Maryland Statement of Financial Affairs - Form 7

Description

How to fill out Statement Of Financial Affairs - Form 7?

US Legal Forms - among the most significant libraries of authorized kinds in the United States - offers a wide range of authorized document web templates you are able to obtain or produce. Making use of the web site, you may get thousands of kinds for company and person reasons, sorted by classes, states, or keywords.You can get the latest variations of kinds much like the Maryland Statement of Financial Affairs - Form 7 within minutes.

If you already have a membership, log in and obtain Maryland Statement of Financial Affairs - Form 7 through the US Legal Forms catalogue. The Down load switch will appear on each and every form you view. You get access to all previously downloaded kinds in the My Forms tab of the profile.

If you would like use US Legal Forms the very first time, listed here are simple recommendations to get you started off:

- Be sure you have chosen the correct form for your personal area/county. Go through the Preview switch to review the form`s information. See the form outline to actually have selected the correct form.

- When the form doesn`t fit your demands, take advantage of the Search field near the top of the display to obtain the the one that does.

- In case you are pleased with the shape, validate your selection by simply clicking the Purchase now switch. Then, choose the costs strategy you prefer and provide your references to sign up for an profile.

- Approach the transaction. Use your credit card or PayPal profile to complete the transaction.

- Pick the format and obtain the shape on your own product.

- Make modifications. Complete, revise and produce and sign the downloaded Maryland Statement of Financial Affairs - Form 7.

Each design you put into your bank account lacks an expiration time and is also your own permanently. So, in order to obtain or produce another version, just visit the My Forms area and then click on the form you need.

Obtain access to the Maryland Statement of Financial Affairs - Form 7 with US Legal Forms, the most extensive catalogue of authorized document web templates. Use thousands of professional and state-distinct web templates that satisfy your organization or person requires and demands.

Form popularity

FAQ

Voluntary bankruptcy is a type of bankruptcy where an insolvent debtor brings the petition to a court to declare bankruptcy because they are unable to pay off their debts. Both individuals and businesses are able to use this approach.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

