Maryland Consents To Extend Time To File Final Report And To Make Distribution In A Modified Administration is a legal document used in the state of Maryland to request an extension of time to file a final report and to make distributions in a modified administration. This document must be signed by all interested parties, including all heirs, the personal representative, and the creditors of the estate. It is important to note that this document must be filed with the court before the expiration of the current term. There are two types of Maryland Consents To Extend Time To File Final Report And To Make Distribution In A Modified Administration: 1. Consent To Extend Time To File Final Report: This form is used to request an extension of time to file the final report of the estate's assets and liabilities. 2. Consent To Make Distribution In A Modified Administration: This form is used to request an extension of time to make distributions in a modified administration. This document must specify the modifications to be made to the estate's administration.

Maryland Consent To Extend Time To File Final Report And To Make Distribution In A Modified Administration

Description

How to fill out Maryland Consent To Extend Time To File Final Report And To Make Distribution In A Modified Administration?

If you’re looking for a method to suitably prepare the Maryland Consent To Extend Time To File Final Report And To Make Distribution In A Modified Administration without enlisting a legal expert, then you’re in the ideal location.

US Legal Forms has established itself as the most comprehensive and respected repository of formal templates for every personal and business scenario. Every document you find on our online platform is created in accordance with national and state laws, ensuring that your paperwork is in compliance.

Another excellent feature of US Legal Forms is that you will never misplace the documents you obtained - you can access any of your downloaded templates in the My documents section of your profile whenever you need them.

