Maryland Assignment of Debt

Description

How to fill out Assignment Of Debt?

You may spend hours online trying to locate the legal document format that meets the federal and state requirements you require.

US Legal Forms offers thousands of legal templates that are examined by professionals.

You can easily download or print the Maryland Assignment of Debt from my services.

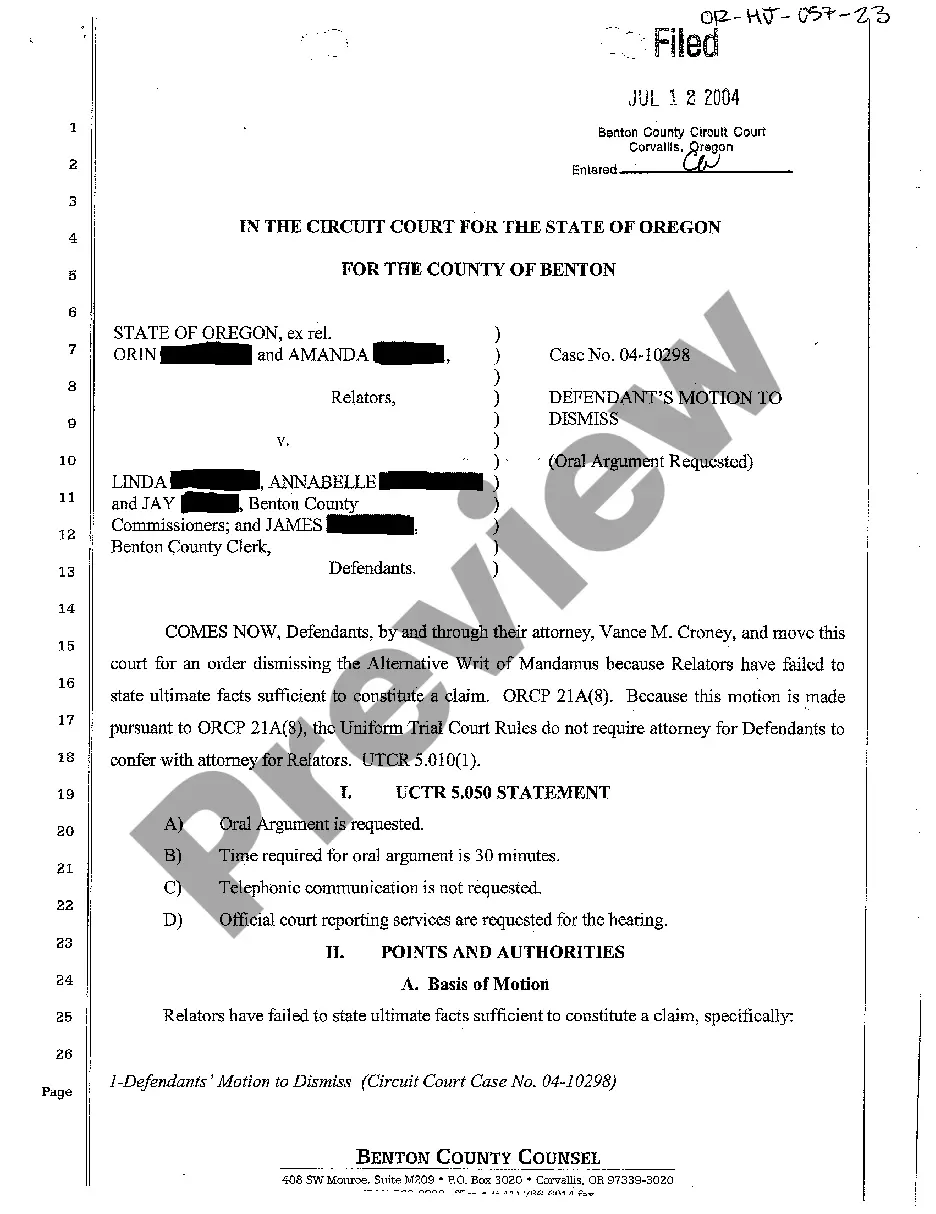

If available, use the Preview button to examine the document format as well.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain button.

- Then, you may complete, modify, print, or sign the Maryland Assignment of Debt.

- Every legal document format you receive is yours permanently.

- To obtain an additional copy of the purchased document, visit the My documents tab and click on the respective button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions provided below.

- Firstly, ensure that you have selected the correct document format for the state/city of your choice.

- Review the document description to confirm you have chosen the appropriate form.

Form popularity

FAQ

For an assignment to be valid, it generally requires a clear writing that identifies the parties involved and the specific debt being assigned. In the context of the Maryland Assignment of Debt, the assignment should also be signed by both parties to confirm agreement. Additionally, consider consulting platforms like USLegalForms, which can provide templates and legal advice, ensuring compliance with state laws.

Yes, an assignment definitely needs to be in writing to ensure its validity. A written document helps eliminate misunderstandings and establishes the terms of the assignment more clearly. When dealing with Maryland Assignment of Debt, having a formal agreement protects both the assignor and the assignee. It's always advisable to seek professional assistance in drafting this document.

In Maryland, creditors can pursue legal action on a debt for up to three years from the date of default. This time frame is known as the statute of limitations. Understanding the rules around the Maryland Assignment of Debt can prevent unnecessary stress when dealing with older debts. If a debt is past this period, it may not be legally collectible.

Yes, an assignment of debt must be documented in writing to be legally binding. This includes essential details of the assignment, such as the parties involved and the amount of debt. By ensuring the Maryland Assignment of Debt is in writing, both parties protect themselves and maintain clarity. A written agreement serves as proof, enhancing legal enforceability.

Yes, debt collectors are required to send you a written notice about the debt. This notice must include essential details such as the amount owed and the name of the creditor. Claiming clarity and adherence to the Maryland Assignment of Debt rules is crucial for your rights. If you don't receive this information, you should ask for it.

The debt relief program in Maryland works by providing individuals with tailored solutions to address their financial burdens. You can access services like credit counseling, debt negotiation, and consolidation plans that fit your situation. The Maryland Assignment of Debt often plays a crucial role in the resolution process, helping reduce stress and enhance your path to financial recovery. Consider using platforms like UsLegalForms to navigate these services effectively.

In Maryland, creditors typically have three years to file a lawsuit for most debts, including credit cards and personal loans. This timeframe starts from the date of your last payment or acknowledgment of the debt. Understanding the implications of the Maryland Assignment of Debt can help you take proactive steps before any legal action occurs. Stay informed to protect your rights effectively.

In Maryland, debt collection laws provide protections against unfair practices by creditors. These laws prohibit harassment and require that debt collectors follow specific procedures when attempting to collect debts. Knowing your rights under the Maryland Assignment of Debt can empower you to address any creditor issues effectively. If you feel overwhelmed, consider seeking help through legal platforms like UsLegalForms for guidance.

Yes, Maryland does have a debt relief program that supports residents facing financial challenges. This program connects individuals with resources to help negotiate debts, consolidate payments, and ultimately reduce total debt. Utilizing the Maryland Assignment of Debt can streamline this process, making it easier to navigate the complexities of debt management. You don't have to face this alone; assistance is available.

The debt relief program in Maryland offers residents various options to manage and reduce their debts effectively. Through this program, you can explore financial counseling services, debt negotiation, and other strategies designed to help you regain control of your finances. Additionally, legal tools like Maryland Assignment of Debt can aid in resolving creditor disputes. It's a comprehensive approach to achieving financial stability.