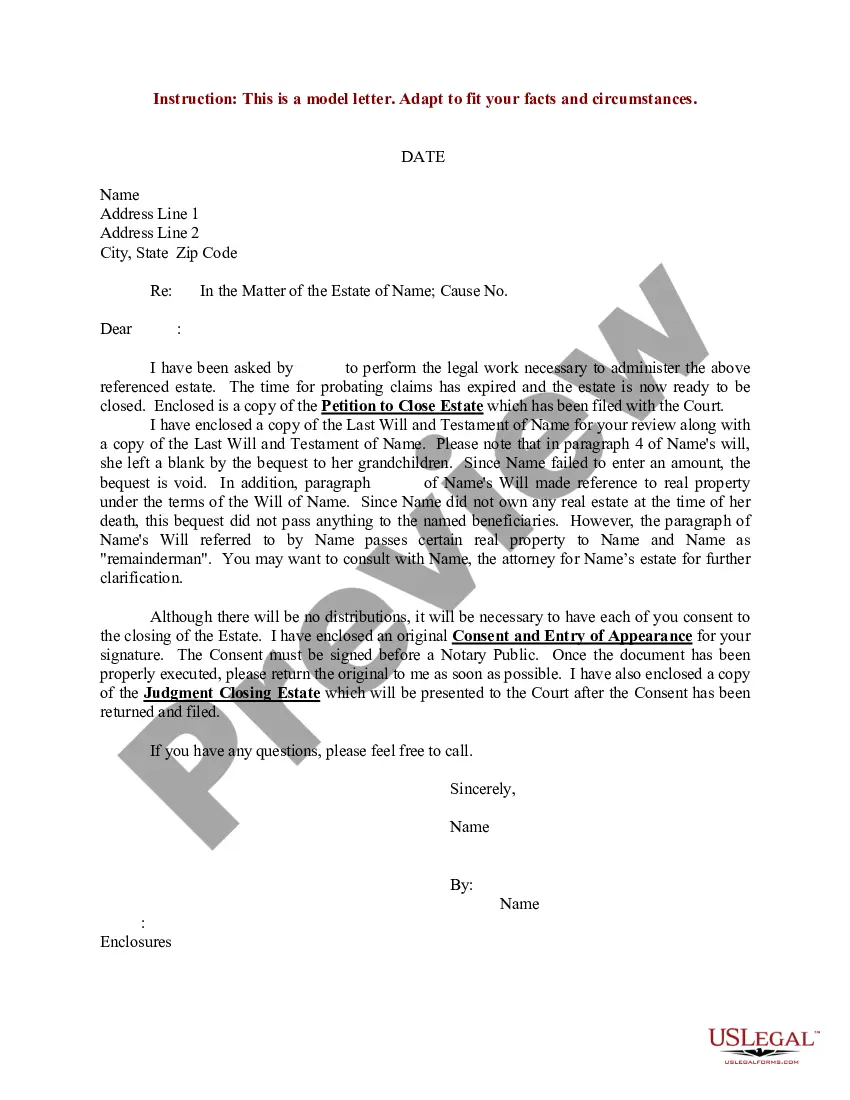

Maryland Sample Letter for Closing of Estate with no Distribution

Description

How to fill out Sample Letter For Closing Of Estate With No Distribution?

You may devote several hours on-line trying to find the legal record format that suits the federal and state requirements you want. US Legal Forms gives 1000s of legal kinds that are evaluated by specialists. It is simple to acquire or printing the Maryland Sample Letter for Closing of Estate with no Distribution from the service.

If you already possess a US Legal Forms profile, you are able to log in and click the Acquire switch. Next, you are able to full, modify, printing, or signal the Maryland Sample Letter for Closing of Estate with no Distribution. Each and every legal record format you get is yours permanently. To acquire another copy of the bought form, go to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site for the first time, adhere to the simple guidelines beneath:

- Initially, make sure that you have chosen the right record format for the region/city of your choice. See the form outline to ensure you have chosen the right form. If offered, utilize the Preview switch to appear with the record format as well.

- In order to discover another model of the form, utilize the Lookup field to discover the format that suits you and requirements.

- When you have discovered the format you want, click on Acquire now to move forward.

- Choose the prices program you want, enter your credentials, and register for your account on US Legal Forms.

- Comprehensive the transaction. You may use your Visa or Mastercard or PayPal profile to fund the legal form.

- Choose the file format of the record and acquire it in your gadget.

- Make changes in your record if necessary. You may full, modify and signal and printing Maryland Sample Letter for Closing of Estate with no Distribution.

Acquire and printing 1000s of record layouts utilizing the US Legal Forms Internet site, which provides the most important collection of legal kinds. Use expert and condition-specific layouts to tackle your organization or individual demands.

Form popularity

FAQ

Generally, the Intestacy statutes provide for property to be distributed to a decedent's closest living relatives, i.e., to a surviving spouse and children, if there are any; to children in equal shares if there is no surviving spouse; to parents if there are no spouse and children; and so on to more distant relatives.

The duration of this process can range from a few weeks to several months, depending on the size and complexity of the estate. In Maryland, the executor is generally given three months from the date of their appointment to submit this inventory to the court.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

If there is a Will and/or Codicil, a regular estate may be closed after the time for challenging the Will and/or Codicil(s) expires (six month from the appointment of the Personal Representative). Many regular estates are closed and final distributions made within one year of death.

This is done by filing a ?Petition for Declaration of Completion of Administration? along with any supporting documentation. The court will review your petition and, if everything ticks, will issue an Order Closing Estate. With this order, you can distribute any remaining assets to the rightful heirs and beneficiaries.

Children in Maryland Inheritance Law Intestate Succession: Spouses and ChildrenInheritance SituationWho Inherits Your PropertyChildren but no spouse? Children inherit everythingSpouse but no children or parents? Spouse inherits everythingSpouse and children who are minors? Spouse inherits half ? Children inherit half2 more rows ?

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.