Maryland Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest

Description

How to fill out Disclaimer And Quitclaim Of Interest In Mineral / Royalty Interest?

Are you currently in the position where you will need documents for both business or person functions just about every working day? There are a lot of legitimate papers layouts available online, but getting types you can rely on isn`t easy. US Legal Forms delivers 1000s of develop layouts, such as the Maryland Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest, that are composed to satisfy federal and state specifications.

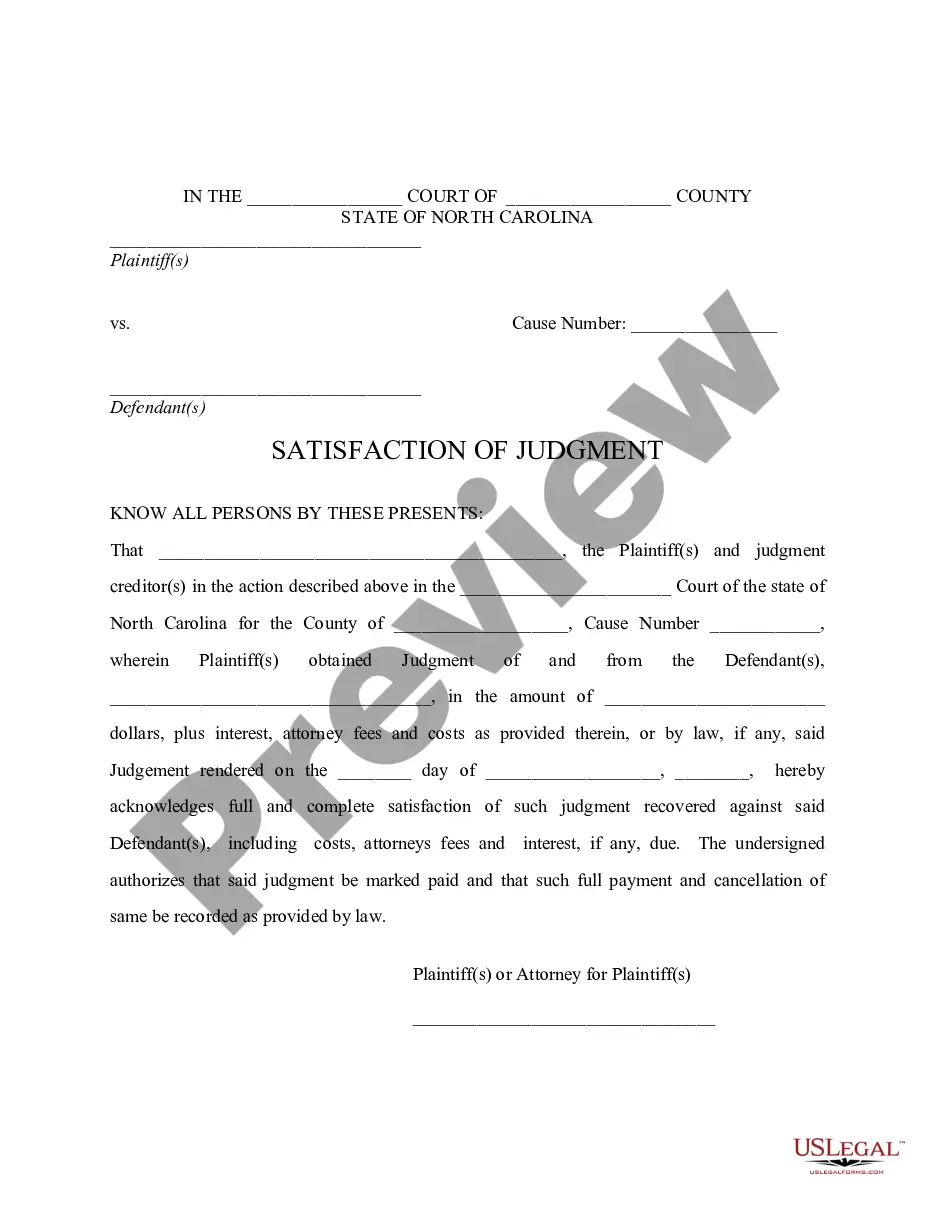

When you are already familiar with US Legal Forms website and get a merchant account, just log in. Afterward, you can acquire the Maryland Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest web template.

Should you not have an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the develop you need and ensure it is for that proper metropolis/state.

- Make use of the Review option to check the shape.

- Browse the information to ensure that you have selected the right develop.

- In case the develop isn`t what you are seeking, use the Research area to find the develop that suits you and specifications.

- Whenever you get the proper develop, simply click Acquire now.

- Pick the rates program you desire, submit the required details to create your money, and purchase an order utilizing your PayPal or bank card.

- Select a hassle-free paper structure and acquire your duplicate.

Find all the papers layouts you possess purchased in the My Forms menu. You may get a further duplicate of Maryland Disclaimer and Quitclaim of Interest in Mineral / Royalty Interest anytime, if required. Just click on the essential develop to acquire or print the papers web template.

Use US Legal Forms, the most substantial collection of legitimate varieties, to save time as well as avoid blunders. The services delivers expertly created legitimate papers layouts which can be used for a range of functions. Generate a merchant account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

Laws & Requirements Signing Requirements: Maryland Code, Real Property, § 4-101: The grantor must sign a quitclaim deed in Maryland before a notary public. Recording Requirements: Maryland Code, Real Property, § 3-104: You must file Maryland quitclaim deeds with the Clerk of the Circuit Court in the property's county.

Michigan has several statutes that permit challenging a quitclaim deed. For example, challenging a quitclaim deed given by a close family member or a court-ordered sale has a five-year statute of limitations. The statute for bringing a lawsuit based on fraud or on a contract in Michigan is six years.

Once a quitclaim deed has been signed, delivered, and recorded with the appropriate county recorder's office, it typically cannot be reversed or ?undone? by the grantor (the person who transferred their property interest).

One can reverse an interspousal grant deed only if the person who receives the property through the deed signs on it again and gives it back to the former. So, without your signatures, this is not possible, be it in any state.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Forged deeds, mortgages, satisfactions, or releases. Deed by person who is insane or mentally incompetent. Deed by minor (may be disavowed) Deed from corporation, unauthorized under corporate by-laws or given under falsified corporate resolution.

A quitclaim deed does not make any promises that the seller owns the property or has clear title to it. A quitclaim deed only passes the interest in the property that the seller actually has, without any guarantee. The seller is not responsible to the buyer for a defect in the title.