Maryland Assignment Creditor's Claim Against Estate

Description

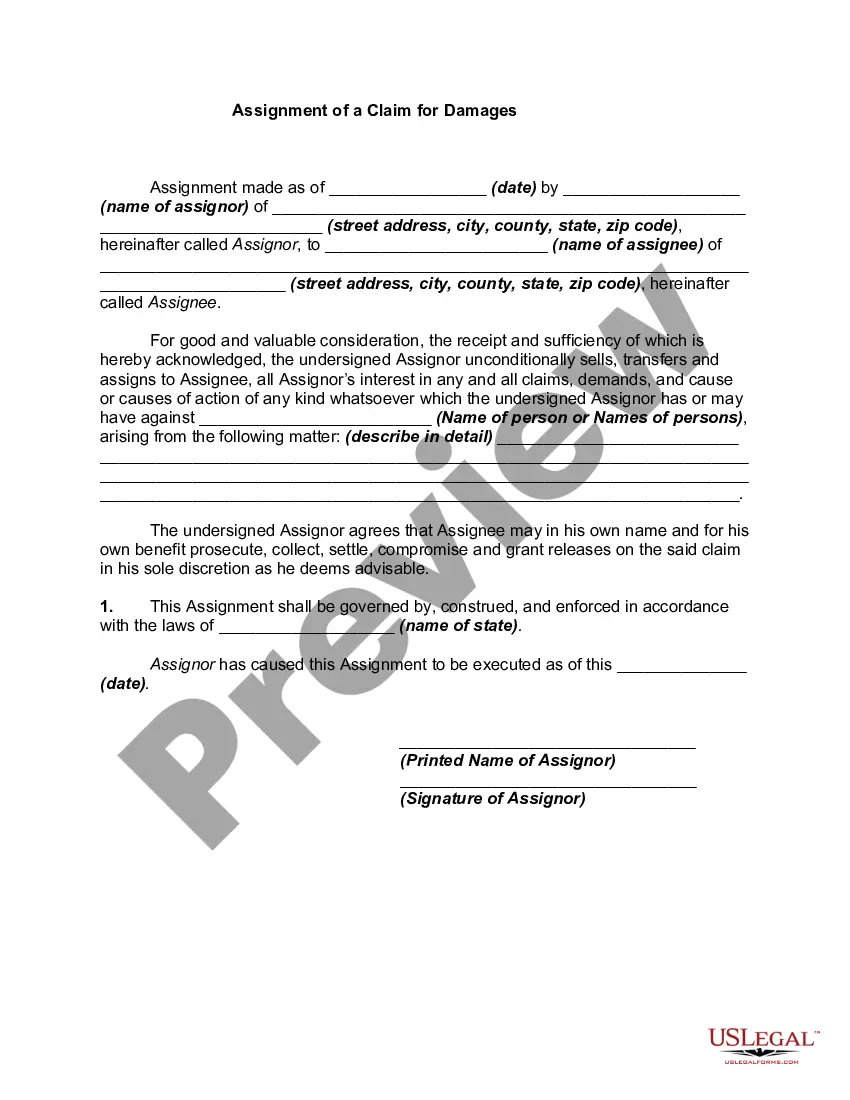

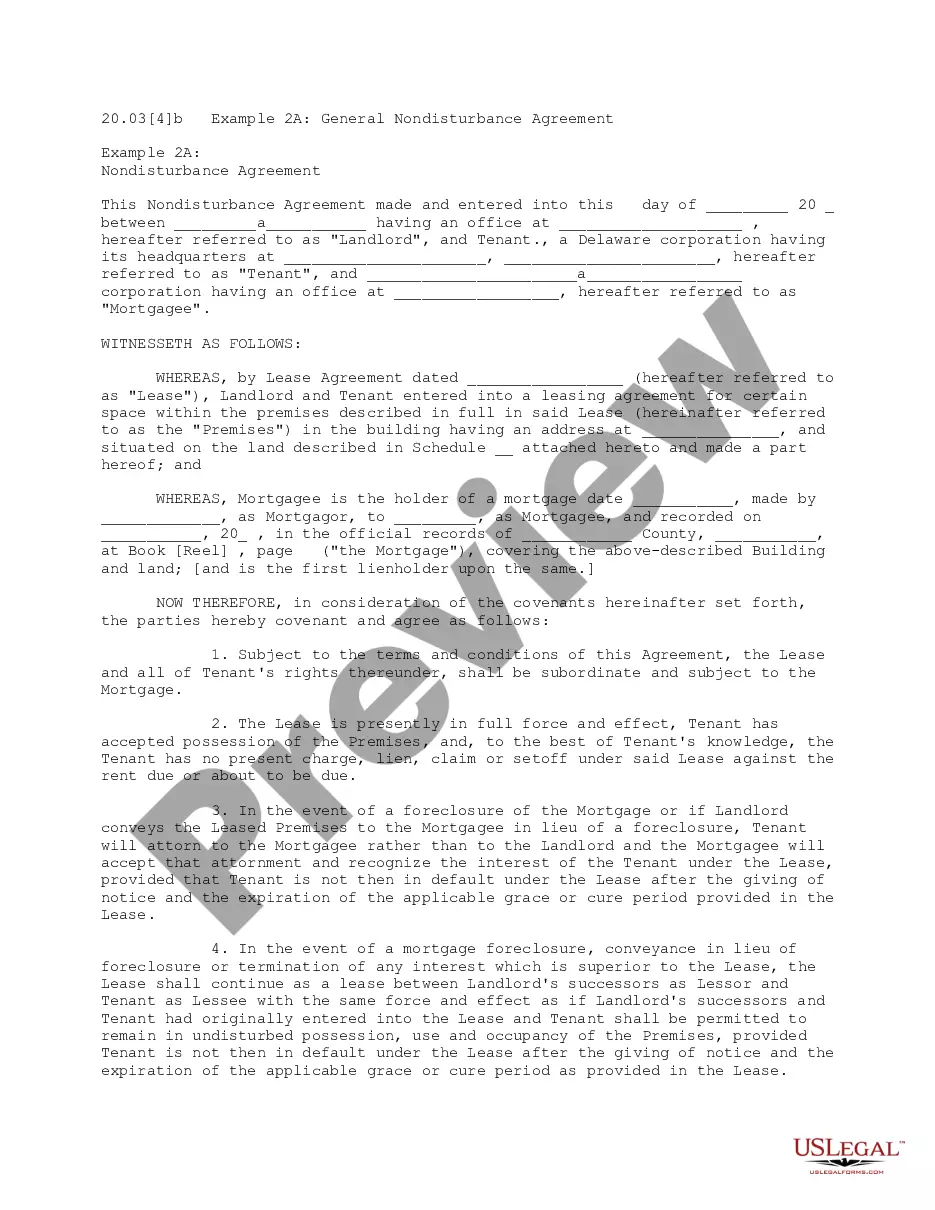

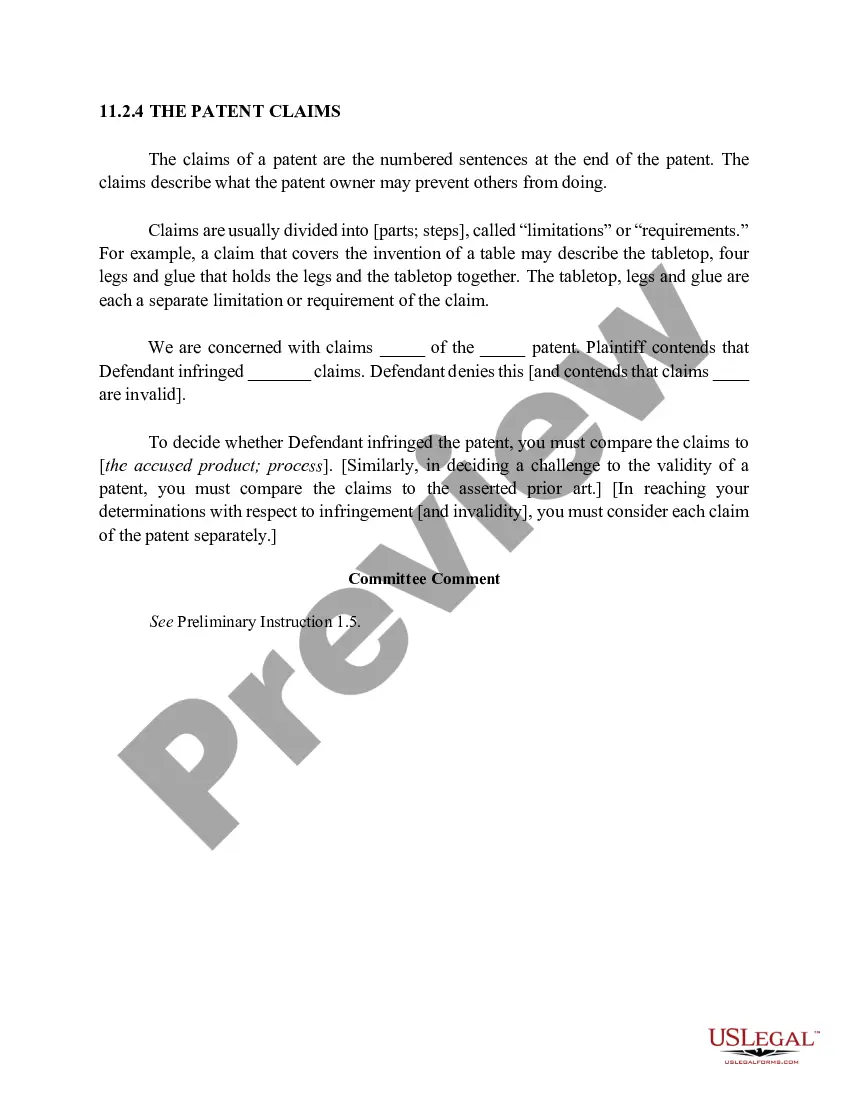

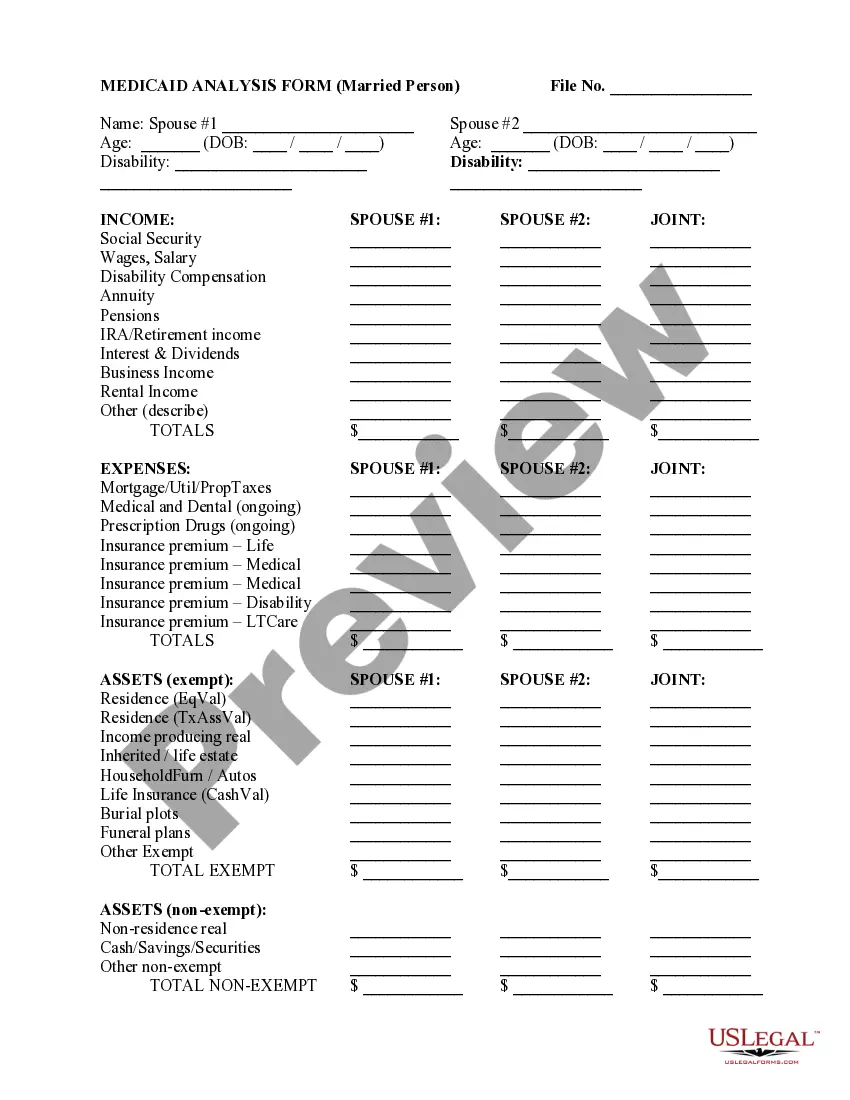

How to fill out Assignment Creditor's Claim Against Estate?

US Legal Forms - one of the largest collections of legal templates in the country - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Maryland Assignment Creditor's Claim Against Estate in just minutes.

If you have a subscription, Log In and download the Maryland Assignment Creditor's Claim Against Estate from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Make edits. Fill out, revise, print, and sign the saved Maryland Assignment Creditor's Claim Against Estate. Each template you saved in your account does not have an expiration date and is yours indefinitely. Therefore, if you want to download or print another version, simply go to the My documents section and click on the desired form. Gain access to the Maryland Assignment Creditor's Claim Against Estate with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review button to examine the contents of the form.