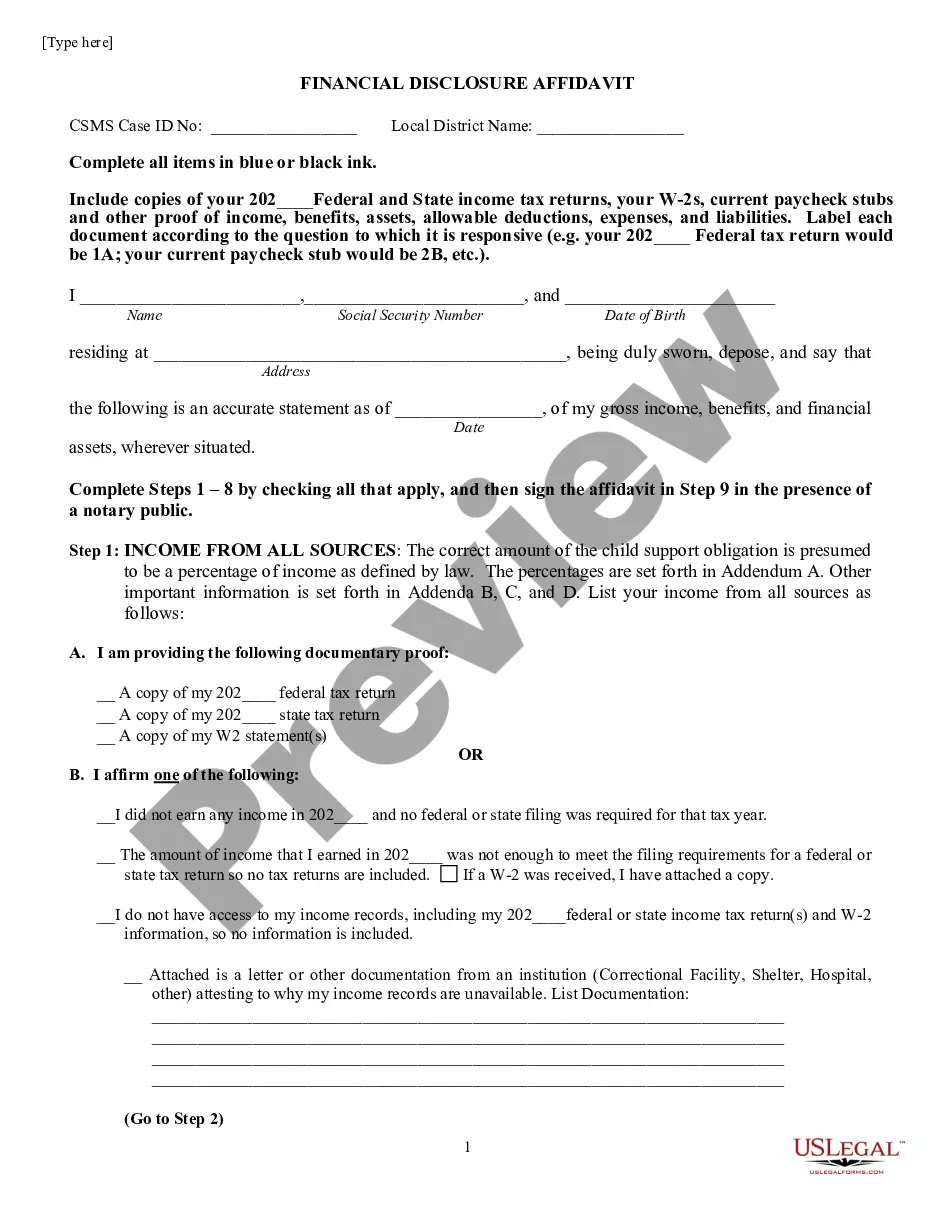

Form 7, the Statement of Financial Affairs, contains a series of questions which direct the debtor to answer by furnishing information. If the answer to a question is "None," or the question is not applicable, an affirmative statement to that effect is required.

