Maryland Final Report Under Modified Administration And Certificate of Service is a document filed with the court to finalize a probate process. It confirms to the court that the executor has completed their duties and that the deceased's estate has been properly administered. The report contains details about the assets, liabilities, and distributions of the estate. It also includes a Certificate of Service attesting that all persons entitled to notice of the administration of the estate were notified. There are two types of Maryland Final Report Under Modified Administration And Certificate of Service: the Independent Final Report and the Modified Final Report. The Independent Final Report is for cases that have been administered without court supervision. The Modified Final Report is for cases that have been supervised by the court. In both cases, the certificate of service must be filed with the report.

Maryland Final Report Under Modified Administration And Certificate of Service

Description

Key Concepts & Definitions

Final Report: In the context of estate administration, it refers to the document that summarizes the actions and transactions completed by the personal representative of an estate. Modified Administration: A streamlined, less formal process under probate court supervision, generally available when certain conditions are met under the Maryland Code. It reduces the paperwork and oversight typically required in traditional probate.

Step-by-Step Guide to Completing a Final Report Under Modified Administration

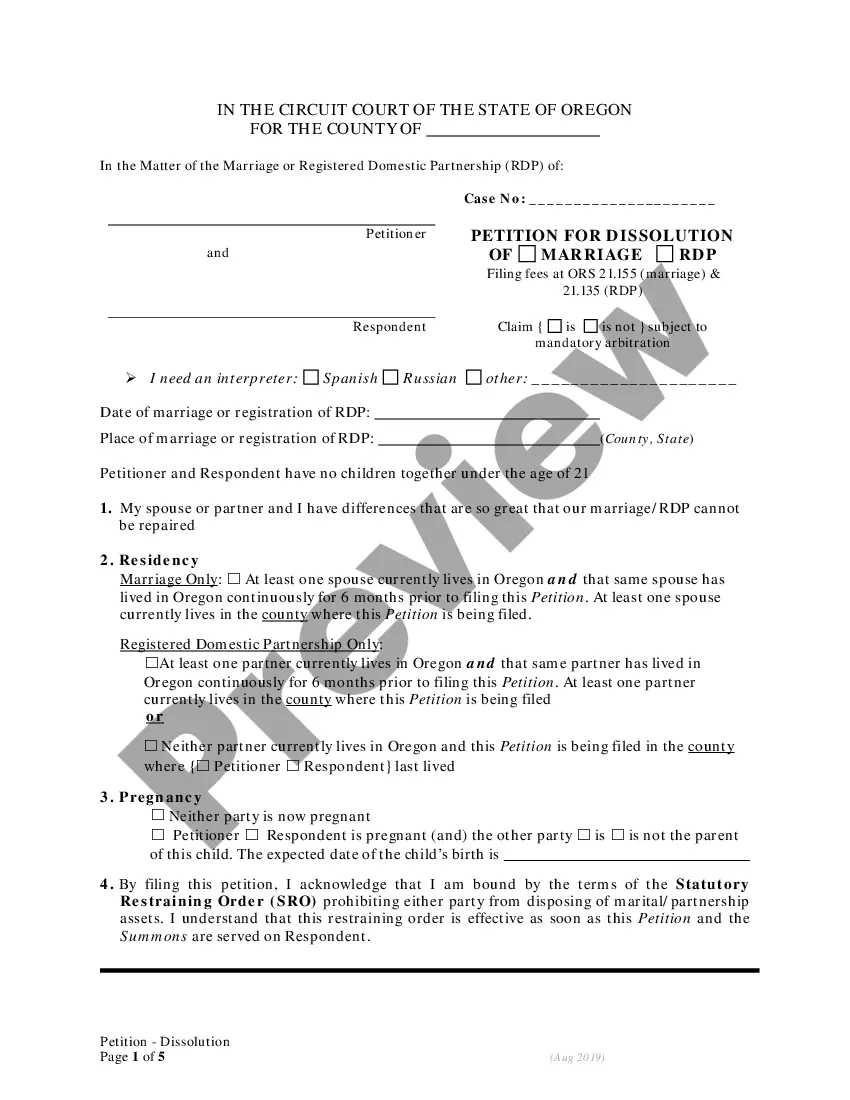

- Verify Eligibility: Confirm that the estate qualifies for modified administration under the relevant sections of the Maryland Code.

- Prepare the Report: Compile financial statements, inventory of assets, and record all transactions made by the estate.

- Submit to Probate Court: File the report with the probate court overseeing the estate administration.

