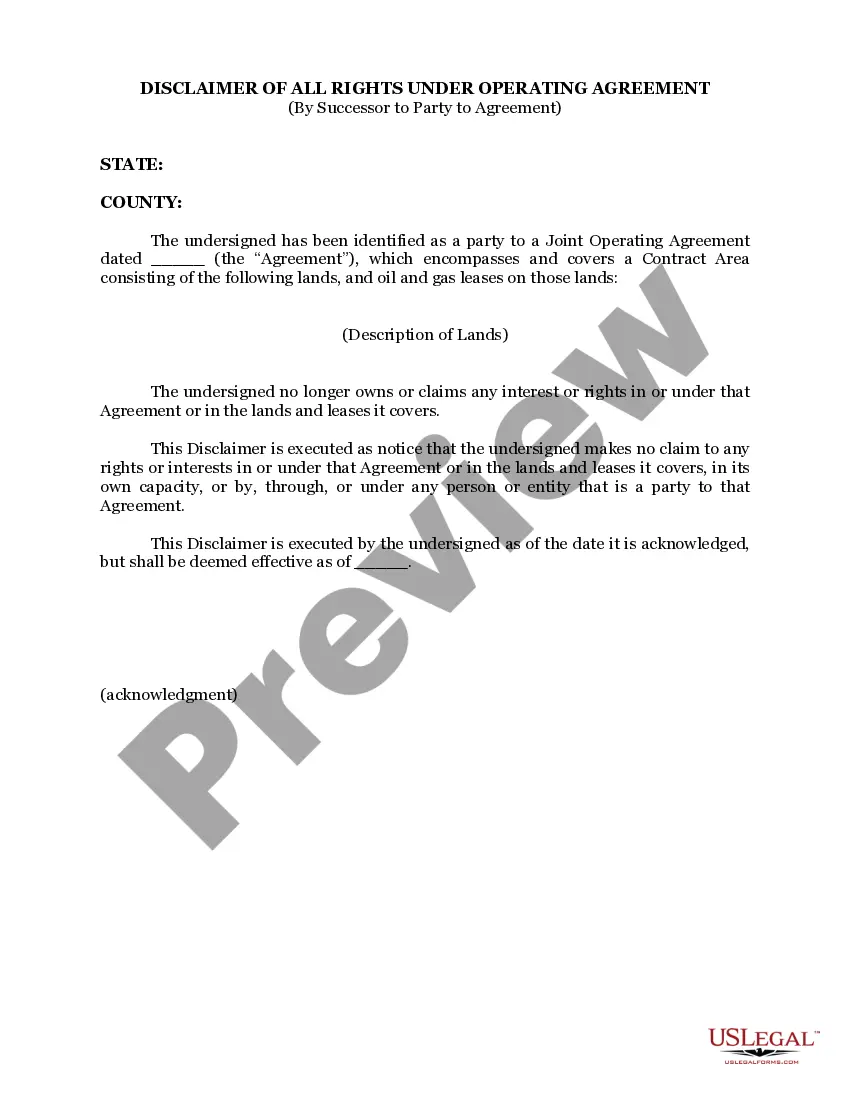

Maryland Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement

Description

How to fill out Disclaimer Of All Rights Under Operating Agreement By Successor To Party To Agreement?

Choosing the best authorized file format might be a have a problem. Needless to say, there are a variety of web templates available on the Internet, but how would you get the authorized kind you want? Take advantage of the US Legal Forms website. The support delivers 1000s of web templates, including the Maryland Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement, which can be used for enterprise and private requirements. All of the types are checked out by specialists and meet federal and state specifications.

When you are previously signed up, log in to the account and then click the Download switch to get the Maryland Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement. Make use of account to appear with the authorized types you may have bought earlier. Proceed to the My Forms tab of your own account and have an additional backup of your file you want.

When you are a whole new consumer of US Legal Forms, allow me to share basic recommendations that you can comply with:

- Very first, be sure you have chosen the proper kind for the area/state. It is possible to check out the form using the Review switch and browse the form information to make sure this is the best for you.

- If the kind fails to meet your expectations, make use of the Seach industry to find the right kind.

- When you are sure that the form is suitable, click on the Get now switch to get the kind.

- Select the rates plan you desire and enter the essential information and facts. Design your account and pay money for the transaction with your PayPal account or charge card.

- Choose the submit format and down load the authorized file format to the system.

- Total, revise and printing and indication the acquired Maryland Disclaimer of All Rights Under Operating Agreement by Successor to Party to Agreement.

US Legal Forms is definitely the most significant catalogue of authorized types in which you will find various file web templates. Take advantage of the company to down load skillfully-manufactured documents that comply with status specifications.

Form popularity

FAQ

The operating agreement should contain a ?Transfer of Membership? clause in which the recipients of the shares are named. This would likely also be noted in the deceased's will. Shares can be purchased outright by the remaining LLC members, with the money going to the deceased member's beneficiaries.

Tax Issues Related to Transferring an LLC Membership Interest. A transfer of an LLC interest where compensation is being paid is treated as a sale or exchange. The selling member will usually have a taxable gain or loss on the sale.

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

Assignment of interest in LLCs happens when a member communicates to other members his/her intention to transfer part or all of his ownership rights in the LLC to another entity. The assignment is usually done as a means for members to provide collateral for personal loans, settle debts, or leave the LLC.

Members invest money into the LLC and get a share of the company in return. Those with an ownership interest receive a share of the LLC's profits and losses.

Maryland law does not require that an LLC have a written operating agreement. However, it is advisable to put your agreement with your fellow LLC members in writing. The agreement itself is not filed anywhere. Nevertheless, it is a binding contract with legal ramifications.

The term member refers to the individual(s) or entity(ies) holding a membership interest in a limited liability company. The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property. They may or may not manage the business and its affairs.