- Check the form description to confirm you selected the right form.

- If the form doesn't meet your requirements, use the Search field at the top of the screen to find the correct one.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, choose your preferred pricing plan and enter your information to register for the account.

Form popularity

FAQ

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.

Creditors have six months from the date of death to submit a claim. Once the assets have been distributed, probate must remain open for at least six months to allow for a creditor to come forward.

The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

In any event, where it is accepted that payment is due, the executor can seek to pay you (the creditor) from the deceased's estate. There is normally a six-month period from the deceased's death for creditors to advise the executor of any sums due to them from the estate.

If a loved one has passed away, you may be wondering how long it might take to wind up the estate. However, there is no simple answer to this question. The length of time it might take to wind up an estate will depend on many factors, but you can expect the process to take at least six months.

Generally, unless the estate includes real property which needs to be sold, requires the filing of a U.S. Estate Tax Return, or is tied up in litigation, a regular estate proceeding may be closed after the period for filing creditor claims expires (six months from the date of death).

Maryland offers a simplified probate procedure for smaller estates. The simplified procedure is available if the property subject to probate has a value of $50,000 or less. If the surviving spouse is the only beneficiary, the cap goes up to $100,000 or less.

How long do creditors have to file a claim against an estate in Maryland? Maryland Estates & Trusts law provides that creditors, except for those otherwise exempt by statute, have six (6) months from the date the decedent died to file claims.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.