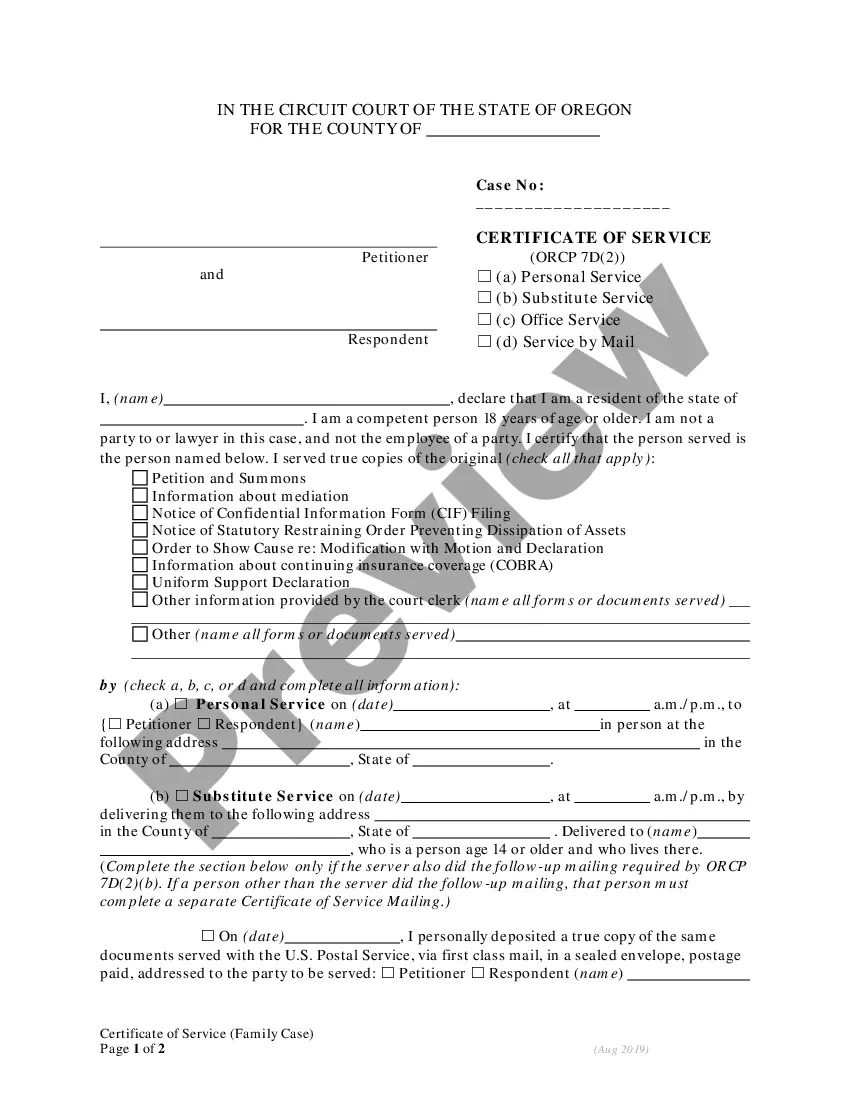

- Notice of Completion: Issue a certificate service to all interested parties informing them about the filing of the report.

- Close the Estate: Once approved by the court, proceed with closing the estate as per the guidelines of modified administration.

Risk Analysis in Modified Administration

- Legal Risks: Misinterpretation of the Maryland Code could result in legal challenges or penalties.

- Financial Risks: Incorrect financial reporting can lead to financial liability for the personal representative.

- Reputational Risks: Errors in administration may affect future opportunities for individuals serving as personal representatives.

Common Mistakes & How to Avoid Them

- Insufficient Documentation: Always maintain detailed records of all estate transactions and communications.

- Ignoring Certificate Service: Ensure that all legally required notifications and certificate services are properly executed to avoid legal repercussions.

- Lack of Legal Representation: Engage with a lawyer specializing in estate administration to navigate complex legal requirements and ensure compliance with the Maryland Code.

FAQ

Q: How do I find a lawyer for estate administration in the United States?

A: Utilize a business directory or legal-specific platforms to find lawyers with specialization in estate administration. Personalized consultations are advised for selecting the right legal representation.

Key Takeaways

Completing a final report under modified administration involves understanding specific legal requirements under the Maryland Code, preparing accurate estate documents, and ensuring proper communication with all parties involved in the estate. Legal representation is highly recommended to navigate potential risks effectively.

How to fill out Maryland Final Report Under Modified Administration And Certificate Of Service?

If you’re seeking a method to properly finalize the Maryland Final Report Under Modified Administration And Certificate of Service without employing a legal advisor, then you've found the perfect place. US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every personal and business circumstance. Each document available on our online platform is crafted in accordance with national and state regulations, ensuring that your forms are correct.

Follow these straightforward steps on how to acquire the ready-to-use Maryland Final Report Under Modified Administration And Certificate of Service.

Another significant benefit of US Legal Forms is that you will never misplace the documents you’ve obtained - you can access any of your downloaded templates in the My documents section of your profile whenever needed.

- Ensure the document displayed on the page aligns with your legal needs and state requirements by reviewing its text description or browsing through the Preview mode.

- Enter the document title in the Search tab at the top of the page and select your state from the dropdown to find an alternative template if there are any discrepancies.

