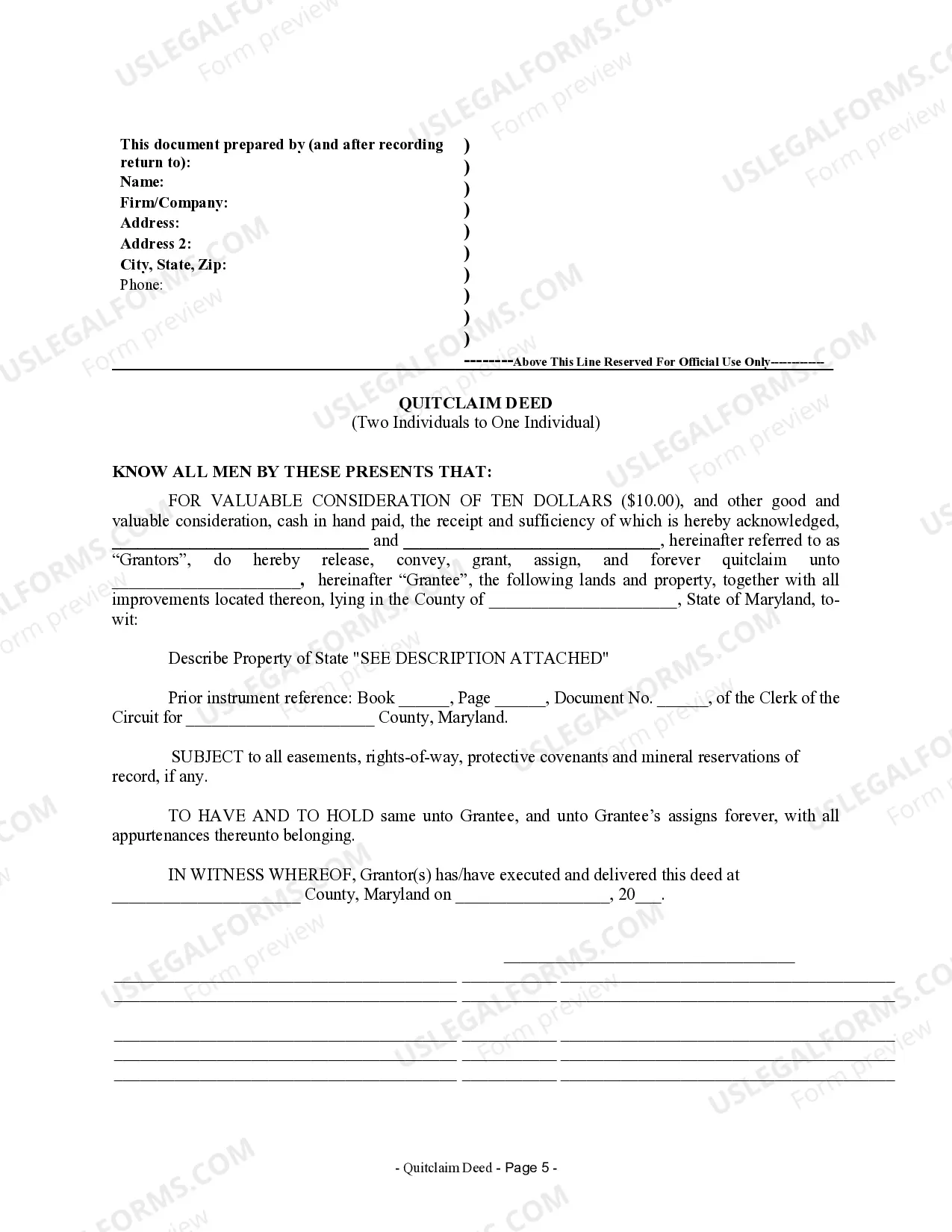

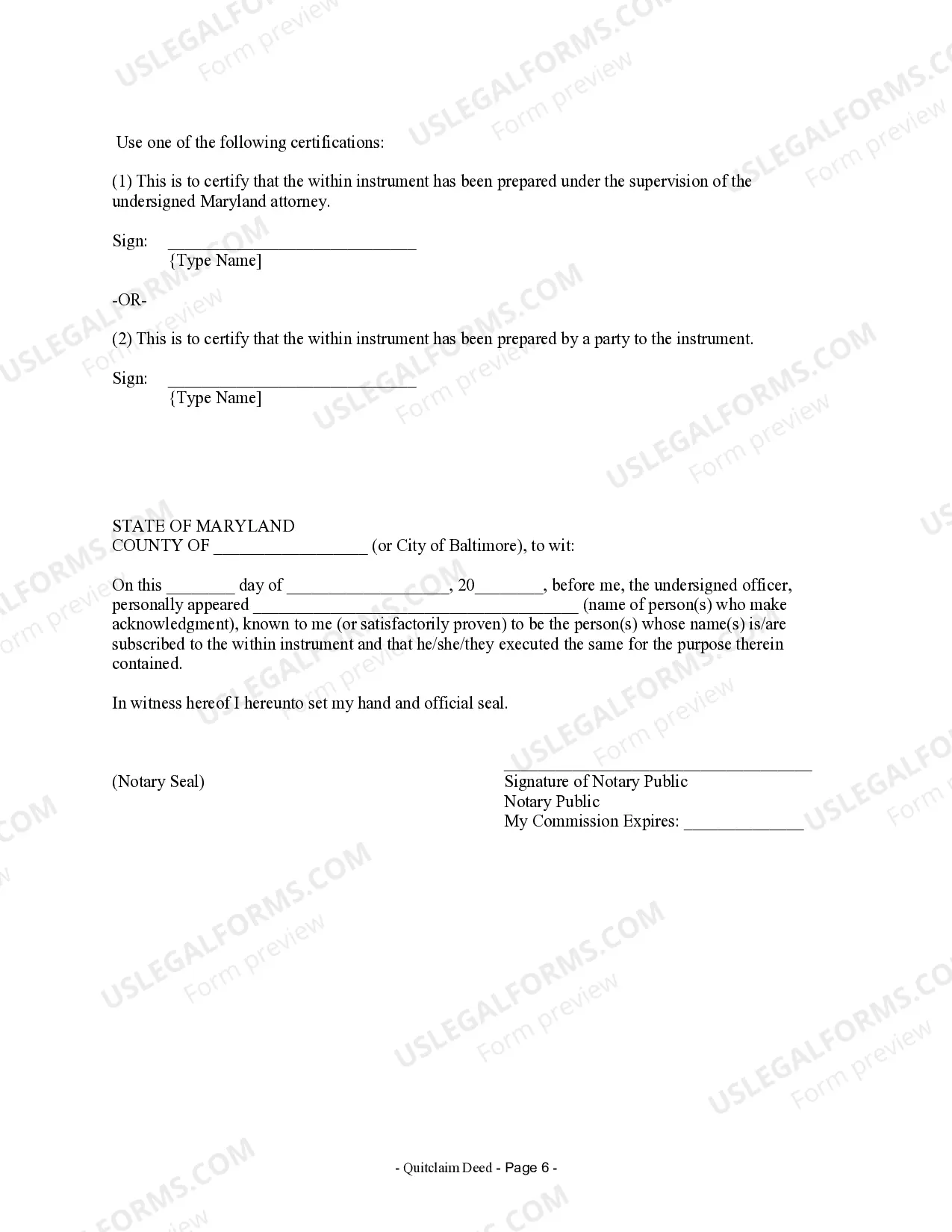

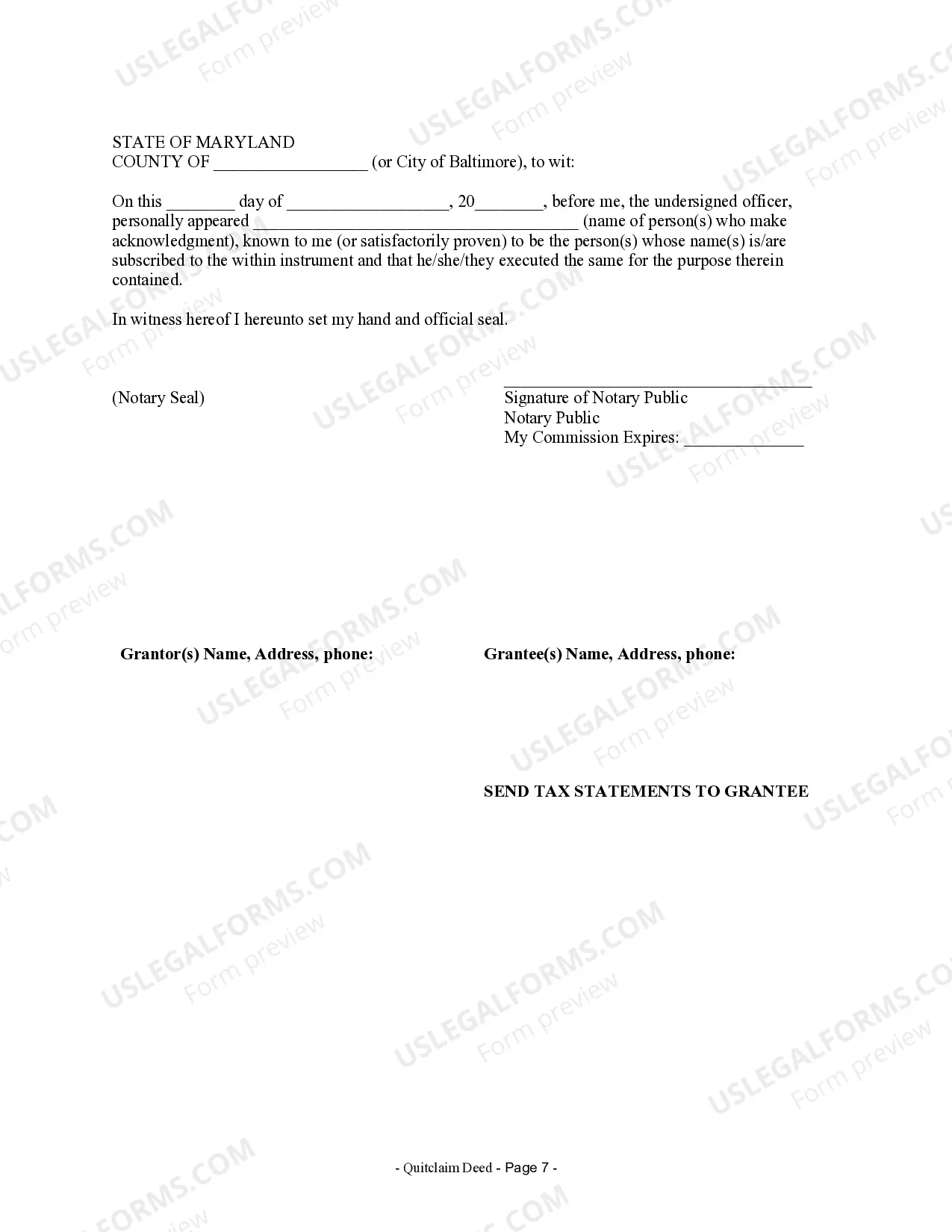

Maryland Quitclaim Deed from two Individuals to One Individual

Description

How to fill out Maryland Quitclaim Deed From Two Individuals To One Individual?

Amid a plethora of complimentary and paid examples available online, you cannot guarantee their precision and dependability.

For instance, who developed them or whether they possess the expertise to address your needs.

Stay composed and utilize US Legal Forms! Explore Maryland Quitclaim Deed examples from two parties to one party, crafted by experienced attorneys, and avoid the costly and tedious task of searching for a lawyer and then compensating them to prepare a document that you can obtain independently.

Select a subscription plan and create an account. Process your payment with your credit/debit card or Paypal. Download the document in your chosen format. After registering and completing your subscription payment, you can utilize your Maryland Quitclaim Deed from two Individuals to One Individual as many times as necessary or for as long as it remains valid in your state. Modify it with your preferred online or offline editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- If you already possess a subscription, Log In to your account and locate the Download button adjacent to the file you are looking for.

- You will also have access to all your previously saved documents in the My documents section.

- If you are using our service for the first time, adhere to the guidelines below to acquire your Maryland Quitclaim Deed from two parties to one party swiftly.

- Ensure the document you find is legitimate in your residing state.

