Maryland Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005

Description

How to fill out Chapter 7 Individual Debtors Statement Of Intention - Form 8 - Post 2005?

US Legal Forms - one of the biggest libraries of legal forms in the USA - offers a variety of legal file themes you can obtain or printing. Using the internet site, you can get 1000s of forms for organization and personal purposes, sorted by types, suggests, or search phrases.You will find the most up-to-date versions of forms just like the Maryland Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 within minutes.

If you already have a subscription, log in and obtain Maryland Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 from the US Legal Forms local library. The Acquire option will appear on each and every form you see. You have accessibility to all in the past downloaded forms within the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, listed here are simple guidelines to help you began:

- Make sure you have selected the proper form to your city/area. Go through the Preview option to check the form`s articles. Browse the form outline to actually have chosen the proper form.

- In the event the form does not fit your needs, utilize the Research discipline on top of the screen to discover the the one that does.

- In case you are pleased with the form, verify your choice by visiting the Acquire now option. Then, select the costs prepare you want and supply your accreditations to sign up on an bank account.

- Process the transaction. Make use of bank card or PayPal bank account to perform the transaction.

- Select the format and obtain the form on the device.

- Make adjustments. Fill up, change and printing and signal the downloaded Maryland Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005.

Every web template you included in your account lacks an expiry time and it is your own property for a long time. So, if you wish to obtain or printing another duplicate, just check out the My Forms area and click on around the form you will need.

Gain access to the Maryland Chapter 7 Individual Debtors Statement of Intention - Form 8 - Post 2005 with US Legal Forms, the most considerable local library of legal file themes. Use 1000s of expert and express-specific themes that satisfy your small business or personal needs and needs.

Form popularity

FAQ

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

? income can vary month to month, and the means test finds the average. Your figure should include not only your wages, but also rental income, child support, alimony, pension or other regular monthly income. Social Security income does not count.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

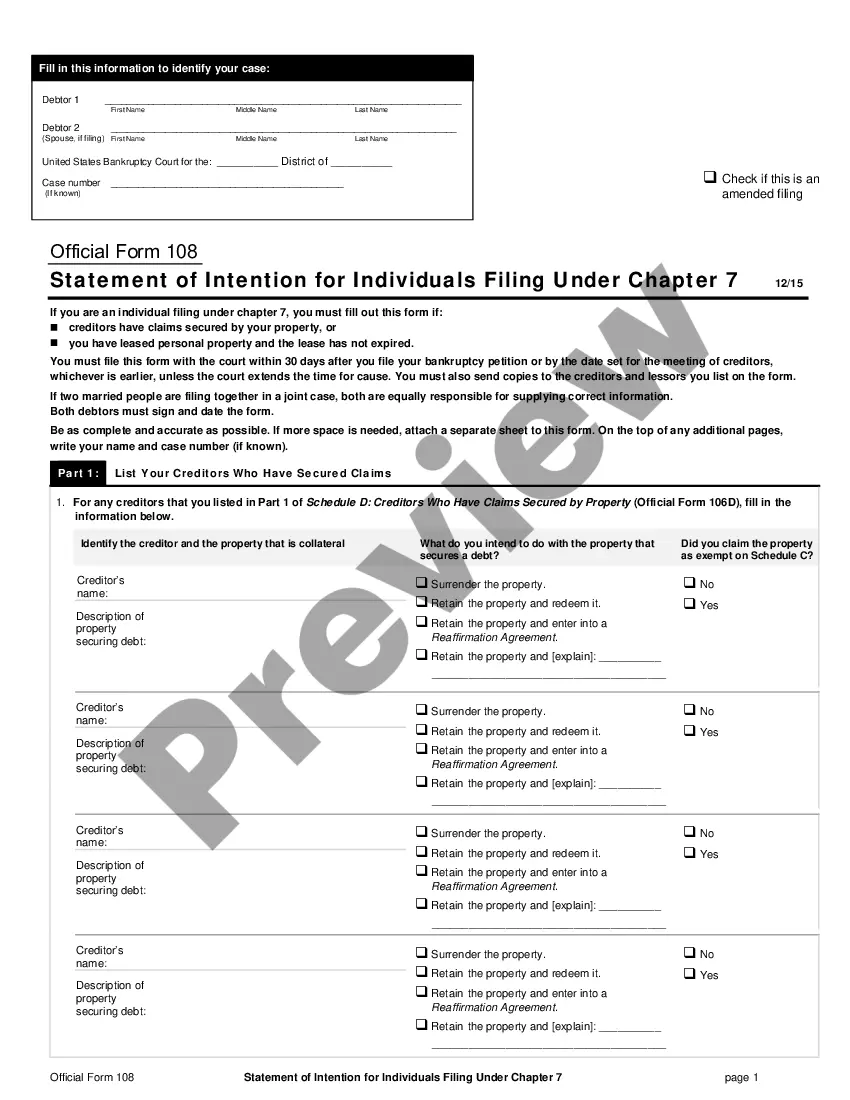

When you file for Chapter 7 bankruptcy, you will have to complete a form called the Statement of Intention for Individuals Filing Under Chapter 7. On this form, you tell the court whether you want to keep your secured and leased property?such as your car, boat, or home?or let it go back to the creditor.

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.

?You may consider Chapter 7 if creditors are harassing you, garnishing your wages and bank accounts and you have no way to pay off the debts. You may consider Chapter 7 as a last resort after your best efforts to pay your debts fail.?

Maryland Bankruptcy Exemptions EXEMPTION DESCRIPTIONLAW SECTION$6,000 of cash or property of any kind and $5,000 of real or personal propertyCourts 7 Jud. Proceedings 11-504(b)(5), (f)28 more rows

The U.S. bankruptcy code doesn't specify a minimum dollar amount someone must owe to make them eligible for a qualified filing. In short, any debt is enough debt. More important than the size of your debt is the size of your income. How much money you earn affects whether you qualify for Chapter 7.