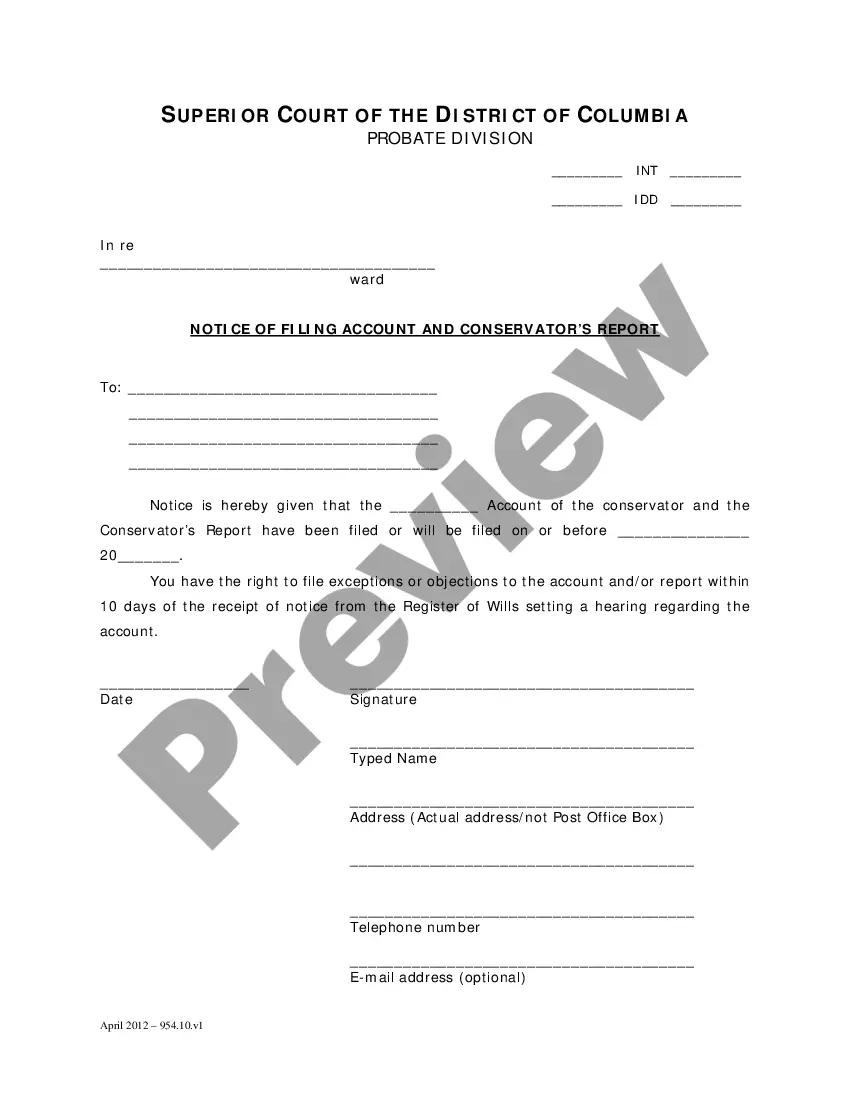

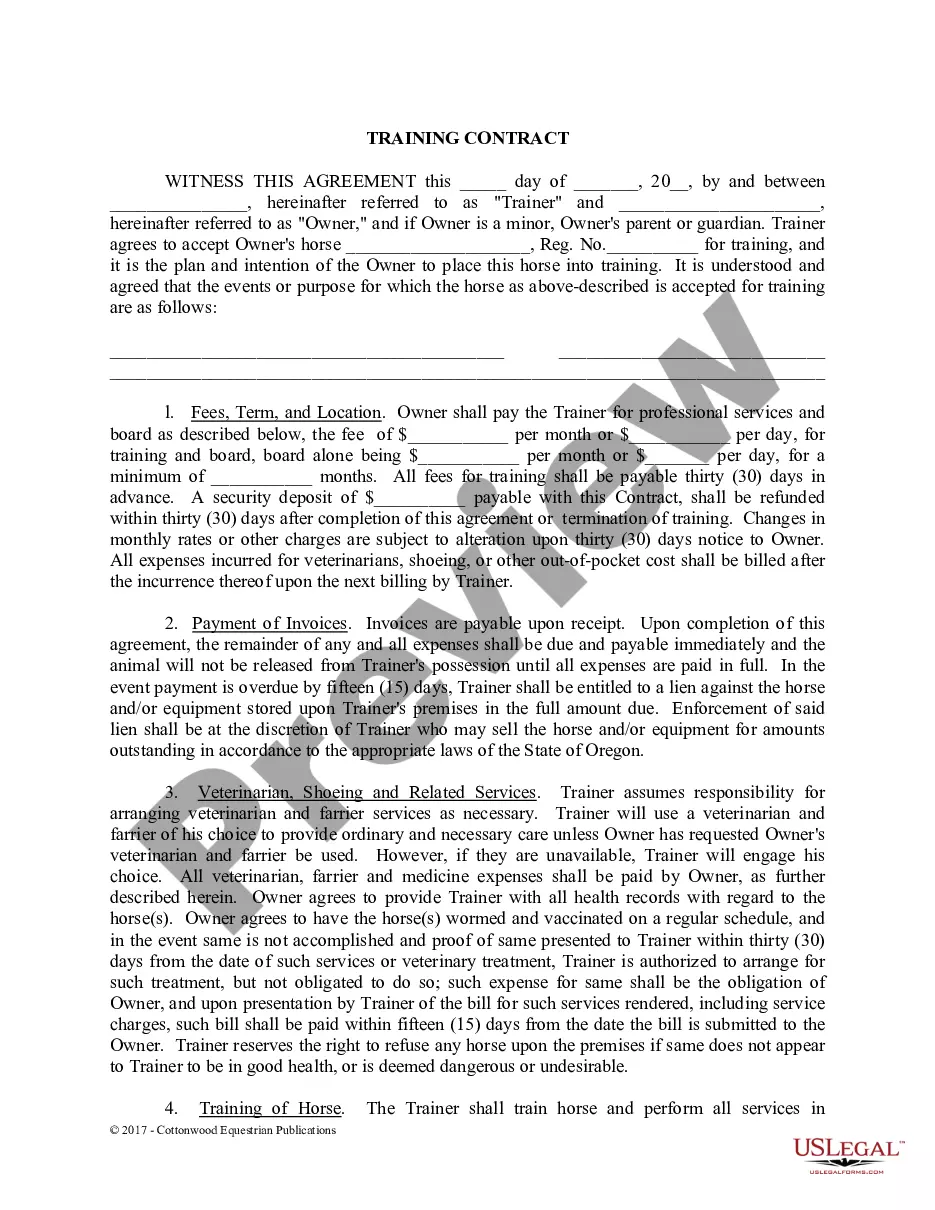

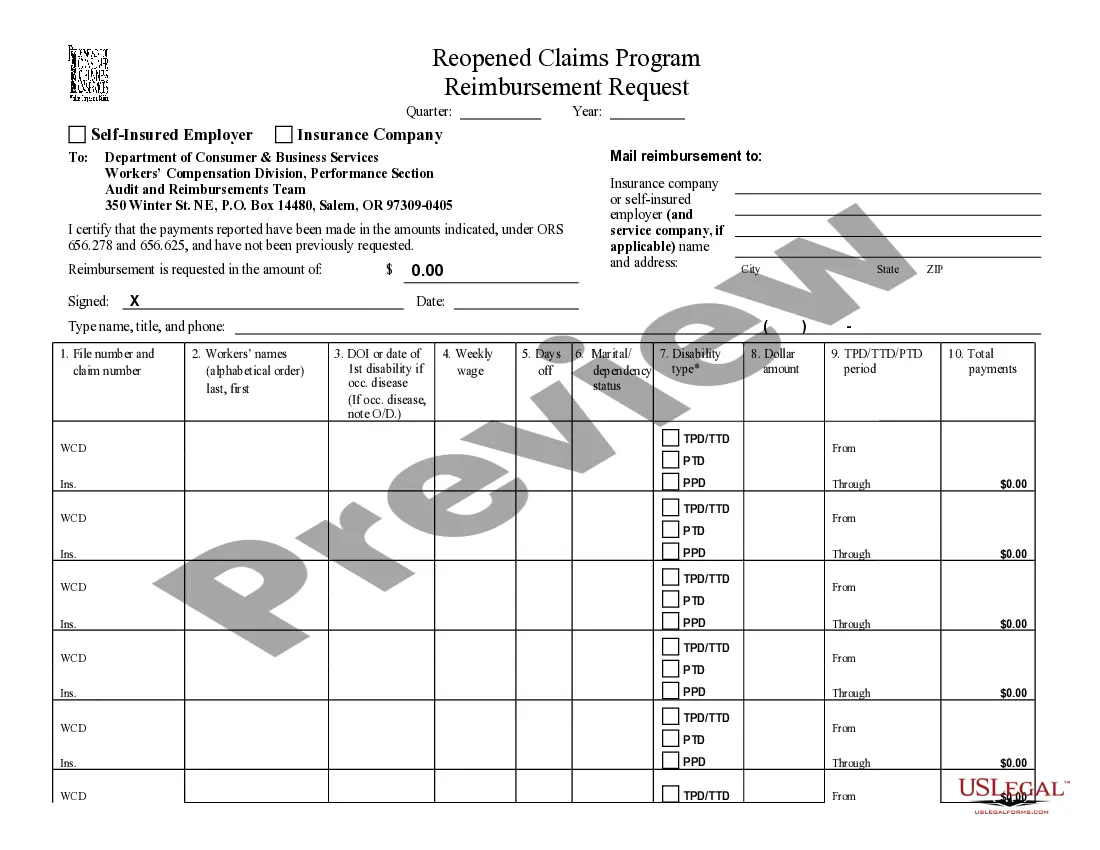

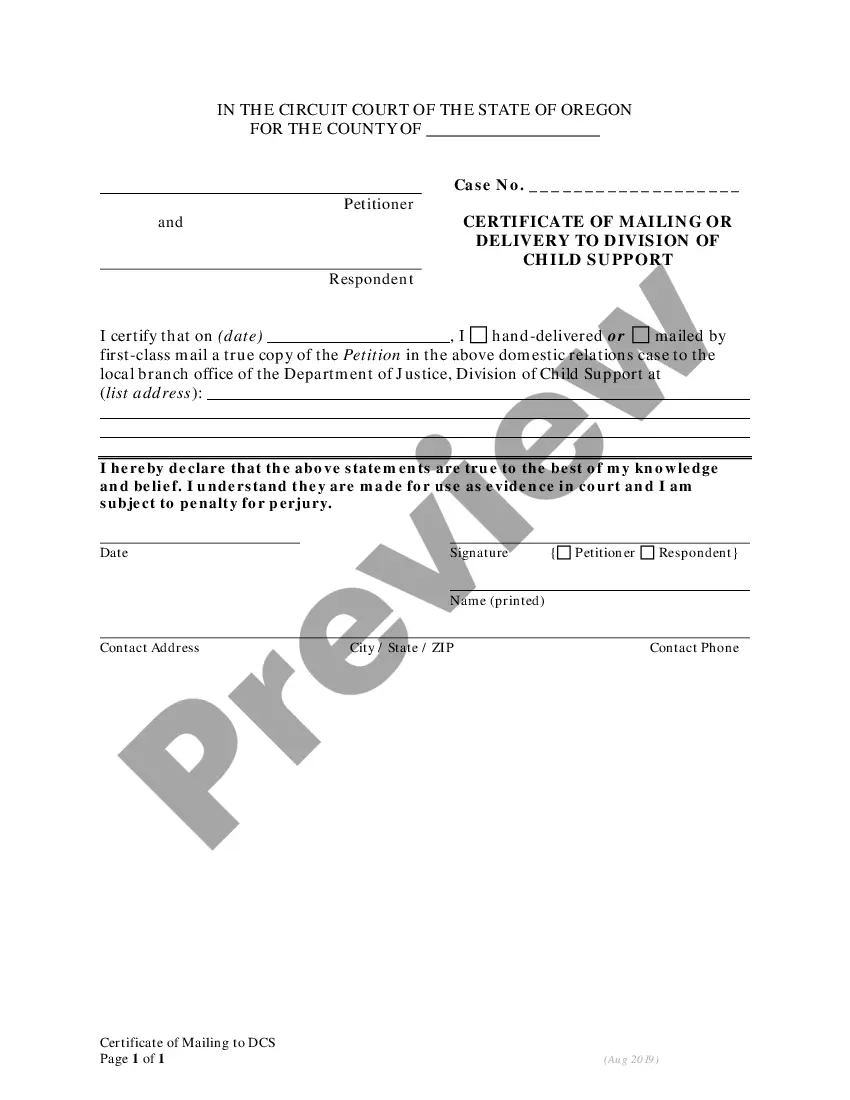

- Verify that the document displayed on the page matches your legal situation and state laws by reviewing its textual description or browsing through the Preview mode.

- Enter the form title in the Search tab at the top of the page and choose your state from the dropdown list to locate an alternative template if there are any discrepancies.

- Repeat the content validation process and click Buy now when you are assured of the paperwork's compliance with all requirements.

- Log in to your account and click Download. Sign up for the service and choose a subscription plan if you do not have one yet.

- Utilize your credit card or select the PayPal option to pay for your US Legal Forms subscription. The blank will be available for download immediately after.

- Select the format in which you wish to receive your Maryland Consent To Extend Time To File Final Report And To Make Distribution In A Modified Administration and download it by clicking the corresponding button.