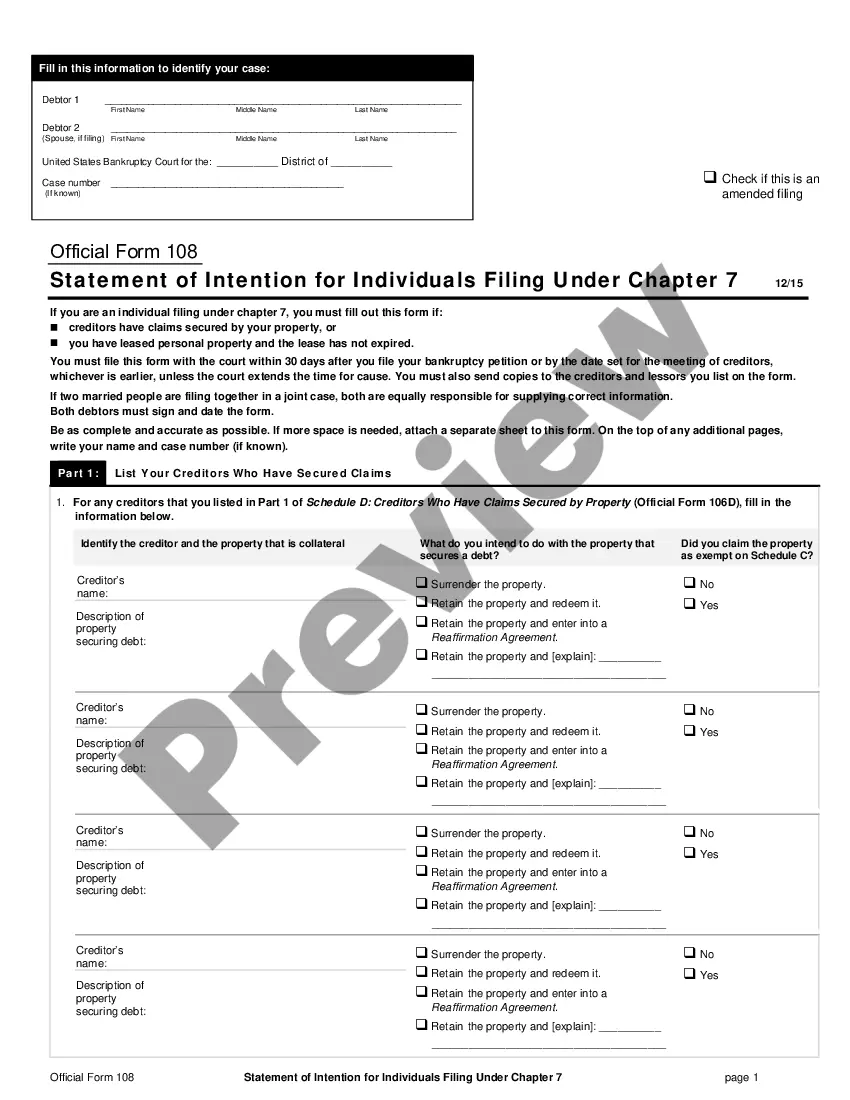

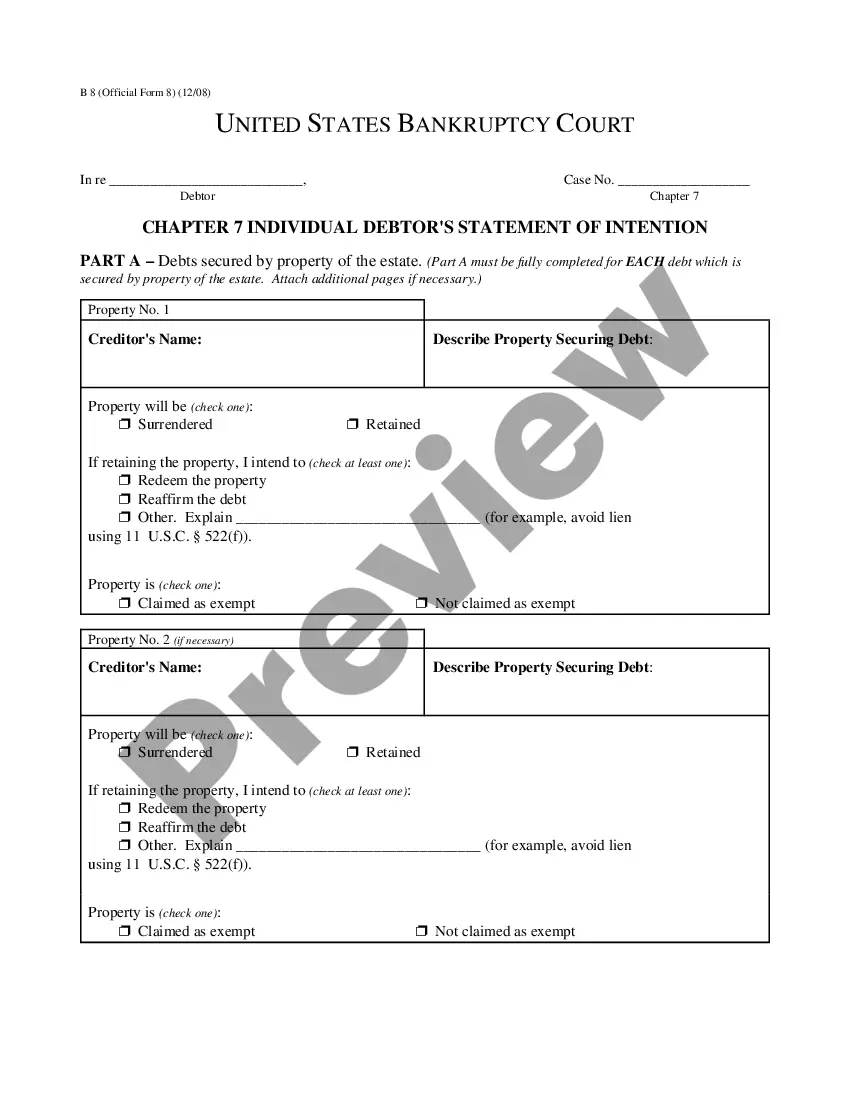

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

As soon as you file for bankruptcy, a trustee will be assigned to your bankruptcy case. The trustee is responsible for managing your bankruptcy estate. The trustee will also oversee the process of selling your non-exempt assets and distributing the proceeds to creditors.

Statement of Financial Af·?fairs. : a written statement filed by a debtor in bankruptcy that contains information regarding especially financial records, location of any accounts, prior bankruptcy, and recent or current debt. called also statement of affairs.

In a Nutshell. The Chapter 7 forms packet consists of a voluntary petition, schedules, and statements. The term ?petition? is often used to describe the set of forms individuals filing for bankruptcy submit to the court.