Maryland Schedule C — Request For Limited Order is a form used by taxpayers in the state of Maryland to request a limited assessment for certain tax credits. This form is used to request a limited assessment of taxes for credits such as the Maryland Historic Preservation Tax Credit or the Maryland Renewable Energy Tax Credit. There are three types of Maryland Schedule C — Request For Limited Order: Form 500CR-C, Form 502CR-C, and Form 504CR-C. Form 500CR-C is used to request a limited assessment of the Maryland Historic Preservation Tax Credit; Form 502CR-C is used to request a limited assessment of the Maryland Renewable Energy Tax Credit; and Form 504CR-C is used to request a limited assessment of the Maryland Qualified Research Activities Tax Credit. All three forms require the taxpayer to provide detailed information about the tax credit being claimed, the amount of the credit requested, and the reason for the request.

Maryland Schedule C - Request For Limited Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Schedule C - Request For Limited Order?

US Legal Forms is the simplest and most affordable method to find appropriate legal templates.

It boasts the largest online repository of business and personal legal documents crafted and validated by lawyers.

Here, you can discover printable and editable templates that adhere to national and local statutes - just like your Maryland Schedule C - Request For Limited Order.

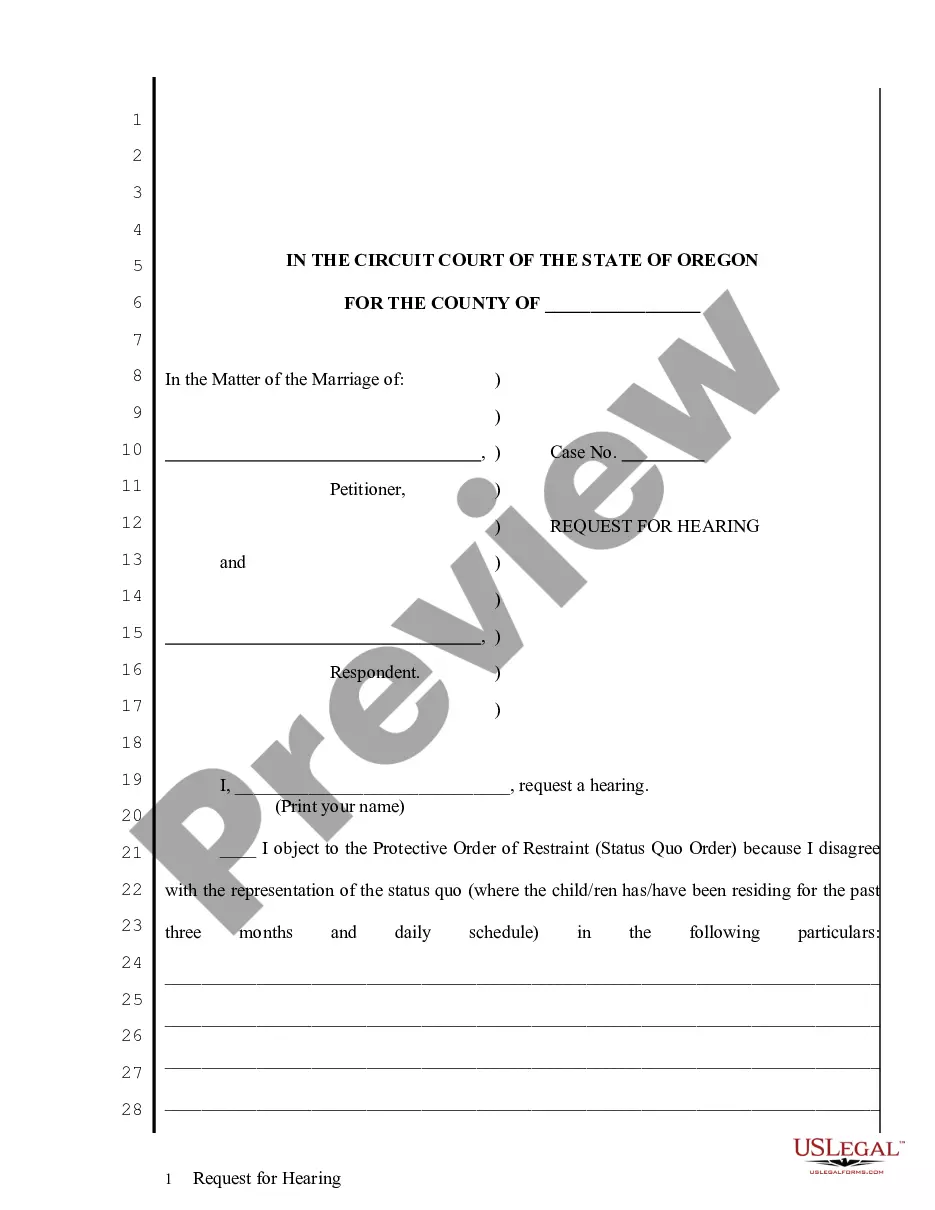

Review the form description or preview the document to ensure it meets your needs, or search for another using the search tab above.

Click Buy now when you're certain it fulfills all the requirements, and choose the subscription plan that suits you best.

- Obtaining your template involves just a few straightforward steps.

- Users with an existing account and an active subscription only need to Log In to the service and download the form onto their device.

- Later, it can be located in their profile under the My documents section.

- If you are using US Legal Forms for the first time, here’s how to get a professionally prepared Maryland Schedule C - Request For Limited Order.

Form popularity

FAQ

This means that person who is nominated as Personal Representative in a will has the highest priority under the law, because the decedent documented. If there is no will, the highest priority is the surviving spouse, then children.

Overview of Maryland Intestacy Law: If the Decedent has children but no spouse: ?Children inherit everything.

In granting letters the register observes an order of priority as established in Maryland law. The usual order begins with persons named in a will, spouse, children, etc., to creditors or any other person. Maryland law has established restrictions on the right to letters of administration.

Rule 6-452 - Removal of a Personal Representative (a)Commencement. The removal of a personal representative may be initiated by the court or the register, or on petition of an interested person. (b)Show Cause Order and Hearing.

The limited order will either allow the search for assets titled in the name of the decedent or the entrance of the safe deposit box in the presence of the Register of Wills or authorized deputy to locate the Will for delivery to the office.

In Maryland, the heirs-at-law are organized by degrees of relationship. If a decedent has no surviving spouse or direct descendants or direct ancestors, the brothers and sisters would be considered the next of kin.

6 months from the date of the decedent's death; or.