- Examine the template by reviewing the details using the Preview feature.

- Click Buy Now to initiate the buying process or search for another example using the Search field in the header.

Form popularity

FAQ

When using a Maryland Quitclaim Deed from two Individuals to One Individual, you may face certain issues. Unlike warranty deeds, quit claim deeds do not guarantee clear title or legal ownership. This means the recipient may inherit undisclosed liens or claims from the grantors. Additionally, this type of deed does not provide the buyer with protection against future disputes, which can lead to complications down the line. For those considering a quitclaim deed, using a reliable platform like US Legal Forms can help ensure you complete the process correctly and reduce potential risks.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

For a flat fee of $240 - $250 in most cases (plus governmental recording fees) the firm can in most circumstances have an attorney prepared deed ready for signature in 2-4 business days. In most cases a true " Quit Claim Deed" is rarely the best choice.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

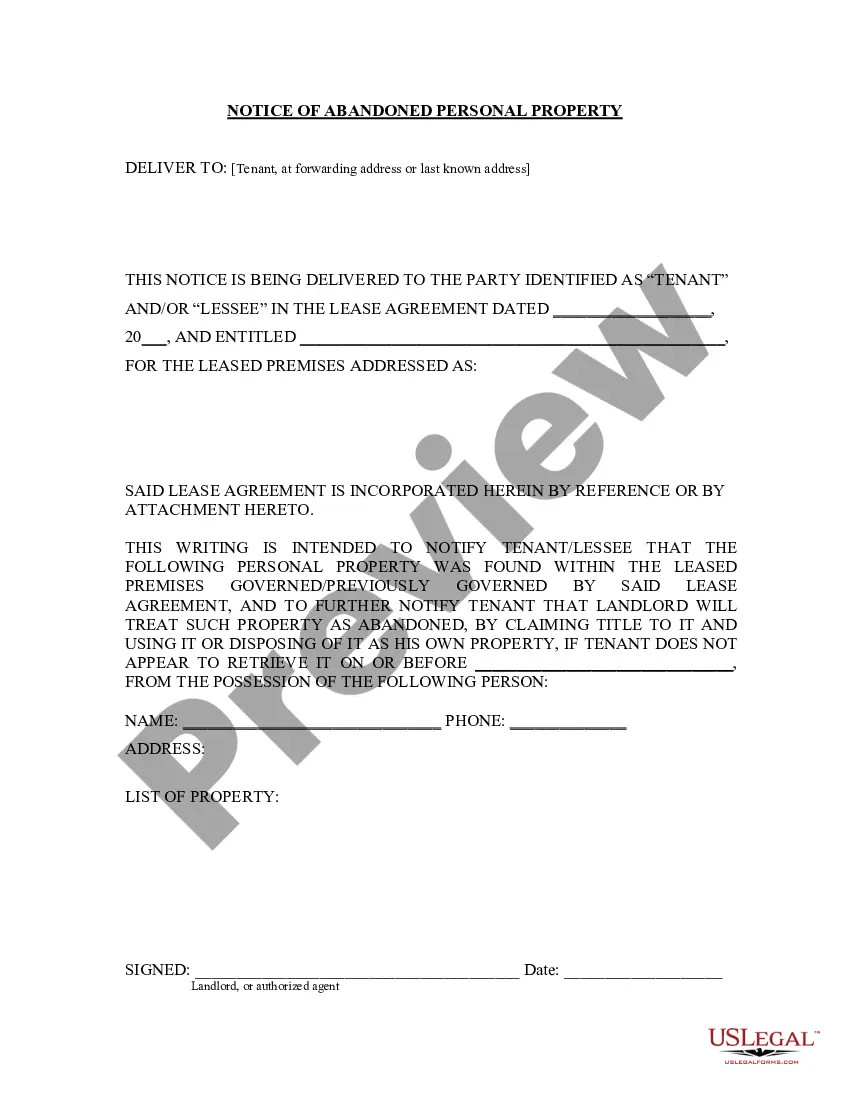

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Discuss property ownership interests. Access a copy of your title deed. Complete, review and sign the quitclaim or warranty form. Submit the quitclaim or warranty form. Request a certified copy of your quitclaim or warranty deed.