- Import your template into an online editor for quick completion and signing, or print it out to fill out your physical copy manually.

Form popularity

FAQ

Rule 6-431 in Maryland regulates the timeline and procedures for filing reports in probate cases. This rule allows for the extension of time to file a final report when certain conditions are met. When dealing with estate management, understanding Rule 6-431 is crucial, and the Maryland Consent To Extend Time To File Final Report And To Make Distribution In A Modified Administration can simplify obtaining these extensions. By taking advantage of this rule, you can better manage the probate process without unnecessary delays.

A final report under modified administration reflects the date of death value of the probate assets, all of the expenses or debts that have been paid and the distributions pursuant to either the laws of intestacy or to the terms of the decedent's last will and testament.

The only creditors the personal representative needs to contact are the secured creditors. If the unsecured creditors don't file a claim within the estate within 6 months of the date of death, they are barred from collecting the debt.

6 months from the date of the decedent's death; or.

6 months from the date of the decedent's death; or.

Generally, unless the estate includes real property which needs to be sold, requires the filing of a U.S. Estate Tax Return, or is tied up in litigation, a regular estate proceeding may be closed after the period for filing creditor claims expires (six months from the date of death).

Children in Maryland Inheritance Law If you have children who are minors, your spouse will inherit half of the intestate property and your children will inherit the other half. If you have no minor children, your spouse will inherit $15,000 of the intestate property and then half of the remaining property.

Probate in Maryland can take a year or longer. Creditors have six months from the date of death to submit a claim. Once the assets have been distributed, probate must remain open for at least six months to allow for a creditor to come forward.

This is done by filing a ?Petition for Declaration of Completion of Administration? along with any supporting documentation. The court will review your petition and, if everything ticks, will issue an Order Closing Estate. With this order, you can distribute any remaining assets to the rightful heirs and beneficiaries.