- Verify the content again and click Buy now when you are confident that the paperwork meets all requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you haven’t done so already.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be ready to download immediately after.

- Choose the format in which you wish to receive your Maryland Final Report Under Modified Administration And Certificate of Service and download it by clicking the corresponding button.

- Add your template to an online editor for quick completion and signing, or print it out to prepare a physical copy manually.

Form popularity

FAQ

Children in Maryland Inheritance Law If you have children who are minors, your spouse will inherit half of the intestate property and your children will inherit the other half. If you have no minor children, your spouse will inherit $15,000 of the intestate property and then half of the remaining property.

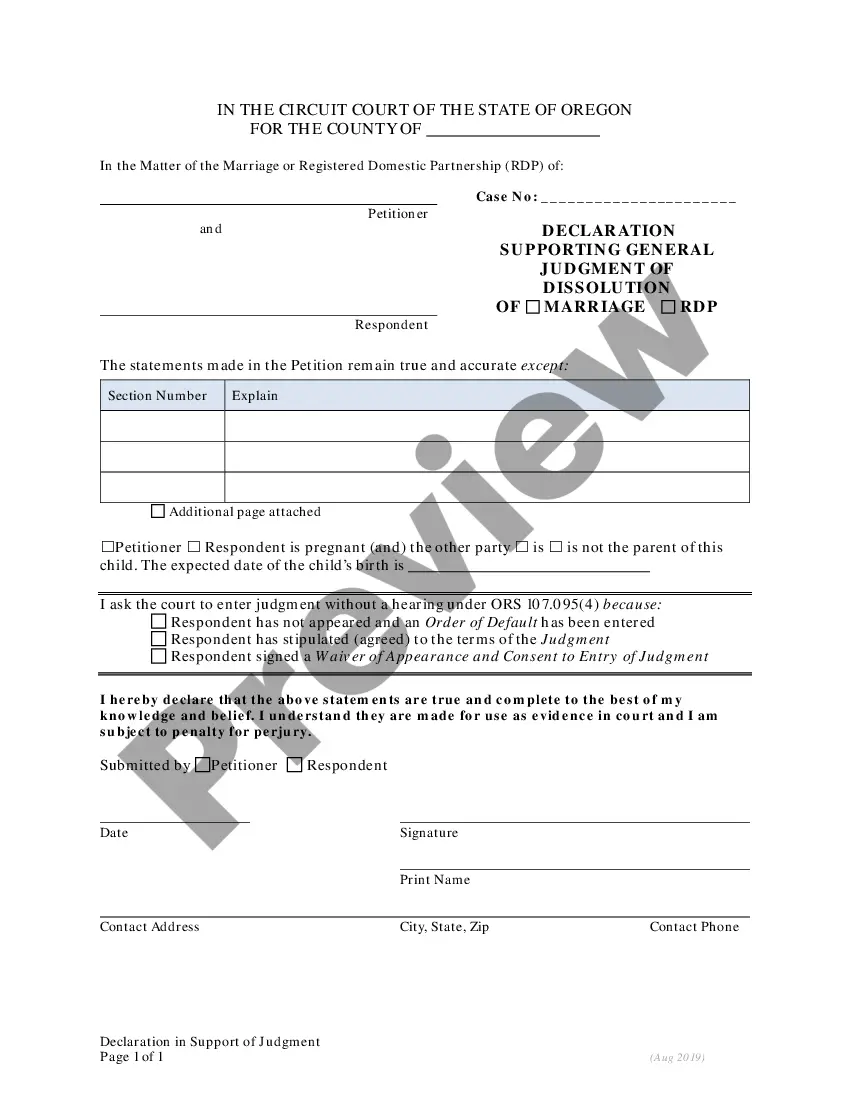

A final report under modified administration reflects the date of death value of the probate assets, all of the expenses or debts that have been paid and the distributions pursuant to either the laws of intestacy or to the terms of the decedent's last will and testament.

This is done by filing a ?Petition for Declaration of Completion of Administration? along with any supporting documentation. The court will review your petition and, if everything ticks, will issue an Order Closing Estate. With this order, you can distribute any remaining assets to the rightful heirs and beneficiaries.

If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit. Beneficiaries can petition the court to have the executor removed from their positon if they can prove they should be removed for one of the reasons listed above.

Providing accounting information to beneficiaries is optional. However, if a beneficiary requests accounting from the executor, the executor must share this information.

Generally, unless the estate includes real property which needs to be sold, requires the filing of a U.S. Estate Tax Return, or is tied up in litigation, a regular estate proceeding may be closed after the period for filing creditor claims expires (six months from the date of death).

6 months from the date of the decedent's death; or.

To get letters of administration, you will need to submit your application to the probate courts. You will need to obtain a copy of the decedent's death certificate from the funeral home. It's best to request extra copies. However, you should submit the original copy with your application if possible.